A complete guide to e-invoicing for modern finance operations

- What is e-invoicing (electronic invoicing)?

- Benefits of e-invoicing

- How does e-invoicing work for small businesses?

- Compliance challenges and how the right e-invoicing solution overcomes them

- 5 best practices to streamline your e-invoicing process

- Ramp Bill Pay automates your invoice workflow

- Why finance teams choose Ramp

Electronic invoicing promises to reduce the paperwork bottlenecks that slow down accounts payable operations. However, many small businesses delay making the switch due to legitimate concerns. Upfront software costs, older accounting systems, and integration issues seem like substantial obstacles.

However, those paper invoices piling up on your desk each week are costing you money. According to Adobe, the average cost to manually process a single invoice is between $15 and $40. Worse, your accounts payable team spends their days managing stacks of vendor invoices instead of providing valuable financial insights that could drive business decisions.

E-invoicing turns accounts payable from an administrative burden into a strategic advantage. The question isn't whether to modernize—it's how quickly you can implement solutions that free your finance team to focus on strategic work instead of paper processing.

What is e-invoicing (electronic invoicing)?

E-invoicing is the process of transmitting structured data files—typically in XML or UBL formats—directly between accounting systems through secure networks. Unlike PDF attachments, these machine-readable invoices skip manual data entry, reduce errors, and create automatic audit trails from creation to payment.

Cloud platforms integrate these standards into their interfaces, allowing you to receive, process, and reconcile vendor invoices directly within your accounting system. This approach transforms invoices from documents requiring human handling into automated data exchanges that integrate seamlessly into your financial workflows.

Traditional invoicing vs e-invoicing

Manual processes seem inexpensive until you calculate the hidden costs—printing, postage, data entry, fixing mistakes, storage, and compliance risk. This comparison tells the story:

Metric | Traditional | E-invoicing |

|---|---|---|

Processing time | Slow: Manual data entry, approvals, and mailing delays | Instant: Automated processing and approvals |

Error rate | High: Prone to typos, lost invoices, and mismatched data | Low: Automated validation reduces mistakes |

Cost per invoice | Expensive: Printing, mailing, and storage costs add up | Lower: No physical paperwork or postage |

Compliance risk | Risky: Manual tax reporting can lead to errors and tax penalties | Safer: Built-in compliance with tax regulations |

Audit trail | Scattered paper/email | Real-time digital log |

Scalability | Adds headcount | Adds zero marginal cost |

Environmental impact | Paper, ink, shipping | Paper-free |

The evolution of e-invoicing

Electronic invoicing started as simple EDI connections between large companies, progressed to emailed PDFs, and now focuses on structured data standards that most governments require. Government initiatives, such as the EU's VAT in the Digital Age program, Brazil's clearance requirements, and Australia's Peppol adoption, all require businesses to adopt automated, standardized exchanges.

Modern platforms respond with API-first designs, real-time tax validation, and AI that identifies anomalies before they hit your ledger. For finance teams, this evolution transforms invoicing from back-office paperwork into a streamlined, compliance-ready data pipeline that supports better business decisions.

Benefits of e-invoicing

E-invoicing reduces invoice processing costs while accelerating payment cycles and improving accuracy—benefits that directly impact your bottom line:

- Cost reduction: Processing expenses drop per invoice, eliminating printing, postage, and storage costs. These immediate savings multiply across every transaction, creating substantial budget relief.

- Processing speed: Cycle time shrinks from weeks to hours through instant delivery and automated workflows.

- Error elimination: Automated validation cuts data-entry mistakes, improving financial accuracy. Structured data formats prevent typos and mismatched information that create payment disputes.

- Cash flow improvement: Payments accelerate through faster delivery and approval cycles. Many businesses unlock early-payment discounts that further reduce costs and strengthen vendor relationships.

- Compliance assurance: Built-in tax validation and permanent audit trails keep you audit-ready without manual documentation. Regulatory requirements get handled automatically, reducing compliance risks and penalties.

- Scalability advantages: Busy periods no longer require extra staff since cloud capacity expands automatically. Your finance team handles growing transaction volumes without proportional increases in administrative work.

How does e-invoicing work for small businesses?

Switching from physical invoices to paperless AP processing is simpler than you might think. You can start with minimal setup, connect directly to your accounting software, and automate the daily administrative work.

Here are three steps that make the transition smooth.

Getting started with basic e-invoicing

Cloud-based tools eliminate the need for servers, installations, or specialist staff. You sign up, configure your vendor list, and set up receiving protocols. When vendors send e-invoices, modern platforms automatically convert them into structured data formats that integrate directly with financial systems.

Everything runs in your browser, eliminating technical barriers. You avoid capital expenses and pay only monthly subscriptions or per-transaction fees.

Most vendors offer free trials or tiered plans that grow with volume. Initial setup takes minutes—configure approval rules, default tax rates, and payment terms without any coding.

Integration with existing accounting software

Seamless connections between your invoicing platform and general ledger keep books clean and accelerate month-end close. API-driven integrations sync vendors, items, taxes, and payment status in real time without manual data entry.

Most major accounting platforms offer native electronic invoice capabilities or certified third-party integrations. Once connected, incoming vendor invoices are automatically captured and routed through your approval workflows.

Status updates appear inside your accounting system immediately, maintaining complete visibility throughout the payment cycle.

Automation workflows

Automated invoice approval workflows transform digital invoicing from electronic documents into hands-off processes. Route and track invoices based on dollar amounts, flag exceptions for review, and trigger payment batches when invoices get approved.

Automated payment scheduling ensures vendors get paid according to terms, improving cash flow predictability and vendor relationships. Real-time dashboards reveal bottlenecks so you step in only when necessary. Your finance team handles fewer touches per invoice and focuses on higher-value analysis instead of chasing paper.

Compliance challenges and how the right e-invoicing solution overcomes them

A single invoice can cross borders, tax jurisdictions, and accounting platforms, with each stop introducing new rules. Miss one and you face penalties, disrupted cash flow, or failed audits.

Regulatory requirements and regional differences

Regulation remains fragmented across global markets. The EU's VAT in the Digital Age project aims to consolidate rules, yet each member state has its own requirements until at least 2030. Latin American countries mandate real-time clearance through government portals before you ship goods.

An electronic invoicing solution can handle country-specific validations and tax authority connections for you, removing compliance complexity. Thanks to automated updates and built-in validation rules, your AP team can immediately process compliant invoices without worrying about regulatory changes.

Adapting to different technical standards

Every vendor has different invoicing formats and processes. Some send simple PDF attachments, while others use structured data formats like XML or EDI. Leading e-invoicing platforms automatically handle this variety. When vendors send invoices in different formats, the system converts them to whatever standard your accounting system or tax office requires.

Look for tools that maintain a central data model, then apply rule-based transformations. If you purchase across borders, insist on built-in multi-currency and VAT logic to avoid duplicate data entry and compliance issues.

Integrating with existing financial systems

Compliance extends beyond the invoices you receive—it includes the data that processes them. Legacy ERPs often store incomplete tax details or use custom fields that don't map to regulatory schemas. During integration, mismatches break validation checks and trigger audit flags.

Modern platforms eliminate this risk with API connectors that pull vendor, GL, and tax data directly from QuickBooks, Xero, or on-premise ERPs. They run real-time accuracy checks before submission.

Look for two-way sync so payment statuses flow back into your accounting system. This preserves a single source of truth and maintains continuous audit trails during transitions, ensuring data integrity throughout your financial ecosystem.

Maintaining audit trails and documentation

Tax authorities commonly require retention of invoice history and proof of payment, while proof of delivery is generally retained for specific industries or operational reasons rather than as a universal tax mandate. Paper files and PDF folders make retrieval painful and time-consuming.

E-invoicing platforms solve these documentation challenges automatically by generating immutable logs that support compliance requirements. Every edit, approval, transmission, and receipt acknowledgement gets time-stamped, encrypted, and made searchable.

You can grant auditors read-only access that surfaces exactly what they need. Automated retention policies ensure documents get purged or archived according to local rules, reducing storage costs and legal exposure while maintaining compliance.

Keeping pace with evolving regulations

According to Way2VAT, the majority of global governments expect electronic invoicing to be standard in 2025. New mandates often arise without much notice, and monitoring each change manually is unrealistic for most finance teams.

Choose a provider that offers continuous regulatory monitoring and pushes updates—new XML tags, tax rate changes, clearance URLs—straight into your workflow. Dashboards that flag upcoming rule changes, plus automated regression tests against your current templates, let you adapt in hours rather than weeks.

You stay compliant, avoid last-minute scrambles, and keep your finance team focused on strategic work instead of regulatory firefighting.

5 best practices to streamline your e-invoicing process

Electronic invoicing platforms deliver results when surrounding processes and workflows support automation.

1. Standardize invoice templates and data formats

Consistent supplier data enables automatic validation instead of manual exception handling. Define mandatory fields—supplier ID, purchase orders, tax rate, payment terms—and lock them into master templates.

Apply validation rules like preventing negative values and matching tax rates to jurisdictional requirements. Template consistency turns data mapping from weekly cleanup projects into one-click syncs with your accounting software, dramatically improving finance team productivity.

2. Implement real-time tracking and visibility

Dashboards updating every few minutes catch stuck invoices before vendors send reminders. Configure views showing processing time, pending approvals, and upcoming due dates.

Set threshold-based alerts—trigger Slack or email notifications when invoices reach five days past terms yet remain unapproved. This enables tighter cash-flow forecasting and prevents surprise late fees, giving finance leaders better control over company finances.

3. Automate vendor invoice receipt and validation

Configure your system to automatically receive e-invoices from vendors and validate them against purchase orders and contracts. Set up rules to flag invoices that exceed PO amounts, have missing required fields, or come from unauthorized vendors.

Automated validation catches discrepancies before they reach your AP team, preventing payment delays and ensuring accurate financial records.

4. Create backup and disaster recovery procedures

Digital invoices offer better security than paper when you plan for outages and implement proper safeguards. Enable daily off-site backups of invoice data and audit logs. Verify recovery by restoring sample files monthly. Retain records for statutory minimums—typically seven years—to satisfy auditors.

Encrypt backups in transit and at rest, restricting restore rights to authorized personnel based on role and business need. Documented playbooks mean operations continue even during primary provider downtime, ensuring business continuity.

5. Monitor performance metrics and continuous improvement

Track core KPIs: average processing time, exception rate, days payable outstanding (DPO), and vendor payment performance metrics. Most platforms export this data to BI dashboards or display it natively.

Review metrics quarterly, identify slowest steps, and adjust workflows—perhaps raising auto-approval thresholds or adding validation rules. Continuous tuning maintains efficiency as volumes grow and regulations evolve, delivering ongoing optimization that supports business growth without adding headcount.

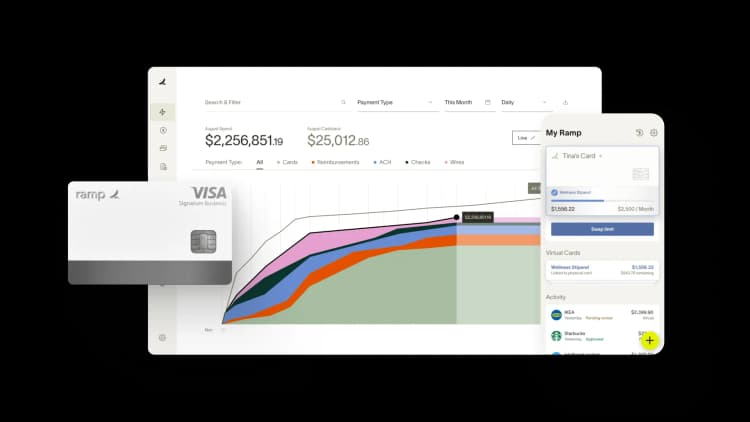

Ramp Bill Pay automates your invoice workflow

Ramp Bill Pay is an autonomous AP platform that takes manual work out of invoice management. Four AI agents handle transaction coding, fraud detection, approval summaries, and card-based payments—processing invoices from capture to payment without manual intervention. With up to 99% accurate OCR extracting every line item, Ramp moves invoices through your workflow 2.4x faster than legacy AP software1.

Use Ramp as a standalone invoice automation solution or connect it with corporate cards, expenses, and procurement for unified spend visibility. Teams on Ramp report up to 95% improvement in financial visibility2.

Even with electronic invoices, AP teams still deal with manual coding, stalled approvals, and disconnected systems. Ramp's touchless, autonomous automation handles each:

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons—then recommends approval or rejection

- Fraud prevention agent: Flags suspicious activity before payments go out, including unexpected banking detail changes, suspicious vendor email domains, and unverified accounts

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Roles and permissions: Enforce separation of duties with granular user controls

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- International payments: Send wires to 185+ countries with global spend management support

- Recurring bills: Automate regular payments with recurring bill templates

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Reconciliation: Close books faster with automatic transaction matching

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Vendor onboarding: Collect W-9s, match TINs, and track 1099 data directly in the platform

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

Why finance teams choose Ramp

Ramp delivers touchless invoice automation—accurate capture, intelligent coding, and faster approvals without the manual overhead. Run it as a dedicated AP solution or integrate it across your financial stack for end-to-end control.

Over 2,100 finance professionals on G2 rate Ramp 4.8 out of 5 stars, making it the easiest AP software to use. Teams highlight faster processing, fewer errors, and cleaner reconciliation as top reasons they love Ramp.

Ramp's free tier includes core AP automation. Ramp Plus unlocks advanced features at $15 per user per month, with enterprise pricing available on request.

Invoice management shouldn't be manual. Ramp automates it.

Try Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits