Best business credit cards with no foreign transaction fees in 2026

- What are foreign transaction fees?

- 11 Best business credit cards with no foreign transaction fees

- Difference between foreign transaction fees and currency conversion fees

- Why more businesses are getting hit with cross-border fees

- How much do foreign transaction fees really cost?

- Signs you may need a card with no foreign transaction fees

- What to expect from a no-foreign-transaction-fee business credit card

- How to evaluate cards if your team makes international purchases

- Which industries benefit most from no-forex-fee cards?

- Get a Ramp Business Credit Card to avoid foreign transaction fees

Business credit cards with no foreign transaction fees help you avoid the issuer’s surcharge, typically 2–3%, on international purchases. You may still see currency conversion costs, since payments in non-USD currencies are converted at the network’s exchange rate, which may include a small margin.

For businesses with international spend, those issuer fees can add up quickly. Spending the equivalent of $100,000 abroad could result in an extra $3,000 in fees with no added value.

Below, we break down how foreign transaction fees work, where they show up, and which business credit cards don’t charge them.

What are foreign transaction fees?

FX fees

A foreign transaction fee is a surcharge your card issuer adds when a purchase is processed in a non-US currency or through a non-US payment processor. The fee typically includes a network charge from Visa or Mastercard plus an additional fee from the issuing bank.

For example, a $5,000 vendor payment processed overseas could include an extra $150 in fees. These charges apply to both online and in-person purchases and are not always labeled clearly on statements, which makes them easy to overlook during reconciliation.

Where do foreign transaction fees show up?

Foreign transaction fees usually appear on your credit card statement either as a separate line item or as an amount baked into the total charge. Some issuers call them out explicitly, while others group them under broader processing fees, which makes them easy to miss.

For example, a $5,000 vendor payment processed overseas could include an extra $150 in fees. These charges apply to both online and in-person purchases and are not always labeled clearly on statements.

Many teams first notice these fees during reconciliation, when statement totals do not match vendor invoices. They also appear in reimbursements, such as when an employee submits a hotel receipt that does not match the amount charged to the card.

Over time, these small differences create extra work for finance teams. Reconciling inflated charges, investigating mismatches, and adjusting entries can slow down close and reduce confidence in expense data.

11 Best business credit cards with no foreign transaction fees

Here’s a breakdown of which business credit cards don’t charge foreign transaction fees.

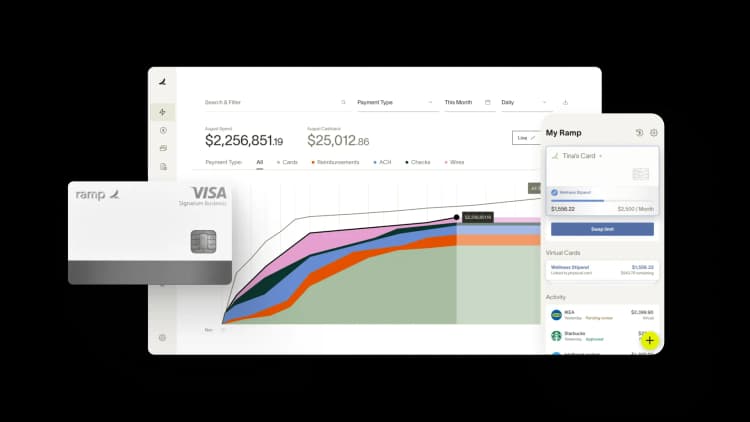

1. Ramp Business Credit Card

Ramp Business Credit Card

- Cashback rewards with flexible redemption options

- Built-in expense management software

- No credit check or personal guarantee required

- Must be a registered business to qualify

- Must have most of your business spend in the US

The Ramp Business Credit Card is ideal for businesses looking to avoid foreign transaction fees while benefiting from a streamlined expense management platform. With cashback on purchases and no preset spending limits, it’s perfect for businesses that value simplicity and flexibility. Additionally, Ramp offers robust tools for managing spending, automating expense reporting, and providing real-time insights into your financial health—all with no fees, including no foreign transaction fees.

2. The Business Platinum Card from American Express

The Business Platinum Card from American Express

- 5x points on flights and prepaid hotels booked via Amex Travel

- No preset spending limit

- Complimentary Marriott Bonvoy Gold Elite and Hilton Honors Gold status

- Access to airport lounges and other travel perks

- No foreign transaction fees

- “Pay Over Time” offers payment flexibility on eligible purchase

- High annual fee of $895

- Rewards program is relatively complex

- Benefits are primarily travel-focused, less so on other business expenses

- Requires full balance payment each month

The Business Platinum Card is perfect for luxury business travelers who want a wealth of travel perks, including lounge access, Global Entry/TSA PreCheck credits, and annual airline fee credits. Despite the high annual fee, the array of perks and rewards, including hotel status and flexible point transfers, statement credits, and more. Enrollment required.

3. Chase Ink Business Premier Credit Card

Chase Ink Business Premier Credit Card

- $1,000 bonus cashback if you spend $10,000 in your first 3 months

- No foreign transaction fees

- Elevated cashback rewards on large purchases over $5,000

- "Flex for Business" provides payment flexibility on eligible purchases

- High annual fee

- Requires significant spend to unlock welcome bonus

- Limited expense management features

- Requires full balance payments each month

- "Flex for Business" only available on specific purchases

This card is ideal for business owners who want flexibility in how they use their rewards. It offers 3x bonus points on key business categories like travel, shipping, and advertising, plus a generous welcome bonus if you spend a certain amount within a period following your account opening. You can redeem points for travel at a 25% higher value through Chase Ultimate Rewards or transfer points to various airline and hotel partners.

4. Amazon Business American Express Card

Amazon Business American Express Card

- No annual fee

- Give out employee cards without any additional cost

- No balance transfer fee

- A $100 Amazon Gift card is a less generous bonus than other business credit cards

- You must do business in the U.S. to maximize your rewards

- 3% cashback on Amazon purchases only applies for the first $120,000

The Amazon Business American Express Card is designed for businesses that frequently shop on Amazon. It offers cardholders the option of earning 5% back on Amazon purchases (up to $120,000, then 1% thereafter) or forgoing rewards for a 90-day 0% intro APR on purchases.

5. Capital One Spark Classic for Business

Capital One Spark 1% Classic

- Unlimited 1% cashback on all purchases

- Unlimited 5% cashback on hotels and rental cars booked through Capital One Travel

- No annual or transaction fees

- Fair credit scores accepted

- Cashback rewards are slightly less than average

- High APR

Does Capital One charge for international transactions? Nope! That’s just one of the reasons businesses turn to the Capital One Spark Classic for Business.

For business owners with fair credit, this card offers an opportunity to earn 1% cash back while building credit. It’s easier to qualify for, has no annual fee or foreign transaction fees, and is ideal for businesses that may not yet qualify for more premium options but still want to earn rewards.

Each card is tailored to different spending habits and preferences, making it important to match your choice to your business needs.

6. Bank of America Business Advantage Travel Rewards World Mastercard

Bank of America Business Advantage Travel Rewards World Mastercard

- No annual fee

- Simple points-based rewards

- Attractive welcome offers

- Potential to boost earnings as a Bank of America business account owner

- No bonus categories

- No lounge access or travel credits

The Bank of America Business Advantage Travel Rewards World Mastercard is a no-annual-fee card that earns 1.5 points per dollar spent on all purchases. Cardholders can potentially earn more points if they qualify for the Preferred Rewards for Business program. The card also offers 0% intro APR on purchases for the first 9 billing cycles, followed by a variable APR.

7. Chase Ink Business Preferred

Chase Ink Business Preferred Credit Card

- Earn 3x points on travel, shipping, internet and phone services, and qualifying ad spending

- Unlimited 1x points on all other categories

- Points are worth 25% more when redeemed through Chase Travel

- $95 annual fee is reasonable for businesses that value travel rewards

- High spending requirement to earn welcome bonus

- Not a good choice for businesses with limited travel needs

The Chase Ink Business Preferred cardmembers earn Chase Ultimate Rewards points. It offers elevated points earnings on travel, shipping, internet, cable, phone services, and advertising purchases, making it useful for businesses with frequent expenses in these categories. Cardholders can transfer points to airline and hotel partners or redeem them through Chase Travel.

8. American Express Business Gold Card

American Express Business Gold Card

- High rewards rate in top spending categories

- Flexible points system with numerous redemption options

- No international transaction fees

- High annual fee

- Rewards capped for 4x earnings

- Requires good to excellent credit

Amex Gold’s international fees do not exist; it does not charge foreign transaction fees for purchases made outside of the United States. The American Express Business Gold Card offers customizable bonus categories so cardholders can earn 4x points in the top two spending categories each month. This is ideal for businesses with varied expenses as it maximizes rewards based on their highest spending areas.

It offers flexibility in redemption options like flights, hotel stays, gift cards, and more through the American Express Membership Rewards program. Cardholders don’t have to worry about paying an Amex Gold Card foreign transaction fee.

9. Capital One Spark Cash Plus

Capital One Spark Cash Plus

- Unlimited cashback rewards

- No preset spending limit

- Offers $150 statement credit to offset annual fee

- 0% interest when used as intended

- Early spending bonus

- 2.99% monthly fee on late payments

- Must spend $150,000 per year to access the $150 statement credit

- Limited spend management features

This card offers a flat 2% cash back on all purchases, making it the best for businesses seeking simplicity and high cash-back rewards across all spending. There’s no preset spending limit, which is great for businesses with large budgets. Plus, it offers 5% back on hotels and car rentals booked through Capital One Travel.

10. CitiBusiness / AAdvantage Platinum Select Mastercard

CitiBusiness / AAdvantage Platinum Select World Elite Mastercard

- Preferred boarding

- No mileage cap

- Additional perks as you accumulate loyalty points

- Annual fee

- You must use American Airlines to get the maximum benefits

- The card is primarily for people who travel often

Some cards from Citi have no foreign transaction fees, including the CitiBusiness AAdvantage Platinum Select World Elite Mastercard. For businesses that frequently fly with American Airlines, this card offers great value with 2x bonus miles on American Airlines purchases, gas stations, and other select categories. You also get travel perks like free checked bags and preferred boarding, making it an excellent choice for frequent flyers loyal to American Airlines.

11. Capital One Venture X Business Credit Card

Capital One Venture X Business Card

- Extensive travel benefits

- No fees for international transactions

- Transferable miles to travel partners

- High annual fee

- Benefits may not justify the cost for non-travel-focused businesses

We’ll round out our list of the best business credit cards with no foreign transaction fees with the Capital One Venture X Business Credit Card. This is a premium travel card that offers unlimited 2x miles on any purchase with no preset spending limits. It also includes an annual travel credit and complimentary airport lounge access, making it a compelling option for businesses with frequent travel needs.

Each card is tailored to different spending habits and preferences, making it important to match your choice to your business needs.

Difference between foreign transaction fees and currency conversion fees

Foreign transaction fees and currency conversion fees are two different costs. A foreign transaction fee is an extra surcharge from your issuer for processing a payment through a non-US financial institution. A currency conversion fee comes from the card network (Visa, Mastercard, etc.) when a transaction in a non-USD currency is converted into US dollars.

Some issuers also add their own margin on the conversion rate (often up to ~3%), which is different from a foreign transaction fee. One charge is tied to how the payment is routed, while the other reflects how the currency is converted.

Feature | Foreign transaction fee | Currency conversion fee |

|---|---|---|

Purpose | Covers the cost of processing through a non-US financial system | Covers the cost of converting currency |

Currency involved | May apply even if charged in USD | Only applies if charged in a foreign currency |

Appears as on statement | Itemized as a separate line or bundled with the transaction total | Reflected in the exchange rate used |

Impact on total cost | Raises the fee above the purchase amount | Affects the final USD amount debited |

Common scenarios | SaaS tools billed through non-US entities | Travel purchases in euros, pounds, etc. |

Applied on | Any international transaction, regardless of currency | Any transaction in non-USD currency |

Tracking difficulty | Often hidden in card statements | Expense approvals get delayed due to unexpected fees |

Ramp does not charge a traditional foreign transaction fee. However, like other providers, some international activity may still involve costs. For example, sending funds via the SWIFT network, making bill payments or reimbursements in foreign currencies, or card purchases that clear in a non-USD currency may include a small margin or network fee. These costs are outlined in Ramp’s Platform Agreement and Payment Card Addendum, and are capped at a 3% markup on currency conversions.

Why more businesses are getting hit with cross-border fees

Cross-border fees used to affect mostly travel-heavy companies. But these days, SaaS startups, e-commerce brands, marketing firms, and even local service providers now face these charges regularly.

If your business pays international vendors, runs digital ads, or works with global contractors, you could be incurring fees without realizing it. These costs often slip through unnoticed because the charges are small but frequent.

- Global vendors are powering more of your tech stack. Many SaaS platforms and ad tools are based outside the United States. If your billing address routes through a foreign processor, your transactions may trigger a cross-border fee. Among US-headquartered multinational enterprises, over 30% of their total workforce is located abroad.

- Remote hiring and international contractors are on the rise. Teams are hiring globally, even for roles that were once domestic. Paying freelancers or agencies based abroad can lead to foreign fees, even if the invoice is in US dollars.

- Credit card networks flag more transactions as international. Even when purchases happen in US dollars, the underlying processor might be outside the country. If the merchant account is non-US, your card issuer may apply a cross-border surcharge.

- Teams book travel or lodging through international providers. Booking through platforms like Ryanair, Agoda, or foreign hotel chains results in non-USD billing. These purchases often come with additional card fees, even when they appear routine.

- Automated billing hides the details. Recurring payments for tools like analytics dashboards, newsletter software, or hosting services may not show the billing entity's location. You often find out after the fee has been applied.

- More cards bundle multiple fees into one charge. Some issuers include both the foreign transaction fee and a cross-border processing fee, making the total charge higher than expected. Businesses that process dozens of transactions per month may not catch these extra costs right away.

How much do foreign transaction fees really cost?

For businesses with regular cross-border spend, foreign transaction fees can quickly compound into a recurring cost. Small charges across software subscriptions, vendor payments, and travel add up faster than most teams expect.

A company spending $25,000 per month on international SaaS tools, vendors, and travel would pay about $750 in foreign transaction fees each month, or roughly $9,000 per year in processing costs alone.

Because these fees show up as minor additions to individual transactions, they often go unnoticed until a quarterly review or audit. Eliminating them frees up cash flow that could fund a software upgrade, extend runway, or support an additional hire without increasing revenue targets.

Signs you may need a card with no foreign transaction fees

Signs often appear as small gaps between what you expect to spend and what actually shows up on your statement. They include recurring charges that feel slightly inflated, inconsistent totals for software tools, or unexplained fees on otherwise routine purchases. These patterns point to international processing or currency-related costs that can quietly reduce your available budget.

Even if your team operates primarily in the US, the way you spend can trigger foreign transaction fees. The signs below help you spot when those fees are becoming a cost center in your business.

Activity or spend type | Why this triggers foreign fees | What to watch for |

|---|---|---|

Paying for SaaS tools from international providers | Many platforms route billing through non-US processors | Monthly subscription totals vary from invoice amounts |

Hiring contractors or freelancers abroad | Payments are often processed through foreign banks | Reimbursement requests or wire fees seem inflated |

Running paid ads on global platforms | Ad networks may process payments through international billing entities. | Fees appear on transactions from Meta or Google Ads |

Booking international business travel | Charges for flights or hotels come from providers based outside the US | Travel-related expenses consistently cost more than expected |

Using marketplaces with global sellers | Vendor location affects how the payment is routed | Product cost is correct but the statement shows an added fee |

Making bulk purchases from overseas | International suppliers often bill in local currency or route via local banks | Payment processor location shows outside the US |

Receiving multiple finance team alerts | Cards with limits may flag international charges | Expense approvals get delayed due to unexpected fees |

Ramp does not charge a traditional foreign transaction fee. However, like other providers, some international activity may involve additional costs. For example, sending funds via the SWIFT network, making bill payments or reimbursements in foreign currencies, or card purchases that clear in a non-USD currency may include a small margin or network fee. These costs are outlined in Ramp’s Platform Agreement and Payment Card Addendum, and are capped at a 3% markup on currency conversions.

What to expect from a no-foreign-transaction-fee business credit card

A business credit card with no foreign transaction fees removes the extra percentage that card issuers normally charge for international payments. For companies making frequent global transactions, this can mean thousands in annual savings. These cards also tend to be designed with cross-border spending in mind, offering features that improve both cost control and ease of use.

- No additional cost on foreign purchases. You will not pay the typical 2% to 3% surcharge when transactions are processed outside the US or in a non-USD currency. A company spending $50,000 annually on global services could save $1,500 or more simply by using this type of card.

- Wide merchant acceptance worldwide. Cards in this category are often backed by major networks like Visa, Mastercard, or American Express, which have extensive global coverage. This makes it easier to pay vendors, book accommodations, or settle invoices without payment failures.

- Accurate and predictable expense reporting. With no extra fee lines added to each transaction, your statements show cleaner figures that match invoice totals. This reduces the time your finance team spends investigating small cost discrepancies.

- Integration with multi-currency accounting platforms. Many cards connect directly to systems like QuickBooks, NetSuite, or Xero. This ensures that foreign purchases are automatically recorded in USD at the correct exchange rate, streamlining reconciliation.

- Real-time tracking of international spend. Card dashboards often update within minutes, allowing you to see global charges as they happen. This visibility helps detect unusual transactions and monitor spend against budget without waiting for month-end reports.

- Custom controls for overseas transactions. Some issuers let you restrict international spending by category, merchant, or limit per cardholder. This can help prevent unauthorized travel bookings or non-business charges abroad.

- Travel perks designed for business use. Benefits can include trip delay reimbursement, rental car insurance, and access to airport lounges. These features add value for employees who travel internationally while reducing the need for separate travel coverage.

How to evaluate cards if your team makes international purchases

Evaluating business credit cards for international use often involves both the finance team and operational leads. Controllers and CFOs look at cost, accounting integration, and approval workflows, while department heads focus on usability for their teams.

Procurement managers may weigh in when vendor relationships span multiple countries. Together, they assess which card delivers the right mix of cost savings, controls, and global acceptance.

Step 1: Review your international spend patterns

Start by pulling 6 to 12 months of expense data. Highlight every payment that went to a vendor, supplier, or service provider based outside the US. Include subscriptions for SaaS tools, payments to global contractors, airline tickets, and hotel stays.

This helps you see how often foreign transaction fees would have applied. If most of your total spend is international, the right card choice can produce significant savings.

Step 2: Compare total cost, not just the absence of fees

A no-foreign-transaction-fee feature can save up to 3% on each eligible purchase, but that alone does not guarantee the card is cost-effective. Review the annual fee, any interest charges, and processing fees for other transactions.

For example, a company that spends $100,000 on international purchases could save $3,000 annually in waived fees, making a $500 annual card fee worthwhile if other benefits align with the business’s needs.

Step 3: Check exchange rate practices

Even if the card does not charge a foreign transaction fee, currency conversion still happens when paying in a non-USD currency. Some networks use competitive market rates, while others add a small markup. Knowing how the card network sets these rates helps you estimate the true cost of each transaction and avoid surprises during reconciliation.

Step 4: Evaluate acceptance in the regions you work with most

Not all cards are equally accepted worldwide. Consider the card networks your key vendors, suppliers, and travel partners accept. Visa and Mastercard have the broadest reach globally, while American Express can be strong in certain regions but less accepted in others. Ensuring the card is widely accepted where you do business prevents delays and the need for backup payment methods.

Step 5: Look for expense tracking and spending controls

International purchases can complicate bookkeeping. Cards that integrate with your accounting system can automatically record the correct USD amount and match it with the original invoice. Features like merchant-specific limits or category restrictions also help you manage spending in different markets without slowing down approvals for legitimate expenses.

Step 6: Weigh additional benefits for your global operations

Many cards in this category include perks tailored to international use, such as trip delay coverage, lost luggage reimbursement, or bonus rewards on travel purchases. If your team travels frequently or orders high-value goods from overseas, these benefits can add meaningful value and help offset other operational costs.

Which industries benefit most from no-forex-fee cards?

No-foreign-transaction-fee cards reduce costs for businesses that regularly make cross-border payments or purchases in non-USD currencies. These savings can be significant in industries where global vendors, overseas suppliers, or international travel are part of daily operations.

SaaS and remote-first teams

SaaS companies often pay for software, infrastructure, and contractors across borders, even when tools are priced in USD. When payments are processed through non-US banks, foreign transaction fees add up quickly. Removing the fee cuts recurring overhead on subscriptions and payroll without changing how teams work.

E-commerce with global suppliers

E-commerce brands that source inventory overseas make frequent, high-value payments to manufacturers, freight providers, and logistics partners. A no-foreign-transaction-fee card removes the surcharge on every order, helping protect margins and leaving more room for inventory, marketing, or faster fulfillment.

Professional services and consultants

Consultants, legal teams, and accounting firms often incur international expenses tied to client work, including flights, hotels, meals, and ground transportation. Avoiding foreign transaction fees keeps billable costs lower and makes it easier to pass through expenses without inflating client invoices.

Manufacturing and supply chain teams

Manufacturers that purchase raw materials, components, or equipment internationally make large and recurring cross-border payments. Eliminating foreign transaction fees reduces operating costs and creates more flexibility to invest in lead times, quality, or new supplier relationships.

Get a Ramp Business Credit Card to avoid foreign transaction fees

As global spending grows more complex, foreign transaction fees can quietly eat into your budget. Ramp’s corporate card eliminates that cost by charging zero foreign transaction fees.

The benefit extends beyond the fee waiver. Ramp supports spending in 200+ countries and territories, covering both travel and vendor payments. Transactions categorize automatically, vendor details update in real time, and integrations with QuickBooks and NetSuite speed up reconciliation.

With fees removed, accounting automated, and spending visible in every market you operate, you can redirect savings toward initiatives that move your business forward.

FAQs

Yes, some business credit cards charge foreign transaction fees, typically as a percentage of each international purchase. Many cards waive these fees, which can make a meaningful difference for businesses with regular cross-border spending.

Many business debit cards charge foreign transaction fees. Even though debit cards pull funds directly from your account, international transactions are often processed through payment networks that apply these fees

Dynamic currency conversion allows a merchant to process a payment in your home currency instead of the local currency. While it may seem convenient, the exchange rate is often worse than your card network’s rate and can include additional fees.

If the purchase was made for business purposes, foreign transaction fees are typically deductible as operating expenses. Check with a tax advisor to confirm how this applies to your business.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits