- What is an electronic bill (e-bill)?

- What is an electronic billing system?

- How does the e-billing process work?

- Benefits and challenges of e-Billing

- Industries that benefit from e-billing

- E-billing vs. e-invoicing: What’s the difference?

- Streamlining invoice management with automation

- Why finance teams choose Ramp

Not all bills are handled the same way, which is why businesses use different billing methods to streamline payments.

Electronic billing streamlines invoicing by automating payment processing, reducing delays, and improving financial visibility. From recurring subscriptions to large-scale B2B transactions, businesses across industries use e-billing to enhance efficiency and optimize cash flow.

Here’s everything you need to know about how e-billing works, its benefits and challenges, and the industries that gain the most from adopting it.

What is an electronic bill (e-bill)?

Electronic bills

Electronic bills, or e-bills, are digital versions of traditional invoices that allow companies to send, receive, and process payments electronically.

Instead of being mailed as paper documents, they are typically delivered via email, secure online portals, or integrated billing platforms. This minimizes manual effort and paperwork, accelerates processing, and enhances convenience.

Depending on the platform and business needs, e-bills can be automated, integrated with accounting systems, or customized for recurring payments.

What is included in an electronic bill?

What’s included in an electronic bill can vary based on factors like industry, billing structure, and customer preferences. However, most e-bills include:

- Basic details: The sender’s and recipient’s business names, contact information, and invoice number for tracking

- Billing breakdown: A list of charges, whether for products, services, or usage-based fees, with itemized costs and applicable taxes

- Due date and payment details: When payment is required and how it can be made—some e-bills include direct payment links for convenience

- Terms and conditions: Any late invoice fees, refund policies, or service agreements that apply to the transaction

For businesses that handle subscription-based services, variable billing, or international transactions, additional details—such as recurring payment setups, currency conversions, or compliance requirements—may also be included.

What is an electronic billing system?

Electronic billing system

An electronic billing system, or e-billing system, is the process of using software to create, deliver, and manage invoices electronically, eliminating the need for paper-based billing.

Businesses use e-billing systems to streamline invoice generation, track payments, and automate payment reminders—all within a digital platform.

An e-billing system typically includes:

- Invoice automation: Generates and sends invoices automatically based on predefined billing cycles

- Multiple delivery options: Sends invoices via email, online portals, or direct integration with accounting systems

- Payment processing integration: Allows customers to pay invoices digitally through ACH, credit cards, or other payment methods

- Real-time tracking and reporting: Monitors invoice status, payment history, and outstanding balances

By replacing manual invoicing with e-billing, businesses reduce errors, accelerate cash flow, and improve customer convenience while maintaining a more efficient accounts receivable process.

How does the e-billing process work?

Electronic billing automates the way businesses generate, send, and track invoices, making the entire billing cycle faster and more efficient. While the exact process depends on the billing system and business model, most e-billing workflows follow these steps:

- Invoice generation: The system creates a bill based on transaction details, pricing, and payment terms, often pulling data from sales records or recurring billing schedules

- Electronic delivery: The e-bill is sent via email, a secure online portal, or direct integration with the recipient’s accounting system

- Customer review and payment: The recipient views the bill and selects a payment method, such as ACH transfer, credit card, or digital wallet

- Payment reconciliation: Once paid, the system records the transaction and updates accounts receivable, syncing with accounting software if integrated

- Reminders and late payment management: Automated reminders notify customers of upcoming or overdue payments, with options for late fees or service restrictions if necessary

E-billing simplifies invoicing by automating billing, payment tracking, and reminders, leading to faster payments and fewer manual errors.

Benefits and challenges of e-Billing

E-billing offers significant advantages in efficiency, cost savings, and accuracy, but businesses should also consider potential challenges before adopting a system.

Benefits of e-billing

- Reduces manual work: Automates invoicing, payment tracking, and reminders

- Speeds up payments: Digital invoices and online payment options reduce delays

- Improves accuracy: Minimizes human errors from manual data entry

- Enhances cash flow visibility: Real-time tracking helps businesses monitor outstanding invoices

- Lowers costs: Reduces printing, postage, and administrative expenses

Challenges of e-billing

- Requires system setup: Initial implementation and integration take time

- Customer adaptation: Some may still prefer paper invoices

- Potential security risks: Electronic invoices can be vulnerable to fraud

- Regulatory compliance: Some industries require adherence to specific e-invoicing standards

- System reliance: Downtime or technical issues can disrupt invoicing

E-billing simplifies invoicing and improves the move towards paperless accounts payable processes. However, businesses should assess system requirements, security measures, and compliance needs before transitioning.

Industries that benefit from e-billing

Businesses in industries with high transaction volumes, recurring payments, or regulatory requirements benefit the most from e-billing. These industries rely on automation, accuracy, and digital payment options to improve efficiency and customer experience

Here’s how e-billing improves operations across different sectors.

Industry | How E-billing improves operations |

|---|---|

Utilities and telecom | Automates monthly billing for electricity, water, and mobile plans, reducing payment delays and service disruptions |

Healthcare and medical | Speeds up patient billing and insurance claim processing, reducing administrative workload and billing errors |

Subscription and SaaS | Ensures seamless recurring payments for memberships and software subscriptions, preventing involuntary cancellations |

Financial services | Digitizes loan statements, credit card bills, and insurance premiums, providing customers with real-time payment tracking |

Manufacturing and wholesale | Automates bulk invoicing for suppliers and distributors, improving cash flow management and reducing late payments |

Government and public sector | Streamlines tax collection, business licensing, and utility payments, ensuring compliance and faster revenue processing |

Some businesses also use third party billing, where an external company manages the entire e-billing process—from invoice generation to payment collection—on behalf of the service provider.

While different industries have unique billing needs, e-billing consistently improves speed, accuracy, and cash flow management, making it a crucial tool for businesses handling large-scale or recurring transactions.

E-billing vs. e-invoicing: What’s the difference?

As more businesses shift to digital invoicing, terms like e-billing and e-invoicing are often used interchangeably—but they aren’t the same. While both involve electronic invoices, e-billing focuses on the overall process of sending and managing invoices, while e-invoicing refers to the structured format used for seamless system-to-system exchange.

Here’s how they compare in detail:

Feature | E-billing | E-invoicing |

|---|---|---|

Definition | The process of sending, managing, and processing invoices digitally | The structured, electronic format of invoices designed for direct system integration |

Purpose | Facilitates online payments and automates billing workflows | Ensures invoices can be processed automatically by financial systems |

Common format | PDFs, online portals, email links | XML, EDI, or other machine-readable formats |

Main use case | B2C and B2B billing with customer payment options | B2B transactions requiring system-to-system invoice exchange |

Integration | Often integrates with payment platforms and accounting software | Typically integrates with ERP and compliance systems |

Compliance | Not necessarily standardized, varies by platform | Often required by governments and regulatory bodies for tax reporting |

Why is e-billing focused on payments, while e-invoicing isn’t?

E-billing is designed to make it easy for customers to view and pay invoices online. This is why it often includes features like payment links, portals, and reminders. E-invoicing, however, isn’t about payment collection—it’s about ensuring that invoices can be processed without manual entry into financial systems.

Why does e-invoicing require a structured format?

Unlike e-bills, which are often PDFs or portal-based, e-invoices use machine-readable formats (like XML or EDI). This ensures that the receiving system can extract and process the data instantly, without requiring someone to manually enter the invoice details.

How do compliance requirements affect e-invoicing?

Many governments require businesses to use e-invoicing for tax reporting, ensuring that invoice data is automatically recorded and auditable. In contrast, e-billing isn’t legally standardized in the same way—it’s more about convenience for businesses and customers.

Can a business use both e-billing and e-invoicing?

Yes, a company might send e-bills to customers for easy payment processing while using e-invoicing for B2B transactions to ensure compliance and automation.

Streamlining invoice management with automation

E-billing and e-invoicing serve distinct roles in financial operations, but they serve different purposes. While e-billing focuses on customer-facing payments, e-invoicing allows for seamless, system-to-system invoice processing—reducing manual entry, improving compliance, and accelerating financial workflows.

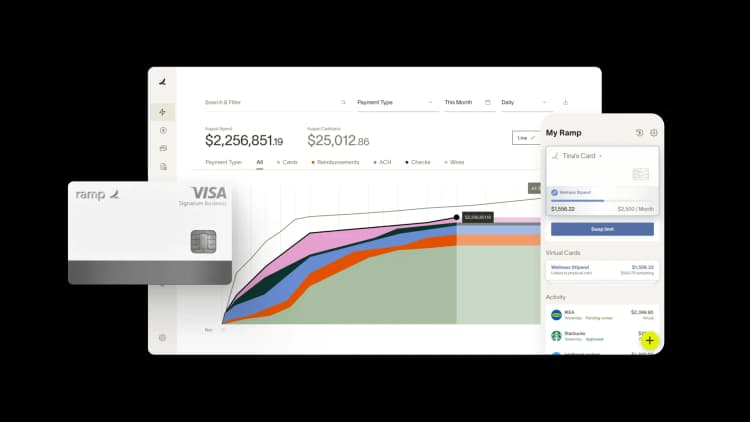

For businesses looking beyond billing to fully optimize their invoice workflows, Ramp’s invoice management software automates key processes to reduce inefficiencies and improve control.

How Ramp Bill Pay automates your invoice workflow

Ramp Bill Pay is an autonomous AP platform that takes manual work out of invoice management. Four AI agents handle transaction coding, fraud detection, approval summaries, and card-based payments—processing invoices from capture to payment without manual intervention. With up to 99% accurate OCR extracting every line item, Ramp moves invoices through your workflow 2.4x faster than legacy AP software1.

Use Ramp as a standalone invoice automation solution or connect it with corporate cards, expenses, and procurement for unified spend visibility. Teams on Ramp report up to 95% improvement in financial visibility2.

Even with electronic invoices, AP teams still deal with manual coding, stalled approvals, and disconnected systems. Ramp's touchless, autonomous automation handles each:

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons—then recommends approval or rejection

- Fraud prevention agent: Flags suspicious activity before payments go out, including unexpected banking detail changes, suspicious vendor email domains, and unverified accounts

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Roles and permissions: Enforce separation of duties with granular user controls

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- International payments: Send wires to 185+ countries with global spend management support

- Recurring bills: Automate regular payments with recurring bill templates

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Reconciliation: Close books faster with automatic transaction matching

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Vendor onboarding: Collect W-9s, match TINs, and track 1099 data directly in the platform

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

Why finance teams choose Ramp

Ramp delivers touchless invoice automation—accurate capture, intelligent coding, and faster approvals without the manual overhead. Run it as a dedicated AP solution or integrate it across your financial stack for end-to-end control.

Over 2,100 finance professionals on G2 rate Ramp 4.8 out of 5 stars, making it the easiest AP software to use. Teams highlight faster processing, fewer errors, and cleaner reconciliation as top reasons they love Ramp.

Ramp's free tier includes core AP automation. Ramp Plus unlocks advanced features at $15 per user per month, with enterprise pricing available on request.

Invoice management shouldn't be manual. Ramp automates it.

Try Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

The difference between billing and invoicing is that billing is the broader process of managing how you request and track customer payments. The billing process includes recurring cycles, payment reminders, and financial recordkeeping.

Invoicing is a specific step within the billing process—it's the creation and delivery of a formal payment request document. An invoice includes detailed line items, payment terms, due dates, and the total amount owed for goods or services already delivered.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits