What is FinOps? Cloud financial operations explained

- What is FinOps?

- Why FinOps matters for cloud financial management

- The FinOps Framework: Inform, optimize, operate

- 6 core FinOps principles

- Roles and responsibilities across finance, engineering, and business

- 5 success metrics to track FinOps impact

- Common FinOps challenges and proven solutions

- How to implement FinOps in your organization

- Choosing FinOps tools and software without blowing your budget

- Extending FinOps beyond cloud: Connecting costs to total spend

- Scale your FinOps discipline with Ramp

Cloud costs now rank among the largest expenses for growing businesses, yet nearly one-third of that spend is wasted, according to Flexera’s 2024 State of the Cloud Report. Finance leaders often struggle to see where their budgets go or how to connect cloud usage with business results.

That’s where FinOps comes in. Short for cloud financial operations, FinOps gives finance, engineering, and business teams a shared framework for managing cloud investments. It turns cloud spending from a black box into a strategic advantage through collaboration, automation, and continuous improvement.

What is FinOps?

FinOps is a cultural and operational framework that helps organizations maximize the business value of cloud computing. It brings together finance, engineering, and business teams to improve financial accountability, optimize cloud spending, and make data-driven decisions in real time.

The term combines “finance” and “DevOps” to reflect its focus on collaboration between technical and financial functions. FinOps encourages cross-functional teams to work together on cloud financial management and align cloud usage with business goals.

FinOps is both a framework and a mindset. It helps teams continuously improve cloud efficiency and cost visibility while maintaining agility. When implemented effectively, FinOps creates a shared responsibility model that unites finance, engineering, and operations around the same goal: driving business value through the cloud.

Why FinOps matters for cloud financial management

Cloud computing replaces formerly predictable capital expenditures for on-premises servers and data centers with variable, usage-based operating expenses. Traditional annual budgeting cycles can't keep pace with the dynamic nature of cloud consumption, where resources can be spun up or down in seconds.

The on-demand and elastic nature of the cloud, coupled with complex pricing structures, requires organizations to continuously monitor their cloud usage and measure its business impact. Without proper financial management practices, organizations face several pain points:

- Unpredictable spending: Cloud bills that surprise finance teams

- Lack of ownership: No clear accountability for cloud costs

- Waste and inefficiency: Resources running without business justification

FinOps addresses these challenges by connecting engineering teams, finance leaders, and business stakeholders around a single goal: driving business value from cloud investments. It enables real-time decision-making, aligns cloud usage with business objectives, and reduces waste through cost optimization and finance automation.

The result is not just lower costs but smarter financial operations that support innovation, scalability, and continuous improvement.

The FinOps Framework: Inform, optimize, operate

The FinOps Framework, developed by the FinOps Foundation, defines three iterative phases that guide how organizations manage cloud financial operations: inform, optimize, and operate. This framework enables continuous improvement as teams gain maturity in cloud financial management.

1. Inform

The inform phase builds visibility and financial accountability. Teams collect and analyze data on cloud usage, billing, and performance metrics to understand where money is going. Strong tagging and cost allocation models, supported by real-time dashboards, ensure transparency in spending across business teams and stakeholders.

Accurate data enables forecasting, budgeting, and benchmarking that link cloud expenditure directly to business value. This foundation allows organizations to establish FinOps KPIs and metrics that measure efficiency, track trends, and guide decisions.

2. Optimize

In the optimize phase, organizations act on insights from the previous stage to improve cost efficiency and cloud performance. Teams analyze usage patterns to rightsize workloads, purchase reserved instances for predictable demand, and eliminate idle resources.

Optimization also includes rate management, such as leveraging savings plans or adjusting pricing tiers from cloud providers. Automation plays a critical role, applying cost-saving policies like shutting down non-production environments during off-hours. The result is cost-effective cloud usage without sacrificing speed or innovation.

3. Operate

The operate phase embeds FinOps practices into everyday operations. Teams implement governance policies, training programs, and accounting workflows that sustain cost optimization at scale.

This phase is about maintaining collaboration across cross-functional teams—finance, engineering, and business ops—to ensure that every decision balances performance, innovation, and cost control. Over time, FinOps becomes part of your organization’s culture, driving continuous improvement and ongoing alignment between cloud investments and business objectives.

6 core FinOps principles

The FinOps Foundation identifies six key principles that guide successful cloud financial management. These principles provide the cultural and operational foundation for how teams collaborate, make decisions, and maximize business value from cloud services:

1. Teams collaborate

Breaking down silos between engineering teams, finance leaders, and business stakeholders creates shared visibility and accountability for cloud costs. Collaboration helps organizations balance speed, performance, and cost efficiency while keeping everyone aligned on business goals.

2. Everyone takes ownership of usage

FinOps promotes a culture where all cloud users are responsible for the costs they generate. Engineers consider pricing and cost models when designing workloads, while product teams evaluate features based on their cost-to-value ratio.

3. Reports are timely and accessible

Real-time dashboards and cloud billing data make it easier for teams to act on current information. Decisions based on month-old reports limit agility; FinOps relies on real-time metrics and data-driven decision-making to drive accountability.

4. Decisions are driven by business value

Every cloud expenditure should map directly to a business objective. FinOps teams balance cost optimization with performance and innovation, ensuring cloud investments deliver real outcomes rather than just cost reductions.

5. A central team drives best practices

A dedicated FinOps team or center of excellence maintains consistency and shares benchmarks across the organization. This team provides guidance, enforces standards, and develops training that helps others apply FinOps principles effectively.

6. Take advantage of the variable cost model

Rather than fighting against the cloud’s on-demand pricing structure, mature FinOps practices embrace it. Teams use automation and forecasting to scale cloud infrastructure up or down as needed, maintaining flexibility while controlling spend.

Together, these principles form the foundation of a strong FinOps culture—one that connects financial operations with engineering and business outcomes to achieve cost efficiency and continuous improvement.

Roles and responsibilities across finance, engineering, and business

FinOps works because it creates shared financial accountability across departments. Each group brings a unique perspective to cloud financial management and plays a specific role in aligning cloud usage with business objectives.

While a dedicated FinOps team may guide the process, successful FinOps adoption depends on participation across cross-functional teams. Engineers, finance professionals, and product leaders all share responsibility for optimizing cloud expenditure and ensuring each dollar contributes to business value:

5 success metrics to track FinOps impact

Tracking measurable results is essential to proving the business value of FinOps. Key performance indicators (KPIs) help FinOps teams understand how well cloud financial management efforts drive cost efficiency and accountability.

1. Unit cost trend

This metric shows whether your organization is achieving economies of scale. Track cost per unit over time, such as cost per user, transaction, or customer, to determine if efficiency improves as usage grows.

2. Forecast accuracy

Measure how closely actual cloud spending aligns with forecasts. High accuracy reflects mature FinOps processes and stronger collaboration between finance and engineering teams. It also builds confidence in budgeting and long-term planning.

3. Percentage of waste eliminated

Monitor reductions in overprovisioning, idle workloads, and unused services. This metric directly connects cost optimization efforts to savings and demonstrates continuous improvement in cloud operations.

4. Reserved instance coverage

Track the percentage of eligible workloads covered by reserved instances or savings plans. Higher coverage means predictable workloads are matched with lower-cost options from cloud providers, improving overall cost efficiency.

5. Change in feature delivery speed

Assess whether cost control efforts affect innovation. Effective FinOps practices should remove financial barriers, helping engineering teams deliver new features faster without increasing spend.

Monitoring these FinOps KPIs over time provides valuable benchmarks for improvement. More importantly, it keeps finance and engineering focused on the same outcome, achieving the best possible balance between performance, agility, and cost.

Common FinOps challenges and proven solutions

Adopting FinOps can transform how teams manage cloud spending, but it also requires overcoming cultural, technical, and organizational hurdles.

Strong FinOps adoption depends on collaboration, visibility, and consistency. By addressing these challenges early, organizations can build sustainable financial operations that scale with their cloud investments.

1. Limited visibility into cloud costs

Many organizations lack a unified view of cloud usage across providers and departments, leading to duplicate services and overprovisioning. To solve this challenge, implement a strong tagging strategy and consistent cost allocation rules, and use real-time dashboards and FinOps tools to centralize reporting.

2. Resistance to cultural change

Finance and engineering teams often operate in silos with different goals and communication styles. FinOps introduces shared ownership of costs, which can challenge established habits. Get ahead of this problem early. Start small with a pilot project that demonstrates measurable savings and share early wins with stakeholders to build buy-in across departments.

3. Skill and knowledge gaps

FinOps requires a blend of technical, financial, and analytical skills that many teams are still developing. Build cross-functional teams that combine finance, procurement, and engineering expertise and consider investing in FinOps Foundation training or certification for key FinOps practitioners.

4. Tool sprawl and data fragmentation

Managing multiple FinOps platforms and native cloud provider tools can create confusion and inconsistent reporting. Consolidate data into a single cloud financial management system that integrates with your accounting or ERP software.

5. Lack of measurable outcomes

Without clear metrics and benchmarks, it’s hard to prove the impact of FinOps initiatives or justify further investment. Define success up front using KPIs like forecast accuracy, unit cost trend, and percentage of waste eliminated. Connect every cost-saving effort back to business value and strategic goals, and review your progress quarterly.

How to implement FinOps in your organization

Launching a FinOps practice doesn’t require a massive overhaul. The most effective programs start small, prove value quickly, and expand as cloud financial management maturity grows. Follow these five steps to get started.

1. Assemble a cross-functional FinOps team

Form a small group with representatives from finance, engineering, and business ops. This team will champion FinOps adoption, coordinate initial efforts, and establish collaboration workflows. Start with volunteers who understand both cost control and operational needs.

2. Tag and allocate every resource

Implement consistent tagging standards across all cloud providers to track cloud usage by team, project, or department. Accurate cost allocation creates the foundation for visibility, forecasting, and cost optimization.

3. Set a 90-day savings target

Identify quick wins that demonstrate immediate value. Focus on eliminating unused instances, rightsizing workloads, or automating shutdowns for idle resources. Achieving measurable savings early helps build momentum and stakeholder buy-in.

4. Automate guardrails and alerts

Use automation to prevent waste before it happens. Deploy alerts for budget anomalies and establish policies that enforce spending limits or stop idle environments outside business hours. Automated workflows reduce manual oversight and ensure consistent execution.

5. Review outcomes and iterate

Evaluate progress every month to measure impact and refine FinOps practices. Share results with business stakeholders to highlight wins and lessons learned. Expand FinOps initiatives to more teams as processes mature and confidence grows.

Choosing FinOps tools and software without blowing your budget

Selecting the right tools is critical to FinOps success, but you don’t need to invest in expensive platforms to get started. The best approach depends on your company’s size, cloud complexity, and FinOps maturity level.

Start with native tools from your cloud providers to gain basic visibility and expense tracking. As your FinOps practice matures, consider dedicated platforms that offer deeper analytics, automation, and benchmarking features.

Key features to look for include:

- Cost visibility and reporting: Real-time dashboards that centralize cloud billing, usage, and allocation data

- Optimization insights: Automated cost-saving recommendations for rightsizing and eliminating idle resources

- Integration capabilities: Seamless connections to cloud providers, accounting platforms, and internal financial systems

- Multi-cloud support: Compatibility with AWS, Google Cloud, and other major cloud providers to unify cloud financial management

- Automation: Built-in workflows for anomaly detection, tagging compliance, and budget enforcement

Extending FinOps beyond cloud: Connecting costs to total spend

As FinOps practices mature, many organizations expand their focus from cloud-only management to full technology financial operations. This evolution reflects how financial accountability and cost optimization can apply across all areas of IT and business spending.

Modern finance teams are blending cloud financial management with other disciplines, including IT asset management (ITAM), IT financial management (ITFM), and SaaS management. The goal is to give decision-makers a complete view of technology investments, not just cloud expenses.

As organizations unify these disciplines, they gain a single source of truth for technology spending. FinOps becomes more than a cloud optimization tool; it evolves into a financial operations strategy that supports smarter decisions across every department.

Scale your FinOps discipline with Ramp

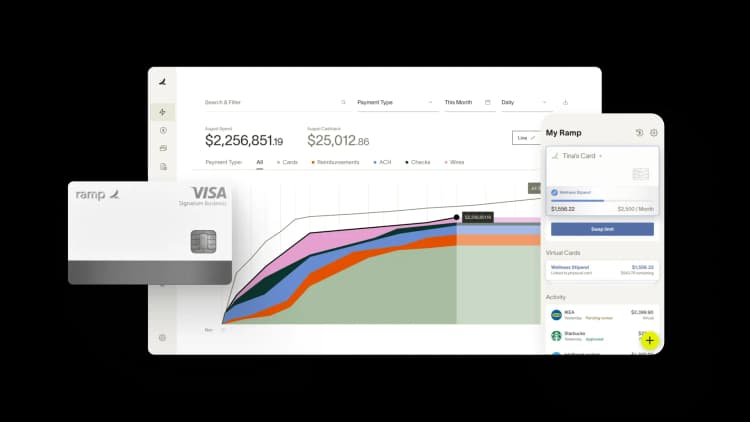

Mastering FinOps is simpler with the right tools in place.

Ramp's expense management software tracks every dollar you spend on cloud resources, enabling real-time visibility into your FinOps metrics. Finance and engineering teams can track unit costs, measure budget variance, and identify cloud cost optimization opportunities across all services.

By combining automation with actionable insights, Ramp turns FinOps metrics into daily decision tools. You gain the visibility to control cloud costs, the data to drive accountability, and the confidence to plan budgets that scale with your business.

Try an interactive demo and see how Ramp can help on your FinOps journey.

FAQs

Traditional IT financial management focuses on fixed budgets and capital expenditures. FinOps, by contrast, manages variable cloud costs that fluctuate with cloud usage. It relies on real-time data and cross-functional collaboration among finance, engineering, and business teams to align spending with business value.

The same FinOps principles that govern cloud infrastructure—visibility, accountability, and data-driven decision-making—apply to SaaS and other recurring technology expenses. Many organizations extend FinOps practices to manage total technology spend, including SaaS, IT assets, and licenses.

A company typically needs a FinOps practitioner once cloud expenses become complex enough to require specialized tracking and forecasting. Mid-sized businesses often start with part-time FinOps responsibilities within existing roles, then transition to full-time positions as FinOps adoption grows.

FinOps improves cost efficiency, forecast accuracy, and financial accountability. It helps teams balance performance and cost, strengthen collaboration between departments, and make faster, better-informed decisions about cloud investments.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group