How to check your Wells Fargo business credit card application status

- How to check your Wells Fargo business credit card application status

- Understanding Wells Fargo's application decision timeline

- Wells Fargo business credit card application status messages

- What to do if your application is pending

- Reasons for application delays or denials

- Alternative business financing options

- Get approved for a Ramp Business Credit Card in 1–3 days, on average

If you’ve applied for a Wells Fargo business credit card, you can check your application status online, over the phone, or at a branch. Each method provides updates on whether your application is under review, approved, or requires additional information.

Most applications are processed within 3–10 business days, though timelines can vary depending on your credit profile and documentation. Understanding these updates helps you stay prepared while Wells Fargo finalizes its decision.

How to check your Wells Fargo business credit card application status

You can check the status of your Wells Fargo business credit card application online, by phone, or at a branch.

Online method

- Go to the Wells Fargo application status page

- Log in with your Wells Fargo Online username and password, or use the Access Code emailed after you applied. You’ll also need your last name, date of birth, and the last four digits of your Social Security number (SSN) or Employer Identification Number (EIN)

- Once logged in, you’ll see your current application status and any follow-up actions

Phone method

- Call Wells Fargo’s credit card application line at 1-800-967-9521 (available 24/7)

- Have your application reference number ready, along with your SSN or EIN

- A representative will provide the current status—whether your application is approved, under review, or requires additional information

Visit a branch

- Use the Wells Fargo branch locator to find the nearest location

- Bring identification and any application documents

- Ask a banker for an update on your application status

Understanding Wells Fargo's application decision timeline

Most Wells Fargo business credit card applications are processed in 3–10 business days. If approved, your card usually arrives by mail within 7–10 business days.

Applications with strong credit profiles, complete details, and an existing Wells Fargo relationship tend to move faster. Delays are common when information is incomplete, credit history is limited, or the bank needs to verify financial or identity documents.

Instant approval vs. standard review

You’re most likely to receive instant approval if you have strong personal credit, low debt, accurate application details, and an active Wells Fargo account in good standing.

Manual review is more likely if your business is new, your credit history is thin, or details on your application don’t align. Instant approvals can be decided within minutes; standard reviews typically take 3–10 business days, though complex cases may take longer.

Wells Fargo business credit card application status messages

When you check your Wells Fargo business credit card application, you’ll see one of several standard status messages. Each message indicates what stage your application is in and whether any action is needed.

| Status message | What it means |

|---|---|

| Application received | Wells Fargo has received your application. No decision has been made yet. You’ll typically hear back within a few business days as the review process begins. |

| Under review | Your application is being evaluated by Wells Fargo underwriters. This process usually takes 3–10 business days. The bank may verify your credit history, business financials, and other details before issuing a decision. |

| Additional information required | Wells Fargo needs more documentation or clarification before moving forward. Common requests include business tax returns, proof of identity, or legal business documents. Responding quickly helps avoid delays. |

| Approved | Your application was approved. Expect your physical card to arrive by mail within 7–10 business days. In some cases, you may receive your new account number earlier for immediate use. |

| Declined | Your application was not approved, often due to credit issues, incomplete information, or business risk factors. You’ll receive a written explanation and may request reconsideration or reapply after addressing the issues. |

What to do if your application is pending

A pending status means Wells Fargo needs more time to review your business credit card application. Common reasons include:

- Incomplete application: Some details may be missing or incorrect

- Credit review: The bank may need extra time to verify your credit history, especially if your score is borderline

- Verification steps: Additional checks may be required to confirm your identity, income, or business information

- Fraud checks: Wells Fargo may conduct extra screening to prevent credit card fraud

- Operational delays: High application volumes or system reviews can slow processing

In some cases, the bank may ask for additional documentation such as identification, business tax returns, proof of income, or legal business formation documents. Having these materials ready can help you respond quickly.

To avoid further delays, monitor your email and Wells Fargo’s secure message center for requests, submit any required documents promptly, and make sure your information matches IRS, bank, and state records. You can also call the Wells Fargo application status line to confirm that documents were received and check for updates.

Reasons for application delays or denials

Not every Wells Fargo business credit card application is approved right away. Delays or denials can happen for several reasons:

- Low personal or business credit scores that don’t meet Wells Fargo’s internal thresholds

- Limited business history, for example, startups operating less than two years

- High existing debt or limited cash flow that signals repayment risk

- Incomplete or inaccurate application details, such as mismatched business information

- Recent credit inquiries or too many new accounts, which can raise red flags

Wells Fargo doesn’t publish its exact approval standards, but applicants generally need good to excellent credit (a FICO score of 670 or higher) and a solid business track record. For newer businesses, personal income and personal guarantees may carry more weight than revenue or time in operation.

How to address each issue

If your application is denied, review Wells Fargo’s adverse action letter for specific reasons. Correct any errors on your credit reports, pay down debt, and verify that all business details are accurate and consistent across documents. Improving credit utilization and maintaining steady cash flow can strengthen your profile before reapplying.

If you believe your application deserves a second look, you can contact Wells Fargo to request reconsideration. Be prepared to provide updated financials or explanations for any issues that appeared in your initial application.

Alternative business financing options

If you’re not approved for a Wells Fargo business credit card, you still have several ways to access funding. Some issuers offer business credit cards with more flexible approval criteria, including secured business credit cards and cards designed for startups.

Wells Fargo also provides a business line of credit, which may be easier to qualify for if your business has steady cash flow or sufficient collateral. Exploring other lenders can also make sense if your company is new or your credit profile is still building.

Business lines of credit vs. credit cards

A business credit card is ideal for everyday expenses, employee purchases, and earning rewards. Approval typically depends on personal credit history and income.

A business line of credit functions more like a revolving loan—you can draw funds as needed and pay interest only on what you use. While it may require stronger business financials or collateral, it offers larger funding amounts and more flexibility for cash flow management.

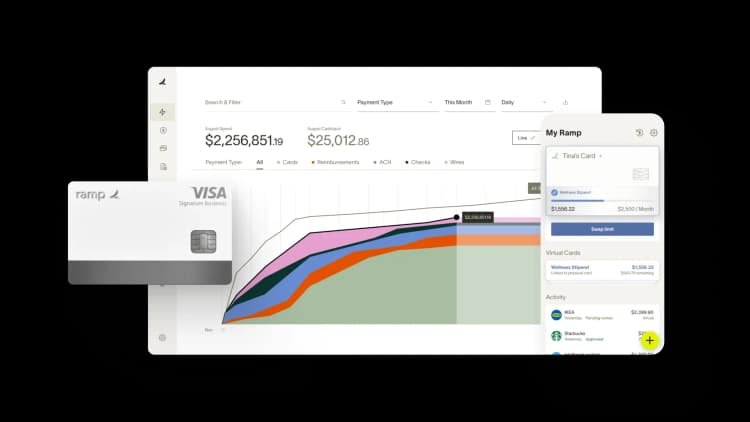

Get approved for a Ramp Business Credit Card in 1–3 days, on average

While Wells Fargo and other banks may take several days (or even weeks) to process a business credit card application, Ramp offers a faster path.

The Ramp Business Credit Card requires no credit check or personal guarantee, and you can typically get approval within 1–3 days. Additionally, the card includes advanced spend management capabilities and unlimited free physical and virtual employee cards. With our business card, you can:

- Prevent out-of-policy spend with preset vendor and category controls

- Skip expense reports by submitting receipts via SMS, app, or integrations

- Save an average of 5% across business spending and enjoy $350,000+ in partner offers

Ready to get started? Explore a free interactive product demo.

Disclaimer: Content on Ramp's blog may change, and opinions are those of the authors and not necessarily Ramp's. The information in this article is provided in good faith for general informational purposes, but does not constitute accounting, legal, or financial advice. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Ramp is not liable for any losses or damages.

FAQs

Once approved, Wells Fargo typically delivers your business credit card within 7–10 business days. In some cases, you may receive your account number earlier for immediate use.

Most traditional banks require a personal guarantee, but alternatives like the Ramp Business Credit Card don’t. Instead, Ramp bases approval on your company’s financials, allowing you to access credit without impacting your personal liability.

To check the status of your Wells Fargo business line of credit, you can either log in to your Wells Fargo online account using your username and password or use a new Access Code sent to your email after application submission.

This Access Code, along with your last name, date of birth, and the last four digits of your SSN, will allow you to access detailed information about your application's progress.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits