Vendor management best practices, tools, and strategies

- What is vendor management?

- Core components of effective vendor management

- Vendor management best practices

- Vendor risk management

- Vendor performance management

- Benefits of vendor management systems

- 4 common vendor management challenges and solutions

- Ramp: A powerful automated vendor management tool

Vendor management helps you reduce risk, control costs, and build more resilient partnerships with the vendors your business depends on every day. Strong processes keep spend in check and ensure you get reliable service from critical suppliers. This matters even more in 2026, when your finance team will likely face tighter budgets, evolving security expectations, and pressure to manage vendor relationships with greater efficiency.

What is vendor management?

Vendor management is the end-to-end process of overseeing the vendors your business relies on, from initial evaluation to contracting, onboarding, and ongoing performance reviews. The goal is to manage risk, service quality, and long-term value, not simply to pay invoices.

Vendor, procurement, and supplier management are related but distinct. Procurement focuses on purchasing goods and services, supplier management often refers to broader supply chain relationships, and vendor management centers on continuous operational and performance oversight of external partners.

Effective vendor management also reduces risk. According to Black Kite’s 2024 Third-Party Data Breach Report, 81 vendors were linked to data breaches affecting more than 200 companies, underscoring the stakes when vendor oversight breaks down.

Core components of effective vendor management

You can build effective vendor management on a few foundational components that keep your processes consistent, scalable, and easier to control. These elements help teams evaluate vendors the same way every time, reduce risk, and avoid the reactive workflows that slow growth.

Vendor selection

Vendor selection works best when you evaluate every potential partner using the same structured criteria. A clear assessment process helps you compare vendors objectively, reduce risk, and avoid decisions based on personal preference or incomplete information.

A weighted vendor scorecard adds consistency. By assigning weights to criteria like cost, security, scalability, and service, you can quantify trade-offs and align the decision with your priorities.

| Criteria | Weight | Definition | Vendor A score | Vendor B score |

|---|---|---|---|---|

| Cost | 30% | Total cost, including hidden fees | 8/10 | 9/10 |

| Security | 25% | SOC 2, encryption, and data handling practices | 10/10 | 7/10 |

| Scalability | 20% | Ability to grow with your organization | 7/10 | 9/10 |

| Service | 15% | Support quality and response times | 9/10 | 8/10 |

| ESG | 10% | Environmental and social practices | 8/10 | 6/10 |

| Total | 100% | 8.4/10 | 8.0/10 |

Adjust these weights to reflect your specific risk and operational needs. A healthcare organization, for example, may increase the weight assigned to security, while a retailer might focus more on scalability.

Vendor onboarding

Strong onboarding creates clarity from the start and reduces downstream risk. It sets expectations, confirms compliance requirements, and gives vendors the information they need to deliver well.

Key elements of effective onboarding include:

- Clear due diligence checklists: Standardize how you evaluate vendors before signing any agreement. Consistent checklists ensure your team reviews financial stability, security controls, legal standing, and operational capabilities for every vendor.

- Standardized onboarding workflows: Replace informal emails and one-off approvals with predictable, documented steps. These workflows reduce bottlenecks, improve accountability, and define ownership.

- Centralized documentation collection: Store contracts, tax forms, insurance certificates, and compliance records in one secure location to improve audit readiness and support faster internal reviews.

Vendor contract management

Vendor contracts set the terms that govern performance, risk, and accountability. Strong contract management ensures deliverables are clear, expectations are enforceable, and renewals don’t happen without your awareness.

Core vendor contract management best practices include:

- Explicit scopes of work and detailed deliverables

- Strong service level agreements (SLAs) that define performance standards

- Balanced terms and conditions that allocate risk fairly

- Structured renewal and review strategies to prevent surprise auto-renewals or service lapses

Vendor performance monitoring

Vendor performance monitoring keeps your vendor relationships measurable and accountable. Without defined metrics, it’s difficult to spot issues early or to compare vendors fairly.

Common vendor performance management key performance indicators (KPIs) include on-time delivery rate, defect rate, SLA compliance percentage, and cost variance against contract. Pair these metrics with regular review schedules, performance scorecards, and direct feedback loops so vendors always understand expectations and improvement areas.

Vendor management best practices

Strong vendor management doesn’t happen by accident. You build it on repeatable habits and systems that help your teams work consistently and keep vendor performance aligned with business goals.

Establish clear communication

Clear communication is the backbone of strong vendor relationships. Without defined processes, updates get lost, expectations become unclear, and small issues can grow into major disruptions.

You need predictable communication structures for day-to-day collaboration and escalation. Regular check-ins create space to surface risks early, stay aligned on priorities, and keep both internal teams and vendors accountable.

Implement a vendor management system

An automated vendor management system gives you a single source of truth for vendor information, contract terms, and performance history. Centralized data makes it easier to enforce standards and reduce inconsistencies.

Look for systems that offer:

- Centralized vendor profiles and contract storage: A unified repository of vendor details and agreements that reduces outdated documents and improves visibility

- Automated alerts for renewals and compliance milestones: Timely reminders that help you avoid surprise auto-renewals and compliance gaps

- Integration with your finance software, expense platforms, and procurement tools: Connected systems reduce manual work and maintain consistent data across teams

Develop strategic vendor relationships

Strategic vendor relationships go beyond basic transactions. Treating key vendors as long-term partners encourages better collaboration, smoother issue resolution, and more reliable performance.

Shared goals, transparent communication, and openness to process improvements help vendors become an extension of your team. When both sides invest in the partnership, outcomes naturally improve.

Create standardized processes

Standardized processes turn vendor management from ad hoc work into a repeatable system. When teams follow the same workflows, documents, and approval paths, you reduce operational risk and improve consistency.

Standardization also accelerates scale. As your organization grows, proven processes help new teams ramp quickly, reduce training time, and support better governance across the vendor lifecycle.

Vendor risk management

Every vendor introduces some level of operational, financial, compliance, or reputational risk. Understanding these risks and monitoring them consistently helps you prevent disruptions, avoid penalties, and protect your brand.

Operational risk

Operational risk arises when a vendor’s internal systems, staffing, supply chain, or processes fail and interrupt their ability to deliver. These issues can cause downtime, missed deadlines, and customer dissatisfaction.

You can reduce operational risk by monitoring performance trends, establishing redundancy plans, and defining clear SLAs that outline required service levels and response times.

Financial risk

Financial risk appears when a vendor faces cash flow problems, mounting debt, or potential insolvency. A vendor in poor financial health may miss deliverables, cut corners, or shut down unexpectedly.

Mitigate this risk through regular financial health checks, credit reviews, and diversification of critical vendors. Consistent oversight helps you stay ahead of sudden disruptions.

Compliance risk

Compliance risk occurs when vendors fail to meet legal, regulatory, or contractual requirements. This may involve data privacy obligations, industry regulations, labor standards, or security requirements.

Even if the violation happens on the vendor’s side, your organization may still face fines, regulatory scrutiny, or legal exposure. Standardized compliance requirements, frequent audits, and automated tracking reduce the chance of vendor compliance breaches.

Reputational risk

Reputational risk emerges when a vendor’s actions—such as unethical labor practices, a data breach, or a public scandal—harm your brand by association. These issues can erode customer trust and damage long-term relationships.

You can reduce reputational exposure by using structured risk assessments, scoring vendors by risk level, conducting regular audits, and maintaining contingency plans that include backup vendors.

Vendor performance management

Vendor performance management is the process of monitoring, evaluating, and improving how vendors meet their contractual obligations. It ensures that service quality, timelines, cost, and support stay aligned with your expectations.

Effective performance management starts with measurable standards, clearly defined metrics, and consistent reporting structures. These may include SLAs, KPIs, and regular performance conversations.

A strong performance management program features:

- Regular performance reviews with documented outcomes

- Clear remediation plans for underperformance

- Recognition and incentive programs for top-performing vendors

Rewarding strong vendors with incentives like vendor rebates helps keep them engaged and motivated to prioritize your business.

Benefits of vendor management systems

Vendor management systems centralize and automate the way you manage third-party relationships. They replace disconnected spreadsheets, shared drives, and manual workflows with structured, real-time visibility across your vendor portfolio.

A strong system helps you track vendor data, contracts, risk, and performance in one place. When implemented correctly, it becomes the operational backbone of your vendor management strategy.

Modern vendor platforms include centralized contract and vendor repositories, risk and compliance tracking, and real-time performance dashboards.

But vendor management automation is where you unlock meaningful efficiency. High-impact automation opportunities include:

- Automated vendor onboarding workflows

- Performance tracking without manual spreadsheets

- Contract renewal reminders

- Continuous compliance monitoring

These capabilities reduce human error and free your team to focus on strategic work rather than administrative tasks. When evaluating platforms, consider ease of implementation, scalability, and how well they integrate with your existing tech stack.

4 common vendor management challenges and solutions

Vendor management breaks down in predictable ways as organizations scale. These four challenges show where teams most often lose visibility, overspend, or miss early signs of vendor risk, and how to address them before they escalate:

1. Lack of visibility into vendor performance

When performance information lives in spreadsheets, separate systems, and email threads, it becomes outdated almost immediately. Teams end up making decisions based on incomplete information, creating blind spots that allow underperformance to persist.

Consolidating KPIs, scorecards, and service metrics into a single system helps you spot trends and risks earlier. Real-time dashboards make it easier to compare vendors and identify issues before they escalate.

2. Multiple vendor relationships

As your organization grows, the number of vendor relationships can quickly become unmanageable. Each relationship may involve different contract terms, renewal cycles, and performance expectations. Teams can spend more time coordinating than optimizing, leading to inefficiencies and wasted resources.

A tiered vendor management approach can help. Use a vendor performance scorecard to track key metrics, categorize vendors by risk and strategic importance, and give critical vendors deeper reviews and closer collaboration. Clear ownership also improves accountability and ensures key relationships aren’t neglected.

3. Ensuring compliance across vendors

Regulations, standards, and risks change often, which makes compliance difficult to maintain manually. Relying on periodic reviews or ad hoc document collection leaves gaps between checks and increases exposure.

Continuous compliance management helps you stay ahead of expirations and regulatory updates. Automated tracking and real-time alerts create complete audit trails and give teams confidence in the strength of their controls.

4. Cost control and budget management

Vendor-related costs often increase when businesses fail to actively monitor contracts and usage. Auto-renewals, unused services, and unapproved scope changes can quietly inflate spend. Without real-time visibility, finance teams struggle to tie contract terms to actual costs.

Align contract management with spend tracking to monitor anomalies, overbilling, and underutilized services early. Structured vendor contract negotiations and regular reviews ensure pricing stays competitive and relevant to your needs.

Ramp: A powerful automated vendor management tool

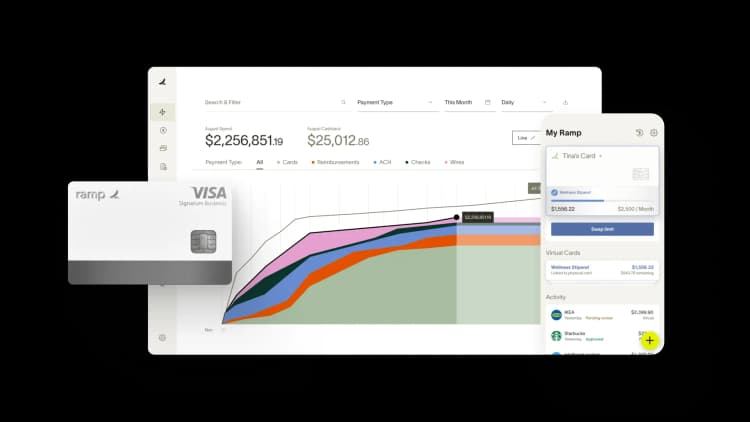

Effective vendor management drives cost savings, strengthens supplier performance, and reduces operational risk. Ramp helps you deliver on those outcomes by centralizing vendor data, contracts, and spend in one place.

With Ramp, you can automatically track all transactions with businesses paid by card or Bill Pay, making it easier to analyze spend and surface insights. Ramp also extracts key details from each contract you upload, reducing manual data entry and giving your team faster, more reliable visibility.

Take the first step toward better vendor management with Ramp.

FAQs

You should only begin onboarding third-party vendors after you’ve defined your project goals, set a budget, and established solid vendor management and review procedures. It’s also important to interview and get quotes from multiple vendors before negotiating a contract, so you can truly choose the best option for your business.

Fostering robust vendor relationships requires establishing effective communication and clear expectations as well as conducting regular check-ins. You also have to offer constructive feedback and work with your vendors to address challenges and enhance performance.

Conduct regular risk assessments, maintain contingency plans, and diversify your vendor base. Also, writing clear contracts and making sure you monitor compliance can help reduce potential disruptions.

Choosing the right vendors ensures your business enjoys high-quality products or services, reliable delivery, and competitive pricing. Careful selection can significantly boost your efficiency and success.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits