Understanding net 60 payment terms: Meaning and examples

- What are net 60 payment terms?

- Who qualifies for net 60 payment terms?

- How net 60 terms appear on invoices and POs

- Types of net 60 payment terms

- Net 60 vs. net 30 payment terms

- Common industries that use net 60 payment terms

- Benefits and drawbacks of net 60 payment terms

- Early payment discounts in net 60 terms

- Managing cash flow with net 60 terms

- Managing net 60 payments effectively

A net 60 arrangement gives customers 60 days to pay an invoice, offering breathing room for buyers while requiring sellers to be more strategic with cash flow planning. Understanding how net 60 payment terms work is essential for maintaining healthy business relationships and financial stability.

In this post, we’ll explore what net 60 means, its benefits and drawbacks, and how to manage it.

What are net 60 payment terms?

Net 60

Net 60 is a payment term where the buyer has 60 days from the invoice date to pay the full balance, without penalties if paid on time.

It functions as short-term trade credit, allowing businesses to receive goods or services up front while deferring invoice payment. For example, if you issue an invoice on March 1 with net 60 terms, payment is due by April 30.

These extended terms are more common in large-scale B2B transactions, particularly in industries where longer payment cycles are standard, such as manufacturing, wholesale, and government contracts.

Net 60 is part of a broader set of trade credit terms, which may also include:

- net 30, net 90, net 120: Variations that extend or shorten the payment window based on the agreement

- 2/10 net 60: A discount incentive where buyers receive 2% off if they pay within 10 days but must pay the full amount if they pay between days 11–60

Because net 60 extends payment terms longer than net 30, you may need to assess a buyer’s creditworthiness more carefully. Offering these terms means carrying unpaid invoices for a longer period, which can impact your cash flow if not managed properly.

Who qualifies for net 60 payment terms?

Net 60 terms aren’t automatically available to every business. Because they allow buyers to delay payment for two full months, you need to ensure you're extending credit responsibly.

Before offering a net 60 payment period, vendors typically assess a buyer’s creditworthiness, considering factors like:

- Business credit history: You can check credit scores from agencies like Dun & Bradstreet (D&B) to evaluate financial stability

- Time in business: Established businesses with a proven track record are more likely to qualify

- Payment history: A history of on-time payments with other vendors increases the chance of approval

- Cash flow strength: You may request financial statements to determine whether your buyer can manage long-term payment terms

Newer businesses or those with inconsistent cash flow may not qualify for net 60 initially. Instead, you might offer net 30 or require up-front payments until trust is established. You might also ask for a personal guarantee from small business owners to minimize risk.

How net 60 terms appear on invoices and POs

Net 60 terms are typically listed on invoices and purchase orders (POs) to clearly define when payment is due. You must pay attention to when the 60-day period starts, as it can vary based on vendor agreements.

Here are some common ways net 60 terms appear:

- Invoice date: The most common option; payment is due 60 days from the invoice issue date

- Shipment date: Some vendors start the 60-day period when goods or services are shipped

- Delivery date: In certain cases, the payment countdown begins when the buyer receives the order

Invoices will usually include both the issue date and due date to eliminate confusion. If you're using accounts payable (AP) automation, you can automatically track due dates to avoid late payments and maintain good vendor relationships.

When do net 60 payment terms begin?

The 60-day period usually begins on the invoice date, but it can also start from the shipment date or delivery date, depending on the vendor agreement. Since net 60 offers a longer payment window, you should be especially mindful of when the countdown starts to avoid cash flow bottlenecks or late payment risks.

Types of net 60 payment terms

Net 60 terms aren’t always structured the same way. Depending on the agreement, you might offer variations in when the 60-day period begins or how discounts apply. Here are the most common types:

Standard net 60

This is the most straightforward version. Payment is due 60 days from the invoice date. For example, if an invoice is issued on April 10, the full balance is due by June 9.

Net 60 EOM (end of month)

With this variation, the 60-day period starts at the end of the month in which the invoice was issued rather than on the invoice date itself. For example, if an invoice is dated April 10, the due date is June 30 instead of June 9.

Net 60 with early payment discounts

You can offer discounts for early payment, commonly structured as 2/10 net 60 or 1/10 net 60. For example, in a 2/10 net 60 agreement, the buyer gets a 2% discount if they pay within 10 days. Otherwise, the full amount is due at the 60-day mark.

Net 60 ROG (receipt of goods)

Instead of counting from the invoice date, net 60 ROG (receipt of goods) starts the 60-day period when the buyer receives the goods or services. If goods arrive on April 15, payment would be due by June 14, even if the invoice was issued earlier.

Net 60 vs. net 30 payment terms

Both net 60 and net 30 payment terms give buyers extra time to pay invoices, but the key difference is how long they have to settle the balance and the impact that has on cash flow. While net 30 is more common, net 60 offers more flexibility for buyers but can create more strain for vendors.

Feature | Net 60 | Net 30 |

|---|---|---|

Payment due date | Due 60 days from the invoice or agreed delivery date | Due 30 days from the invoice or agreed delivery date |

Cash flow impact | Slower cash flow for vendors; more time for buyers | Faster turnover for vendors; buyers pay sooner |

Client flexibility | More flexible, better for large purchases | Moderate flexibility, balances cash flow and convenience |

Risk of late payments | Higher risk due to the longer payment window | Lower risk since the due date is sooner |

Early payment incentives | Can include 2/10 net 60 or similar discounts | Often paired with 2/10 net 30 discounts |

Common industries that use net 60 payment terms

Net 60 is most common in industries with long sales cycles, large transactions, or supply chain dependencies, where businesses need extra time to generate revenue before making payments.

Industry | Why net 60 is used |

|---|---|

Wholesale and distribution | Retailers buy in bulk and need time to sell inventory before paying suppliers |

Manufacturing | Covers raw material costs and production expenses before customer payments arrive |

Construction | Contractors manage cash flow for long-term projects where payments come in stages |

Healthcare and medical supplies | Large hospitals and healthcare providers spread out costs for medical equipment and supplies |

Enterprise and government contracts | Big corporations and government agencies negotiate extended terms as part of vendor agreements |

Benefits and drawbacks of net 60 payment terms

Net 60 payment terms offer flexibility for buyers but can create cash flow planning challenges for vendors. Here’s a breakdown of the benefits and risks.

Benefits of net 60 payment terms

- Builds stronger customer relationships: Offering extended terms shows trust and flexibility, encouraging long-term loyalty

- Attracts larger clients: Many enterprise-level businesses prefer net 60, making it easier to secure high-value contracts

- Eases financial pressure for buyers: More time to pay helps businesses manage cash flow without immediate strain

- Reduces invoice disputes: Buyers have more time to review and verify invoices, lowering the risk of payment disagreements

Drawbacks of net 60 payment terms

- Strains cash flow for sellers: Waiting two months for payment can limit working capital, especially for smaller businesses

- Higher risk of late payments: Longer payment windows increase the chances of delays or non-payment

- Requires stricter credit checks: Vendors must screen buyers carefully to avoid financial risk

- Encourages payment delays: Some clients may habitually push payments to the last minute, creating unpredictable cash flow

- Acts as interest-free credit: Sellers effectively provide buyers with a 60-day, zero-interest loan, which can impact profitability

Early payment discounts in net 60 terms

You have the option of offering early payment discounts to encourage buyers to pay before the full 60-day term ends. These discounts provide a financial incentive for paying ahead of schedule while helping you improve cash flow.

A common example is 2/10 net 60, which means:

- The buyer receives a 2% discount if they pay within 10 days

- If they don’t take the discount, the full amount is due by day 60

How to calculate a 2/10 net 60 discount

A vendor issues a $10,000 invoice with 2/10 net 60 terms:

- If the buyer pays by day 10, they owe $9,800 (saving $200)

- If they pay between days 11–60, they owe the full $10,000

Early payment discounts benefit both parties. Buyers reduce costs, while suppliers receive payment sooner, reducing reliance on credit lines.

Managing cash flow with net 60 terms

Since net 60 terms delay payment for two months, you might consider looking for ways to maintain cash flow while waiting for funds. One option you have is invoice factoring, where you sell unpaid invoices to a third-party lender in exchange for immediate cash. While this provides liquidity, it also comes with fees and reduces total revenue.

Instead of relying on financing, you can set clear payment policies, assess buyer creditworthiness, and use automated reminders to keep payments on track without disrupting cash flow.

Managing net 60 payments effectively

Net 60 terms can offer more financial flexibility, but they also require careful tracking to prevent cash flow disruptions and late payments. Without a structured system, vendors risk waiting two months for payments, while buyers need to ensure they don’t miss due dates.

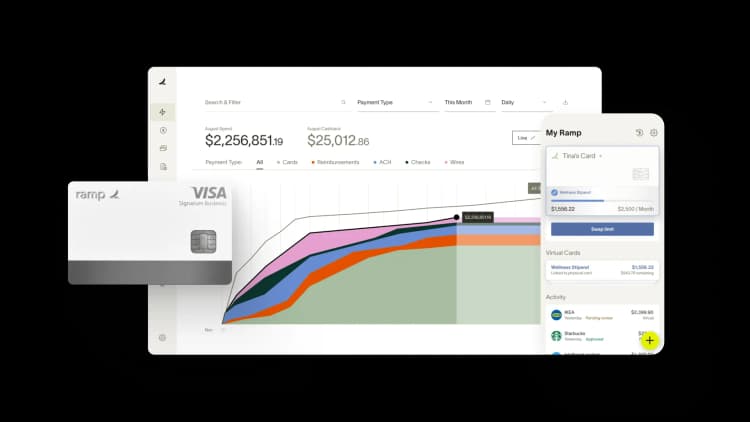

That’s where Ramp’s accounts payable automation helps you stay on top of net 60 terms without the manual effort:

- Automated invoice processing: Capture, categorize, and approve invoices faster without manual data entry

- Smart approval workflows: Route invoices to the right stakeholders, ensuring approvals happen before payments are due

- Visibility into cash flow: Get a real-time picture of upcoming payments and optimize working capital

While net 60 payment terms extend flexibility for buyers, having the right AP automation in place ensures payments stay on track, vendor relationships remain strong, and cash flow stays predictable.

Try an interactive demo and see for yourself why companies choose Ramp to save time and money.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits