- Why businesses are looking for Airwallex alternatives

- At a glance: Airwallex alternatives compared

- Best overall Airwallex alternative: Ramp

- Paylocity

- Spendesk

- Expensify

- Ramp vs. Airwallex: a closer look

- Ramp isn’t just an Airwallex alternative—it’s an upgrade

Airwallex is known for its global payments infrastructure, multi-currency business accounts, and API-first architecture. With a 4.4-star rating on G2 from 40+ reviews, it’s a solid choice for small to mid-sized companies managing international payments and virtual card spend.

But while Airwallex performs well for cross-border finance operations, businesses scaling up their finance tech stack—or needing more advanced expense management, AP automation, or ERP integration—often look elsewhere.

This guide compares five of the best Airwallex competitors based on real user reviews, G2 ratings, and feature sets to help you find the right platform for your business needs.

Why businesses are looking for Airwallex alternatives

Despite its strengths, users report recurring friction points that lead finance teams to explore Airwallex alternatives:

Limited ERP integrations

Airwallex offers integration with Xero, but many users cite the lack of deeper ERP connectivity—especially with tools like NetSuite or QuickBooks—as a limitation. One mid-market user noted, “It restricts connection to any other software than Xero…which increases a lot of manual import of data.”

Mobile app functionality gaps

Several users praise the desktop interface but say the mobile app lacks depth. One review reads, “The mobile app is quite basic and lacks many options… Expanding functionality would greatly enhance the experience.”

Confusing wallet and reconciliation structure

Airwallex’s wallet-based approach, where each currency or card has its own balance, can make financial reconciliation challenging. Reviewers mention that “it becomes tricky when you’re looking at it holistically.”

Missing T&E-specific features

While Airwallex handles card spend and reimbursements well, it lacks traditional travel and expense (T&E) features like per diems or mileage tracking. Users also want more robust approval chains and auditing capabilities.

Customer support and onboarding delays

Most reviewers acknowledge Airwallex support is helpful, but a few mention long setup times or inconsistent assistance during peak hours.

At a glance: Airwallex alternatives compared

Not all Airwallex competitors have the same scope. Some focus primarily on expense management and compliance, while others, like Ramp, take a broader approach to cover spend management across cards, expenses, bill pay, and procurement.

| Platform | G2 Rating | Best For | Key Features | Starting Cost |

|---|---|---|---|---|

| Ramp | 4.8 | Startups Small Businesses Mid-market | Expense management Corporate cards Travel booking | $0 – Unlimited free tier |

| Airbase | 4.5 | Mid-market | Procurement Expense management | N/A – All pricing is quote-based |

| Spendesk | 4.6 | Startups Mid-market | Virtual cards Invoice management Expense management | N/A – All pricing is quote-based |

| Freshbooks | 4.6 | Small businesses | Invoicing | $6.30 – Lite plan |

| Expensify | 4.5 | Small business Mid-market | Expense management Corporate cards | $5 per month/use |

Best overall Airwallex alternative: Ramp

Ramp is a comprehensive finance automation platform that combines corporate cards, expense tracking, bill pay, and procurement in a single, unified experience. It’s designed for scale, with deep automation, tight ERP integrations, and no per-seat fees at the base tier.

While Airwallex centers on international payments and virtual cards, Ramp is focused on helping teams automate finance from end to end without switching banks. With a 4.8-star G2 rating from 2,000+ reviews, Ramp is the top-rated platform in this category.

Key features

- Real-time policy enforcement and receipt matching at the point of spend

- AI-powered invoice matching and line-item coding with 99% accuracy

- One-click reimbursements and custom approval workflows

- Built-in procurement tools for vendor requests and contract tracking

- Seamless ERP sync with QuickBooks, NetSuite, Xero, Sage, and more

Ramp vs. Airwallex

Where Airwallex focuses on international payments and FX savings, Ramp delivers broader finance automation. Its consolidated approach helps teams speed up month-end close, reduce tool sprawl, and enforce spend policies at the point of transaction. Ramp also supports global payments through AP automation, though it does not offer multi-currency wallets like Airwallex.

Best for

Organizations of all sizes—from startups and small businesses to mid-market and enterprise companies—across industries such as SaaS, healthcare, education, retail, real estate, professional services, and nonprofits.

Pricing

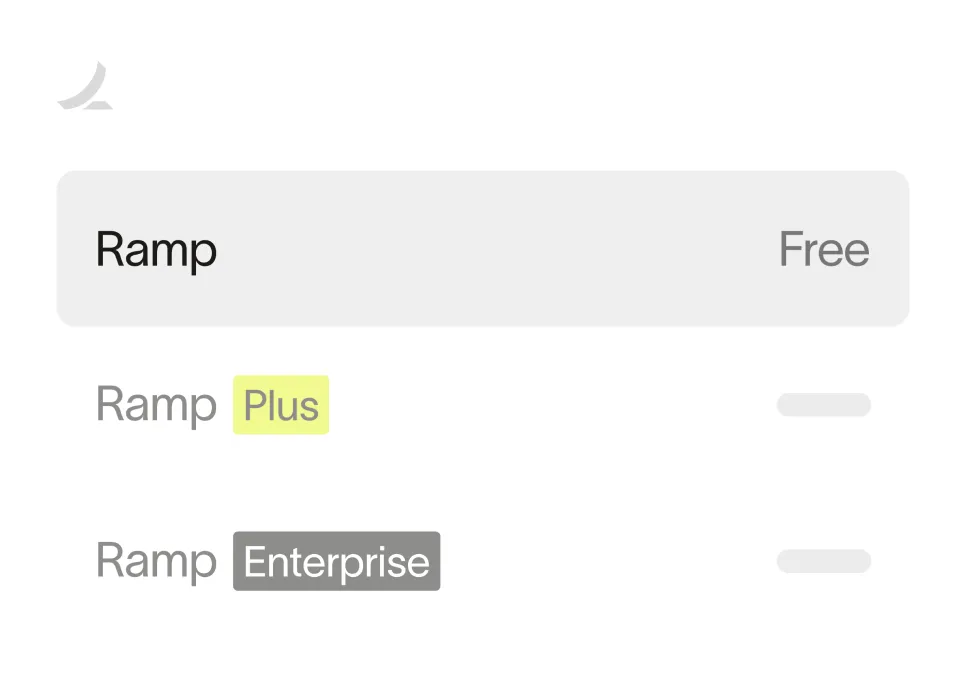

Ramp’s core platform is free with unlimited seats and cards. Ramp Plus, which adds advanced fields, custom workflows, and procurement features, starts at $15 per user per month.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Paylocity

Paylocity’s spend and expense management platform, which now includes the former Airbase product, offers a unified procure-to-pay experience as part of its broader HR and finance suite. According to G2, Paylocity currently holds an average rating of 4.5 out of 5 based on more than 4,600 verified reviews.

Key features

- Guided procurement workflows

- Invoice capture, processing, and payment automation

- Real-time expense tracking and spend visibility

Paylocity vs. Airwallex

While Airwallex is centered on payments and FX infrastructure, Paylocity emphasizes internal governance. It offers deeper visibility and approval rigor for finance leaders managing multiple entities or complex spend policies.

Best for

Mid-market companies (50–1,000+ employees) in industries like technology, finance, legal, and consulting where compliance and audit readiness are top priorities.

Pricing

Paylocity pricing is fully quote-based.

Spendesk

Spendesk is a spend management platform designed for startups and mid-market companies looking to streamline employee expenses and invoice management. It has a 4.6-star G2 rating from 400+ reviews and is widely adopted across Europe.

Key features

- Virtual and physical card issuance with spend limits

- Centralized invoice processing and approvals

- Real-time spend tracking and receipt capture

Spendesk vs. Airwallex

Spendesk focuses on managing internal company spend, while Airwallex prioritizes cross-border payments. For teams looking for centralized expense controls and budget visibility, Spendesk offers stronger tools for day-to-day employee expenses.

Best for

Startups and mid-market firms that want greater visibility over recurring spend, subscriptions, and travel expenses.

Pricing

Spendesk does not publish standard pricing. Custom quotes are available based on company size and needs.

FreshBooks

FreshBooks is accounting software designed for small businesses and freelancers who need easy invoicing and expense tracking. It holds a 4.5-star G2 rating from 900+ reviews and is known for its simple setup and user-friendly design.

Key features

- Invoicing with recurring billing and client management

- Expense and receipt tracking for tax readiness

- Time tracking and project profitability reporting

FreshBooks vs. Airwallex

Unlike Airwallex’s global payments focus, FreshBooks is optimized for service-based businesses managing billing and bookkeeping. It’s a lighter, easier-to-use solution for small teams that don’t need complex ERP integrations.

Best for

Freelancers, solopreneurs, and small businesses focused on invoicing and project-based work.

Pricing

Plans start at $8.40/month for the Lite plan, scaling up with more clients and features.

Expensify

Expensify is an expense management platform that helps companies of all sizes simplify reimbursements, receipt capture, and reporting. With a 4.5-star G2 rating from over 5,000 reviews, it’s widely adopted for its mobile-first design and ease of use.

Key features

- Smart receipt scanning and auto-categorization

- Expense reporting and reimbursements

- Corporate cards and policy enforcement

Expensify vs. Airwallex

Expensify focuses on employee expense management, while Airwallex is geared toward international payments. Companies choose Expensify for simplified reimbursement workflows and mobile-friendly reporting.

Best for

Small businesses and mid-market teams that want to eliminate manual expense reporting and speed up reimbursements.

Pricing

Plans start at $5 per user per month, with both free and paid options depending on features.

Ramp vs. Airwallex: a closer look

Airwallex is designed primarily for international money movement—ideal for businesses holding and sending funds across currencies, issuing virtual cards, and automating FX payments.

Ramp, by contrast, is built for scaling finance teams that want automation across all non-payroll spend. It consolidates cards, expenses, bill pay, and procurement without requiring a change in banking.

Airwallex is a strong fit if you:

- Need local currency accounts in multiple countries

- Want to minimize FX fees on transfers

- Prefer an API-first setup for embedding payments

- Are focused on payments infrastructure over finance automation

Ramp is a strong fit if you:

- Need corporate cards with real-time spend controls

- Want automated expense categorization and invoice ingestion

- Require built-in procurement workflows

- Rely on deep ERP integrations for faster close

Ramp also supports international payments through AP automation, though it doesn’t offer native currency wallets. Where Airwallex focuses on global payments infrastructure, Ramp focuses on making finance teams faster and more efficient.

Companies using Ramp report 5% cost savings, books closed 86% faster, and significant time saved on expense reports and reviews.

Ramp isn’t just an Airwallex alternative—it’s an upgrade

Airwallex delivers speed and savings for global payments, but growing teams often need deeper automation, richer integrations, and full finance workflow support.

Ramp provides that in one centralized platform—advanced controls, automation, and integrations that scale. For businesses focused on modernizing their finance operations, Ramp offers more value with less friction.

Learn how Ramp’s expense management solutions can help your finance team drive reach not just the next level, but scale beyond that.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits