Provisional credit: What it is and how it works under Regulation E

- What is a provisional credit?

- When are you eligible for provisional credit?

- The provisional credit timeline

- Common provisional credit scenarios

- How to file a dispute and request a provisional credit

- What happens after a provisional credit is issued?

- How does a provisional credit impact vendors?

- Gain visibility and control with the Ramp Business Credit Card

A provisional credit is a temporary refund issued to your account while your bank or credit card issuer investigates a disputed transaction. It lets you recover access to funds while your claim is under review.

Provisional credits are common when you spot unauthorized transactions, billing errors, or duplicate charges on your statement. While the credit offers short-term relief, it can be reversed if your dispute is denied. Understanding how the process works helps you avoid surprises on your account.

What is a provisional credit?

You typically receive a provisional credit when you dispute a transaction that your bank can’t resolve right away. This temporary refund gives you access to the disputed funds while the bank reviews your claim.

Common situations that may trigger a provisional credit include:

- Unauthorized or fraudulent charges on your account

- Billing errors or duplicate transactions on your statement

- Purchases for goods or services you didn’t receive

- Canceled subscriptions or returned items that haven’t been refunded

Not all disputes qualify for a provisional credit. Your bank or credit card issuer usually considers the type of charge, the timing of the dispute, and your account history before approving one. Even if you receive a credit, it doesn’t always mean the dispute will end in your favor. The credit remains temporary until the bank’s investigation is complete and your claim is approved.

Provisional credit vs. chargeback

Although provisional credits and chargebacks both involve disputed transactions, they’re not the same process. A provisional credit is a temporary refund your bank or card issuer provides while it investigates your dispute. A chargeback is the formal reversal of a credit card transaction once the issuer decides the merchant is at fault.

Key differences include:

- Type of transaction: Provisional credits usually apply to debit card or bank account disputes covered by Regulation E, while chargebacks are specific to credit card transactions governed by Regulation Z

- Process and timing: A provisional credit gives you access to disputed funds quickly, while a chargeback occurs after the investigation concludes and permanently reverses the charge if the dispute is upheld

- Outcome: Provisional credits can be reversed if the investigation doesn’t go in your favor, while a chargeback represents a final decision that closes the dispute

How provisional credit protects consumers

Provisional credits exist to prevent consumers from being left without funds while a dispute is pending. If your debit card is compromised or a billing error drains your account, waiting weeks for an investigation could create financial strain. By issuing a temporary credit, banks help you stay financially stable while they review your claim.

This protection, required under Regulation E for qualifying electronic fund transfers, ensures you have continued access to money that may rightfully be yours. Even though the credit can later be reversed, it provides peace of mind during the investigation period.

When are you eligible for provisional credit?

You are generally eligible for a provisional credit when you dispute an electronic fund transfer that your bank cannot resolve within the initial investigation window. Under Regulation E, if a covered debit or ACH dispute is still under review after 10 business days, the bank must issue a temporary credit so you have access to funds while the review continues.

Eligibility depends on the transaction type and when you report the issue. Most banks require you to flag an error within 60 days of the statement date.

Covered transactions

Provisional credits most often apply to consumer bank accounts and debit activity regulated by the Electronic Fund Transfer Act and Regulation E. Covered scenarios include:

- Unauthorized electronic transfers such as fraudulent debit card use or compromised account information

- ATM errors or discrepancies including incorrect withdrawal amounts or deposits that do not post

- Point-of-sale debit card transactions that are billed incorrectly, duplicated, or posted in error

- Incorrect electronic transfers such as ACH payments taken for the wrong amount or from the wrong account

If the bank cannot complete its investigation within 10 business days, it must issue a provisional credit while the review continues.

Transactions not covered

Some disputes fall outside Regulation E or follow different rules:

- Credit card disputes handled under Regulation Z and the chargeback process

- Wire transfers initiated in person that typically fall under the UCC rather than Regulation E

- Check disputes involving paper checks or check conversions

- Transactions reported after required time limits such as reports made more than 60 days after the statement date

The provisional credit timeline

Banks must follow specific deadlines when reviewing disputed transactions under Regulation E. If they cannot complete an investigation quickly, they must issue a provisional credit so you are not left without access to your money.

The following timeline shows how the process typically unfolds:

| Day | What happens |

|---|---|

| Day 1 | You file a dispute with your bank or card issuer |

| Days 2–10 | The bank investigates your claim |

| Day 10 | If unresolved, the bank issues a provisional credit |

| Days 11–45 | The bank continues investigating and gathers evidence |

| Up to Day 90 | Extended window for new accounts, foreign transactions, or point-of-sale purchases |

If your bank resolves the issue before Day 10, no provisional credit is needed. If the case extends beyond that, the temporary credit remains on your account until the bank reaches a final decision.

Important deadlines to remember

The key deadlines under Regulation E include the following:

| Deadline | Requirement |

|---|---|

| 60 days | Report an error within 60 days of the statement date |

| 10 business days | Bank must issue provisional credit if the case is still open |

| 45 days | Standard investigation window |

| 90 days | Maximum timeframe for certain complex cases |

Missing one of these deadlines can affect your eligibility for a provisional credit or delay resolution of your claim.

Common provisional credit scenarios

Provisional credits most often come into play in the following situations:

| Scenario | What happens | Example |

|---|---|---|

| Fraudulent activity | Unauthorized transactions appear on your debit card or ACH account | A hacker uses your debit card to make online purchases |

| Billing error or duplicate charge | You are charged twice or billed for a canceled subscription or service | A streaming platform bills you after you cancel your plan |

| Goods or services not received | You paid for something that never arrived or was not provided | You order a product online, but it never ships |

| ATM or transaction error | A withdrawal, deposit, or point-of-sale payment posts incorrectly | You withdraw $100, but your account is debited $200 |

In these cases, your bank may issue a provisional credit so you can access funds while the dispute is under review. If your claim is approved, the temporary refund becomes permanent.

How to file a dispute and request a provisional credit

While the exact process can vary by bank or card network, most provisional credit investigations follow similar steps. You report the issue, your financial institution begins reviewing it, and if the case remains unresolved after 10 business days, the bank must issue a temporary credit while the investigation continues.

1. Spot the disputed charge

Start by reviewing your bank or credit card statement carefully. If you notice a charge that looks wrong, whether it is fraudulent, a billing error, or a transaction that did not go as expected, note the date, amount, and merchant name for reference.

2. File a dispute with your bank

Contact your bank or card issuer to report the problem. Many institutions let you file disputes online or through their mobile apps, while others may require a call or a written request. Act quickly: most issuers require that disputes be submitted within 60 days of the statement date to qualify under Regulation E.

3. Issuer review and provisional credit

After you submit a dispute, the bank begins its investigation. If it cannot resolve the issue within 10 business days, it must issue a provisional credit to reimburse you temporarily. This ensures you can access the disputed funds while the review continues.

4. Investigation and evidence gathering

Your bank will reach out to the merchant and review receipts, transaction logs, and any communications related to the purchase. If the case is complex, Regulation E allows the bank to extend the timeline up to 45 days or 90 days for new accounts, foreign exchange payments, or point-of-sale purchases.

5. Final resolution

Once the investigation ends, your bank decides the outcome. If your dispute is approved, the provisional credit becomes permanent. If denied, the temporary refund is reversed and the original charge reapplied to your account.

Required documentation

Have your details organized before contacting your bank. Most institutions will ask for:

- Transaction details and dates including the amount, date, and merchant name

- Explanation of why the transaction is disputed

- Supporting evidence such as receipts, refund confirmations, or messages exchanged with the merchant

- A written dispute letter or completed form if the bank requires it

Tips for a successful dispute

Follow these best practices to keep your case moving quickly:

- Act promptly to stay within the 60-day reporting window

- Keep detailed records of all communications, receipts, and confirmation numbers

- Follow up in writing even if you report the issue by phone

- Monitor your account regularly to confirm the provisional credit posts correctly and that no new unauthorized charges appear

What happens after a provisional credit is issued?

After your bank issues a provisional credit, it continues investigating the disputed transaction to decide whether your claim is valid. The temporary credit stays on your account while the review is underway.

The investigation may last a few days or several weeks, depending on the complexity of the case and the bank’s internal process. Most institutions follow the time limits outlined in Regulation E, which govern how long they have to resolve disputes and notify you of the outcome.

Your bank may contact the merchant to gather receipts, shipping records, or customer correspondence. You might also be asked to provide additional information to support your claim.

If your dispute is approved

If the investigation confirms your claim, your provisional credit becomes permanent. The bank will remove the temporary status from the transaction and send a written notice confirming that the dispute was resolved in your favor.

Once the adjustment is finalized, no further action is required. The funds remain in your account permanently, and the case is closed.

If your dispute is denied

If your bank determines that the charge was valid, the provisional credit will be reversed and the original transaction amount reapplied to your account. You will receive a written explanation that outlines why the claim was denied and any evidence used in the decision.

If you disagree with the outcome, you have the right to appeal or escalate the dispute. You can:

- Contact your bank’s dispute resolution department for a secondary review

- File a complaint with the Consumer Financial Protection Bureau (CFPB) or your state financial regulator if you believe your claim was mishandled

- Consider mediation or arbitration if the issue remains unresolved

How does a provisional credit impact vendors?

Provisional credits protect cardholders but can create challenges for vendors. When a customer disputes a charge, the merchant may face temporary revenue loss, additional administrative work, or even long-term effects on their reputation, especially if disputes happen often.

Temporary loss of funds

When a dispute is filed, the amount in question is usually held or withdrawn from the vendor’s account. Even if the transaction was valid, the business may not regain access to those funds until the bank completes its investigation. This can disrupt cash flow, particularly for smaller companies or those with tight margins.

Sometimes, the merchant is not immediately notified of the dispute. They may continue to fulfill orders or provide services without realizing that payment is being questioned.

The burden of proof

Vendors are generally responsible for proving that a transaction was valid. They may need to submit receipts, shipping confirmations, or customer communications. If they do not respond on time or fail to provide enough documentation, the bank may side with the customer by default.

Chargeback disputes are especially difficult for businesses that sell digital or service-based products, where proof of delivery can be hard to establish. These companies need detailed records and clear processes to manage disputes effectively.

Long-term impact

Even when a vendor successfully resolves a chargeback, frequent disputes can cause larger issues. High chargeback rates may lead to fines, account freezes, or a “high-risk” label from payment processors. This can affect a business’s ability to process payments and harm customer trust.

Clear billing practices, transparent refund policies, and accurate transaction records can help vendors reduce the likelihood of disputes and respond more efficiently when they occur.

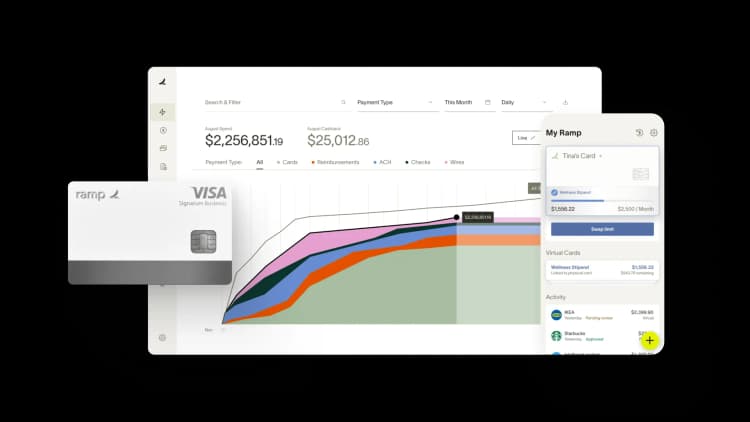

Gain visibility and control with the Ramp Business Credit Card

Disputed or out-of-policy charges can create confusion quickly. The Ramp Business Credit Card helps you prevent them with built-in spend controls, real-time tracking, and automated expense management.

With Ramp, you can:

- Prevent unauthorized spend by setting card limits and vendor restrictions

- Skip expense reports by submitting receipts instantly through SMS, app, or integrations like Gmail and Lyft

- Track company spend as it happens and uncover savings opportunities immediately

- Grow without personal risk through cashback rewards and over $350,000 in partner perks, with no personal credit checks or personal guarantees

Get started with a free interactive product demo.

FAQs

If your provisional credit is not made permanent, your bank determined the disputed charge was valid. The temporary refund will be reversed and the original charge reapplied to your account. You will receive a written explanation and may have the option to appeal or escalate the decision.

Yes. Banks can deny a provisional credit if the dispute does not meet Regulation E criteria or if there is not enough evidence of an error. Certain transactions, such as credit card purchases or those reported late, may not qualify.

A provisional credit is reversed when the bank determines that the original charge was valid. This often happens if the merchant provides proof to refute the claim or if the customer does not respond to follow-up requests. When that occurs, the temporary refund is withdrawn and the original charge appears on your account again.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits