What is the American Express Platinum card limit?

- American Express Business Platinum Card overview

- Key benefits and rewards structure

- Premium travel benefits

- Business-specific benefits

- Credit limit and spending power

- Who should get this charge card?

- American Express Business Platinum vs. other cards

- Application process and approval requirements

- Need a high credit limit? Consider the Ramp Business Credit Card as an alternative

The American Express Business Platinum Card operates as a charge card rather than a traditional credit card, which means it has no preset spending limit. Instead of a fixed credit cap, American Express determines your purchasing power based on your business’s financial profile, payment history, credit record, and spending patterns. This setup lets your available spending power grow over time as your business builds a stronger relationship with American Express.

While there’s no official ceiling, American Express regularly reviews your account activity and may approve or decline charges depending on your current financial profile and payment history. For larger purchases, you can use the Check Spending Power feature in your American Express account to confirm whether a transaction amount is likely to be approved before completing it.

American Express Business Platinum Card overview

The American Express Business Platinum Card is a business charge card designed for entrepreneurs, business owners, and executives who travel frequently. This card differs from most business credit cards because it's built as a charge card.

Rather than offering revolving credit, it provides flexible spending power while requiring full payment each billing cycle. The premium positioning appeals to high-spending businesses that value travel perks, lounge access, and statement credits over standard cashback rewards.

The Business Gold Card works well for category-based spending with a lower annual fee, while the Blue Business Plus provides everyday earning with no annual fee. The Business Platinum sits at the top as the premium travel option with the broadest set of benefits and the highest annual cost.

Charge card vs. credit card: Key differences

Charge cards and credit cards look similar, but they work differently. Here’s a quick comparison of how they handle spending limits, payments, and credit impact:

| Feature | Charge card | Credit card |

|---|---|---|

| Spending limit | No preset limit (adjusts to your financial profile) | Fixed limit assigned at approval |

| Payment terms | Must pay in full monthly | Can carry a balance month to month |

| Interest | None (unless using Pay Over Time) | Charged on unpaid balances |

| Credit utilization impact | Minimal | Directly affects credit score |

Annual fee and card basics

The annual fee is $895, making this one of the most expensive business cards available. Additional employee cards cost $400 each per year. That premium pricing makes sense only for businesses that can fully leverage the card’s benefits.

The card itself is made of metal, underscoring its premium positioning. You’ll earn 5 points per dollar on flights and prepaid hotels booked through American Express Travel. Large purchases of $5,000 or more earn 2 points per dollar, up to $2 million annually. Select business categories also earn 2 points per dollar. All other eligible purchases earn 1 point per dollar, and points never expire as long as your account remains open.

Key benefits and rewards structure

Membership Rewards points are the backbone of the Business Platinum’s value. You’ll earn points quickly in a few high-impact categories, then choose from several redemption options based on your travel plans and cash flow needs.

Earning rewards points

The card’s earning structure targets business travel and large purchases while providing baseline rewards on everything else:

- 5x points per dollar on flights and prepaid hotels booked through American Express Travel

- 2x points per dollar on eligible purchases of $5,000 or more (up to $2 million annually)

- 2x points per dollar at select business merchants, including construction materials and hardware suppliers, electronic goods retailers, software and cloud providers, and shipping companies

- 1x point per dollar on all other eligible purchases

Redeeming Membership Rewards

You can redeem points through transfer partners or the Amex Travel portal, or take the simpler route with statement credits and gift cards. Travel redemptions typically deliver the most value.

Here’s a quick look at typical redemption values:

| Redemption type | Typical value per point | Notes |

|---|---|---|

| Transfer to airline partners | ~2¢ | Highest value, especially for premium flights |

| Amex Travel portal | ~1¢ | Simple booking for flights, hotels, cars, cruises |

| Statement credit | ~0.6¢ | Flexible but lower value |

| Gift cards | ~0.5–1¢ | Varies by retailer |

Gift cards

Gift cards offer a straightforward way to offset costs, though values vary by retailer. If you’re optimizing for cents-per-point, it’s usually better to transfer to travel partners or book through the portal.

Statement credits

Statement credits reduce your balance with minimal effort but typically provide lower value per point. They work well when you prioritize cash flow over maximizing redemption value. Points don’t expire as long as your account remains open and in good standing.

Premium travel benefits

The Business Platinum Card packs some serious travel perks that can make those work trips feel a lot more civilized. With more than $3,500 in potential annual value when you use the benefits, this card goes well beyond basic rewards points. Let's break down exactly what you're getting and how much these perks could actually save you.

Airport lounge access

When you're spending a lot of time in airports, lounge access becomes less of a luxury and more of a necessity. The Business Platinum gives you access to the American Express Global Lounge Collection, which includes more than 1,550 airport lounges across 140 countries, more locations than any other credit card company on the market.

Centurion Lounge network

The crown jewel of the collection is the Centurion Lounge network. These lounges feature premium food from local chefs, top-shelf cocktails, high-speed Wi-Fi, and workspaces designed for business travelers. Many locations also offer shower suites and spa services.

There are currently 13 Centurion Lounges across the U.S. and several international locations, with new lounges planned in Salt Lake City, Newark, and Boston over the next few years.

Cardmembers can enter within three hours of departure. Guests cost $50 per adult and $30 per child ages 2–17 unless you spend $75,000 annually, in which case two guests per visit are complimentary through January 31 of the second following year.

Priority Pass Select membership

Your card also includes Priority Pass Select enrollment, giving you access to more than 1,700 additional lounges worldwide. This fills in the gaps at airports without Centurion Lounges, so you're covered almost anywhere you travel.

Delta Sky Club access

When flying on a Delta-operated or Delta-marketed flight, you receive ten complimentary visits per year to Delta Sky Clubs. Spend $75,000 annually and you unlock unlimited access for the rest of that year and the next.

International lounge partners

The Global Lounge Collection also covers select international lounges, such as certain Lufthansa lounges when flying Lufthansa, plus Plaza Premium and other partner locations.

Even moderate travelers can extract $600–$1,800 in annual value from lounge access alone, depending on usage frequency.

Travel credits and rebates

The Business Platinum provides several statement credits that can quickly offset the $895 annual fee if used strategically.

| Credit/benefit | Annual value | Notes |

|---|---|---|

| Hotel credit | $600 | Up to $300 twice per year via Fine Hotels + Resorts or The Hotel Collection |

| Airline fee credit | $200 | Covers incidental fees like checked bags and seat upgrades |

| Dell Technologies credit | $150 | Two $75 credits per year for Dell purchases |

| Adobe credit | $250 | After $600 in U.S. Adobe purchases per calendar year |

| Indeed credit | $360 | Up to $90 per quarter for recruiting and hiring |

| Total potential value | ~$1,560 | Enough to offset or exceed the annual fee |

High-spending cardholders who exceed $250,000 annually can unlock an additional $3,600 in travel and accounts-payable credits for the following year.

Additional credits for high spenders

If you spend $250,000 in a calendar year, you unlock an additional $3,600 in credits for the following year: $1,200 for flights booked through Amex Travel and $2,400 for One AP, American Express's accounts payable platform. This is only relevant for larger businesses with significant card spend.

If you use the $600 hotel credit, $200 airline credit, and even half of the Dell, Adobe, and Indeed credits, you're looking at roughly $1,100–$1,300 in value, more than covering the annual fee.

Travel protections and insurance

Business travel often comes with unexpected disruptions. The Business Platinum includes strong built-in protections that can save thousands of dollars if things go wrong.

Trip cancellation and interruption coverage

If you have to cancel or cut short a trip due to covered reasons such as illness, injury, or severe weather, the card provides up to $10,000 per trip and $20,000 per year in protection. To qualify, you must purchase the entire round-trip ticket with your Business Platinum Card.

Coverage extends to the cardholder, traveling companions, and immediate family members. Eligible events include sickness or injury, jury duty, natural disasters affecting your destination, and other unforeseen circumstances outside your control. The benefit reimburses prepaid, non-refundable expenses like airfare, hotels, and tours, making it especially useful for international or high-cost itineraries.

Baggage insurance

If your luggage is lost or damaged, you’re covered for up to $3,000 per person, with certain limits on high-value items such as jewelry and electronics. Coverage applies to both checked and carry-on bags when traveling on a common carrier such as a plane, train, or bus.

This protection can easily save you hundreds of dollars in replacement costs and is automatically included whenever you use your Business Platinum Card to book travel.

Car rental loss and damage insurance

The card includes secondary coverage of up to $75,000 for damage or theft of rental vehicles, valid worldwide with limited exceptions. This benefit can help you avoid filing a claim with your personal auto insurer when renting for business travel.

Premium Global Assist Hotline

Available 24/7 when you’re more than 100 miles from home, the Premium Global Assist Hotline connects you to emergency support anywhere in the world. The service offers medical and legal referrals, help replacing lost passports and documents, coordination of emergency travel, urgent message relay, and assistance arranging emergency cash. You’re responsible for the cost of services provided, but having access to immediate global help can make a major difference during a crisis abroad.

Business-specific benefits

The American Express Business Platinum Card goes beyond personal perks to deliver real operational value for your company. These features help you manage team spending more effectively while saving money on everyday business expenses.

Employee cards and expense management

Adding team members to your account comes with no additional fees for standard Expense Cards. You can issue up to 99 Expense Cards for employees to handle travel and work purchases without worrying about stacking annual charges. Platinum Employee Cards with full benefits are available for $400 each per year.

You maintain full control over each card’s permissions. Set custom spending limits by day, transaction, or merchant category, or block certain vendor types entirely. For example, you can allow your sales team to charge client dinners while restricting nonbusiness purchases.

Transactions sync automatically with your accounting software, which dramatically reduces manual data entry and reconciliation. For finance teams processing hundreds of transactions a month, this integration can save 10–15 hours of administrative work each month.

Employee Card vs. Expense Card

An Employee Card gives full card benefits to another user, while an Expense Card provides limited spending permissions for team members.

Business services and discounts

The vendor payment feature helps improve cash flow by allowing you to pay suppliers and vendors with your Business Platinum Card even if they don’t typically accept credit cards. American Express pays the vendor directly, while you earn points and extend your payment timeline by up to 14 days. Although a small processing fee applies, the rewards and extended float often outweigh the cost for strategic payments.

You’ll also find valuable discounts and offers with partner companies on common business expenses such as shipping (FedEx and UPS), office supplies, technology, and professional services. The exact savings depend on your spending mix, but businesses that regularly use these partner programs often save $500–$1,500 annually—enough to cover a large portion of the card’s annual fee.

Credit limit and spending power

The American Express Business Platinum Card works differently from traditional business credit cards. Instead of assigning a fixed limit, it uses a no preset spending limit model. That doesn’t mean unlimited spending—it simply means your purchasing power adjusts dynamically based on your business’s financial profile.

American Express reviews several factors to determine your spending capacity, including your payment history, current balance, spending patterns, and overall financial relationship with the company. Businesses that consistently pay in full and maintain a positive track record generally enjoy more flexibility than new cardholders or those who carry high balances.

Understanding your spending limit

Your spending power changes over time based on multiple factors. Payment history carries the most weight: paying on time and in full expands your available limit, while late or partial payments restrict it. American Express also considers your business’s revenue, financial health, and account longevity, reviewing this data periodically.

The Pay Over Time feature adds flexibility by allowing you to revolve certain charges and pay interest on them at a variable APR of 18.24% to 28.99%. However, you’ll typically get the most value by paying in full each month to avoid interest.

The length of your relationship with American Express also matters. New cardholders often start with conservative spending power that grows with consistent on-time payments and responsible usage. Large, atypical purchases may still require advance approval even if you have strong payment history.

Check your spending power

Before making a large purchase, use the Check Spending Power tool in your Amex account to see whether a transaction is likely to be approved. It’s a quick way to verify your purchasing capacity without risking a declined charge.

Building business credit

The Business Platinum Card reports activity to commercial credit bureaus such as Dun & Bradstreet, Experian Business, and Equifax Business. Regular on-time payments help you build business credit separate from your personal credit profile, which can make it easier to negotiate favorable vendor terms and qualify for higher limits on other accounts.

American Express will check your personal credit when you apply, resulting in a hard pull on your personal report. Missed payments or defaults can appear on your personal credit, but your ongoing monthly spending generally does not—so high business use won’t raise your personal utilization ratio. Over time, a strong business credit profile helps you qualify for better financing and vendor terms, strengthening your company’s financial flexibility.

Who should get this charge card?

The American Express Business Platinum Card delivers exceptional value—but only for the right kind of business. The $895 annual fee means you need to use the benefits actively to come out ahead. Here’s who tends to benefit—and who doesn’t.

For many businesses, the tipping point comes around $30,000 in annual spend, especially if a large portion goes toward travel or business services. At that level, the combination of lounge access, credits, and point multipliers can easily outweigh the fee.

For example, a consulting firm with three partners who travel regularly for client meetings could spend $15,000 on flights, $8,000 on hotels, $5,000 on client meals, and $10,000 on advertising each year. With the card’s earning rates and benefits, that firm could see more than $2,000 in annual value.

| Annual spend level | Estimated rewards and credits | Covers $895 fee? |

|---|---|---|

| $20,000 (low) | ~$400 | ❌ No |

| $40,000 (moderate) | ~$950–$1,100 | ✅ Barely |

| $80,000+ (high) | ~$1,800–$2,500 | ✅ Yes |

Best for these businesses

This card is ideal for specific business types that can take full advantage of its premium features and earning structure, including:

- Frequent business travelers: Companies sending employees on regular trips benefit from airport lounge access, airline fee credits, and hotel perks. Even two travelers taking monthly flights can save hundreds in lounge fees alone.

- Professional services firms: Consultants, accountants, and attorneys often have high travel and client entertainment expenses that align with the card’s strongest categories

- Companies with large ad or software budgets: Businesses spending heavily on digital ads or software subscriptions can rack up points fast while taking advantage of annual statement credits

- Established firms with predictable cash flow: Businesses that pay balances in full each month can unlock the card’s best value without incurring interest charges

- High-margin, growth-oriented companies: Firms able to justify upfront fees for long-term savings and perks, such as agencies or tech startups, tend to benefit most

These business types typically recover the annual fee value within the first few months of card membership through travel benefits and bonus points.

Not ideal for these situations

Some business scenarios make this card a poor financial choice, regardless of the attractive benefits and branding.

- Businesses spending under $25,000 annually: Low spend makes it difficult to recover the annual fee value

- Companies with minimal travel needs: The card’s premium perks lose impact if you rarely fly or stay in hotels

- Startups or cash-strapped firms: Businesses managing tight cash flow should prioritize flexibility over premium benefits

- Companies preferring fixed credit limits: The “no preset spending limit” structure can be unpredictable for organizations needing precise budgeting

- Businesses carrying monthly balances: Paying interest wipes out much of the value the card provides

For these situations, a business cashback card or a travel card with a lower annual fee delivers better value.

American Express Business Platinum vs. other cards

The American Express Business Platinum Card sits at the top of the premium business card market, but it's far from your only option. Several competing cards offer compelling benefits at different price points and with different reward structures. The right choice depends on your specific spending patterns, travel habits, and which perks matter most to your business.

Some businesses will find better value with cards that emphasize cashback over travel perks. Others might prefer cards with lower annual fees and more straightforward earning structures. The key is matching the card's strengths to your actual business spending rather than being swayed by aspirational benefits you won't realistically use.

American Express Business Platinum vs. competitor cards

The Business Platinum sits at the top of the premium business card market, but several competitors offer strong value at lower annual fees. Here’s how it compares to both rival cards and other American Express options.

American Express Business Platinum vs. competitor cards

Two major competitors—Chase Ink Business Preferred and Capital One Spark 2X Miles—offer similar rewards potential at a fraction of the annual cost.

| Feature | Amex Business Platinum | Chase Ink Business Preferred | Capital One Spark 2X Miles |

|---|---|---|---|

| Annual fee | $895 | $95 | $0 first year; $95 after |

| Welcome bonus | 250,000 points after $20,000 spend (3 months) | 90,000 points after $8,000 spend (3 months) | 50,000 miles after $4,500 spend (3 months) |

| Primary earning rate | 1x–5x points depending on category | 3x on first $150,000 in select categories; 1x elsewhere | 2x miles on all purchases (unlimited) |

| Travel credits | $200 airline, $600 hotel credits | None | None |

| Airport lounge access | Centurion, Priority Pass, Delta Sky Club | None | None |

| Employee cards | $400 each for Platinum; free for Expense Cards | Free | Free |

| Foreign transaction fees | None | None | None |

Best for:

- Amex Business Platinum: High-spend travelers who use premium perks and value comprehensive travel protections

- Chase Ink Business Preferred: Businesses optimizing bonus categories like advertising or shipping with moderate budgets

- Capital One Spark 2X Miles: Companies that want simple, flat-rate earning with minimal upkeep

American Express Business Platinum vs. other Amex Business cards

Within American Express’s own lineup, the Business Platinum caters to high spenders seeking perks, while the Business Gold and Blue Business Plus target cost-conscious companies.

| Feature | Business Platinum | Business Gold | Blue Business Plus |

|---|---|---|---|

| Annual fee | $895 | $375 | $0 |

| Welcome offer | 250,000 points after $20,000 spend (3 months) | 175,000 points after $15,000 spend (3 months) | 15,000 points after $3,000 spend (3 months) |

| Earning rate | 1x–5x depending on category | 4x on top 2 categories (up to $150,000 annually), 1x elsewhere | 2x on all purchases (up to $50,000 annually, then 1x) |

| Travel credits | $200 airline, $600 hotel credits | None | None |

| Airport lounge access | Centurion, Priority Pass, Delta Sky Club | None | None |

| Employee cards | $400 each for Platinum; free for Expense Cards | Free (up to 99) | Free (up to 99) |

Best for:

- Business Platinum: Frequent travelers and larger teams using travel credits and lounge access to offset high fees

- Business Gold: Firms with heavy category spending, like advertising, software, or gas, that want strong rewards at a mid-tier fee

- Blue Business Plus: Smaller or early-stage businesses that prefer simplicity and no annual fee

Application process and approval requirements

Applying for the American Express Business Platinum Card takes about 10–15 minutes and can be completed entirely online. Most applicants receive an instant decision, though some cases may go to manual review for up to 10 business days.

Application steps

- Go to the American Express Business Platinum Card application page and select Apply Now

- Enter your personal details, including your name, Social Security number, and residential address

- Provide business information such as your legal business name, type of entity (sole proprietorship, LLC, corporation, etc.), and Employer Identification Number (EIN)

- Report your business revenue and how long you’ve been operating—even if it’s a new or side business

- Include your total annual personal income from all sources; Amex considers this when evaluating your ability to manage the account

- Review your information and submit your application

- Wait for an instant decision or, if flagged for review, a follow-up email within a few business days

Typical approval criteria

American Express reviews several factors to determine eligibility. While it doesn’t publish exact cutoffs, these are general benchmarks:

- A strong credit history with consistent on-time payments

- Adequate personal income to support expected spending and the annual fee

- Reasonable debt-to-income ratio

- No recent bankruptcies or serious negative marks on your credit report

- Verifiable business activity and revenue

Hard pull vs. soft pull

A hard pull appears on your credit report and can temporarily affect your score. A soft pull does not and is used for prequalification checks.

Eligibility requirements

While Amex evaluates each application holistically, meeting these standards improves your odds:

- High credit score: 690+ recommended; 740+ typically receives instant approval if other factors are strong

- Solid business revenue: Many successful applicants report $50,000+ in annual revenue, though high personal income can offset lower business revenue

- Supporting documentation: Amex may request proof of income, business registration, or bank statements for verification if your application is flagged for review

Application tips

- Be accurate: Report revenue and business details honestly; inconsistencies can cause denial or later account closure

- Time your application: Space out Amex applications by at least 90 days to avoid multiple recent inquiries

- Leverage existing relationships: Current Amex customers with strong payment history often receive preferential review

Common reasons for denial

Applications are most often declined due to:

- Low credit score (below 690)

- Too many recent inquiries

- High utilization across existing cards

- Short or limited credit history

- Unverified or inconsistent business information

Reconsideration process

If you’re denied, you can call the Amex reconsideration line at 1-800-567-1083 within 30 days. Be ready to discuss your business operations, explain any negative marks on your credit report, or provide updated documentation. Many applicants succeed after clarification, especially if they demonstrate strong personal credit and legitimate business activity.

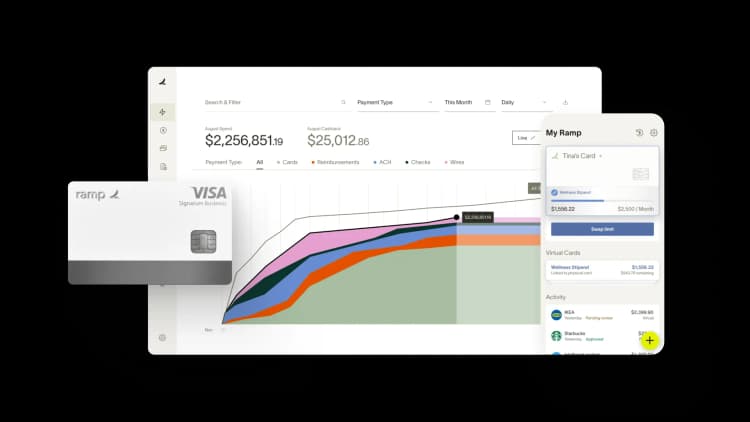

Need a high credit limit? Consider the Ramp Business Credit Card as an alternative

If you’re looking for a high-limit business credit card, the Ramp Business Credit Card is a compelling alternative.

While the American Express Business Platinum offers exceptional travel benefits, Ramp provides a simpler, more cost-effective solution for businesses focused on spend control and financial efficiency. Here’s a quick comparison:

| Feature | Ramp Business Credit Card | American Express Business Platinum |

|---|---|---|

| Annual fee | $0 | $895 |

| Rewards | Cashback | Tiered points (up to 5x) |

| Credit limit structure | No preset limit (adapts to business finances) | No preset limit (charge card model) |

| Spend management tools | Built-in | Limited |

Here’s what you can expect from Ramp:

- Spending controls: Set proactive limits, category restrictions, and vendor-level receipt requirements to prevent unauthorized spending

- Real-time visibility: Get instant insight into company spending with customizable daily limits and card programs

- Accounting integrations: Connect seamlessly with systems like NetSuite, QuickBooks, Xero, and Sage Intacct for faster close and reconciliation

- No annual fee: Enjoy zero annual or hidden fees, plus straightforward cashback rewards without complex categories

Apply for the Ramp Business Credit Card and start earning cashback while improving your company’s financial visibility.

The information provided in this article has not been officially confirmed by American Express and is subject to change.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°