- What is cashback on a credit card?

- How do cashback credit cards work?

- Types of cashback credit cards

- How to redeem your cashback rewards

- Cashback vs. points vs. miles

- What credit score do you need for a cashback credit card?

- Are cashback credit cards worth it?

- How to maximize your cashback rewards

- How corporate cashback cards work for businesses

- Simplify cashback and spend management with Ramp

Cashback credit cards give you a percentage of your purchases back as rewards. Every time you use the card, you earn cash back that you can redeem as a statement credit, bank deposit, or other options depending on the issuer. Understanding how cashback works helps you choose the right card and avoid rewards structures that limit how much you actually earn.

Note: The cashback percentages, limits, fees, and other figures mentioned in this article are for illustrative purposes only. They do not represent guaranteed or expected rates. Actual terms, credit limits, rewards, and approval criteria vary by card issuer and may change at any time. Readers should verify current details directly with each issuer before applying.

What is cashback on a credit card?

Cashback is a credit card rewards program that returns a percentage of your spending back to you as cash rewards. When you make a qualifying purchase, the card issuer gives you a small portion of that amount back.

Unlike travel credit cards, which earn points or miles with variable redemption value, cashback rewards have a fixed cash value. That makes them easier to understand and use:

- How it works: You make a purchase, and the issuer returns a small percentage of the amount as cashback

- Where rewards go: Cashback accumulates in a rewards account tied to your card until you redeem it

- Why issuers offer it: Card issuers earn interchange fees from merchants on every transaction and share a portion of that revenue with you as an incentive to use their card

Over time, consistent cashback earnings can help offset expenses, especially if you use the card for recurring or high-volume purchases.

How do cashback credit cards work?

Cashback credit cards follow a simple earn-and-redeem model tied to your spending:

- You use the card to make a qualifying purchase

- The issuer credits a percentage of that purchase as cashback rewards

- Rewards accumulate in your account over time

- You redeem the cashback through available options like statement credits or deposits

Your cashback rate determines how much you earn. For example, a card offering 1.5% cashback earns $0.015 for every $1 spent on eligible purchases.

Earning cashback on purchases

You earn cashback only on eligible, net purchases, meaning completed transactions after returns or credits are applied. Eligible categories often include subscriptions, travel, dining, or office supplies, depending on the card.

Most issuers exclude certain transactions from earning rewards, including:

- Cash advances

- Balance transfers

- Fees and interest charges

- Some gift card purchases

Cashback isn’t free money. You earn it only by spending, and you’re still paying the majority of each purchase out of pocket.

When cashback posts to your account

Cashback usually posts after a transaction fully clears, not when it’s pending. In most cases, issuers credit rewards at the end of each billing cycle, though some cards post rewards sooner.

Expect a short delay between making a purchase and seeing the cashback reflected in your rewards balance.

Types of cashback credit cards

Credit cards offer different cashback structures based on how and where you spend. Understanding these structures helps you choose a card that matches your spending patterns and earning goals.

| Card type | How it works | Best for |

|---|---|---|

| Flat-rate | Earns the same cashback percentage on every purchase | Simple, predictable rewards |

| Tiered or bonus category | Higher cashback in fixed categories, lower rate on other purchases | Spending concentrated in specific categories |

| Rotating category | High cashback in categories that change quarterly | Cardholders willing to track and activate bonuses |

| Choose-your-own category | You select which categories earn bonus cashback | Customized or uneven spending patterns |

Flat-rate cashback cards

Flat-rate cashback cards earn the same rewards percentage on every qualifying purchase. You don’t need to track categories or activate bonuses, which makes these cards easy to use and predictable. They’re a good fit if your spending is spread evenly across categories or if you want consistent rewards without extra effort.

Tiered or bonus category cards

Tiered cashback cards offer higher rewards in specific spending categories and a lower rate on everything else. For example, a card might earn 3% cashback on travel or dining and 1% on other purchases. These cards work well if a large share of your spending falls into a few fixed categories that earn higher rewards.

Rotating category cards

Rotating category cards offer elevated cashback rates, often up to 5%, in categories that change each quarter. Common categories include gas, groceries, dining, or rideshares. You usually need to activate the categories and stay within quarterly spending caps to earn the higher rate. The payoff can be high, but it requires more tracking.

Choose-your-own-category cards

Some cards let you select which categories earn bonus cashback. These work like tiered cards, but you choose the category that best fits your spending. If most of your budget goes toward a specific expense, such as internet services or software subscriptions, choosing that category can help you earn more rewards over time.

How to redeem your cashback rewards

Once you’ve earned cashback, you can redeem it through your card issuer’s website or mobile app. Some cards require you to meet a minimum rewards balance before you can redeem.

The most common redemption options include:

- Statement credit: Applies your cashback directly to your card balance, reducing what you owe

- Direct deposit: Transfers cashback to a linked bank account or issues a check

- Gift cards: Lets you redeem rewards for retailer gift cards, sometimes at a higher face value

- Travel: Uses cashback toward flights, hotels, or other bookings through the issuer’s travel portal

- Merchandise: Applies rewards to online shopping portals or checkout tools, though these redemptions often offer lower value

In most cases, you redeem rewards by logging in to your account, navigating to the rewards section, and selecting a redemption method.

Watch how rewards are issued

Some cards advertise “cashback” but actually issue rewards as points. Those points may still redeem for cash, but redemption options and value can vary by program.

Cashback vs. points vs. miles

When choosing a rewards credit card, the biggest difference comes down to how rewards are earned, redeemed, and valued. Cashback, points, and miles each work well for different spending habits and priorities.

| Feature | Cashback | Points | Miles |

|---|---|---|---|

| Reward type | Cash returned on purchases | Flexible reward currency | Travel-focused rewards |

| Value | Fixed percentage of each dollar spent | Varies by program and redemption method | Varies by airline or travel partner |

| Ease of use | Very simple and predictable | Requires tracking redemption value | Often more complex and restrictive |

| Best for | Simple savings on everyday spending | Flexible rewards and mixed redemptions | Frequent travelers who maximize travel perks |

| Downsides | Lower upside potential | Inconsistent redemption value | Blackout dates and limited flexibility |

Cashback is usually the easiest option if you want predictable value without managing points systems or transfer partners. Points and miles can deliver higher value, but only if you’re willing to track redemptions and optimize how you use them.

What credit score do you need for a cashback credit card?

Most cashback credit cards with competitive rewards require good to excellent credit. In practice, that usually means a FICO score of 670 or higher, with the best rewards and sign-up bonuses often reserved for scores of 740+.

If you’re building or repairing credit, you may still qualify for entry-level or secured cashback cards. These cards typically offer lower rewards rates or require a security deposit, but they can help you establish a credit history before moving to higher-earning cards.

Before applying, check your credit score and review each issuer’s requirements. Multiple hard inquiries from denied applications can temporarily lower your score.

Are cashback credit cards worth it?

Cashback credit cards are worth it if you pay your balance in full each month. If you carry a balance, interest charges will almost always outweigh the rewards you earn. With most cashback cards charging APRs between 15%–25%, even a small carried balance can erase the value of 1%–2% rewards.

Pros

- Simple, predictable savings: You earn a clear percentage of your spending back without tracking points or conversion rates

- Flexible redemption: Most cards let you redeem cashback as statement credits, bank deposits, gift cards, or travel

- Lower everyday costs: When used responsibly, cashback can offset regular expenses and help improve cash flow

- Consistent value: Cashback rewards don’t fluctuate in value the way points or miles can

Cons

- Interest negates rewards: Carrying a balance typically costs far more in interest than you earn in cashback

- Overspending risk: Chasing rewards can encourage unnecessary purchases

- Annual fees: If your spending is low, fees can cancel out rewards

- Lower upside than travel cards: If you frequently travel for business, points or miles may deliver more value

- Redemption limits: Some issuers impose minimum thresholds or restrictions on how rewards can be redeemed

How to maximize your cashback rewards

Maximizing cashback takes more than just using a rewards card. You earn the most when your card choice and spending habits work together.

Match your card to your spending habits

Start by reviewing the categories where you spend the most, such as travel, software, or office supplies. Choosing a card that rewards your highest-spend categories helps you earn more without changing behavior.

If your spending is evenly distributed, a flat-rate card may be the best option. If it’s concentrated, tiered or category-based cards can deliver higher returns.

Use multiple cards strategically

Some cardholders use different cards for different categories to earn the highest rate on each purchase. For example, one card might earn 3% on dining while another earns 2% on everything else. This approach requires more tracking, but it can materially increase total rewards over time.

Pay your balance in full each month

This is the most important rule. Any interest you pay will almost certainly exceed the value of your cashback. A 20% APR quickly wipes out the benefit of earning 1.5% or 2% back. If you can’t pay in full, the card is costing you more than it’s returning.

Track bonus categories and promotions

If you use a rotating category card, set reminders to activate bonus categories each quarter. Many people miss higher rewards simply because they forget to opt in.

Also watch for limited-time offers that provide extra cashback with specific merchants or spending thresholds.

Avoid annual fees unless the math works

A card with an annual fee only makes sense if the extra rewards exceed the cost. For example, a $95 annual fee requires at least $95 more in rewards than a no-fee card just to break even.

How corporate cashback cards work for businesses

Corporate cashback cards work like personal credit cards, but they’re built for company-wide spending and financial control. Similar to cashback business credit cards, you earn cashback on business purchases while gaining tools to manage employee spend at scale.

Compared to personal cards, corporate cards typically offer:

- Higher limits: Designed to support larger transaction volumes and recurring business expenses

- Employee cards: Issue cards to team members with role-based limits and permissions

- Centralized expense tracking: Automatically categorize and monitor spending across teams

- Accounting integrations: Sync transactions directly with accounting systems

- Spend controls: Set rules by merchant, category, or transaction size

For finance teams, the real value comes from combining cashback with automation. Instead of earning rewards at the cost of manual expense reports, corporate cards let you capture cashback while reducing reconciliation, approvals, and month-end close work.

Simplify cashback and spend management with Ramp

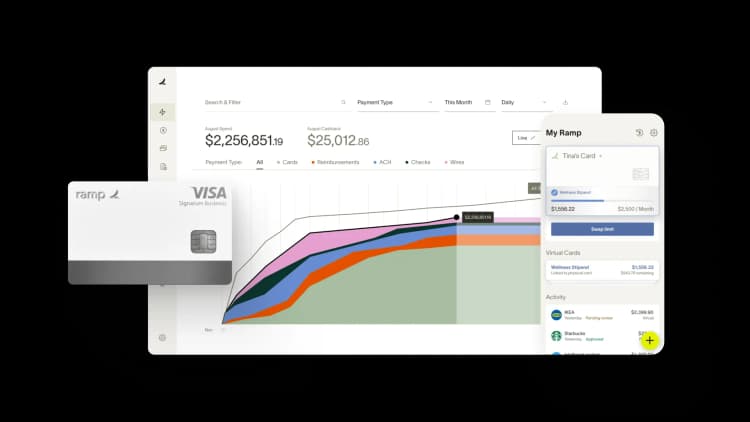

The Ramp Business Credit Card combines cashback rewards with built-in expense management, so you earn value without adding operational complexity. Instead of juggling cards, receipts, and approvals, you manage spend and rewards in one place.

Ramp gives you unlimited physical and virtual corporate cards, automated expense tracking, customizable approval workflows, and direct accounting integrations. Finance teams use Ramp to gain real-time visibility into spending, enforce policies, and reduce manual work across the month-end close.

Companies using Ramp have saved over $10 billion and 27.5 million hours by pairing smarter spend controls with automation. Explore how it works with an interactive product tour.

FAQs

No. Cashback is a percentage of money you’ve already spent that’s returned to you as a reward. You only earn cashback by making purchases, so you’re still paying most of the cost out of pocket.

It depends on the issuer. Some cards offer cashback that never expires while the account is open, while others impose expiration dates or forfeit rewards when the account closes. Always check your card’s terms.

Generally no. Cashback at checkout is typically a debit card feature. Credit card cashback refers to rewards earned on purchases, not cash dispensed at the register.

Multiply the purchase amount by the cashback rate: $1,000 * 0.015 = $15 in cashback rewards.

Cashback earned from spending is generally treated as a rebate, not taxable income. However, sign-up bonuses that don’t require spending may be taxable. For business use, treatment can vary, so consult a tax professional.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°