What are general and administrative (G&A) expenses?

- What are general and administrative expenses?

- Why G&A expenses matter

- Examples of general and administrative expenses

- G&A vs. SG&A: What's the difference?

- Semi-variable vs. fixed expenses

- G&A rate and its impact

- How to record G&A expenses

- 3 challenges that can increase G&A expenses

- How to reduce G&A expenses

- Control G&A spend with real-time visibility and automated enforcement

General and Administrative Expenses

General and administrative (G&A) expenses are the costs your business incurs to maintain daily operations. They're day-to-day operating expenses, such as rent and office supplies, that keep your business operational.

General and administrative (G&A) expenses are a core operating expense on every company’s income statement. Understanding your G&A expenses can help you plan more accurate budgets, forecast future spending, and make more informed financial decisions.

In this article, we’ll explain what G&A expenses are and how they factor into your business’s income statement, and we’ll wrap up by sharing some strategies for managing them.

What are general and administrative expenses?

General and administrative expenses, or G&A expenses, are operating expenses that don't include overhead costs related to the production or sale of goods and services. G&A expenses are indirect costs a business must spend throughout the year to maintain operations, regardless of revenue or sales.

Some examples of G&A expenses include:

- Rent

- Insurance

- Office supplies

- Fixed employee salaries

Importantly, you should always differentiate general and administrative expenses from costs related to projects designed to increase revenue, such as research and development (R&D) or production costs.

For example, the monthly rent paid to occupy a manufacturing facility would fall under the category of G&A, whereas the cost of manufacturing a certain product within that facility would fall under the category of cost of goods sold (COGS).

Identifying these costs early on will help you make more informed decisions about budgeting and resource allocation.

Why G&A expenses matter

It’s important to track G&A expenses because they demonstrate how well you manage funds across your company. Overspending on operational costs or not having accounting processes in place to effectively manage G&A can hurt your bottom line, especially as a small business or startup.

Strategically managing G&A expenses can help increase revenue by reducing your overall cost of operations. In fact, if you’re specifically looking to reduce costs across the organization, G&A expenses should be one of the first costs you evaluate. That’s because you can significantly reduce, if not entirely eliminate, some costs that fall into the G&A category without any negative impact on production or sales.

Tracking G&A expenses is also important for calculating and reporting revenues on your income statement. When operational costs are higher, net income is lower, and vice versa. Also, remember that most G&A expenses will be tax-deductible. To maximize your benefits, you must demonstrate that each cost incurred was necessary for the company to operate during the accounting period.

Many businesses struggle with overspending on administrative costs, misclassifying expenses that could qualify for better tax treatment, or missing opportunities to negotiate better rates with vendors and service providers. Recognizing the importance of G&A expenses helps you avoid these pitfalls and spot opportunities for cost control and smarter spending.

Want to talk to an accounting expert?

Examples of general and administrative expenses

G&A expenses comprise any overhead costs associated with your business’s day-to-day operations. Some examples of G&A expenses include:

- Salaries and wages: This includes pay for human resources staff, executive compensation, and other wages and salaries for indirect labor that’s unrelated to production

- Rent and utilities: The cost of leasing office space and paying for utilities such as phone, electricity, water, and internet services

- Office supplies and equipment: Costs incurred for items such as stationery, software subscriptions, postage, computers, printers, and other equipment necessary for administrative tasks

- Accounting and legal fees: Fees paid to lawyers and accountants for their services in managing legal and financial matters for the company

- Insurance: Premiums for insurance policies covering liability, property, and other business risks

- Depreciation and amortization: Costs associated with depreciating assets over their useful life, affecting the company's book value and income statement

- Miscellaneous administrative expenses: Other administrative expenses, such as permits, licenses, and fees paid to regulatory bodies for compliance purposes

These expenses form the backbone of your company's operational infrastructure, making accurate tracking and classification essential for financial reporting, tax optimization, and spotting potential cost reduction.

G&A vs. SG&A: What's the difference?

G&A expenses refer to the overhead costs associated with day-to-day business operations. Selling, general, and administrative expenses (SG&A) are a broader category that includes selling expenses in addition to G&A expenses.

G&A expenses are the general overhead costs necessary for running a business, such as:

- Executive salaries

- Office rent

- Utilities

In contrast, selling expenses are the costs associated with selling and marketing the company's products or services and include:

- Sales commissions

- Advertising

- Promotional materials

These expenses are often aggregated under the SG&A line item in a financial statement. However, you may choose to separate selling expenses from general and administrative expenses. Clear distinctions between G&A and SG&A help you avoid misclassification and improve financial reporting.

Semi-variable vs. fixed expenses

G&A costs are separated into two distinct expense categories: fixed expenses and semi-variable expenses.

Fixed expenses are operating costs that an organization incurs at a consistent price on a regular basis. For example, if a business enters into a 12-month rent agreement for office space at a monthly rate, each monthly payment would be considered a fixed cost recorded as G&A. By definition, fixed expenses remain consistent and can’t be decreased or eliminated through cost-reduction strategies.

Semi-variable expenses, on the other hand, are regularly occurring operating expenses that remain relatively stable but can fluctuate with usage. This means you can strategically reduce or eliminate them. Electricity is a classic example of a semi-variable expense. While most businesses require electricity to function, you can take actions to reduce your electricity bill.

Most G&A expenses are either fixed or semi-variable, but there are exceptions. For example, the depreciation of office equipment or furniture is a G&A expense but doesn’t correlate with outgoing cash flows.

G&A rate and its impact

Your G&A rate reveals how efficiently you're managing administrative costs relative to your overall business performance and helps identify optimization opportunities.

The G&A rate measures your general and administrative expenses as a percentage of total revenue. Calculate it by dividing your G&A expenses by total revenue, then multiplying by 100.

For example, if your G&A expenses are $50,000 and total revenue is $500,000, your G&A rate is 10%:

($50,000 / $500,000) * 100 = 10%

This metric helps you budget more effectively, compare your efficiency against industry benchmarks, and assess your company's financial health. A high G&A rate might signal overspending on overhead costs. Monitoring your G&A rate regularly enables better cost control and more informed financial decisions for sustainable growth.

How to record G&A expenses

You record and list G&A expenses on your company’s income statement. G&A should appear below COGS and will ultimately help calculate your company’s net income for a given accounting period.

The overall complexity of an income statement will vary depending on your specific organization and business model, but in most cases, you’ll apply the same general formula:

- Calculate net revenue: Factor in revenues, minus all taxes, fees, and interest, to generate your net revenue

- Determine gross margin: Deduct the cost of goods sold from net revenue to arrive at your gross margin

- Find net income: Deduct all general and administrative expenses from your gross margin to calculate your net income for the accounting period

In most cases, you won’t list and deduct G&A expenses from your gross margin as one line item. Rather, you’ll categorize them separately based on the nature of the expense and its relation to your company's operations. For example, while the cost of both salaries and rent fall into the G&A category, you’d list each as an individual line item on your income statement.

Be sure not to mix up G&A expenses with COGS or production costs, which can distort your financial statements and tax calculations. Many businesses also fail to properly document expenses or misclassify certain administrative costs as G&A, leading to inaccurate reporting and potentially lost tax deductions.

3 challenges that can increase G&A expenses

When the G&A portion of your income statement gets too bloated, your operating costs may eat into your revenue, hurting your ability to turn a profit. Here are a few challenges that frequently contribute to bloated operating costs:

1. SaaS sprawl

The software as a service (SaaS) industry continues to boom, and this influx of tools and services has led to a considerable challenge for many businesses: SaaS sprawl. SaaS sprawl happens when a company loses the ability to effectively manage the various software used across the organization.

When this issue goes unaddressed, it often leads to overspending on services and platform licenses. For example, you may be paying for 2 (or more) SaaS tools that do pretty much the same thing, or more user seats than you actually need. Even one unnecessary expenditure can have a significant impact on G&A, so it’s important to get a grip on your SaaS management.

2. Zombie spend

Zombie spend occurs when a company accumulates recurring expenses for services and products that either aren’t being used or no longer create value. In many cases, zombie spend is directly related to issues such as SaaS sprawl. For example, you might have started a subscription to a platform last year, and even though your team has since moved on to a different platform, you're still paying the monthly fee for the old one.

But zombie spend isn’t exclusively a SaaS problem. It often manifests as a simple oversight, such as auto-purchasing office supplies when you already have more than you need. Spending money on items or services you aren’t using hurts cash flow and impacts how G&A expenses factor into your income statement.

3. Shadow IT

Shadow IT refers to any technology being used in your organization without IT or upper management knowing. Ideally, your IT teams are aware of all the platforms employees are using across the business. However, there’s often a disconnect between individual employees or entire departments, and this lack of transparency results in shadow IT.

Shadow IT can create several issues. First, it’s a matter of security: Teams or employees operating on insecure networks that might be vulnerable to a data breach put your organization at risk. And even if it doesn’t compromise security, you’re still footing the bill for tools you haven’t approved or evaluated for cost efficiency.

Managing these challenges requires ongoing attention and clear processes. By addressing them proactively, you can keep G&A expenses under control and protect your profitability.

How to reduce G&A expenses

Effectively managing G&A expenses requires both a thoughtful strategy and clear visibility into your business spending. Here are a few ways you can optimize G&A expense management:

Establish and enforce spending policies

Establishing a comprehensive expense policy is critical to managing G&A expenses. Unfortunately, rules around spending can be difficult to enforce, and expense policy violations often go unnoticed until it’s too late.

You’ll want to create a clear business expense policy and have your employees sign off on it so they know exactly where and how much they can spend. You can also look for a company card that allows you to set customizable spending limits and vendor controls.

Create your expense policy with Ramp's template

Automate your expense tracking

Modern accounting software can automate much of your expense management process. It can help you categorize your operating expenses while automatically logging new transactions into the appropriate categories you’ve set. That way, you’ll know in real time how much you’re spending in each category.

Review and eliminate redundant SaaS tools

Software subscriptions can quickly multiply across departments, often leading to overlapping functionality and wasted spending. Many companies discover they're paying for multiple tools that serve similar purposes or subscriptions that employees no longer actively use.

Start by creating a comprehensive inventory of all software subscriptions across your organization. For each subscription, document the cost, number of users, and primary business function it serves.

Then identify overlap between different software solutions and examine usage data to determine which subscriptions deliver real value. Cancel subscriptions with low engagement rates or that duplicate functionality available in other tools you're keeping.

Negotiate better vendor rates

Vendor contracts present significant opportunities for cost reduction, especially when you have established relationships or can demonstrate your value as a customer. Begin by gathering data on your current spending with each vendor and research alternative vendors in the market to establish competitive benchmarks.

Schedule formal contract reviews well before renewal dates and approach vendors with specific requests such as volume discounts, extended payment terms, or reduced rates for multi-year commitments. Vendor negotiations represent a significant opportunity for savings; many suppliers are willing to offer concessions to retain long-term customers, especially if you can demonstrate a consistent payment history.

Make a plan to reduce costs

The first step in designing a strategy to control costs is having clear and consistent visibility into company-wide spending. Use a spend management platform that can track business expenses and automatically categorize them for you, so you always know where you are with your budget.

Once you have a clear view of your spending, look for areas where you can reduce costs. This might mean reducing employee budgets in certain categories or switching vendors.

The best expense management software will also offer insights into how you can save money. For example, Ramp Intelligence automatically finds ways for your business to save.

Control G&A spend with real-time visibility and automated enforcement

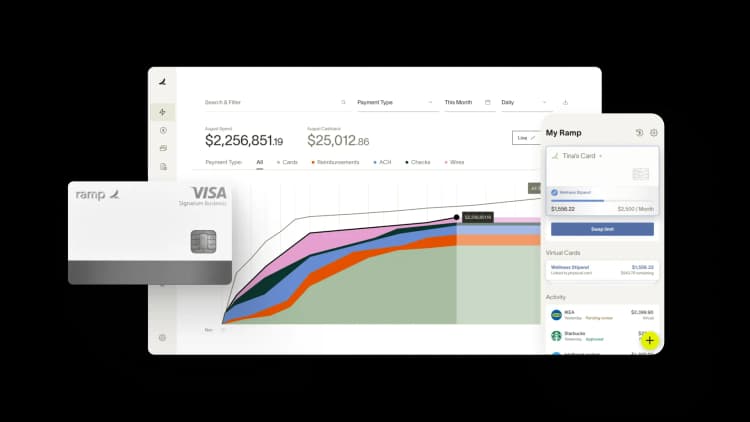

G&A expenses are notoriously difficult to control because they're spread across departments, vendors, and payment methods. Without centralized visibility, finance teams struggle to track spending as it happens, enforce budgets consistently, or identify cost-saving opportunities before expenses spiral.

Ramp gives you complete control over G&A spend with tools that enforce budgets, surface insights, and automate approvals in real time. Every transaction is visible the moment it posts, categorized automatically, and matched against department budgets so you can spot overages and redirect spend before month-end surprises hit your P&L.

Here's how Ramp helps you reduce and control G&A expenses:

- Set spending limits by department: Create custom budgets for each G&A category and department, then enforce them automatically with card controls that decline out-of-policy transactions before they post

- Automate approval workflows: Route requests through multi-level approval chains based on amount, vendor, or category so every dollar is reviewed by the right stakeholder before it's spent

- Track spend in real time: Monitor G&A expenses as they happen with live dashboards that show spending by department, vendor, and category so you can course-correct immediately

- Identify savings opportunities: Ramp's AI-powered accounting software analyzes your spending patterns and surfaces duplicate subscriptions, unused licenses, and vendor consolidation opportunities so you can cut costs proactively

- Close faster with automated coding: Ramp codes G&A transactions automatically across all required fields, syncs them to your ERP, and reconciles everything so month-end close is faster and more accurate

Try a demo to see how businesses reduce G&A expenses and close their books 3x faster with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits