Periodic inventory system: A complete guide for businesses

- How a periodic inventory system works

- Periodic vs. perpetual inventory system

- How to choose the right inventory system for your business

- How to implement a periodic inventory system successfully

- Tools that support periodic inventory systems

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

A periodic inventory system tracks inventory where you update stock levels at fixed intervals rather than after every transaction. With this method, you count your inventory at the end of a set period, like weekly, monthly, or quarterly, to determine stock levels and calculate the cost of goods sold (COGS).

Many small and medium-sized businesses use this system. It’s ideal if you sell large volumes of low-cost goods or don’t have constant inventory movement. Retail stores, wholesalers, and smaller businesses with fewer daily transactions prefer it because it’s simple, cost-effective, and doesn’t require complex tracking software.

Since inventory updates only happen periodically, you need to plan stock counts carefully. This helps you avoid shortages, overstocking, and inaccurate accounting records. Despite its limitations, a periodic inventory system remains a practical choice for businesses that don’t need real-time tracking but still require accurate financial reporting.

How a periodic inventory system works

Tracking inventory with a periodic inventory system takes time because stock levels are only updated at the end of a set period. The process can take several hours to multiple days, depending on the size of your inventory and the frequency of counts.

For small businesses with limited stock, a physical inventory count might take just a few hours at the end of each month. However, for retail stores, wholesalers, or businesses with high inventory volume, counting stock can take several days, especially if done quarterly or annually.

- Record beginning inventory

At the start of the accounting period, you use your last recorded stock count as the beginning inventory. This number represents the total value of goods available before purchases or sales. This system assumes the starting value remains unchanged until the next count. - Track purchases separately

Throughout the period, you record all inventory purchases in a temporary purchases account instead of adjusting stock levels immediately. This account keeps track of everything you buy but doesn’t show real-time inventory changes. For example, if you purchase 500 units during the month, your financial records will reflect the total cost, but your inventory count stays the same until the next stock audit. - Conduct a physical inventory count

At the end of the period, you perform a manual stock count to determine how much inventory remains. This step is critical because it updates records that haven’t changed throughout the period. It also helps identify missing, damaged, or unsold goods. - Calculate cost of goods sold (COGS)

The cost of goods sold (COGS) is calculated by adding the beginning inventory to the total purchases made during the period and subtracting the ending inventory (the value of inventory remaining at the end of the period). - Update financial records

After calculating COGS, you adjust your financial statements. The purchase account is cleared, and the remaining stock is recorded as the new ending inventory. This ending inventory then becomes the beginning inventory for the next period, and the cycle repeats.

Periodic vs. perpetual inventory system

Choosing between a periodic and perpetual inventory system depends on how often your business moves inventory, how accurate you need stock records to be, and whether you have the resources to invest in automation.

The periodic inventory method is best for businesses that don’t require constant inventory tracking. This system keeps operations simple if you run a small or medium-sized business, such as a boutique store, local wholesaler, or seasonal business. You won’t need expensive software or barcode scanners, making it a cost-effective choice for businesses with limited budgets.

Businesses that sell high-volume, low-cost items, like groceries, office supplies, or clothing, often prefer periodic tracking. Since these products move quickly, daily stock updates aren’t always necessary. Instead, you can conduct physical counts at regular intervals, ensuring records stay up to date without the complexity of continuous tracking.

On the other hand, a perpetual inventory method is the better choice for businesses that need real-time stock tracking. Accurate inventory management is essential if you run an e-commerce store, a large retail chain, or a company with multiple locations. A perpetual system helps you track every sale, return, or restock automatically, reducing errors and ensuring you always know what’s available.

Business owners selling high-value or serialized items like electronics, jewelry, or pharmaceuticals rely on this system. When every unit matters, real-time tracking prevents stock discrepancies and ensures customers get the right products. Since inventory updates happen instantly, businesses can prevent stockouts.

However, a perpetual system requires a higher investment in technology. You’ll need barcode scanners, POS systems, and inventory accounting and management software to automate tracking.

How to choose the right inventory system for your business

Deciding between periodic and perpetual inventory tracking depends on how often your stock moves and how much control you need. A periodic system keeps things simple if you operate a small business with minimal supply chain fluctuations. It’s affordable and easy to maintain if you plan stock counts carefully.

If inventory changes frequently, sales volume is high, or stock errors impact your bottom line, a perpetual system is the better option. While it requires more resources, it provides the accuracy and efficiency needed to support growth.

43% of businesses struggle with inventory item inaccuracies, leading to lost sales and operational inefficiencies. The right inventory system depends on your business size, budget, and long-term goals. If precision and automation matter, invest in a perpetual system. A periodic system will serve you well if cost and simplicity are your priorities.

How to implement a periodic inventory system successfully

A well-implemented periodic inventory system helps businesses avoid costly mistakes like stock shortages, over-ordering, and inaccurate financial reporting. Since inventory balance is only updated at set intervals, errors can go unnoticed if the system isn’t structured properly.

In 2022, inventory shrinkage caused businesses to lose over $94.5 billion, often due to mismanagement, theft, or record-keeping errors. Without a clear plan, a periodic inventory system can create gaps in tracking that make it difficult to manage stock efficiently.

- Establish a clear inventory counting schedule

Decide how often you will count inventory, like weekly, monthly, or quarterly. The right frequency depends on your business size and sales volume. If you sell high-turnover items, more frequent counts help prevent errors. - Train your team on proper counting procedures

Since periodic inventory relies on manual counts, ensure your employees follow a standardized process. Assign responsibilities to specific team members and provide clear guidelines on how to record stock. Use count sheets or inventory tracking software to minimize mistakes. - Organize inventory before each count

A cluttered stockroom makes counting inefficient and increases the chance of errors. Before each inventory audit, arrange products systematically, group similar items, and label stock clearly. A well-organized inventory account speeds up the counting process and improves accuracy. - Implement basic tracking tools

Even though a periodic system doesn’t require real-time tracking, basic inventory software or spreadsheets can help maintain accurate records. Tools like Excel, Google Sheets, or entry-level inventory management systems can streamline counting and reporting. - Conduct audits to verify accuracy

Regular audits help identify discrepancies in stock records and offer better inventory control. Compare physical inventory counts with purchase receipts and sales data to spot errors. If you frequently notice missing stock, it could indicate theft, mismanagement, or tracking errors. Addressing these issues early prevents larger financial problems. - Adjust purchasing decisions based on inventory cost and data

Since you don’t have real-time stock updates, analyzing past inventory trends helps prevent overstocking or running out of products. Use sales history to determine optimal reorder points and adjust purchases accordingly. Businesses that don’t track inventory properly risk tying up cash in excess stock or losing sales due to shortages.

Tools that support periodic inventory systems

Manual stock counts alone can be time-consuming and prone to errors. Tools help you maintain accurate records and ensure your inventory is tracked efficiently between updates. Without the right tools, discrepancies between physical counts and recorded data can go unnoticed, leading to stockouts, overstocking, or financial misstatements.

Inventory management software

Inventory management software helps you organize and track your stock. It allows you to log purchases, monitor stock levels, and generate reports. While periodic systems don’t update stock in real time, the software can still help you keep records of purchases and compare purchases to physical counts.

These software help you track inventory, manage purchase orders, and integrate real-time data with your accounting software. It allows barcode scanning and automates purchase order tracking to reduce mistakes and improve accuracy.

Barcode scanners for inventory counts

A barcode scanner can speed up your inventory counts and improve accuracy. Instead of manually writing down stock, you can scan each item, ensuring a precise record. This tool helps you quickly update your stock counts and reduces human error.

They help you scan products and track inventory levels in your system, and they can integrate with your inventory management software, making the counting process much faster and more accurate.

Accounting software with inventory tracking features

Accounting software with inventory tracking helps you integrate purchases into your financial records. This reduces mistakes in your cost of goods sold and ensures accurate financial reports. Even in a periodic system, accounting software helps track purchases and keeps your financial records up to date.

QuickBooks Online and Xero help you track purchases, inventory, and financial reports. They integrate with your inventory management system, making it easier to keep your books accurate.

For businesses using a periodic inventory system, Ramp can complement these platforms by automating the syncing of transactions, receipts, and reimbursements, reducing the time spent on manual reconciliation and improving accuracy across your accounting system and inventory data.

Point-of-sale (POS) systems for sales tracking

A POS system tracks your sales, providing insight into inventory usage between counts. Even though a periodic inventory system doesn’t update stock in real time, POS systems clearly show which products are selling quickly. This helps you plan better for restocking and avoids stock shortages.

For example, Shopify POS tracks your sales and helps you manage orders. It provides detailed reports to show which items are selling best, helping you prepare for your next physical inventory count.

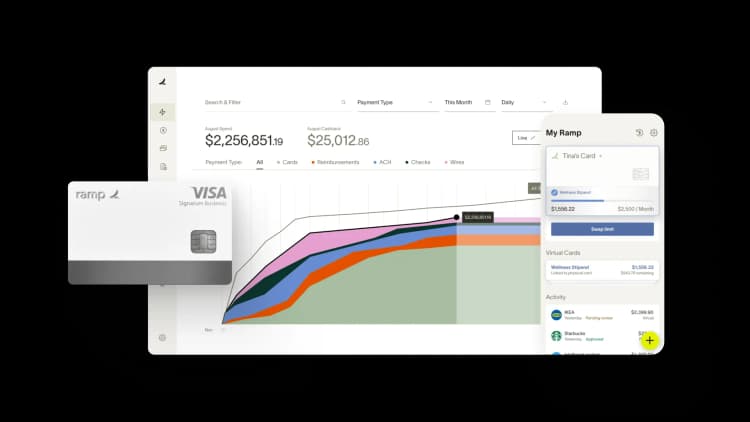

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group