How to set accounts payable goals (with examples)

- What are accounts payable goals?

- Why setting accounts payable goals matters

- Choosing the right accounts payable goals

- How to set goals for accounts payable

- Example AP goals and their impact

- Common challenges in meeting AP goals and how to overcome them

- How Ramp helps teams reach their AP goals

- Why Ramp Bill Pay is the best AP software

- Meet your AP goals with Ramp Bill Pay

Accounts payable (AP) departments often deal with invoice backlogs, late payments, and errors, many of which stem from manual processes. Any business should address those inefficiencies and reduce costs. But while those are respectable objectives, they might be tough to achieve without clearly defined, measurable goals.

Taking a strategic approach to setting goals for accounts payable can elevate your department's impact by boosting cash flow, strengthening vendor relationships, improving compliance, and contributing to business growth.

We'll walk you through how to choose the right AP goals and how to set yourself up to achieve them. Plus, if you need guidance on where to start, we’ll also give a few examples of AP goals and their potential impact on your business.

What are accounts payable goals?

Accounts payable goals are specific targets that finance teams set to improve how they manage vendor payments and related processes. These measurable objectives help departments track progress and identify areas for enhancement. Well-defined targets create accountability and give teams clear direction for improvement efforts.

Common AP objectives include reducing processing costs, improving payment efficiency, maintaining strong vendor satisfaction, and supporting regulatory compliance. Some teams also focus on qualifying for early payment discounts, reducing manual tasks, or shortening approval cycles.

Clear accounts payable goals align your team's daily work with broader business priorities, creating measurable improvements that benefit both finance operations and vendor relationships.

Why setting accounts payable goals matters

Well-defined AP goals directly boost business performance by creating clear targets for payment accuracy, processing speed, and vendor management. These objectives connect with broader company priorities, such as maintaining healthy cash flow and strong supplier relationships.

When AP teams have specific goals, they can better support enterprise-wide initiatives, such as optimizing working capital. Clear targets also help identify opportunities for early payment discounts and process improvements.

Without defined goals, AP departments often face increased processing errors, missed discount opportunities, and strained vendor relationships. Teams may struggle with inconsistent workflows and lack direction for meaningful improvements.

Choosing the right accounts payable goals

When your goals for accounts payable align with overall business objectives, that synergy can positively affect cash flow, reduce unnecessary expenses, and improve accounts payable metrics, such as invoice processing time and accuracy rates.

Here are a few common goals for any accounts payable department:

- Reduce cost per invoice: Lowering the cost to process each invoice can free up budget for strategic initiatives

- Increase efficiency: Streamlining AP approvals, payments, and reconciliations lets your team focus on higher-value tasks

- Reduce invoice cycle time: Shortening the time to process invoices from receipt to payment helps optimize working capital and avoid penalties

- Improve vendor relationships: Timely and accurate payments strengthen vendor relationships. It might even qualify you for better terms and potential discounts because vendors are more likely to offer favorable terms to reliable payers.

- Improve accuracy: Reducing data entry and payment processing errors helps avoid costly reworking, duplicate payments, and compliance risks

- Improve AP automation adoption: Increasing the use of automated tools for invoice processing, approvals, and payments reduces manual workload while improving speed and accuracy across your entire AP workflow

These foundational goals provide a starting point for building an AP strategy that delivers measurable improvements while supporting your company's broader financial objectives.

How to set goals for accounts payable

Setting effective AP goals requires a structured approach that balances your team's capabilities with business needs while ensuring measurable outcomes that drive meaningful improvements. Here’s how to do it:

1. Evaluate current processes

Map out your invoice-to-payment workflow step by step. Document approval chains, identify bottlenecks, and note manual tasks that slow processing. Look for redundant steps or unclear handoffs between team members.

2. Identify key metrics

Review your current metrics, such as processing costs, cycle time, error rates, late invoice fees, or payment accuracy. Analyze recent vendor feedback, audit results, and team workload data to identify strengths and areas needing improvement. This assessment sets the foundation for measuring progress.

3. Set SMART goals

Once you understand your current AP performance, establish specific objectives using the SMART goal framework.

SMART goals are specific, measurable, achievable, relevant, and time-bound.

For example, instead of deciding you want to “improve efficiency,” set a goal to reduce invoice cycle time by 20% within 6 months. This SMART goal is clear and promotes accountability, making it easier to track progress.

4. Create your action plan

Once you set your goals, create a step-by-step plan to achieve them. Break down the goal into actionable steps, assign responsibilities, and set milestones to monitor progress.

Accountability and deadlines are essential components of any successful action plan. When team members have clear ownership of specific tasks and realistic timelines, they're more likely to stay focused and deliver results. Regular check-ins help identify potential roadblocks early, while firm deadlines create urgency and prevent tasks from lingering indefinitely.

5. Monitor, evaluate, and adjust

Track your progress using the same key performance indicators (KPIs) you used in step 2. Use this data to assess whether you’re on track to meet your goals. Review your progress regularly—at least once a month—and make adjustments as needed.

Example AP goals and their impact

To help you better understand how to set and achieve your AP goals, let's look at a few detailed accounts payable goals examples.

Reduce cost per invoice

Say you’re a mid-sized company processing 1,000 invoices per month. Each invoice costs $15 to process, including labor, paper, and storage. Your goal is to reduce this cost by 30% within a year.

Here are some steps to achieve that goal:

- Implement AP automation software to reduce manual data entry and approval time

- Shift to electronic invoicing and payments to minimize paper and postage expenses

- Consolidate vendor payments to reduce processing fees and banking costs

The result is that lower processing costs free up room in the budget for strategic initiatives, improve overall financial efficiency, and reduce reliance on manual labor.

Increase efficiency

Say your organization has a backlog of invoices, and your AP team is burned out from working long hours. You want to improve AP efficiency by increasing invoice processing speed from 10 invoices per hour to 20 within 6 months.

Here’s how you do it:

- Standardize invoice submission by implementing an electronic portal for vendors

- Automate invoice approval workflows to eliminate bottlenecks and manual interventions

- Train staff on best practices for using your AP automation technology

This leads to faster processing times and gives your team back work/life balance. It also improves job satisfaction because people spend less time on routine manual processes and more time on strategic initiatives.

Reduce invoice cycle time

Your business currently takes an average of 25 days to process an invoice. You want to reduce it to 15 days within the next 90 days.

To achieve this goal, you:

- Automate invoice matching and approvals to speed up processing times

- Establish clear policies and guidelines to minimize discrepancies and rework

- Analyze cycle time metrics regularly and address process bottlenecks

By doing so, you’ll have shorter invoice cycle times leading to improved cash flow management, fewer late payment penalties, and increased operational agility.

Improve vendor relationships

You’ve been dealing with frequent vendor complaints about late payments, so you set a goal to improve vendor satisfaction scores by 20% over the next year.

To do this, you would:

- Implement early payments to build goodwill with certain vendors and potentially secure discounts

- Automate invoice processing and approvals with invoice management software to ensure accurate and timely payments

- Schedule regular check-ins with your top vendors to address their concerns and foster better collaboration

In turn, you’ll gain strengthened vendor relationships resulting in better terms and cost savings through negotiated discounts.

Improve accuracy

Say your AP team has a 5% error rate in invoice processing. You want to reduce AP errors to below 1% within six months.

Here’s how you achieve it:

- Leverage AI data capture to minimize manual entry errors

- Introduce automated validation checks to flag inconsistencies before processing

- Audit payments regularly to identify common errors and implement corrective measures

- Train your staff to ensure they understand processes

The payoff is improved accuracy that reduces costly reworking, improves financial and accounts payable reporting, and minimizes the risk of compliance issues.

Improve AP automation adoption

Say your company has invested in AP automation software, but only 40% of invoices are being processed automatically, with the rest still handled manually. You want to increase automation adoption to 80% of all invoices within the next 12 months.

Here's how you achieve it:

- Provide comprehensive training sessions for AP staff to build confidence and competency with the automation tools

- Work with vendors to standardize invoice formats and encourage electronic submission through your automated portal

- Set up performance metrics and incentives that reward teams for using automation features effectively

- Identify and address common reasons why invoices fall back to manual processing, such as formatting issues or missing data

Higher automation adoption leads to consistent cost savings, reduced processing errors, and allows your team to focus on more strategic financial analysis rather than routine data entry tasks.

These accounts payable goals examples show how specific, measurable objectives can deliver real results for your business while making your team's daily work more manageable and rewarding.

Common challenges in meeting AP goals and how to overcome them

Even with clear goals in place, AP teams often face obstacles that can derail progress and make targets feel impossible to reach.

- Manual processes slow everything down: Paper-based workflows and manual data entry create bottlenecks that limit your team's ability to meet efficiency and accuracy goals. Start by mapping your current processes to identify where automation can have the biggest impact, then prioritize implementing digital solutions for high-volume, repetitive tasks.

- Lack of visibility makes it hard to track progress: Without real-time data and reporting, you can't tell if you're on track to meet your goals or where problems are occurring. Invest in a highly-rated AP automation solution that provides dashboards and analytics, and establish regular reporting schedules to monitor key metrics, such as processing times, error rates, and vendor satisfaction.

- Resistance to change slows adoption: Team members may be hesitant to adopt new processes or technology, especially if they're comfortable with existing workflows. Address this through comprehensive training programs, clear communication about the benefits, and involving staff in the planning process so they feel ownership of the changes.

- Limited resources stretch teams thin: Small AP departments often struggle with competing priorities and tight budgets that make goal achievement feel unrealistic. Focus on quick wins that deliver immediate value, consider outsourcing non-critical tasks, and build a business case for additional resources by demonstrating the ROI of your improvements.

With the right approach and persistence, these common challenges become manageable hurdles rather than insurmountable barriers to AP success.

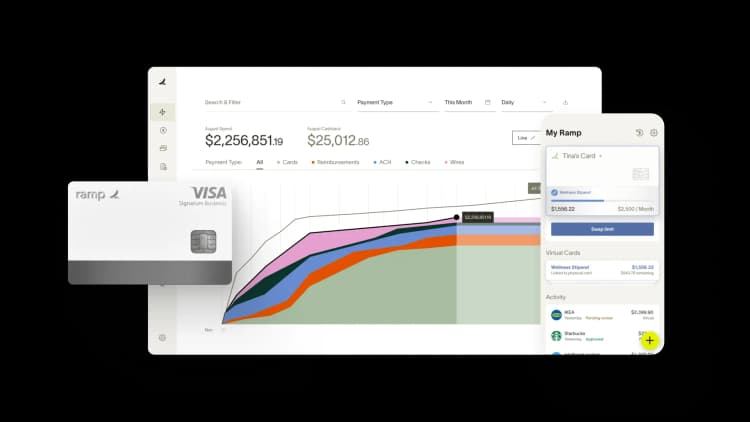

How Ramp helps teams reach their AP goals

Accounts payable automation can improve your team’s ability to hit their AP goals. Automating repetitive tasks, reducing manual errors, and providing real-time insights lets your team focus on analysis and other strategic initiatives rather than getting bogged down by manual processes.

Of course, transitioning to automated systems—especially AI tools—can seem overwhelming. To help you overcome the mental hurdle, here’s a real-world example of how Ramp’s AP automation helped a company streamline its operations and meet its goals for accounts payable.

How Precision Neuroscience streamlined systems and reduced data entry

Precision Neuroscience’s fragmented procurement process required extensive manual data entry, so it was inefficient and error-prone. Implementing Ramp's integrated platform allowed the company to consolidate multiple tools into a single system and automate data capture.

Brian Lautenbach, Precision Neuroscience’s Financial Controller, found Ramp's optical character recognition (OCR) technology particularly beneficial because it automatically extracted information from documents and minimized manual data entry.

With Precision Neuroscience’s transition to Ramp, we helped them:

- Accelerate their procurement process by 50%

- Reduce manual data entry and error rates

- Cut the month-end close time to just 1 to 2 days

- Improve operational efficiency and allow the team to focus on more strategic tasks

Precision Neuroscience’s success shows that while the leap to AI-driven AP automation may seem intimidating, a user-friendly and highly effective solution like Ramp can help your team achieve its AP goals efficiently.

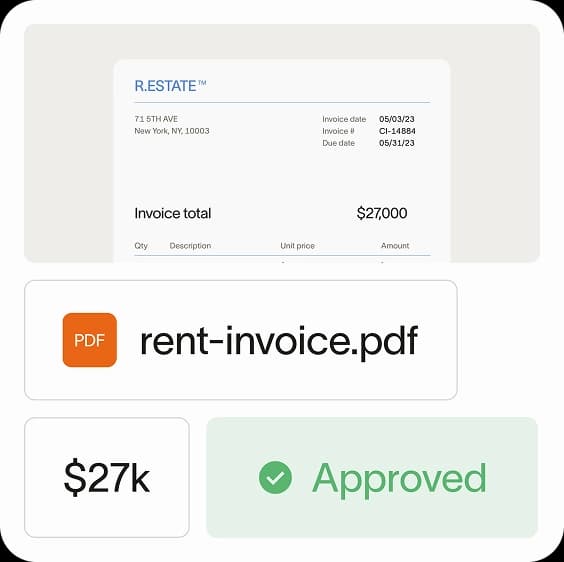

Why Ramp Bill Pay is the best AP software

Ramp Bill Pay helps finance teams hit critical AP objectives through intelligent automation. It’s an autonomous AP platform that uses AI agents to code invoices based on transaction history, catch fraud before payments process, write approval documentation, and push card payments to vendors—eliminating manual bottlenecks.

OCR pulls invoice data at up to 99% accuracy while processing invoices 2.4x faster than legacy systems1—helping your team work faster while keeping error reduction low. While using Ramp, up to 95% of businesses also report stronger oversight over their processes2.

Top AP features

- Four AI agents: Code invoices automatically using transaction history, detect fraud pre-payment, build approval summaries with vendor background and pricing analysis, and execute card payments through vendor portals

- Intelligent invoice capture: Pulls data from every line item with 99% OCR accuracy

- Automated PO matching: Compares invoices to purchase orders with 2-way and 3-way matching to catch overbilling

- Approval orchestration: Cuts clicks, boosts visibility, and speeds processing across reviewers

- Real-time invoice tracking: Provides visibility from invoice receipt through payment

- Reconciliation: Automatically matches transactions for faster book closing

- Real-time ERP sync: Connects vendor data bidirectionally with 10 ERPs like NetSuite, QuickBooks, Xero, and Sage Intacct for audit-ready books

- GL coding: Assigns transactions to correct accounts with AI assistance

- Batch payments: Processes multiple vendor payments at once

- Payment methods: Sends payments through ACH, corporate card, check, or wire transfer

- Vendor Portal: Gives vendors secure access to update payment information, check payment status, and contact your AP team

- Recurring bills: Processes regular payment schedules with templates

- AI-powered 1099 prep: Automatically categorizes bill pay spend into 1099-NEC and 1099-MISC boxes with calculations

- One-click IRS filing: Submits filings to IRS and states in minutes without extra portals

- Bulk W-9 collection: Sends W-9 and e-consent requests to all vendors simultaneously

Meet your AP goals with Ramp Bill Pay

Ramp Bill Pay delivers what modern AP automation should be—accurate, autonomous, touchless, and fast. Whether your goals include reducing processing time, cutting costs, improving accuracy, or gaining real-time visibility, Ramp provides the automation and insights to get there. Finance teams on G2 even rate it as one of the easiest AP platforms to use.

Use Ramp Bill Pay as standalone AP software, or link it with Ramp’s corporate cards, expense tools, and procurement features for end-to-end spend management. Its free tier covers essential AP automation features, or try Ramp Plus at $15 per user per month for more advanced capabilities.

Managing AP is easy. With Ramp Bill Pay, it is.

See how Ramp Bill Pay helps finance teams achieve their AP goals.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits