Subscription creep can sneak up on you: How to reduce unnecessary SaaS expenses

- What is subscription creep?

- Why subscription creep is a long-term, compounding issue

- The most common types of subscriptions that sneak under the radar

- How to reduce subscription creep

- Expense management software helps you prevent subscription creep and get your budget back

Ever hear the phrase “death by a thousand cuts?” That’s exactly what subscription creep is: a series of insignificant software fees that can sneakily drain an SMB dry.

Subscription creep (sometimes called SaaS creep) can take a significant bite out of the financial well-being of any business. However, small-to-medium-sized businesses are in the most danger from subscription fees building up because an SMB’s margin for error is much smaller. In the era of “software as a service” and additional fees for every small feature in your tool stack, SMBs have to create a system to manage, reduce, and eliminate these subscriptions before they pile up.

Gone unnoticed and unaddressed, these subscription fees aggregate into a massive burden on your operating budget. According to the Flexera 2022 “State of ITAM” report, a staggering 29% of software spend goes to unused or underused SaaS subscriptions.

In this article, we’re going to help explain what subscription creep is, warn you of the damage it can cause, and help you find the right methods to take control of your finances using real-world examples from companies that have successfully eliminated subscription creep.

What is subscription creep?

Subscription creep is the gradual build-up of unused or underused software subscriptions, memberships, and licenses that go unnoticed but have a significant negative effect on an individual or company budget.

We’re all familiar with the concept of subscription creep from our personal budgets. If you’ve ever found yourself paying for a streaming service months after you finished the one show you signed up for, or you’ve spotted that New Years' resolution gym membership still clinging to your bank account in July, then you get it.

For companies, subscription creep usually comes in the form of SaaS subscriptions or memberships that:

- Aren’t being used anymore

- Were specific to an individual who left the company

- Should be downgraded for actual current use

- Could be bundled into a better package

- Have a cheaper, more effective alternative

Subscription creep often goes unaddressed because it either isn’t noticed or the energy required to do everything in that bullet point list above feels too high for such a small fee.

However, this form of zombie spend accumulates, causing real financial damage if left to run rampant.

Why subscription creep is a long-term, compounding issue

Subscription creep is part of the greater problem of spend control, which costs businesses billions of dollars per year. Billions, with a “B.”

That $2.99 fee for a single defunct account for a former employee might not seem worth the effort to employ a management strategy at first blush. But multiply that fee by every past, present, and future employee for every service you have, and the scale of the problem becomes apparent.

It isn’t just former employees draining subscription funds. Consider products your company doesn’t use anymore, or even unused features of an otherwise well-used product that are still adding to the fee.

The most common types of subscriptions that sneak under the radar

Before creating a strategy to fight subscription creep, you need to zero in on the most common perpetrators.

Cloud storage fees

Between the rise of remote work and the switch to cloud-based networking, most companies pay a subscription for cloud storage services. Google Drive, OneDrive, Dropbox, IDrive, Egnyte, and Citrix are all popular choices and have various fee structures based on number of employees (and tied to individual user accounts).

Design tools subscriptions

Does your marketing or creative department use Adobe Photoshop, After Effects, InDesign, or Illustrator? They do, that was a hypothetical question. Are there parts of your license you’re not using? Maybe your design team uses a free tool like Canva or GIMP more often, or your marketing person doesn’t make vector graphics and you’re paying for software that does.

Internal documentation licenses

Software that manages your internal documentation and/or company wiki costs money. The hosting fee, if it’s not bundled with the software, costs money. Then comes the most important question that all internal documentation people have asked since the beginning of time: is the wiki even being used? Is it being used effectively? Is it up to date? If the answer to these questions is “no,” is there a free, lower cost, or just better version of that software?

Collaboration and task management tools

If you’re paying for a task management software like Asana or ClickUp but everyone on your team is making lists in free spreadsheet software or scribbling on post-it notes, that’s a waste.

Marketing subscriptions

Traffic monitoring (Google Analytics), newsletter tools (Mailchimp), social media managers (Hootsuite), automation tools (Hubspot), CRMs (Salesforce), are all part of what can be a sizable marketing tool stack. And with any large tool stack, it's no trouble at all to lose track of a few subscriptions.

Subscriptions that aren’t paid monthly

Quarterly, biannual, and annual subscription fees are the most likely to go unnoticed when examining the typical monthly budget.

These are just a few of the more common fees that can go unnoticed. Communication tools (email and chat), dev tools, and hosting licenses all contribute to subscription creep, too.

We’ve recognized the problems and how varied (and dire) subscription creep can be. Let’s move on to how to actually fix subscription creep and get some of your budget back.

How to reduce subscription creep

There are 4 primary steps for taking control of subscription creep. You have to identify the subscriptions that may be creeping, analyze their usage and value (with staff members that use them), and then downsize or eliminate the unnecessary subscriptions.

The last step is “automating what you can,” because subscription management can be a tedious process that doesn’t ever really end. Unless you want to create an entire position for subscription management–which might eliminate the cost-savings of the entire process in the first place–automation can be very beneficial here.

1. Identify the subscriptions subject to creep

We’ve covered some of this above, but examining your tool stack is a good starting place. Software and hosting services can always use a closer look, as can subscriptions that outsource things you could be doing in-house.

Any subscriptions based on number of people or tied to specific user accounts should be scrutinized.

Also consider asking what subscriptions individuals might be using that haven’t gone through proper centralized approval. Sometimes called “shadow IT,” these forms of unreported, à la cart software subscriptions are particularly difficult to find on a budget report. A company or team-wide inventory of all personally-used subscriptions is a good starting point for outing these shadow IT subscriptions.

You should also gather a report of your subscriptions, both monthly fees and billings with more irregular periods. This will come in useful when you move to step two and begin analyzing the value of your subscriptions.

2. Analyze the subscription’s usage and value

Schedule a meeting or chat with a representative from every department—marketing, development, sales, shipping, etc. Have them ready to discuss their department’s tool stack, licensing fees, and subscription services.

Then, you need to ask them these questions:

- What tools and services do they use every day?

- Are they working?

- Are there features of the software or service in question that aren’t being used?

- Do those extra features cost money?

- Is there a system in place for eliminating subscription accounts for employees who leave or are transferred or promoted out of their positions?

- Do you know of a better or comparable alternative that doesn’t cost as much?

Analyze the answers closely, and ask follow-up questions. The people using these tools are the experts, and they’re already on your payroll. Use their knowledge and you both might benefit—your team gets a more useful tool stack, and you save money on subscription creep.

3. Downsize and/or eliminate underused subscriptions

This step is simple. After step 1 and step 2, you have a list of subscriptions that may not be necessary.

Cut redundant employee accounts, subscriptions you don’t use anymore, and features or add-ons that don’t fit into your process.

Don’t make unilateral management-level decisions on what to eliminate, though. You need the people who use the tools every day to help you throughout this process. Take their suggestions into account for how to streamline your subscriptions.

4. Use virtual cards to control subscription creep

Once you’ve sorted out what subscriptions you’re keeping and what you’re losing, consider switching some recurring payments to virtual credit cards.

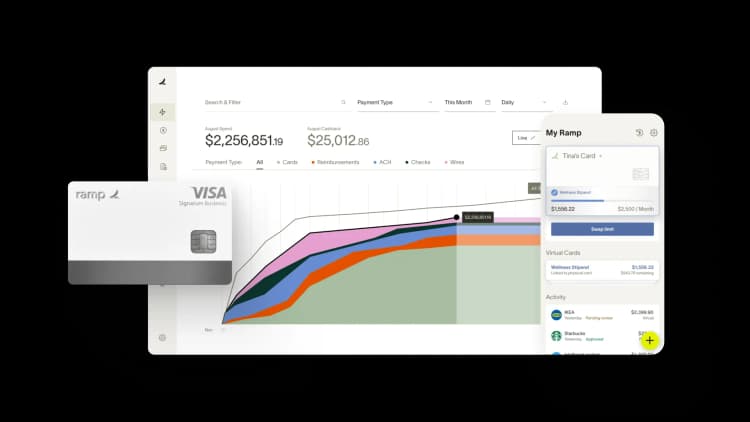

Rather than putting subscriptions on a central company credit card or account, you can use virtual credit from a finance platform like Ramp to issue an unlimited amount of temporary cards to staff members and departments.

For instance, let’s say you have a subscription fee per account or per individual. Or maybe you have software that only one person is using, like your marketing person being the only one who uses Mailchimp. You can assign that person a virtual card with a limited monthly value (the cost of the subscription or subscriptions, for instance), and have the fee charged to that card.

If that employee leaves or moves to a different position, their virtual card can simply be canceled. Then, all subscriptions that only they use disappear.

Eight Sleep, a company that makes high-tech sleep aids, uses this virtual card method to successfully take control of their own subscription creep.

Expense management software helps you prevent subscription creep and get your budget back

Subscription creep is going to stick with us for as long as the SaaS economy, which means it's time to create a cohesive strategy to dig subscription creep out now and prevent it in the future.

Creating a system for managing subscriptions and subscription fees shouldn’t be all doom and gloom. Consider what you and your business can do with the portion of your budget you’ve freed from sneaky and wasteful charges. You’ll be able to afford better tools, bolster the subscriptions you do find valuable, and in general provide your workers and your company with more resources to work with.

If you’re looking to learn more about how to fight subscription creep and other forms of zombie spending, check out Ramp’s tools for expense management.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits