- What are LLC expenses?

- Deductible LLC expenses

- Non-deductible LLC expenses

- How to write off LLC expenses

- Key tax considerations for LLCs

- How to track and manage your LLC expenses

- How Ramp simplifies LLC expense tracking

Key takeaways

- LLC tax write-offs are ordinary and necessary business costs that you can deduct to lower your company's taxable income for the year.

- You can deduct a wide range of common business expenses, including payroll, office supplies, professional services, business travel, and marketing costs.

- To claim deductions properly, you must keep detailed records for every purchase and maintain separate bank accounts for your business and personal finances.

- It's important to distinguish deductible expenses from non-deductible costs, such as personal expenses, commuting costs, and most entertainment.

- You can automate expense tracking and tax compliance by using Ramp's expense management software, which captures receipts and categorizes transactions in real time.

Knowing which expenses you can legally deduct as an LLC owner puts more money back in your pocket. Every dollar you keep through proper tax write-offs is a dollar that stays in your business to fuel growth and build long-term success.

Managing business expenses while staying compliant with tax regulations can feel overwhelming, especially when you're focused on running your company. The good news is that the IRS allows LLCs to deduct many ordinary business expenses, and taking advantage of these deductions is simpler than you might think.

In this guide, we'll provide a list of LLC tax write-offs, explain how to track and manage your expenses, and share a few advanced tips.

What are LLC expenses?

Deductible LLC business expenses are costs of doing business that you can deduct from your income taxes. Also known as write-offs, deductible business expenses save you money by lowering your LLC’s taxable income for the year.

Tracking and categorizing these expenses properly is essential for maximizing your tax savings. When you can clearly document what you've spent on legitimate business activities, you can claim those deductions with confidence and reduce your overall tax liability. The IRS divides business expenses into two main categories: deductible and non-deductible.

Deductible expenses are ordinary and necessary costs directly related to running your business, such as office supplies, professional services, and business travel. Non-deductible expenses include personal costs, fines and penalties, or expenses that benefit you personally rather than your business operations.

Keeping accurate records and knowing which category each expense falls into ensures you claim every deduction you're entitled to while staying compliant with tax regulations.

Deductible LLC expenses

Here’s a list of some of the most common deductible expenses your LLC may encounter, fully up to date for 2025:

Payroll expenses

Payroll expenses represent one of the largest deductible costs for most LLCs. This category includes all compensation paid to employees and contractors for work performed on behalf of your business.

What qualifies: Salaries, hourly wages, bonuses, commissions, and payments to independent contractors all count as deductible payroll expenses. You can also deduct employer-paid payroll taxes, including Social Security, Medicare, federal and state unemployment taxes, and workers' compensation premiums.

IRS rules: You must issue 1099 forms to contractors paid $600 or more during the tax year. Employee wages require proper payroll tax withholding and reporting through quarterly filings and annual W-2s.

Employee benefits

Employee benefits are fully deductible business expenses that help you attract and retain quality team members while reducing your tax burden.

What qualifies: Health insurance premiums paid for employees, contributions to retirement plans (up to 25% of annual compensation for 401(k) plans), life insurance premiums, disability insurance, and wellness programs all qualify for deduction.

IRS rules: Benefits must be offered to all eligible employees on a non-discriminatory basis. Some benefits have annual contribution limits. For 2025, 401(k) employee contributions are limited to $23,500 for those under 50, with an additional $7,500 catch-up contribution for those 50 and older.

Startup costs

Startup costs refer to the expenses you incur when launching your LLC. The IRS allows you to deduct up to $5,000 in the first year, with remaining costs amortized over 15 years.

What qualifies: Legal fees for entity formation, state filing fees ($100–$500 depending on the state), initial marketing campaigns, business licenses, consulting fees for business planning, and costs for setting up accounting systems.

IRS rules: If total startup costs exceed $50,000, the $5,000 first-year deduction is reduced dollar-for-dollar. Costs must be incurred before the business begins active operations to qualify as startup expenses rather than regular business expenses.

Office supplies and equipment

Office supplies and equipment purchases are generally fully deductible in the year you buy them, making this category particularly valuable for new businesses.

What qualifies: Computers, printers, office furniture, software licenses, paper, pens, filing cabinets, and any other items used primarily for business operations.

IRS rules: Equipment costing over $2,500 may need to be depreciated rather than expensed immediately, though Section 179 of IRS Publication 946 allows you to deduct up to $1,250,000 in qualifying equipment purchases in 2025. Items must be used more than 50% for business purposes to qualify.

Rent and utilities

Rent and utilities for your business location are straightforward deductions that can significantly reduce your taxable income.

What qualifies: Monthly rent payments, electricity, gas, water, trash service, internet, business phone lines, and any other utilities necessary for business operations.

IRS rules: Expenses must be for business use only. If you use part of your home for business, you can deduct the business percentage of rent and utilities through the home office deduction rather than claiming them separately.

Business insurance

Business insurance premiums are fully deductible and help protect your company from various risks while reducing your tax liability.

What qualifies: General liability insurance, professional liability coverage, property insurance, cyber liability insurance, workers' compensation premiums, and commercial auto insurance for business vehicles.

IRS rules: Insurance must be ordinary and necessary for your business type. Personal insurance policies don't qualify, even if you occasionally use covered items for business purposes.

Professional services

Professional services are essential business expenses that maintain your company's legal and financial health while providing full tax deductions.

What qualifies: Accounting and bookkeeping services, legal fees for business matters, business consulting, tax preparation, and other professional advice directly related to business operations.

IRS rules: Services must be business-related to qualify. Personal legal fees or tax preparation for individual returns don't count, even if you're a business owner.

Marketing and advertising

Marketing and advertising expenses are fully deductible and essential for business growth, making them valuable deductions for most LLCs.

What qualifies: Digital advertising campaigns, print advertisements, website development and maintenance, business cards, brochures, trade show expenses, and promotional materials.

IRS rules: Advertising must promote your business to qualify. Expenses for personal social media promotion or non-business-related marketing don't count as deductions.

Travel and meals

Business travel and meal expenses offer valuable deductions, though meals are typically only deductible up to 50% of the actual cost.

What qualifies: Airfare, hotels, rental cars, parking, and other travel expenses for business trips. Business meals with clients, employees, or business associates and meals during business travel also qualify.

IRS rules: Travel must be primarily for business purposes. Meals are generally 50% deductible, though some exceptions apply for company events or employee meals. Keep detailed records, including business purpose and attendees.

Vehicle expenses

You can deduct vehicle expenses using either the standard mileage or actual expenses method, whichever provides the larger deduction.

What qualifies: Business mileage (the standard mileage rate is 70 cents per mile in 2025), gas, maintenance, insurance, and depreciation for vehicles used for business purposes. You can also deduct parking fees and tolls for business trips.

IRS rules: You can choose whether to use the standard mileage or actual expenses method for a given tax year, but in order to do so, the IRS requires that you use the standard mileage rate in the first year that you claim business use of your vehicle. In later years, you can choose whichever of the two methods gives you the larger deduction.

If you don’t use the standard mileage rate deduction in the first year you claim business use of your vehicle, you’ll be required to use the actual expenses method each year moving forward.

You’ll also need to keep a mileage log showing the business purpose, destinations, and miles driven for each trip.

Home office deduction

The home office deduction allows you to deduct expenses for the part of your home used exclusively for business operations.

What qualifies: A dedicated space used regularly and exclusively for business activities. This can include a separate room or a clearly defined area within a room used only for business.

IRS rules: The space must be used exclusively for business—no personal use allowed. You can use either the simplified method ($5/square foot, up to $1,500 maximum) or actual expense method (percentage of home expenses), but not both.

Education and training

Education and training expenses that improve your business skills or keep you current in your field are fully deductible business expenses.

What qualifies: Professional courses, certifications, conferences, seminars, business books, and training programs directly related to your business activities.

IRS rules: Education must maintain or improve skills needed in your current business. Training that qualifies you for a new trade or business generally isn't deductible.

Bank fees and interest

Business banking fees and interest on business loans are ordinary business expenses that qualify for full deductions.

What qualifies: Monthly account maintenance fees, transaction fees, overdraft charges, business credit card interest, loan interest, and credit line fees for business financing.

IRS rules: Interest and fees must be for business purposes. Personal credit card interest isn't deductible even if you occasionally use the card for business purchases.

Depreciation

Depreciation allows you to deduct the cost of business assets over their useful life, spreading the tax benefit across multiple years.

What qualifies: Equipment, vehicles, buildings, and other business assets with a useful life of more than one year can be depreciated. You can often accelerate depreciation using Section 179 or bonus depreciation. For example, a piece of manufacturing equipment might be depreciated over seven years, or you could elect to deduct the full amount in 2025.

IRS rules: Assets must be used more than 50% for business to qualify. The IRS sets different depreciation schedules for different asset types. Section 179 allows immediate deduction of up to $1,250,000 in qualifying assets for 2025.

Other common deductions

Many smaller business expenses add up to significant deductions throughout the year and shouldn't be overlooked.

What qualifies: Software subscriptions, shipping and postage, professional membership dues, business licenses, domain name registrations, cloud storage, and office cleaning services.

IRS rules: Expenses must be ordinary and necessary for your business type. Keep receipts and documentation for all deductions, especially smaller expenses that might be questioned during an audit.

Non-deductible LLC expenses

Non-deductible business expenses are any expenses that you can’t claim as a tax write-off. While you always need to keep an eye on spending regardless of what you can write off, it’s especially important to avoid non-deductible expenses whenever possible since they don’t help lower your tax bill.

Some non-deductible expenses may seem obvious, such as personal expenses, but you may wonder why others don't qualify as business expenses. It’s all based on guidelines set by the IRS, many of which are covered in Chapter 8 of Publication 334, Tax Guide for Small Business.

Some common non-deductible expenses you’re likely to encounter as an LLC include:

- Personal expenses: Personal meals and entertainment, clothing, haircuts, grooming costs, personal travel expenses, vehicle expenses that aren’t related to business use

- Household expenses: Household utilities, personal cell phone plans, residential landlines, furniture, groceries, and supplies

- Childcare expenses: Babysitting, daycare, preschool, and private school tuition

- Commuting costs: Gasoline, bridge and tunnel tolls, parking fees, bus and subway fare, train tickets, and mileage to and from your primary place of work

- Certain insurance premiums: Life insurance policies taken out to secure a business loan or where you are the beneficiary, and disability insurance policies that replace your income if you can’t work

- Entertainment costs: Whether related to employee, client, customer, or business partner entertainment

- Gifts above $25: To employees, customers/clients, suppliers/distributors, and other business associates (over $25 per recipient per year)

- Penalties and fines: Incurred in the course of doing business, such as workplace safety (OSHA) violations, parking and speeding tickets, and late fees on federal and state taxes

- Political contributions: To political candidates, campaigns, political action committees (PACs), and other political organizations

- Charitable contributions: Made to a qualified organization, such as a religious, educational, scientific, or social charity or nonprofit. However, you can often claim these donations on your personal tax return if you itemize deductions instead of claiming the standard deduction.

How to write off LLC expenses

Claiming legitimate business deductions requires proper preparation and documentation. Follow these essential steps to maximize your tax savings while staying compliant with IRS requirements:

1. Keep organized records

Maintain detailed expense receipts for every business purchase, whether physical or digital. Use accounting software to track expenses automatically. Create digital logs for cash transactions and categorize expenses by type. Store receipts in cloud-based systems for secure and easy access during tax season.

2. Separate business and personal finances

Open a dedicated business bank account exclusively for your LLC’s transactions. Apply for a business credit card to handle company purchases separately from personal spending. This separation creates a clear paper trail that simplifies bookkeeping and strengthens your position during potential audits.

3. Document each deduction

In addition to receipts, tax deductions for LLCs require different types of documentation:

- Business meals: Notes about attendees and business purpose

- Vehicle expenses: Mileage logs with dates, destinations, and business reasons

- Home office deductions: Measurements of the dedicated workspace

- Equipment purchases: Invoices showing business use percentage

- Travel expenses: Itineraries and business meeting documentation

4. Choose the correct tax form

Single-member LLCs typically file Schedule C with their personal tax return. Multi-member LLCs generally use Form 1065 to report partnership income and losses. LLCs electing corporate tax treatment will file Form 1120 or 1120S. Consult a tax professional to determine which form applies to your specific situation.

Proper documentation and organization make tax preparation smoother and help you claim every deduction you're entitled to while avoiding potential compliance issues. If you have any doubts, consult with a tax professional.

Key tax considerations for LLCs

Beyond basic deductions, you can leverage advanced tax strategies and navigate special rules to optimize your tax position while staying compliant with IRS requirements.

Qualified business income (QBI) deduction

The QBI deduction allows eligible LLC owners to deduct up to 20% of their qualified business income from their taxable income. This significant tax benefit applies to pass-through entities like LLCs, provided your taxable income falls below certain thresholds ($197,300 for single filers, $394,600 for joint filers in 2025).

If you earn more than the applicable threshold, you may still qualify for the QBI if your business meets specific criteria related to W-2 wages paid or depreciable property owned. But service-based businesses face additional restrictions once income exceeds the threshold amounts.

Self-employment tax deduction

LLC owners typically pay self-employment tax on their business earnings, but they can deduct the employer portion (7.65%) of this tax as an above-the-line deduction. This deduction reduces your adjusted gross income, lowering both your income tax and self-employment tax liability.

The deduction applies automatically when you file your tax return and doesn't require itemizing deductions.

State-specific rules and limits

Tax rules vary significantly by state. Some states don't recognize federal S corp elections, while others impose franchise taxes or annual fees on LLCs regardless of income. California charges an $800 minimum franchise tax, and states like New York have specific deduction limitations. Always consult your state's tax authority or a local tax professional for state-specific guidance.

Tips to avoid common audit triggers

First and foremost, keep business and personal expenses completely separate. Maintain detailed records for all business expenses, especially those that could appear personal, such as meals, travel, or home office. Avoid claiming 100% business use for vehicles unless they're genuinely used exclusively for business.

Also, don't claim excessive meal and travel deductions. Ensure your business shows a profit motive by generating income in at least three of five consecutive years, and document the business purpose for all expenses that may be questionable.

Tax reduction strategies require careful planning and thorough, consistent documentation. Consult with a qualified tax professional to maximize benefits while maintaining compliance with all applicable regulations.

How to track and manage your LLC expenses

If you’ve never tracked business expenses before, it can be tricky to know where to get started. Here are five best practices to help you track and manage your LLC’s expenses year-round.

1. Establish a clear expense policy

If your employees make purchases on behalf of your business, it’s essential to have a process in place to manage those expenses. This is where expense policies come into play.

An expense policy explicitly specifies which purchases employees are allowed to make, outlines any spending limits, and details the expense approval process. Alongside your expense policy, you also need a reimbursement policy. This document outlines the process employees should expect if they incur a reimbursable business expense with their own money.

Other policies to consider, depending on the nature of your business and the types of spending you see, include a travel expense policy and a corporate credit card policy.

2. Document everything

If you plan to claim any expenses as business tax write-offs, you need to document every deduction. This sets you up for success come tax time and is the only way you can be sure your business is safe from penalty if you ever find yourself audited by the IRS.

For purchases, this means collecting receipts, invoices, and work orders. For mileage deductions, this means following the IRS mileage log requirements, including tracking the number of business miles driven per trip and annually. In both cases, it’s important to have a record of the business purpose of the purchase or travel.

3. Use a business credit card

Many entrepreneurs and self-employed individuals open a second checking account for their business and link it to their personal accounts. While convenient, this can blur the lines between personal and business-related spending and might subtly encourage you to mix funds. A completely separate business credit card for your LLC sets a clear distinction between these two money sources.

4. Leverage multiple expense categories

Deductible and non-deductible business expenses aren't the only way to categorize your expenses. For example, you might also break out spending by:

- Recurring vs. one-time expenses: One-time expenses are expenses that your business pays for once, like when you purchase new equipment or supplies. Recurring expenses occur on a repeating basis, whether that’s weekly, monthly, or annually. Subscriptions and software fees are examples of recurring costs.

- Fixed vs. variable expenses: Fixed expenses are recurring costs that are the same each time you pay them, like rent payments and employee salaries. Variable expenses are recurring costs that fluctuate, typically based on usage. Utility bills and raw material costs are examples of variable expenses.

By leveraging multiple expense categories, you’re empowered to compile your expenses in various ways to truly understand how your business spends its money and where you can potentially cut back.

5. Use accounting software and tools

Investing in quality accounting software streamlines expense tracking and simplifies tax preparation. Popular options like QuickBooks and Xero automatically categorize transactions, generate reports, and integrate with your bank accounts.

You can go a step further by using advanced expense management software like Ramp, which integrates with popular accounting software and combines corporate cards with automated expense tracking and real-time spending controls.

Ramp offers receipt scanning, mileage tracking, and automated bank reconciliation features built in, and gives you the reporting features you need for tax compliance and business insights.

How Ramp simplifies LLC expense tracking

Managing tax deductions for your LLC can feel overwhelming. If you aren't actively tracking all your expenses, you risk missing valuable deductions or facing compliance issues. The challenge intensifies when you're tracking receipts across multiple team members, categorizing expenses correctly for tax purposes, and ensuring every deductible expense is properly documented before year-end.

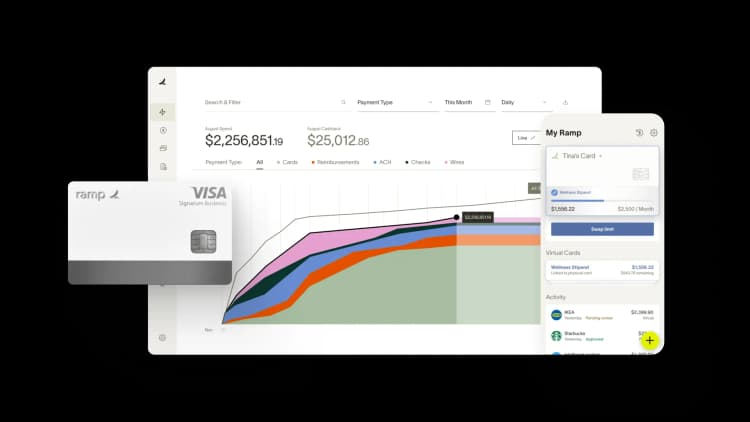

Ramp's expense management software transforms this complex process into a streamlined workflow that captures every deductible expense automatically. When employees make purchases with Ramp corporate cards, the platform instantly captures transaction data and prompts users to upload receipts through the mobile app. This real-time documentation means you'll never scramble to find receipts during tax season or miss deductions because paperwork went missing.

The platform's intelligent categorization engine automatically assigns expenses to the appropriate tax categories, whether it's meals and entertainment, travel, office supplies, or professional services. You can customize these categories to match your LLC's specific needs and tax strategy. For expenses that need special attention, Ramp flags these transactions and applies the correct tax treatment automatically.

What makes Ramp particularly powerful for LLCs is how it handles expense policies and approval workflows. You can set spending limits and category restrictions that align with IRS guidelines, ensuring compliance before expenses occur rather than catching issues after the fact.

The platform also integrates seamlessly with popular accounting software, syncing categorized expenses directly to your books with the proper tax codes already applied. This integration eliminates hours of manual data entry and reduces the risk of miscategorization that could trigger audit concerns or cause you to miss legitimate deductions.

Start saving time and money with Ramp

Beyond expense management and tracking, Ramp delivers measurable results for your LLC's bottom line. More than 50,000 businesses have saved over $10 billion and 27.5 million hours with Ramp.

Want to see what your LLC could save? Try our savings calculator to get a personalized estimate based on your business size and spending patterns.

FAQs

Yes. It’s very important to maintain proper records and supporting documentation for anything you’re planning to write-off on your taxes. This includes receipts, bank statements, invoices, and additional information, depending on the expense.

Yes, an LLC can write off a vehicle purchase or recurring car payments provided the vehicle is used for business purposes. How you calculate your deduction, and ultimately how much you can write off, depends on whether you use the standard mileage rate or actual expenses method.

If your cell phone is a necessary expense for your LLC, you can expense it. However, it’s best to invest in a separate business line to keep the lines between personal and business use from blurring. If you are using the same cell phone for both, you can only write off the percentage used for business purposes.

You may not always turn a profit when you’re first starting a business. So even if your LLC has no income, you can still write off your expenses and report them as a loss, since that still counts as business activity.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits