6 small business finance tips to build resilience in a challenging economy

- The unique challenges of managing small business finances

- Common financial mistakes to avoid for startups and small businesses

- 6 small business financial tips to cut costs and increase profits in an economic downturn

- How Ramp helps you weather financial storms with automated controls

- How Ramp helps startups, entrepreneurs, and small businesses optimize their finances

Running a small business isn’t easy—and the current state of the economy isn’t making it any simpler. Inflation, higher interest rates, and limited access to financing means more businesses must make do with their financial situation.

But here’s the good news: Despite the market downturn, the success of your business is still up to you. So, to help you prepare for whatever the market brings, we’ll walk you through some common financial mistakes to avoid and share some tips to optimize your small business finances for the months ahead.

The unique challenges of managing small business finances

Small businesses have much fewer assets, resources, and financing options to rely on than larger businesses and corporations, and their margins and financial runways are often much smaller too. So, it makes sense that they’ll need different financial management strategies to be successful too.

Small businesses must be more strategic with how they spend and allocate funds to avoid cash flow problems. One big mistake or unexpected event can put the entire viability of the business at stake. This is especially important in the current market, as businesses with little credit history or collateral will have difficulty getting the funding needed to maintain their operations.

Additionally, larger businesses have in-house accountants and finance professionals dedicated to managing the company’s funds. In comparison, small business owners—who generally don’t have any finance expertise of their own—often must add accounting and financial management tasks to their already extensive to-do lists, so they have much less time to dedicate to the company’s finances.

Common financial mistakes to avoid for startups and small businesses

Being overly optimistic about your financial future

It takes time to build a stable and profitable business—and thanks to the inevitable obstacles and unexpected detours, it’ll take longer than you think.

Be careful with making plans that revolve around certain milestones in your business, especially in today’s turbulent economy. For instance, if you don‘t have an emergency fund, it’s not practical to quit your day job immediately after making your first sale.

Instead, base your decisions on your current business needs and financial data—then add in a buffer for good measure.

Not taking out business insurance

When disaster strikes, you want to be prepared for it. That’s where business insurance comes in. Depending on the type of business you own, you’ll want to consider purchasing a number of policies, including:

- General liability insurance

- Business interruption insurance

- Professional liability insurance

- Commercial property insurance

- Workers’ compensation insurance

- Data breach insurance

Don’t just settle for the cheapest policy available, either. A policy with the right amount of coverage can save you time, money, and stress if or when the worst happens. Keep in mind: on top of these insurance options, your assets in banks and brokerages are also protected by the FDIC and SIPC.

Not hiring a good accountant

If you’re hiring the best of the best to manage other aspects of your business, why wouldn’t you do the same for your company’s finances? Hiring an expert accountant won’t just save you time and effort—they’ll also find ways to reduce operational costs and keep you out of trouble with tax authorities.

If you don’t know where to start your search, ask for referrals from other business owners in your industry or sector.

You may also find it helpful to search through directories offered by financial software providers like QuickBooks or Gusto. These companies partner with financial professionals that use their software and offer them training and additional resources so they stay up-to-date with the platform. So, if your financial software vendor has a directory of their own, consider using it to find a professional who’s already up-to-speed on the platform.

6 small business financial tips to cut costs and increase profits in an economic downturn

1. Invest in your company

It’s tempting to take all your business profits as take-home income, especially after a particularly good month. However, this short-term thinking only offers short-term benefits. It’s much more beneficial to reinvest some of that money into your business instead.

By giving your company the resources it needs to grow, you’ll see your investments multiply in the long run. Investing in your business shows your customers and employees that you care about them, and can make them even more supportive and loyal to you. Making efforts to improve your business also increases its value, which is helpful if you plan on selling the company later on.

Consider supporting your existing team by hiring more people in a department that’s always working at maximum capacity, or by buying software that makes their jobs easier (more on this later). If you’re interested in further ramping up revenue, perhaps you can add another salesperson or increase your marketing budget.

2. Build up your business credit history

As your company grows, you may find yourself in need of small business loans or other forms of financing. But without a strong credit history, lenders will reject your applications or subject your company to unattractive payment terms when you need the money most.

Make sure you’re prepared when the time comes by building up your business credit now. An easy way to do so is by applying for a small business credit card or line of credit and paying it in full every month.

But if you’d rather avoid taking out a credit card you don’t really need, consider opening accounts with net-30 vendors instead. These companies give you 30 days after a purchase to pay your bill, after which they report your payments to business credit agencies—in turn building up your credit profile.

Of course, you’ll only want to buy what you can afford to pay for in full, as on-time payments are the most important factor in building your credit score.

3. Be mindful of tax deductions

If you don’t take advantage of the many business deductions available to you, you’re essentially leaving free money on the table. Small businesses qualify for a variety of tax write-offs, including:

- Advertising and promotions

- Business insurance

- Business meals

- Home office expenses

- Legal and professional fees

- Training and education

- Travel expenses

During your next financial planning session, ask your accountant or tax preparer what you can write off on taxes and discuss strategies to maximize your deductions for the current tax year. Don’t forget to make note of and save receipts for each qualifying business expense—this ensures that, if you’re audited by the IRS, you’re still able to keep those deductions.

4. Create expense policies

An expense policy sets expectations for your employees on what they can purchase and get reimbursed for. It’s your first line of defense against out-of-policy spending, and ensures that no one at your company can change spending guidelines at a whim.

If you don’t have one yet, use this article on how to create an expense policy as a guideline for your own. Make sure to update it every few years so it’s up-to-date with the latest changes in your company.

5. Cut unnecessary expenses

When cutting costs, today’s business owners might decide to end the lease on their office or dial down on advertising. However, there are other hidden ways your company might be losing money too.

Zombie spend, for instance, refers to charges that are continuously made to a company but have been forgotten by employees. Imagine a marketing software subscription that’s purchased and used by only one team member. If the employee leaves the organization without canceling the subscription, the company will continue to pay for it month after month until the expense is discovered.

Maverick spend, on the other hand, refers to transactions that don’t follow the company’s expense policy. These purchases often lead to overspending, breakdowns in vendor relationships, and operational roadblocks that take time and effort to sort out.

It’s important to catch these transactions as soon as possible before they wreak havoc on your company’s finances. Avoid these unexpected expenses with regular audits of employee purchases (or by enlisting spend management software to monitor them on your behalf).

6. Use financial software to streamline operations

Excel may have worked well for you up to this point, but it’s time for an upgrade. With so many tools available to support your finance operations, there's no need to continue using a manual expense management system or budgeting spreadsheet.

Conduct an audit of your team’s time to see where they’re bogged down by tedious tasks, then find an appropriate software to automate them. Look for accounting software for small businesses and other tools that integrate with your tech stack and automate time-consuming processes like pulling expenses, organizing receipts, and running payroll.

Not only will these features save you time and money upfront, they’ll also give you better insights into your financial health so you can make smarter decisions for your business.

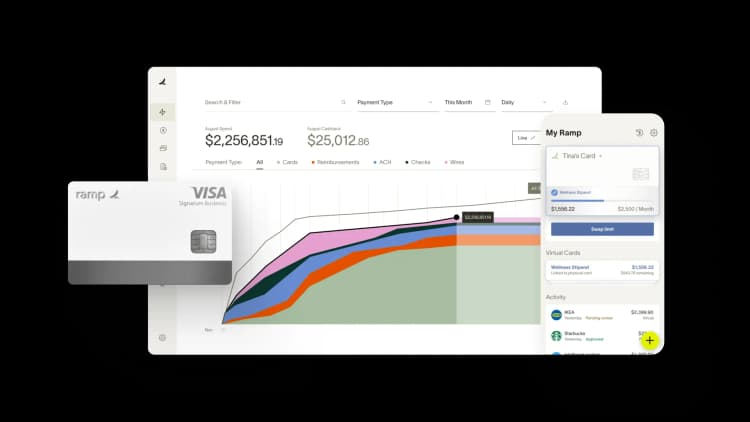

How Ramp helps you weather financial storms with automated controls

Economic uncertainty hits small businesses hard. When market conditions shift, you need real-time visibility into spending, tighter expense controls, and the ability to pivot quickly without drowning in manual processes. The challenge isn't just cutting costs—it's maintaining financial discipline while keeping your team productive and operations running smoothly.

Automated expense management transforms how you control spending during volatile times. Instead of chasing receipts and manually reviewing expenses after the fact, Ramp automatically captures and categorizes every transaction in real-time. This means you spot unusual spending patterns immediately, not at month's end when it's too late to course-correct. The platform's intelligent receipt matching eliminates hours of manual reconciliation, freeing your finance team to focus on strategic cost optimization rather than administrative tasks.

Beyond expense tracking, Ramp's virtual and physical cards give you granular control over every dollar spent. You can set precise spending limits by category, vendor, or time period—perfect for tightening budgets without micromanaging. Need to reduce software spending by 20%? Set category limits that automatically decline transactions once thresholds are hit. The platform's real-time notifications alert you to any unusual spending patterns, helping you identify and eliminate waste before it impacts your runway.

Ramp's automated bill pay capabilities ensure you never miss critical payments that could damage vendor relationships during tough times. The system learns your payment patterns and suggests optimal payment timing to maximize cash flow—crucial when every day of float matters. By automating routine financial tasks and providing instant visibility into spending, Ramp helps you make faster, data-driven decisions that protect your business's financial health when economic conditions demand agility and precision.

How Ramp helps startups, entrepreneurs, and small businesses optimize their finances

Small businesses face unique challenges—from managing limited resources to scaling operations efficiently. Ramp's platform streamlines your financial workflows so you can focus on growth instead of administrative tasks.

Our expense policy builder helps you create custom spending rules that reflect your company culture and business goals. Define approval hierarchies, set merchant restrictions, and create department-specific budgets that scale with your team. When employees request exceptions, you'll receive instant notifications to approve or deny them right from your phone.

Ramp integrates seamlessly with your existing accounting software and business tools, creating a single source of truth for all financial data. This connectivity eliminates duplicate data entry and reduces errors that can derail your financial planning. Plus, our AI-powered insights surface cost-saving opportunities you might miss—like duplicate subscriptions or better vendor pricing.

Companies using Ramp save an average of 3.3% annually through smarter spending and reduced manual work. Ready to see how Ramp can transform your finance operations? Take a tour of our software today.

FAQs

Small businesses and corporations operate on different scales, so the financial strategies and processes they use are different as well.

Most small businesses won’t have many shareholders (if any) to impress, and much fewer financing options to lean on if the need arises. Financial decision-making typically rest in the hands of the business owner, rather than with a CEO or board of directors.

These small businesses will need to operate more like corporations if they want to grow past a certain point, though. This is because corporate finance involves making decisions that best utilize the vast amount of assets and capital they have, usually with the aim of scaling the business or making a profit for shareholders.

Today, small business owners can take advantage of software and automation tools that simplify the way they manage their business finances. Here are some tools you’ll want to consider for your own financial tech stack:

- Business bank account with online banking features

- Accounting software

- Business budgeting tools

- Tax preparation software

- Payroll management systems

- Billing and invoicing software

- Inventory management tool

- Expense tracking software

- POS (point of sale) system

- Spend management software

Improving the financial performance of your small business often comes down to increasing your margins, revenue, and cash flow while reducing your costs and business debts. Some ways to do so include:

- Reducing your expenses

- Raising your prices

- Recovering outstanding payments

- Consolidating your debt at a lower interest rate

- Giving your customers more payment options

- Improving your marketing efforts

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits