- How does the post-closing trial balance differ from other trial balances?

- How to prepare a post-closing trial balance

- Format of a post-closing trial balance

- Does post-closing trial balance help with compliance and audits?

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

A post-closing trial balance is a financial report listing all permanent account balances after recording closing entries. It ensures that your books are balanced by verifying that total debits equal total credits at the end of an accounting period. This step helps confirm that all temporary accounts, such as revenues and expenses, have been closed properly.

The post-closing report does not include income or expense accounts since they reset to zero at the end of the period. This trial balance only shows balances that carry forward into the next cycle, such as assets, liabilities, and equity.

Almost half of small business owners lack accounting knowledge to manage finances properly. This report helps you catch errors before they affect your financial statements. If the numbers don't match, a mistake needs fixing.

How does the post-closing trial balance differ from other trial balances?

A post-closing trial balance differs from both the unadjusted and adjusted trial balances. Each trial balance serves a different purpose at various stages of the accounting process, ensuring accuracy before financial statements are finalized.

The unadjusted trial balance is the first version, prepared before any adjustments. It lists all account balances directly from the general ledger, including temporary accounts like revenues and expenses. Since no adjusting or closing entries have been made yet, it may contain errors or missing transactions that require correction.

The adjusted trial balance comes after recording all necessary adjustments, such as accrued expenses and depreciation. It ensures that all financial activity is correctly reflected before generating financial statements. However, it still includes temporary accounts, which will later be closed.

A post-closing trial balance is the final step, created after closing entries are made. Unlike the previous two, it only includes permanent accounts since all revenue and expense accounts have been reset to zero. This confirms that the books are balanced and ready for the next accounting period.

While all three trial balances act as checkpoints for accuracy, the post-closing trial balance provides the final verification, ensuring that no temporary accounts remain and that financial records are complete and compliant before moving forward.

How to prepare a post-closing trial balance

A post-closing trial balance is the final step in the accounting cycle before a new period begins. It ensures that only permanent accounts carry forward while temporary accounts have been fully closed.

Step 1: Review the adjusted trial balance

Start by examining your adjusted trial balance, including all account balances after adjustments for accruals, deferrals, and other corrections. This is your foundation for closing entries, so it must be accurate.

Look for any unadjusted transactions, missing expenses, or errors in revenue recognition. If mistakes exist at this stage, they will carry into the post-closing trial balance, causing inaccuracies in your financial statements.

Step 2: Record closing entries

Next, close all temporary accounts by transferring their balances to the retained earnings account. Revenue accounts should be debited to bring their balance to zero, and the corresponding amount should be credited to retained earnings. Expense accounts should be credited to remove their balances, and the same amount should be debited to retained earnings.

If your business distributes dividends, you must close the dividends account by transferring its balance to retained earnings. After posting these entries, all revenue, expense, and dividend accounts should show a zero balance in your general ledger.

Step 3: Prepare the post-closing trial balance

Now, create a new trial balance that lists only permanent accounts. These include all asset accounts, such as cash, accounts receivable, and equipment; liability accounts, like accounts payable and loans; and equity accounts, such as retained earnings and owner's capital.

Temporary accounts, including revenue and expense accounts, should no longer appear. This report ensures that only the correct balances move forward into the next accounting period.

Step 4: Verify total debits and credits

Your post-closing trial balance must be balanced, meaning total debits equal total credits. If they don't, it indicates an error in the closing process that needs to be addressed. Common mistakes include miscalculations, failing to transfer all temporary account balances, or accidentally posting transactions to the wrong account.

Step 5: Identify and correct errors

If your trial balance doesn't balance, review your closing entries and general ledger. Double-check calculations, confirm that each temporary account was properly closed, and ensure every amount was posted correctly. If needed, record adjusting entries to correct any discrepancies.

Correctly recording and categorizing transactions is challenging while preparing a post-closing trial balance. You can automatically track your expenses and maintain up-to-date financial records with expense management tools to deal with this. This helps you reduce the risk of reconciliation errors.

Once everything is accurate, your books are officially closed, and you can confidently start the next accounting period with clean financial records.

Format of a post-closing trial balance

A post-closing trial balance follows a structured format that ensures all permanent accounts, like the assets, liabilities, and equity, are correctly recorded before the next accounting period begins. This helps confirm that total debits and credits are balanced, reducing the risk of errors in future financial reports.

The post-closing trial balance is typically presented in a tabular format with three main columns:

- Account names: A list of permanent accounts, arranged in the standard accounting order: assets first, followed by liabilities, and then equity.

- Debit balances: The balances of all accounts with debit entries, such as cash, accounts receivable, inventory, and equipment. Most asset accounts are increased with a debit entry.

- Credit balances: The balances of all accounts with credit entries, including accounts payable, loans, and retained earnings. Most liability and equity accounts are increased with a credit entry.

At the bottom of the report, total debits and total credits must be equal. If they don't match, it signals an issue with the closing process, such as incorrect closing entries, misclassified transactions, or calculation errors.

This format serves as the final checkpoint before a new period begins. It ensures that only active balances carry forward, giving businesses a clean and reliable starting point for the next accounting cycle.

Does post-closing trial balance help with compliance and audits?

The post-closing trial balance confirms that your financial records are accurate and that all temporary accounts are fully closed. Since this report only includes permanent accounts, it ensures your books are balanced before moving into the next accounting period. This step reduces errors that could lead to compliance issues or financial misstatements.

From a compliance standpoint, you must keep accurate financial records to meet tax regulations and financial accounting standards like GAAP and IFRS. Agencies like the IRS and SEC require businesses to report financials correctly. Errors in closing entries can cause compliance issues and potential penalties.

Most small businesses face IRS penalties due to bookkeeping mistakes. A post-closing trial balance helps you avoid this by verifying that revenue and expense accounts are closed and that retained earnings are accurate. This reduces your risk of non-compliance and financial penalties.

A post-closing trial balance acts as a financial checkpoint for internal or external audits. Auditors use it to verify that your records are complete and accounts are correctly classified. They also check that total debits match total credits.

If errors exist, such as incorrect closing entries or missing adjustments, it can raise concerns and trigger a deeper review. A balanced post-closing trial balance improves transparency and helps auditors confirm that your financial statements are accurate.

A well-prepared post-closing trial balance also strengthens internal controls. It helps you detect fraud, accounting mistakes, or financial misstatements before they become bigger problems. You improve financial reliability by ensuring that only valid and ongoing balances carry forward. This step makes sure your records are audit-ready and compliant.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

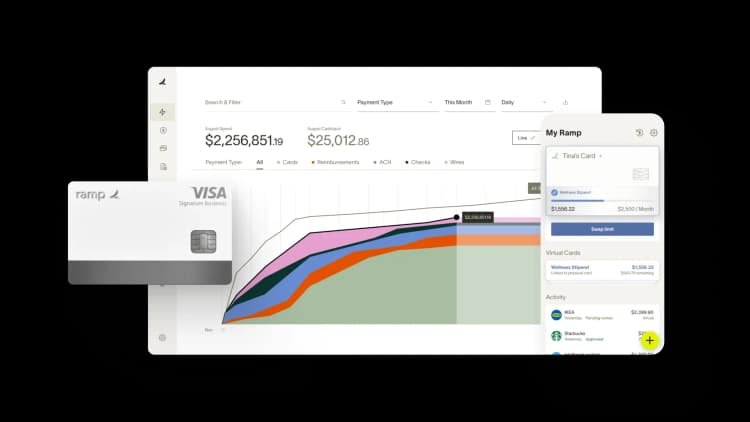

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits