- What enterprise accounting software actually solves

- Best accounting software for enterprises

- How to choose the best software for your business?

- Scale financial operations with AI that learns your business and automates the work

Enterprise accounting software is designed to manage the complex financial operations that come with a growing business. Built for large organizations with multifaceted needs, these systems handle high transaction volumes, support multi-entity reporting, and seamlessly integrate with tools across finance, HR, and operations.

What enterprise accounting software actually solves

Enterprise accounting software is designed to solve problems that surface as companies scale. Basic tools or manual systems cannot handle these problems. Enterprise accounting software helps finance teams manage complexity, reduce risk, and improve organizational decision-making.

- Disconnected financial data. As your small business grows, so does the number of systems handling financial information. Without the right accounting platform, data lives in silos. This slows down financial reporting and increases the chance of errors. Enterprise software solves this by acting as a central hub. It connects with other business systems to sync data automatically.

- Limited visibility into real-time performance. Traditional accounting systems rely on batch processing and static reports. This leaves finance teams working with outdated numbers. Enterprise platforms fix this by offering real-time dashboards, live balance sheets, and automated reporting. You can see cash flow, track expenses, and revenue performance as it happens. This helps leadership spot trends early and make decisions with confidence.

- Manual, error-prone processes. Without automation, finance teams spend hours on repetitive tasks, like creating journal entries or reconciling accounts. These manual processes introduce delays and increase the risk of human error. Enterprise accounting software automates these tasks at scale. It automatically handles things like multi-entity consolidations and recurring billing. With automation integrations like Ramp, The Second City was able to process bills two times faster.

- Compliance and audit risk. Larger businesses face tighter regulations from GAAP and IFRS. Without a system to enforce controls, it’s easy to miss steps or fall out of compliance. Enterprise systems are built with controls in place. You can set user roles, enforce approval workflows, track audit trails, and generate compliance-ready reports. Everything is in order if the IRS, SEC, or internal auditors ask for documentation.

- Scaling with the business. Enterprise software supports growth by adapting to new entities, geographies, and operating models. Whether you’re expanding internationally, acquiring new companies, or preparing for an IPO, the system grows with you without breaking workflows.

Best accounting software for enterprises

The best accounting software for your enterprise depends on how your business operates—and where it’s headed. Different industries, growth stages, and internal processes all shape what “best” looks like. Some companies need deep integrations with ERP systems. Others prioritize automation, audit trails, or support for international compliance standards.

That’s why enterprise software decisions rarely sit with one person. CFOs lead the charge, but controllers, IT leaders, and operations teams all weigh in on choosing which accounting software will best suit their business needs.

1. Epicor: Best for manufacturing and supply chain-driven enterprises

Epicor is an ERP and accounting platform built specifically for product-centric businesses like manufacturers, distributors, and construction firms. It combines core financial management with robust industry-specific modules, helping enterprises align financial processes with production, inventory, and project operations. Its flexible deployment options and modular architecture make it a strong fit for enterprises needing both control and configurability.

Key benefits

- Tightly integrates financials with manufacturing, inventory, and supply chain workflows for end-to-end visibility.

- Supports project-based accounting with job costing, billing, and real-time budget tracking.

- Includes industry-specific features tailored to manufacturing, construction, and distribution environments.

- Offers flexible deployment options, including on-premise, cloud, or hybrid, to match IT and compliance requirements.

- Provides real-time analytics and dashboard tools for operational and financial performance monitoring.

Drawbacks

- Implementation can be time-intensive and often requires certified Epicor consultants

- Interface can feel dated compared to newer cloud-native platforms

- Customization may require development resources or external support

Epicor is best for large enterprises in manufacturing, distribution, or construction that need accounting software built to support operational complexity. It’s ideal for finance teams that need visibility into inventory, job costing, and production alongside traditional general ledger and reporting functions.

2. Acumatica: Best distribution-focused enterprises with inventory needs

Acumatica is a cloud-based ERP and accounting platform built to support complex operations. It’s widely adopted by manufacturing and distribution companies that need real-time visibility, inventory control, and flexible deployment. With a strong focus on usability and scalability, Acumatica stands out for its high customer satisfaction across large, fast-moving organizations.

Key benefits

- Offers native support for discrete and process manufacturing, including bill of materials, production scheduling, and material requirements planning (MRP).

- Enables detailed inventory tracking with lot and serial number control, expiration dates, and multi-warehouse support.

- Provides real-time dashboards for work-in-progress (WIP) tracking, job costing, and production performance analytics.

- Supports multi-company, multi-currency, and multi-warehouse operations in a single unified system.

- Delivers flexible deployment options with the same functionality across environments.

- Uses a browser-based UI with strong mobile accessibility, helping field teams and warehouse operators stay connected.

Drawbacks

- Setup can be complex for first-time ERP users

- Standard reports may need customization

- Some features depend on third-party add-ons

Acumatica is best suited for manufacturing, supply chain, or distribution enterprises that need deep operational control, flexible deployment, and accounting tools built for scale. It is a good option for business owners that value cost transparency and mobile access without sacrificing functionality.

3. SAP S/4HANA: Best for compliance and risk management

SAP S/4HANA is a full-scale, enterprise-grade ERP and accounting system designed for large organizations with complex, global operations. Built on SAP’s in-memory HANA database, it supports real-time analytics, multi-entity reporting, and deep customization. It’s especially well suited for businesses operating across multiple countries, business units, or regulatory environments that need full control over their financial and operational data.

Key benefits

- Handles global financial operations with built-in support for multi-entity, multi-currency, and tax localization.

- Provides real-time reporting and analytics powered by SAP HANA for faster, data-driven decisions.

- Offers advanced automation and integrated workflows across finance, supply chain, and manufacturing.

- Highly customizable to meet industry-specific needs in sectors like pharma, energy, and manufacturing.

- Backed by SAP’s enterprise-grade security, contract compliance, and global support network.

Drawbacks

- Implementation is complex and often requires SAP partners or system integrators

- Total cost of ownership can be high, especially for smaller teams or less complex operations

- Requires internal expertise or external consultants to manage post-deployment customization and upgrades

SAP S/4HANA is best for large, multinational enterprises that need advanced automation, compliance, and real-time financial and operational visibility. It’s particularly strong for regulated industries with deep reporting and audit requirements across multiple business units.

SAP S/4HANA is strong in compliance and control but can require heavy customization and third-party support to keep up with evolving workflows. Some companies pair traditional ERPs like SAP with modern tools to automate manual tasks, like auto-categorize transactions.

4. NetSuite: Best for centralized financial visibility at scale

NetSuite is a cloud-based ERP and an online accounting solution built to support the financial backbone of large, growing businesses. Its strength lies in bringing all financial operations, like accounting, compliance, payment processing, and reporting, into one connected system. For enterprises looking to scale without juggling multiple disconnected tools, NetSuite offers a centralized, real-time view of their entire financial landscape.

Key benefits

- Connects core financial processes like accounts payable, accounts receivable, tax, and asset management in one platform.

- Delivers real-time visibility into financial data across departments and entities.

- Supports compliance with built-in controls for audit, tax, and regulatory reporting.

- Offers modular scalability with the ability to add CRM, inventory, or procurement tools as the business grows.

- Built for global operations with multi-entity, multi-currency, and tax localization support.

Drawbacks

- Implementation can be time-intensive and complex

- Pricing isn’t transparent and can vary based on modules

- Custom role configurations can be difficult to manage without admin expertise

NetSuite is a good option for enterprises that need a fully integrated financial management system with room to scale. It’s especially strong for companies operating across multiple locations or entities that want a centralized, real-time view of their financial performance.

5. Microsoft Dynamics Finance (F&O): Best for AI-driven automation and financial intelligence

Microsoft Dynamics Finance is a powerful accounting and ERP platform built for large enterprises with complex financial needs. It combines traditional financial management with advanced AI and automation to help teams streamline processes, reduce manual work, and gain deeper insights into business performance. Its flexibility across cloud and on-premise deployments makes it suitable for enterprises with varied infrastructure needs.

Key benefits

- Automates financial close, forecasting, and cash flow analysis using AI-driven insights.

- Integrates seamlessly with other Microsoft products, including Power BI and Office 365.

- Offers deep functionality across tax, cash, and asset management.

- Provides scalable modules for advanced ERP needs beyond accounting features.

- Available in both cloud and hybrid environments to fit enterprise IT requirements.

Drawbacks

- Setup and configuration are complex and often require third-party consultants

- Outdated UI and non-intuitive workflows can slow adoption

- Pricing can escalate quickly with add-ons and custom modules

Microsoft Dynamics Finance suits enterprises looking to automate high-volume financial processes and unlock real-time insights through AI. It’s a strong fit for companies already embedded in the Microsoft ecosystem that want to centralize finance, forecasting, and reporting across departments and regions.

Microsoft Dynamics Finance (F&O) is powerful, but setting up automation often requires custom development or external support. Some finance teams use tools like Ramp alongside Dynamics to automate transaction categorization, simplify approvals, and speed up month-end close without the added complexity.

6. Sage X3: Best for complex operations and global financial control

Sage X3 is an ERP and accounting solution designed for enterprises with complex operations, multiple entities, and global compliance needs. It goes beyond core accounting to support manufacturing, inventory, and supply chain processes. This makes it a strong fit for businesses that need more than just financial reporting. Its customizable workflows and multi-language, multi-currency support help teams manage finance at scale with full visibility and control.

Key benefits

- Handles global operations with support for multiple currencies, languages, tax jurisdictions, and legal frameworks.

- Offers integrated modules for inventory management, procurement, and production alongside financials.

- Customizable workflows and user roles help streamline approvals, reporting, and internal controls.

- Provides real-time visibility across business units with built-in analytics and dashboarding.

- Designed for enterprises that need both deep accounting functionality and operational flexibility.

Drawbacks

- Implementation is complex and often requires partner support

- User interface is dated compared to newer cloud-native tools

- Upfront cost and customization requirements may be high for smaller teams

Sage X3 is best suited for mid-sized to large enterprises with complex operational structures, especially those needing unified control across finance, inventory, and global compliance. It’s a strong option for businesses in manufacturing, distribution, or multi-location environments that require more than standalone accounting.

How to choose the best software for your business?

The right business accounting software depends on how your business operates—and what’s slowing it down. Start by identifying which financial workflows take the most time or cause the most errors. For many enterprises, it’s manual transaction coding, reporting delays, or multi-entity consolidation.

More than half of CFOs say automating finance processes is a top priority, with cloud computing spending increasing by over 10% in the last quarter. However, automation only works if it fits your systems, data structure, and team workflow.

- Scalability for growth. Look for a platform that can grow with your business. If you plan to expand into new regions, acquire companies, or operate across entities, your software should support multiple currencies, tax rules, bank accounts, and reporting structures without needing heavy custom work.

- Ability to integrate with your existing systems. Accounting software should not live in isolation. The best tools connect easily with your ERP, payroll systems, HRIS, and procurement platforms, so you are not wasting hours moving data between systems or fixing sync errors.

- Real-time financial visibility. Choose a platform that gives you up-to-date insights with customizable reports and not static ones. Real-time dashboards help leadership teams track spend, spot anomalies and make faster decisions. Delayed data leads to missed opportunities and reporting risk.

- Built-in automation for routine tasks. Automating tasks like transaction categorization, general ledger entries, and intercompany eliminations saves hours of manual work. Look for software that reduces friction in your monthly close, not just manages it.

- Compliance and internal controls. Enterprises operate under tight regulatory standards. Make sure your system supports audit trails, approval workflows, and user-based permissions. Strong controls reduce the risk of errors, fraud, or audit failures.

- Ease of use for finance and non-finance teams. A platform is only as good as its adoption. If the interface is too complex, teams will not use it consistently. Prioritize tools that simplify data entry for employees and streamline review workflows for accountants.

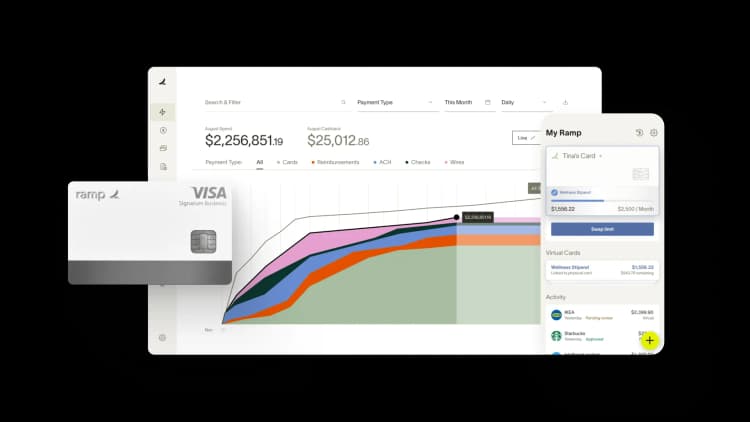

Scale financial operations with AI that learns your business and automates the work

Enterprise finance teams face a common challenge: manual processes that don't scale as the business grows. Ramp's AI-powered accounting software eliminates repetitive work across spend management, accounting, and compliance so you can handle more volume without adding headcount.

Ramp's AI learns from your accounting patterns and applies that knowledge across every transaction. It codes spend in real time across all required fields, flags exceptions that need review, and syncs routine transactions automatically. Teams clear their accounting queue 3x faster because Ramp handles the volume while you focus on exceptions and strategic work.

Here's how Ramp consolidates and automates at scale:

- AI coding that learns over time: Ramp achieves 90%+ accuracy on AI coding by learning your chart of accounts, department structures, and vendor patterns—then applies your feedback to improve over time

- Automated sync for routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, reducing manual entry and keeping review queues focused on what matters

- Centralized spend visibility: Track all corporate cards, reimbursements, and bill pay in one platform with real-time reporting across departments, entities, and cost centers

- Built-in compliance controls: Enforce approval workflows, spending limits, and policy rules automatically so you maintain control as teams and budgets expand

- Seamless ERP integration: Ramp syncs with NetSuite, Sage Intacct, QuickBooks, and other major systems to ensure data flows accurately without manual reconciliation

Try a demo to see how Ramp helps finance teams save 40+ hours every month by eliminating manual receipt collection, expense approvals, and coding.

FAQs

Accounting software focuses on financial tasks like bookkeeping, reporting, and compliance. ERP systems include accounting but also cover areas like inventory, HR, and supply chain management.

Many enterprise tools offer features tailored for specific industries, such as HIPAA compliance for healthcare or ASC 606 support for SaaS companies.

Licensing can vary widely—some offer per-user pricing, while others charge based on transaction volume or modules. It’s important to evaluate total cost of ownership, not just base fees.

Some legacy platforms offer limited mobile features, while modern cloud-based tools typically support full access through mobile apps or browsers.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits