Accounts payable best practices: 9 tips to optimize AP

- Is accounts payable optimization worth it?

- Accounts payable best practices: 9 tips for improved AP processing

- How to monitor your AP process

- AP optimization in action: Success stories to inspire your workflow

- Why Ramp Bill Pay is the best way to simplify AP processes

- Why Ramp Bill Pay delivers results

When you talk strategy with your business partners, how often do you bring up accounts payable?

Few businesses think AP needs their attention unless something’s going wrong, but this couldn’t be further from the truth. Accounts payable can significantly impact your financials, affecting your cash flow, bottom line, reputation, and even opportunities in the market.

Fortunately, optimizing your accounts payable process isn’t complicated. With the right approach, your AP system can become a strategic asset—something we’ll explore through success stories after breaking down our top 9 best practices for accounts payable optimization.

Is accounts payable optimization worth it?

Before we dig into how to optimize your AP process, let’s talk about why it’ll be worth your time. Good accounts payable practices will:

- Increase efficiency: Implementing accounts payable best practices can reduce your AP processing workload, freeing your employees to focus on value-added tasks rather than compliance and manual processes.

- Reduce costs: AP best practices can help reduce your business’s cost per invoice. Better efficiency leads to cost savings on late fees, fraud containment costs, excess salaries, and more.

- Produce more accurate financials: When you perfect your AP process, your financials will be more accurate and up-to-date. This helps with bookkeeping and ensures better financial decision-making.

- Reduce fraud and cash mismanagement: Certain AP best practices can help prevent fraud and protect against losses resulting from negligence and cash mismanagement

- Improve vendor relationships: Adopting AP best practices will ensure your vendor payments are timely and accurate. When you prove you’re a reliable customer, your vendors and supplier relationships improve and they may be more likely to offer better payment terms or grant early payment discounts.

- Reduce stress: With the right AP strategies, you and your employees will almost never have to stress about missed due dates or late payments. And because your vendors and suppliers are happy, you won’t have to worry about fraying those key relationships.

Accounts payable best practices: 9 tips for improved AP processing

Optimizing your AP process is a big undertaking, so tackle it in chunks. Even making one or two small changes can have a big impact on your organization. Here are nine best practices to improve your AP process.

1. Standardize your workflow

Create a workflow that describes exactly how you receive, approve, and process invoices. If you standardize your invoice approval workflow, you can look up the status of an order at any time. This ensures:

- All invoices are accounted for; no invoice is left behind

- Invoices are paid on time to the correct party—only once—in the correct amount

- Employees understand the workflow, preventing bottlenecks in the approval process

- There’s a record of how the invoice was managed

- Payments are recorded in your financial records

- You’ve taken advantage of early payment discounts and avoided late payment fees

2. Establish internal controls

Controls aren’t a thrilling topic, but keeping your invoicing system secure is necessary to safeguard against fraudulent activities. Internal controls for accounts payable can also provide better visibility into which employee—or which software—performed a task so you can trace errors and discrepancies to the source.

For example, your AP clerk, AP outsourcing provider, or automation software should perform a three-way match, outlined in an AP policy, by matching the purchase order to the receiving report and the invoice.

3. Go paperless

Encourage your vendors and suppliers to ditch paper invoices; if they won’t, digitize them yourself. You can use optical character recognition (OCR) software to scan invoices, read them, and pull relevant numbers into your system. Not only does going paperless for AP create a more reliable invoice record, but it also makes that invoice searchable.

4. Integrate

Centralize your financial data by ensuring your invoice management software is integrated into your other systems. This could include your accounting software, enterprise resource planning (ERP) software, customer relationship management (CRM) software, project management software, and expense tracking software.

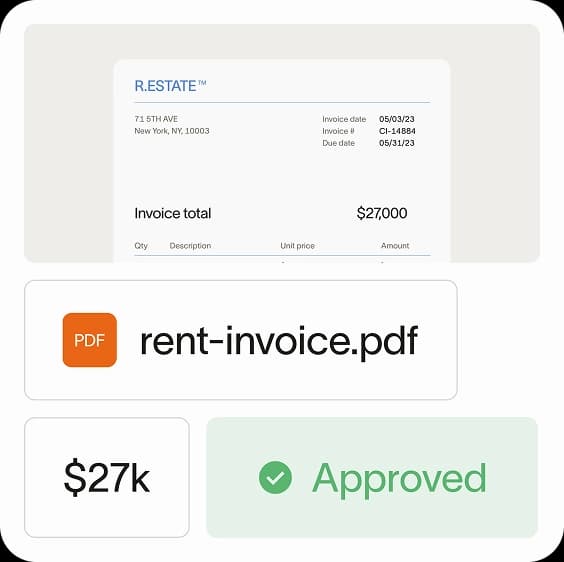

5. Automate

Manually entering invoices is time-consuming, introduces inefficiencies, and can lead to costly errors. Automating your AP processes can ensure that the data in your system is accurate, reduce the chance of fraud, reduce the chance you’ll approve duplicate invoices, and help you avoid making duplicate payments or incorrect payments. A few AP automated solutions are:

- OCR for processing invoices, digitizing them, and extracting data from paper documents and PDFs

- Automated invoice approvals with 3-way matching

- Automated systems for procure-to-pay solutions

- Creating an audit trail

6. Build relationships with suppliers

If you haven’t already, create an open line of communication with your suppliers. Regular touches every now and then, even when you haven’t ordered in a while, can be a great way to build rapport. A good relationship puts you in a better position to negotiate early payment discounts or more flexible payment terms.

7. Understand your goals

Leverage your AP department to further your accounts payable goals. If your AP staff understands your vision, they can help guide you there. You can start by isolating KPIs that depend on your AP department, like cost per invoice, AP turnover ratio, or days payable outstanding (DPO). Then, empower your employees to help improve those numbers.

8. Train employees

When you use automation software to handle backend accounting functions, you might be tempted to think you can lighten up on employee training. But you shouldn’t overlook ongoing training; you might just need to adjust your focus.

Instead of training your accounts payable team to perform AP functions, you may just need to train them to use your AP software properly. Either way, whether you use automation software or perform all functions manually, your employees need to understand your AP workflow and why each task is being performed.

9. Keep good records

Businesses run on data, so good recordkeeping is essential. Invoice processing software will keep records of who approved the purchase order, processed the invoice, approved payment, and recorded the AP journal entry. The best software can also build accounts payable reports that help you make better strategic decisions surrounding AP.

How to monitor your AP process

Let’s say you’ve implemented many or all of the best practices we listed above. How will you know if your AP process is improving? You should review your AP data regularly.

The right software makes this much easier, allowing you to pull up the following metrics at any time:

- Overall financial performance: With accurate financials, you can be sure your payables balance is manageable relative to your working capital

- Outstanding payments: This report will help you see what payments are about to hit your cash account and when

- Short-term cash needs: This report will tell you your cash needs over the next week, two weeks, month, etc.

- Forecast future cash needs: Based on historical data, your software can predict your future cash needs over the next year, adjusting for seasonality and predicted materials cost increases

- AP metrics and KPIs: Software can calculate useful financial metrics like DPO, AP ROI, overdue payables, AP turnover ratio, average invoice processing time, and others

- Aging reports for accounts payable: AP aging reports can help you prioritize payments if cash reserves are tight, showing you which invoices have been unpaid longest

- Supplier invoice analysis: This report can show the average number of invoices (and average invoice amounts) from each supplier

Aside from hard metrics, you can monitor your AP process by simply talking to your employees. How does your AP department feel about the changes? Do they find their jobs easier or less stressful after implementing these solutions?

AP optimization in action: Success stories to inspire your workflow

Let’s take a look at how two companies improved their AP workflows by adopting Ramp Bill Pay. These real-world examples demonstrate how AP automation delivers cost savings, simplifies workflows, and saves your team hours every week.

FirstBlood: Simplifying AP and expense reimbursements

FirstBlood, a global organization with employees worldwide, faced a common challenge—managing the flood of employee reimbursement receipts. Sorting through physical receipts and manually coding reimbursements became a time-consuming headache.

That’s where Ramp’s receipt management system came into play. By adopting Ramp, FirstBlood transformed its AP and reimbursement processes to be much simpler through:

- Seamless receipt uploads: Employees can now upload receipts digitally, eliminating the need to track physical documents.

- Smart coding: Ramp automatically suggests expense codes based on past transactions, making accounts payable approvals quick and intuitive for employees.

- Faster, more accurate reimbursements: Employees are reimbursed faster, and the AP team no longer has to manually code every request.

With Ramp, FirstBlood’s team achieved a 150% faster close time while also saving 40 hours each month. Employees now enjoy a smoother, more accurate reimbursement process, while the AP team can dedicate their time to higher-value, strategic work.

Crossbeam: Saving money on vendor contracts

Crossbeam, a rapidly growing technology company, faced a different challenge. Procuring new software often required hours of research to ensure they were getting the best value. Comparing vendor quotes and procurement processes manually wasn’t just tedious—it left room for missed savings opportunities.

That’s where Ramp came in. Ramp’s spend management software has built-in pricing intelligence based on millions of financial transactions from other Ramp users. Crossbeam can now see at a glance whether their new quotes and existing SaaS contracts are reasonable, streamlining their vendor selection process and saving them hours of manual work.

With Ramp, Crossbeam achieved impressive outcomes: saving over $10,000 on a single contract, reducing cost per seat by 42.8%, and reclaiming 8 hours each week.

Why Ramp Bill Pay is the best way to simplify AP processes

Ramp Bill Pay enables finance teams to streamline AP operations through intelligent automation. This autonomous AP platform deploys AI agents that categorize invoices using historical data, flag suspicious activity pre-approval, generate comprehensive approval records, and execute vendor payments via cards—removing manual friction from your AP workflow.

OCR technology extracts invoice details at up to 99% accuracy while moving invoices through 2.4x faster than traditional platforms1—accelerating AP cycles while reducing processing errors. Up to 95% of businesses also report gaining stronger oversight of their operations when using Ramp2.

Core Ramp Bill Pay features

- Four AI agents: Code transactions automatically by learning from invoice patterns, identify fraudulent submissions and anomalies, build approval documentation with vendor history and contract analysis, and process card-eligible payments through vendor portals

- Automated PO matching: Performs 2-way and 3-way verification between invoices and purchase orders to catch discrepancies and overbilling

- Intelligent invoice capture: Pulls data from every line item with 99% OCR accuracy for complete invoice processing

- Real-time invoice tracking: Monitors each invoice from receipt through final payment for complete workflow visibility

- Custom approval workflows: Builds multi-tier approval routing based on your organizational structure and business rules

- Approval orchestration: Accelerates reviewer processes while maintaining control and visibility across approval chains

- Payment methods: Executes vendor payments through ACH, corporate card, check, or wire based on your payment strategy

- Vendor Portal: Provides vendors secure access to check payment status and update account details

- Real-time ERP sync: Connects bidirectionally with ERPs like NetSuite, QuickBooks, Xero, Sage Intacct, and others for synchronized financial data

- GL coding: Assigns transactions to appropriate accounts using AI-powered recommendations

- Vendor onboarding: Collects W-9s, verifies TINs, and manages 1099 information for compliance

- Recurring bills: Handles regular payment schedules through automated templates

- Batch payments: Combines multiple vendor payments into single processing runs for operational efficiency

- Reconciliation: Automatically matches transactions during month-end close to accelerate book closing

Why Ramp Bill Pay delivers results

Ramp Bill Pay represents modern AP software—precision in data handling, autonomous operations that eliminate busywork, touchless processing that accelerates workflows, and transparency that improves financial control.

Your AP priorities might include faster processing cycles, lower operating costs, higher data accuracy, or better spend visibility—Ramp delivers the automation tools and insights to achieve these outcomes. Finance professionals on G2 consistently rate it as one of the most intuitive AP platforms available.

Run Ramp Bill Pay as your dedicated AP system, or connect it with Ramp's corporate card infrastructure, expense management capabilities, and procurement tools for end-to-end spend governance. Begin with the no-cost tier handling essential AP functions, or upgrade to Ramp Plus at $15 per user monthly for expanded features.

AP management doesn't have to drain resources. Ramp Bill Pay handles it efficiently.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°