Days payable outstanding (DPO): Definition, formula, and why it’s important

- What is days payable outstanding?

- How to calculate DPO

- Understanding days payable outstanding

- How do businesses use DPO?

- How can you optimize your days payable outstanding?

- Optimize your DPO and improve cash flow with Ramp

- What makes Ramp Bill Pay different

Days Payable Outstanding (DPO)

Days payable outstanding (DPO) is the average number of days your business takes to pay back its accounts payable. More simply, DPO measures the amount of time it takes you to pay your bills and invoices. Your business can strategically adjust DPO to optimize cash flow.

Managing cash flow is a big part of keeping your business running smoothly, and one metric that plays a big role in this is days payable outstanding (DPO). In this guide, we’ll break down what DPO is, how to calculate it, and how you can use it to optimize your business’s working capital.

What is days payable outstanding?

Days payable outstanding is a financial metric that measures the average number of days it takes your company to pay suppliers after receiving an invoice. Essentially, it shows how long your business holds onto cash before settling its accounts payable (AP).

A higher DPO might suggest that your business effectively manages cash flow, while a lower DPO could indicate quicker payments, which might build stronger relationships with suppliers. But it’s a delicate balance—managing DPO effectively improves your working capital without straining vendor relations.

How to calculate DPO

Calculating days payable outstanding is straightforward. The formula looks like this:

DPO = (Average accounts payable / Cost of goods sold) * Number of days

Here’s a breakdown of the three AP metrics you need to calculate DPO:

- Average accounts payable is the sum of the period's beginning and ending accounts payable balance, divided by two

- Cost of goods sold (COGS) refers to the direct costs of producing the goods and services sold during the accounting period. Service businesses might use cost of sales (COS) instead of COGS.

- Number of days is typically 365 for a year, but you can adjust this number if you’re calculating DPO for a shorter period

Let’s look at an example to see how it might apply to your business. Say you pull the following information from your year-end financial statements, including your balance sheet and income statement:

- Beginning AP: $25,000

- Ending AP: $75,000

- COGS: $600,000

First, let’s calculate your average accounts payable for the year:

($25,000 + $75,000) / 2 = $50,000 average accounts payable

Now we can calculate your DPO for the year (365 days):

($50,000 / $600,000) * 365 = 30.42 days payable outstanding

This means, on average, your business takes about 30 days to pay its suppliers.

Understanding days payable outstanding

Now that you know how to calculate DPO, the next step is understanding how this metric fits into the bigger picture of your business’s financial health and AP goals. DPO is one of several metrics you can use to assess working capital management, so let’s compare it to some other terms to help you put it into context:

DPO vs. DSO

While DPO focuses on how long it takes to pay your suppliers, days sales outstanding (DSO) measures how long it takes your business to collect payments from customers.

In simple terms, DSO tracks incoming cash flow, while DPO tracks outgoing cash flow. The goal is to find a healthy balance—ideally, you want to collect payments faster than you’re paying your suppliers.

Along with a third metric, days inventory outstanding (DIO), DPO and DSO are part of the cash conversion cycle (CCC), which measures the amount of time it takes to convert inventory into cash.

High DPO vs. low DPO

A high DPO means your business takes longer to pay suppliers. This can be a strategic move to hold onto cash longer, freeing up money for other expenses. But you don’t want to delay paying suppliers and vendors too long. Otherwise, you could owe late payment fees or interest, strain vendor relationships, or even lose access to certain suppliers.

On the other hand, a low DPO suggests you're paying suppliers quickly. While this may help you take advantage of early payment discounts and lead to stronger supplier partnerships, it could reduce the cash available for day-to-day operational expenses.

Is it better to have a high or low days payable outstanding?

Ultimately, it depends. A high DPO can improve cash flow, but extending payments too far beyond your payment terms can strain vendor relationships. A low DPO may strengthen supplier relationships but strain your own cash flow. You need to find the right balance based on your business needs.

DPO vs. payment terms

DPO measures the average amount of time you take to pay invoices, but it’s not the same as payment terms. Payment terms refer to the conditions agreed upon with your suppliers—such as net 30 or net 60—which set the deadline for payment.

For example, say most suppliers offer net 45 terms, but your DPO is 60. In that case, your DPO exceeds your credit terms, meaning you’re paying late. On the other hand, if your DPO is 30, you’re paying suppliers early.

How do businesses use DPO?

Days payable outstanding is more than just a number on your financial statements. You can use it to assess your accounts payable processes, and vendors and creditors may use it to gauge your business’s financial strength and creditworthiness.

Let’s look at how different stakeholders might use this valuable key performance indicator (KPI).

How do business owners and managers use DPO?

Business owners, C-suite executives, and managers might calculate DPO during financial planning or when reviewing cash flow cycles. It’s particularly valuable for:

- Forecasting accounts payable and working capital

- Negotiating with suppliers to extend payment terms

- Preparing for financial audits

- Seeking business loans or lines of credit since it shows how well you manage your payables

Here are a few things you should watch for when reviewing DPO:

- Sudden fluctuations: A sudden increase in DPO could indicate cash flow problems or breakdowns in your AP workflow. On the other hand, a sharp decline might mean you’re paying suppliers too quickly, reducing your cash available for paying employees, reinvesting in the business, or covering other expenses.

- Supplier relationships: A high DPO could indicate you’re consistently pushing out payments beyond the agreed-upon terms. This can strain relationships with important suppliers and result in late fees and other penalties.

- Industry benchmarks: It’s helpful to compare your DPO to industry standards to understand whether your payment processes align with what’s typical for your sector.

What does DPO tell you about your business?

DPO reveals how efficiently you manage outgoing payments. A higher DPO suggests better cash retention, while a lower DPO indicates faster payments to suppliers, potentially improving vendor relations but reducing available cash. It’s helpful to put your DPO in context by comparing it to your supplier payment terms and the average DPO for your industry.

What do vendors and creditors want to see?

Vendors and creditors often keep a close eye on your DPO because it can indicate how reliable your business is when it comes to paying bills.

Vendors generally prefer businesses with a shorter DPO, as it shows you pay on time or even early, potentially qualifying you for discounts or better terms.

Creditors, on the other hand, may see a higher DPO as a sign that you’re managing cash flow well—so long as it’s not a signal of financial distress. A too-high DPO can be a red flag, suggesting potential cash flow issues or strained vendor relationships.

Factors that influence DPO

Several factors influence your company’s DPO, including:

- Industry standards: Different industries have different average DPOs. Industries with long supply chains may have higher DPOs, while service-based businesses might have shorter ones. According to the American Productivity and Quality Center (APQC), the median DPO across all industries is about 38 days.

- Company size: Larger companies often have more leverage to negotiate longer payment terms. As a result, large companies tend to have higher DPOs than smaller businesses.

- Cash flow management: If cash flow is tight, you may push out payments to extend your DPO. Just keep in mind that regularly exceeding your payment terms can hurt supplier relationships. If you’re having a hard time paying your suppliers and vendors, reach out sooner rather than later.

Additionally, your negotiated payment terms with suppliers (e.g., net 30, net 60, etc.) directly affect your DPO. Negotiating longer payment terms can give you more time to pay, freeing up capital for other uses.

The following tips can help you negotiate extended payment terms with your existing suppliers:

- Identify suppliers you can negotiate with: You’ll have better luck negotiating payment terms with suppliers you spend a lot of money with, order from frequently, and have been doing business with for a while

- Talk to the right person: The person delivering the goods and services might not have the authority to negotiate changes to payment terms. Check your supplier contract to see who signed it.

- Know your current terms: You need to know your existing payment terms to negotiate for “better” terms. Review your vendor contract to ensure you understand your payment terms and the consequences of late payments.

- Make it a win/win: Your chances of a successful negotiation increase if you can offer something in exchange for extended payment terms. For example, you might offer to increase your order volume, give the supplier a larger share of your procurement budget, or refer industry peers to them.

- Ask for more than you expect: Ask for the high end of what you need so there’s room for back and forth. For example, if you ask the vendor to extend your payment terms from 30 to 60 days, they might agree to 45 days.

- Get it in writing: If you successfully negotiate your payment terms, formalize the new terms in a new vendor contract

What is a good DPO?

A "good" DPO varies by industry. Large companies with long supply chains may have higher DPOs, while service-based businesses tend to have a lower average DPO. The ideal range aligns with your business's cash flow and supplier relationships, so compare your DPO to industry standards to ensure you’re not paying too quickly or too slowly.

How can you optimize your days payable outstanding?

Optimizing your days payable outstanding is all about finding the right balance between maintaining good relationships with suppliers and keeping enough cash on hand to meet your business needs.

You generally have two options for optimizing your DPO:

1. Reduce DPO by paying vendors quickly

The first option is to lower your DPO by paying your suppliers faster. Paying vendors quickly can build stronger relationships, potentially leading to better terms or even early payment discounts.

For example, you might leverage AP tools for automated invoice processing and pay invoices within 15 days to take advantage of early payment discounts.

But there’s a trade-off: While paying outstanding invoices quickly shows financial responsibility, it reduces the cash you have available for other uses, like covering incidental expenses or making new investments.

A lower DPO might work best if your business has a steady cash flow and you want to build supplier trust.

If you're exploring tools that support this strategy, reviewing a comparison of accounts payable automation software can help you identify platforms that speed up approvals, reduce manual delays, and improve visibility into outstanding payables.

2. Increase DPO to free up cash flow

Increasing your DPO is another option for optimizing your company’s cash flow. By strategically delaying payments (while staying within agreed terms), you can keep more cash on hand for longer, improving liquidity and allowing you to invest in growth or handle unexpected expenses.

For example, if your payment terms call for net 30 payments but you regularly pay within 20 days, stretch those payments out to the full 30 days. Couple those extra 10 days with a lower days sales outstanding—that is, collecting accounts receivable from customers faster—and you’ll really be able to maximize the amount of free cash you have available.

Of course, the key is not to overdo it. Extending your DPO too much might free up cash in the short term, but it can also damage supplier relationships or indicate financial trouble to creditors.

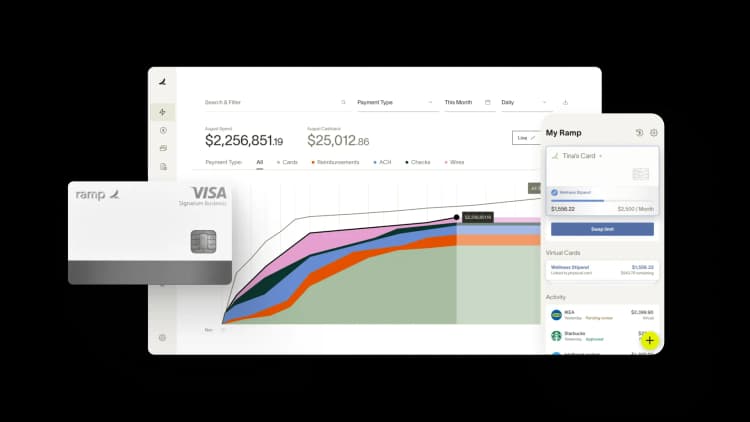

Optimize your DPO and improve cash flow with Ramp

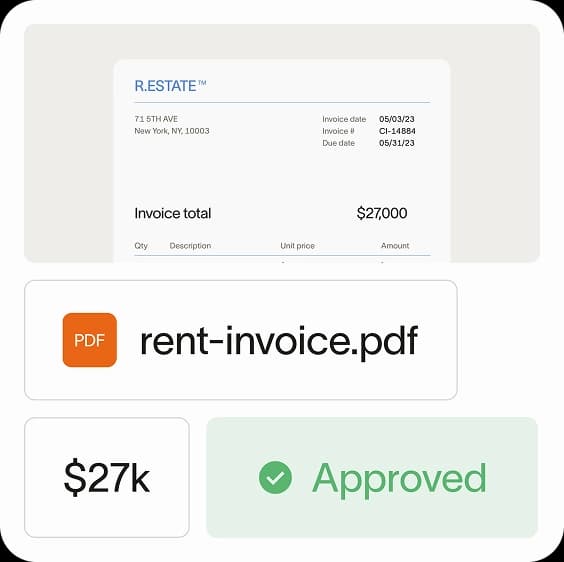

Optimizing your company’s DPO is a lot easier if you automate your AP workflow. If you’re looking to strategically improve cash flow and vendor relationships for your business, try Ramp Bill Pay.

Ramp Bill Pay is autonomous AP software that converts manual work into touchless workflows. Four AI agents handle invoice coding, catch fraud before payments process, build approval documentation, and push vendor payments through cards—removing your team from repetitive work.

OCR hits up to 99% accuracy on data extraction while processing invoices 2.4x faster than traditional platforms1, helping you reduce DPO.

Use Ramp Bill Pay on its own, or link it with Ramp's corporate cards, expense management, and procurement tools for total spend oversight. Up to 95% of companies report better visibility when using Ramp2.

The platform supports better AP features like:

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- Automatic card payments agent: Identifies card-eligible invoices, fills card details directly into vendor payment portals, and captures cashback opportunities automatically

- Reconciliation: Close books faster with automatic transaction matching

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Recurring bills: Automate regular payments with recurring bill templates

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Fraud prevention agent: Flags suspicious activity before payments go out

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

What makes Ramp Bill Pay different

Ramp Bill Pay delivers AP automation that's accurate, autonomous, touchless, and quick. Over 2,100 verified G2 reviews give Ramp a 4.8-star average, with finance teams calling it one of the most straightforward AP platforms to implement.

Ramp Bill Pay works as standalone AP software, but for teams wanting to manage bills alongside card spend, expenses, and procurement, they can use Ramp's unified platform that connects it all. Start with Ramp's free tier covering core AP automation, or upgrade to Ramp Plus at $15 per user monthly for advanced features.

See what Ramp Bill Pay can do for your team.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits