Accounting firm automation: How to implement it and why you should

- What is accounting automation?

- Why accounting automation matters for firms

- Key areas to automate in your accounting firm

- Choosing the right accounting automation tools for your firm

- Key features to look for in accounting software

- Automate accounting with AI that codes, syncs, and reconciles for you

Accounting firm automation involves using software and technology to simplify and streamline routine accounting tasks, allowing firms to focus on higher-value work. As more firms look to modernize, automation has become a crucial tool in enhancing accuracy, saving time, and reducing costs.

From managing invoices and bookkeeping to reconciling accounts, automation offers a solution to eliminate repetitive, time-consuming accounting processes, making your team more productive and better equipped to serve clients. By integrating intelligent systems, firms can automate everything from data entry to reporting, ensuring consistent and accurate results without manual Excel work.

What is accounting automation?

Accounting automation involves leveraging technology to streamline repetitive accounting tasks, enabling accounting professionals to save time and minimize human error. It boosts efficiency by automating manual processes such as expense management, pricing calculations, categorizing transactions from bank statements, reconciling accounts, managing accounts payable, and financial reporting.

Automation tools save time and allow your CPAs to concentrate on more valuable work, such as financial analysis and strategic planning.

Why accounting automation matters for firms

Implementing automation in your firm leads to measurable improvements in productivity, accuracy, and client satisfaction. For accounting professionals, automation helps firms handle more clients without increasing headcount, enabling growth without significant overhead costs. Key benefits include:

- Time-saving: Automate routine tasks like data entry, billing, and reconciliation. With tools such as Ramp saving its customers 10.8 million hours of work in 2024, your accounting team will have more time to focus on higher-level activities, such as strategic advisory.

- Accuracy: Reducing human error improves the reliability of financial reports and ensures compliance with industry standards

- Client satisfaction: Automated systems help you deliver faster and more accurate results, boosting client trust and satisfaction

How do I implement automation in my firm?

Start by identifying repetitive tasks such as invoicing or data entry. Choose accounting automation software that integrates well with your existing systems, and automate the tasks that consume the most time.

Key areas to automate in your accounting firm

Automation can transform various aspects of your accounting firm, streamlining routine tasks and improving efficiency. Here’s where automation can have the greatest impact on your firm’s operations.

1. Engagement letter creation

Creating engagement letters has traditionally been a time-consuming task requiring careful attention to detail. However, automation tools have transformed the way firms handle client onboarding:

- Ignition and GoProposal automate engagement letter creation, sending, and management with customizable templates and e-signatures, completing tasks in minutes

- PandaDoc streamlines document signing by consolidating multiple documents such as NDAs, power of attorney forms, and tax return authorization into one process, making it easier for clients

- TaxDome offers proposal and engagement letter features, though its functionality is still evolving

2. Client appreciation

Once the client accepts the engagement letter, automation can trigger actions that enhance the client experience. Welcome emails can be personalized based on the services the client has signed up for, setting a tailored tone for the relationship.

Tools such as Handwrytten or OnGoody integrate with your CRM to automatically send personalized gifts or cards, offering a thoughtful touch that shows clients you value their business. This automation streamlines client appreciation and strengthens client relationships.

Handwrytten samples. Machine-generated handwritten cards, shipped automatically.

3. Client communication

Effective communication is essential for client satisfaction. Automating communication with tools such as Slack can streamline the process by setting up reminders, creating project channels, and automating client updates. This reduces email overload and ensures everyone is in the loop.

Ramp’s Slack integration routes requests for one-click review

4. Invoices and payment

Automating the invoicing process ensures that bills are created and sent on time. Tools such as FreshBooks and Zoho Invoice help you generate invoices, track payments, and set up automated reminders for overdue bills.

Automated invoicing prevents payment delays, maintaining healthy cash flow and ensuring your clients are billed correctly every time.

5. Bank reconciliation

Bank reconciliation is traditionally time-consuming. With tools such as BankRec and AutoReconcile, you can automatically match transactions between your accounting system and bank records. This speeds up the process and ensures accurate reconciliation.

Ramp’s seamless integration automatically reconciles bank transactions, saving time and reducing the chance of mistakes. For example, Ramp allowed Construction One to cut its reconciliation time by 75%.

6. Workflows

Automating workflows improves efficiency across various tasks, including client onboarding, task management, and follow-ups. Jetpack Workflow automates project tracking, assigning tasks and setting deadlines. Tools like this ensure your firm overlooks nothing and completes everything on time.

For instance, you can optimize client onboarding with tools such as Zapier. Once a new client signs on, the system can automatically integrate them into your accounting software, streamlining the process.

Simple use cases shown on Zapier’s website.

7. Expense tracking

Expense tracking can be tedious, but automation tools such as Ramp make it easy. Using AI, Ramp suggests how to categorize transactions, reducing the need for manual input and ensuring accurate expense tracking. Ramp automatically categorizes business expenses based on past behavior, ensuring accuracy and saving time in your reports.

8. Document collection

Automation tools such as ContentSnare streamline document collection via automated requests, reminders, and client collaboration. It makes it easy for clients to upload documents securely and accurately, reducing the time spent on follow-ups.

For an even more integrated solution, practice management such as Soraban and Keeper offer document request features that integrate directly with accounting and tax software.

Example of how client and firm interact within a document request.

9. Financial reporting

Generating financial reports manually can take hours. Automation tools like QuickBooks and Xero allow firms to generate financial reports on demand, such as income statements, balance sheets, and cash flow forecasting. This saves time and ensures your reports are always up-to-date.

10. Tax compliance and filing

Automation simplifies tax season. Tools such as TaxJar and ProConnect help automate tax calculations, file returns, and generate tax reports. Automation also helps your firm comply with tax regulations.

Ramp’s integration with tax tools syncs transaction data directly with your current software, reducing manual data entry during tax season.

Choosing the right accounting automation tools for your firm

When selecting automation tools, consider these key factors:

Integration

Ensure the tools integrate seamlessly with your existing systems, such as payroll, CRM, and ERP platforms. Integration reduces manual data entry and keeps systems synchronized.

Customization

Select software that can be tailored to meet your firm’s specific needs. Ramp’s accounting rules let you create custom workflows and automate categorization based on your preferences.

Cost vs. benefit

While implementing automation tools does have a cost, the long-term savings and increased productivity far outweigh the investment. Automating routine tasks allows your team to focus on more strategic, revenue-generating activities.

Ramp offers customizable reporting features that allow firms to generate detailed financial reports, ensuring accuracy and timely delivery.

Key features to look for in accounting software

When selecting automation tools, choose features that match your firm's needs and growth potential. Look for software that integrates seamlessly with your existing systems, offers scalability, and provides advanced security to safeguard sensitive financial data. The following features are critical for ensuring your automation tools support long-term efficiency and accuracy.

- Seamless integration: Look for software that integrates easily with your existing accounting, CRM, and ERP systems. This will ensure smooth data flow and reduce manual errors.

- User-friendly interface: Choose tools with intuitive, easy-to-navigate interfaces. This will minimize the learning curve and maximize team adoption.

- Scalability: As your firm grows, your accounting automation tools should scale with it. Make sure your choice can handle increasing transaction volumes and more clients without compromising performance.

- Advanced security features: Prioritize software with strong encryption and robust security protocols to protect sensitive financial data and client information

- Automated reporting: A core feature of automation is the ability to generate reports automatically. Choose software that can create real-time, accurate reports, allowing you to monitor key metrics without manual input.

If your firm is looking to integrate more comprehensive automation tools, accounting partnerships with Ramp can provide you with valuable resources to optimize operations and scale your services efficiently.

Automate accounting with AI that codes, syncs, and reconciles for you

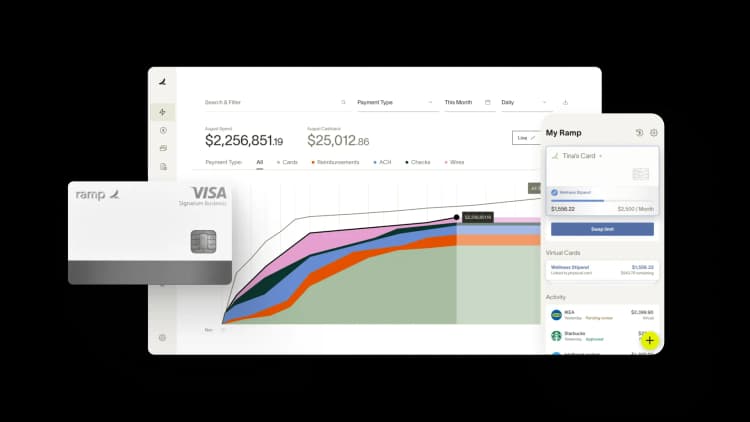

Manual accounting tasks drain time and introduce errors that slow down close and create compliance risk. Ramp's accounting automation software eliminates repetitive work by handling transaction coding, receipt matching, and ERP sync automatically, so you can focus on analysis instead of data entry.

Ramp's AI learns your coding patterns and applies them across all transactions in real time. It codes to your chart of accounts, assigns classes and departments, and matches receipts automatically, achieving a 67% increase in zero-touch codings compared to rules-only automation. When context is missing or a transaction falls outside normal patterns, Ramp flags it for review and suggests the right action, so you're not hunting through queues to find what needs attention.

Here's how Ramp automates your accounting workflow:

- AI-powered transaction coding: Ramp codes every transaction across all required fields as it posts, learning from your feedback to improve accuracy over time

- Smart sync to your ERP: Ramp identifies in-policy spend and syncs it to NetSuite, QuickBooks, Sage Intacct, or Xero automatically, so routine transactions never touch your review queue

- Automated accruals and amortization: Post and reverse accruals automatically, and amortize prepaid expenses without manual journal entries

- Built-in reconciliation: Ramp's reconciliation workspace surfaces variances and missing entries so you tie out faster with full confidence

Try a demo to see how teams save 40+ hours every month and close 3x faster with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°