What are miscellaneous expenses? Definition and examples

- What are miscellaneous expenses?

- Common examples of miscellaneous expenses

- How to categorize miscellaneous expenses

- Are miscellaneous expenses tax deductible?

- 4 best practices for managing miscellaneous expenses

- How Ramp helps wrangle miscellaneous expenses

- Control all your business expenses with automation

Every business has small, one-off expenses that don’t quite fit anywhere else in your chart of accounts—things like parking fees, notary charges, and one-time software purchases. Individually, they seem minor, but over time they can add up, complicate your books, and create issues during tax season if they’re not tracked properly.

Understanding how to classify, document, and manage miscellaneous expenses helps you keep cleaner records and see your true spending more clearly.

What are miscellaneous expenses?

Miscellaneous expenses are small, irregular business costs that don’t fit neatly into standard expense categories such as rent, utilities, or payroll. They’re typically necessary to run the business but occur too infrequently or at too low a dollar amount to justify a dedicated account.

In accounting, miscellaneous expenses are usually recorded as operating expenses and grouped into a single “miscellaneous” or “other” category. This keeps your chart of accounts manageable while still allowing you to track legitimate business costs that fall outside your usual categories.

Key characteristics of a miscellaneous expense include:

- Irregular occurrence: The expense happens sporadically, not on a predictable schedule

- Low dollar value: It’s typically a small amount, often under $100 per transaction

- No obvious category fit: The transaction doesn’t clearly belong in an existing expense account

- Clear business purpose: The expense supports business operations, even if indirectly

Miscellaneous vs. other expense categories

Knowing when to use the miscellaneous category instead of a dedicated account helps keep your books organized and easier to analyze. As a general rule, recurring or high-dollar expenses should always have their own category:

| Expense type | Category treatment | Reason for classification |

|---|---|---|

| Monthly software subscription | Dedicated software category | Recurring, predictable expense |

| One-time app purchase | Miscellaneous | Infrequent, small-dollar transaction |

| Weekly team lunches | Meals and entertainment | Regular, trackable pattern |

| Parking during a client visit | Miscellaneous | Sporadic, unpredictable occurrence |

| Quarterly office cleaning | Facilities or maintenance | Scheduled, recurring service |

| Emergency lock replacement | Miscellaneous | Unexpected, one-time repair |

Common examples of miscellaneous expenses

What counts as a miscellaneous expense can vary depending on your business size, industry, and how detailed your chart of accounts is. An expense a small team treats as miscellaneous might warrant its own category at a larger company with higher transaction volume.

The examples below illustrate the types of costs businesses commonly group into this category.

Office and administrative expenses

- Bank fees and wire transfer charges

- Notary and document certification fees

- One-time software purchases or apps

- Postage for occasional mailings

- Key duplication or lock changes

- Minor office repairs below your capitalization threshold

- Business cards for new hires or events

Travel and incidental expenses

- Parking meters and garage fees

- Road tolls during business travel

- Baggage handling or porter fees

- Airport Wi-Fi charges

- Currency exchange fees related to business trips

- Laundry services during extended travel

Professional and operational expenses

- One-time legal consultations for a specific issue

- Background check fees for new hires

- Small equipment repairs that don’t qualify as capital expenses

- Industry publications you don’t renew annually

- Training materials for a single course or certification

- Business license or permit renewal fees

How to categorize miscellaneous expenses

A consistent approach to categorization keeps the miscellaneous account useful instead of turning it into a catch-all for unclear or poorly documented spending. Clear criteria make it easier to decide when an expense truly belongs there and when it deserves its own category.

When to use the miscellaneous category

Before classifying an expense as miscellaneous, it should meet all three of the following conditions:

- The amount is small: Set a dollar threshold that makes sense for your business, often under $75–$100

- The expense is infrequent: If it shows up regularly, it likely needs its own category

- No existing category fits: Review your chart of accounts before defaulting to miscellaneous

For example, a $500 equipment repair is likely too large, monthly parking fees are too frequent, and a recurring software subscription already fits a standard category. In each case, a dedicated account provides better visibility and reporting.

Documentation requirements

Even small, one-off expenses need proper documentation to remain deductible and audit-ready. For every miscellaneous expense, you should record:

- Date of purchase

- Vendor name

- Amount paid

- Receipt or proof of payment

- A clear business purpose

The business purpose matters more than many teams realize. Instead of a vague note like “lunch,” record “Lunch with prospective client to discuss Q1 marketing contract.” That level of detail makes your intent clear if the expense is ever reviewed.

Are miscellaneous expenses tax deductible?

Yes, most miscellaneous business expenses are tax deductible as long as they qualify as ordinary and necessary for your business and are properly documented. The rules differ depending on whether the expense is incurred by a business owner or an employee.

For business owners, miscellaneous expenses are generally deductible when they support normal business operations, even if they’re small or infrequent. For employees, the rules are stricter. The Tax Cuts and Jobs Act of 2017 eliminated the deduction for unreimbursed employee expenses through 2025, which means W-2 employees can no longer claim these costs on their personal tax returns.

| Business structure | Deductibility | Where to report |

|---|---|---|

| Sole proprietor | Deductible if ordinary and necessary | Schedule C, Line 27a |

| Partnership or LLC | Deductible at the entity level | Form 1065 |

| S corporation or C corporation | Deductible as business expenses | Form 1120 or 1120-S |

| W-2 employee | Not deductible under current law | Cannot claim on personal return |

To be deductible, a miscellaneous expense must meet all three of these criteria:

- It is ordinary, meaning it’s common and accepted in your industry

- It is necessary, meaning it’s helpful and appropriate for your business

- It is documented, with receipts and a clear business purpose

Keep records for at least three years from the date you file your return, though many businesses retain documentation for up to seven years to stay on the safe side.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

4 best practices for managing miscellaneous expenses

Managing miscellaneous expenses well is less about perfection and more about consistency. Clear rules, regular review, and a willingness to reclassify expenses as patterns emerge can keep this category useful instead of cluttered.

1. Set clear spending policies

Define what qualifies as a miscellaneous expense, including dollar thresholds and documentation requirements. Sharing concrete examples helps employees make better categorization decisions and reduces cleanup work later.

2. Review and reclassify regularly

Build time into your monthly or quarterly close to review miscellaneous transactions. Look for misclassified expenses, missing documentation, or repeat charges that signal it’s time to create a dedicated category.

3. Establish triggers for reclassification

Decide in advance when an expense should move out of miscellaneous. For example, if the same type of expense appears several times in a quarter or becomes meaningful in total spend, it’s usually a sign that it deserves its own account.

4. Avoid common mistakes

Even well-intentioned teams can create issues if they’re not careful. Watch for these patterns and address them early.

Dumping everything into “miscellaneous”

- Employees default to miscellaneous instead of choosing the most accurate category

- The account becomes bloated and loses analytical value

Address this by reinforcing policies and requiring a reason when miscellaneous is selected.

Skipping documentation

- Receipts are missing because the amounts feel too small to matter

- Business purpose is unclear or undocumented

Prevent this by requiring receipts and explanations for all expenses, regardless of size.

Ignoring recurring patterns

- The same vendor or service shows up repeatedly as miscellaneous

- Systematic spending is hidden from budgets and forecasts

When patterns appear, create a dedicated category to improve visibility and control.

How Ramp helps wrangle miscellaneous expenses

Miscellaneous business expenses are silent budget killers—those unpredictable purchases that don't fit neatly into standard categories but somehow add up to thousands each month. You know the culprits: last-minute office supplies, unexpected software subscriptions, random vendor fees, and "urgent" purchases that bypass normal approval channels.

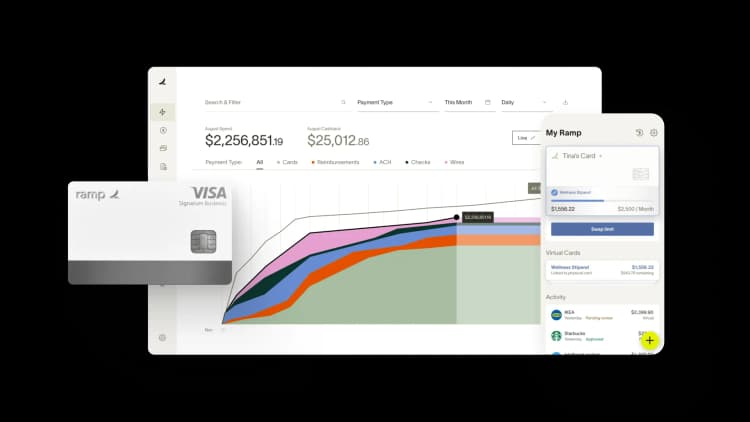

Ramp's expense management platform tackles this challenge head-on with intelligent categorization and real-time controls. The platform automatically categorizes expenses using merchant data and machine learning, eliminating the guesswork when employees submit receipts for those oddball purchases.

When an expense doesn't match existing categories, Ramp flags it for review, ensuring nothing slips through the cracks. You can create custom categories specifically for your business's unique miscellaneous spending patterns, making it easier to spot trends in what was once a black hole of "other" expenses.

The real game-changer is Ramp's proactive spend controls. Instead of discovering miscellaneous overspending at month's end, you set precise limits on employee cards—by merchant category, individual vendor, or even time period.

Need to control those unpredictable Amazon purchases? Set a monthly limit. Worried about SaaS sprawl? Ramp automatically detects recurring charges and alerts you to new ones. The platform even allows you to create virtual cards for one-time purchases, perfect for those miscellaneous vendor payments that pop up unexpectedly.

By combining automated categorization with granular spending controls, Ramp transforms miscellaneous expenses from an unpredictable line item into a manageable budget category. Finance teams that use Ramp report average savings of 5% across all spending thanks to intelligent controls that limit spending before it happens.

Control all your business expenses with automation

Overwhelmed by the prospect of documenting all of the miscellaneous expenses incurred by your business, especially when it comes to filing your tax returns? Ramp’s finance automation platform can help. More than 50,000 businesses have saved $10 billion and 27.5 million hours with Ramp.

Ready to learn more? Try an interactive demo.

FAQs

Miscellaneous expenses are for irregular, low-value costs that don't fit established categories. Other expense categories capture predictable, recurring costs like rent or salaries. If an expense happens monthly or represents significant spending, it needs its own category.

Miscellaneous expenses should ideally represent 1–3% of total business expenses. If your percentage is higher, you are likely misclassifying expenses that belong in dedicated categories.

Create a new category when an expense type appears three or more times per quarter, totals more than $500 annually, or is strategically important to track. Regular patterns indicate systematic spending that deserves its own line item.

Yes. A law firm might regularly incur notary fees and give them a dedicated category, while a retail store might rarely need them and classify them as miscellaneous. Your business model and transaction volume determine what's appropriate.

Self-employed individuals can deduct miscellaneous business expenses on Schedule C as long as they are ordinary and necessary for the business. Be sure to document the business purpose and keep all receipts.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits