- Why AP is harder in construction than other industries

- Why accounts payable is uniquely complex in construction

- How AP automation benefits construction companies

- What construction finance teams should look for in AP software

- How Ramp Bill Pay can automate AP for construction

- AP automation success stories from construction companies

- Start automating AP with Ramp Bill Pay

If you manage accounts payable in construction, you're dealing with challenges most industries don't face. Project-based expenses, decentralized teams, varied vendor relationships, and strict compliance obligations make your AP process far more complicated. Manual processes turn this complexity into delayed payments, missed discounts, and increased risk.

To solve these problems, you need accounts payable automation software built for construction. The right AP system should offer mobile-friendly invoice approvals, integrations with major accounting platforms, secure document management, and flexible payment scheduling.

Here's a breakdown of what to look for when picking AP tools as a construction company.

Why AP is harder in construction than other industries

Construction AP is more layered than in most industries because payments must be managed across multiple, concurrent projects where each involve its own set of vendors, timelines, and payment conditions.

Core challenges in AP for construction companies include:

- Multi-project tracking: Teams need to accurately associate costs with specific job sites. Standard AP systems often lack the flexibility to handle the variation in payment terms and approval structures that exist across different projects.

- Diverse vendor types: Projects typically involve subcontractors, materials suppliers, and rental providers, each with their own billing expectations and documentation needs.

- Compliance documentation: Finance teams must collect, verify, and store, W-9s and other forms which are often categorized by both project and vendor.

- Field-based approvals: Many invoices need to be reviewed by job-site personnel. Without digital workflows, these approvals are often delayed due to paper-based processes or limited connectivity.

These factors create a heavy administrative burden and increase the likelihood of issues such as higher error rates due to repeated manual entry, approval delays when invoices rely on paper routing, and unpredictable cash flow from bottlenecks in processing.

Why accounts payable is uniquely complex in construction

Construction AP is more layered than in most industries because payments must be managed across multiple, concurrent projects—each involving its own set of vendors, timelines, and payment conditions.

Core challenges in AP for construction companies include:

- Multi-project tracking: Teams must accurately associate costs with specific job sites. Standard AP systems often lack the flexibility to handle the variation in payment terms and approval structures that exist across different projects.

- Diverse vendor types: Projects typically involve subcontractors, materials suppliers, and rental providers, each with their own billing expectations and documentation needs.

- Conditional payment terms: Practices like retention, milestone-based billing, and progress payments require confirmation of work completed before invoices can be processed.

- Compliance documentation: Finance teams must collect, verify, and store lien waivers, W-9s, insurance certificates, and other forms—often categorized by both project and vendor.

- Field-based approvals: Many invoices need to be reviewed by job-site personnel. Without digital workflows, these approvals are often delayed due to paper-based processes or limited connectivity.

These factors create a heavy administrative burden and increase the likelihood of issues such as higher error rates due to repeated manual entry, approval delays when invoices rely on paper routing, and unpredictable cash flow from bottlenecks in processing.

Here’s how these issues map to broader risks for construction companies:

Pain point | Category | Impact |

|---|---|---|

Multi-project tracking | Financial visibility | Inaccurate cost allocation |

Diverse vendor management | Vendor relationships | Inconsistent payment processes |

Complex payment terms | Cash flow | Unpredictable payment timing |

Compliance documentation | Legal/regulatory | Risk of liens and audit issues |

Field-based approvals | Operational efficiency | Delayed processing |

Manual data entry | Accuracy | Higher error and rework rates |

Paper-based processes | Visibility | Limited real-time insights |

How AP automation benefits construction companies

Accounts payable in construction means maintaining the momentum of complex, multi-site operations. With tight timelines, the traditional invoice-to-payment cycle quickly becomes a liability when handled manually.

Here's how the benefits of adopting AP automation helps construction finance teams:

- Faster workflows with fewer bottlenecks: Automation tools minimize repetitive tasks like invoice data entry and manual routing

- Fewer errors, better audit trails: Systems that automatically capture and validate invoice details help reduce mismatches, prevent duplicate payments, and keep compliance documentation organized by vendor and project

- Lower processing costs: Cutting down on paper handling, manual reviews, and rework leads to more efficient use of headcount—and fewer late fees or missed early payment discounts

- Stronger supplier coordination: Consistent, on-time payments improve working relationships with subcontractors and materials suppliers

- Smarter cash flow visibility: Automation makes it easier to forecast liabilities, schedule payments by due date or project milestone

- Centralized financial insight: With all payables data in one system, finance teams can track spend across projects

What construction finance teams should look for in AP software

Here are some of the most important features to consider when choosing AP automation software as a construction company.

- Automated invoice intake and extraction: Look for tools that scan and digitize invoices from multiple formats—paper, email, PDF—and extract key fields automatically

- Project-aware approval workflows: Invoices should be routed based on criteria like dollar threshold or department—ideally with mobile approval options

- Invoice and PO matching: Built-in logic to match invoices to purchase orders to flag discrepancies early and reduce manual review time

- Vendor record and document management: Centralized vendor profiles with attached W-9s

- Payment automation and control: Ability to schedule payments by method (ACH, check, card, wire) and by due date

- Customizable reporting and dashboards: Visibility into approvals, spend by vendor, and historical payments

- Accounting and ERP integrations: Seamless sync with systems like QuickBooks, NetSuite, or Sage Intacct ensures financial data stays accurate and up to date

- Granular permissions and audit controls: Role-based access and full audit trails help enforce internal policies and external compliance requirements

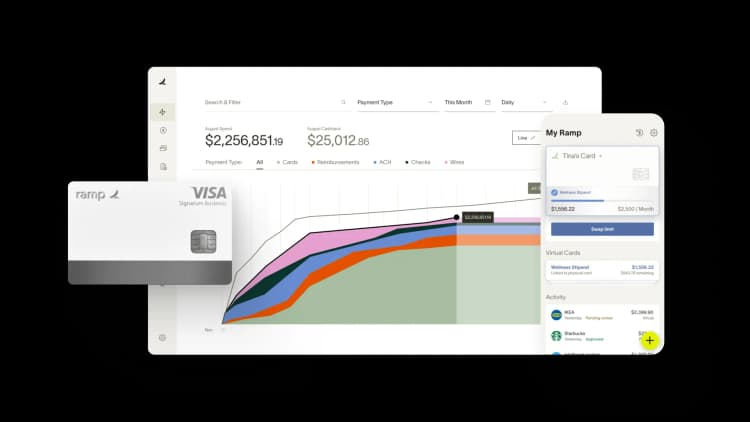

How Ramp Bill Pay can automate AP for construction

Ramp Bill Pay is accounts payable software that automates the entire AP lifecycle—from invoice intake and approval routing to payment execution and accounting sync. The platform includes automated invoice capture via OCR, two-way matching, configurable approval workflows, scheduled payments via ACH, check, or card, and real-time ERP integrations.

You can approve invoices from your mobile device and code expenses on the go, making it easy to manage AP whether you're in the office or on a job site. Each feature helps you eliminate bottlenecks and reduce risks that come with manual AP processes.

Automated invoice capture

Ramp Bill Pay uses OCR technology to automatically extract vendor details, invoice numbers, dates, amounts, and line items from various invoice format. You'll spend less time on data entry and reduce the risk of payment errors, helping your AP team keep pace with job site activity.

Expense tracking and coding

Ramp Bill Pay provides configurable rules and custom fields for expense categorization. When integrated with your accounting system, you can automatically assign invoices to specific departments, categories, or projects. Every invoice gets properly attributed, making expense tracking more reliable and less time-consuming.

Approval workflows

Ramp supports configurable, role-based approval workflows with routing options based on amount, department, or category. Your team can review and approve payables from any location using their mobile devices, helping you avoid bottlenecks and keep payments on schedule.

Flexible payment scheduling

Managing these complex payment terms with spreadsheets or disconnected tools makes it hard to match payment timing with project cash flow and contract obligations.

You can schedule payments by due date or batch-process them with Ramp Bill Pay. This makes it easier to align payments without juggling multiple systems.

Vendor management

Ramp Bill Pay centralizes vendor information and document storage for W-9s and 1099 vendor tax data. You can verify documentation before releasing payments and simplify preparation for audits or compliance checks.

Integrations with construction management and accounting platforms

Ramp integrates with whichever accounting system your construction business uses—so you can reconcile your books without friction. Ramp offers over 200+ direct integrations, including connections with leading platforms like NetSuite, QuickBooks Online, Sage Intacct, and Acumatica, enabling real-time sync of vendor bills, reimbursements, payments, and accounting fields. Select systems also support bi-directional sync for vendor bills and imported item receipts.

For platforms without native integrations—like Viewpoint Vista and Viewpoint Spectrum—Ramp provides Universal CSV (uCSV) exports that match your chart of accounts, tracking categories, and project codes for seamless reconciliation. Ramp also offers a robust API and trusted implementation partners to support custom integrations when needed.

Reporting and analytics

Ramp provides visibility into expenses, approvals, and payment status with reporting that you can segment by custom fields. When integrated with your accounting system, you can track spending and support more proactive financial management without waiting for month-end close.

Low pricing and processing fees

Ramp offers a free plan that lets you manage spend, automate vendor payments, and speed up your month-end close. For businesses with more advanced needs, Ramp Plus is available at $15 per user per month, and custom Enterprise plans are also available upon request. Plus, you can handle all domestic and global vendor payments on a single platform—by check, card, ACH, or international wire with zero fees*.

AP automation success stories from construction companies

From speeding up invoice approvals to cutting check volume and payment delays, here's how these three construction companies automated their AP processes with Ramp Bill Pay.

1. How Roof Squad saved 10+ hours per week with Ramp Bill Pay

Roof Squad’s AP process was heavily manual—staff had to route invoices from their CRM into bill pay tools, reconcile records in QuickBooks, and constantly shift money between bank accounts to ensure vendors were paid on time. With limited payment flexibility from their traditional bank and little automation across invoice intake or approvals, the risk of late payments was constant.

After adopting Ramp Bill Pay, the team integrated their existing CRM workflows and enabled automated invoice ingestion and job costing. For Roof Squad, invoice processing that once took hours became a few clicks. Errors dropped, and the team saved more than 10 hours each week on bill processing alone.

Same-day ACH payments through Roof Squad’s Ramp Business Account also gave them the flexibility to pay vendors exactly when needed—without having to preemptively move money between systems. By centralizing all their payments, records, and workflows on Ramp, they also eliminated late payments entirely.

“The way bill pay works now is super easy… Now it’s just a couple clicks away, saving us about 10 hours a week and reducing the number of errors we make.” — Alejandro Calderon, CFO at Roof Squad

2. How Bratjen Construction streamlined invoice approvals with Ramp Bill Pay

Bratjen’s AP process was time-consuming and error-prone—approvals were routed manually, invoice data was marked up in PDFs, and checks were written by hand with job codes added in pen. For higher-dollar invoices, back-and-forth email approvals often delayed payments and created confusion about who authorized what.

That’s where Ramp Bill Pay helped Bratjen fully digitize and automated its AP workflow. Now, invoices are uploaded directly into Ramp, where vendor info auto-populates and each invoice is routed based on amount: smaller bills are auto-paid, while larger ones trigger project manager or senior leadership approvals. This structure has improved controls, reduced payment errors, and flagged unnecessary charges before money goes out the door.

Instead of manually writing and reconciling 100 checks each month, Bratjen’s team now exports a clean CSV of bill payments to their accounting system—freeing up hours of manual effort and improving accuracy.

“Before we would have to pay an invoice and mark up a PDF with all that information. Now everything’s just a click of a button. As soon as we get an invoice now, we can drag it over into Bill Pay and populate all the vendor information.” — Michael Irvin, Director of Operations at Bratjen Construction

3. How Viking Well Service improved AP visibility with Ramp Bill Pay

Viking Well Service had heavily manual AP processes, requiring its controller to spend hours each week digging through fragmented invoices, payment records, and purchase approvals. Without a centralized system, bills and purchase orders were disconnected—making it difficult to track payment status or maintain oversight of large equipment purchases.

With Ramp Bill Pay, Viking consolidated its purchase orders and bills into a single platform. The AP team can now match payments to POs, track what’s been paid or is still outstanding, and rely on a simplified, single-approval workflow. This has improved visibility into spend and eliminated the need for repetitive invoice follow-ups.

Month-end close, which once took over a week due to missing card statements and manual coding, now happens in just two days. And because transactions are automatically categorized and visible in real time, Viking’s finance team can focus on planning rather than chasing paperwork.

“Having the purchase order and bills all in one place just makes a whole lot more sense… It’s really important for control purposes, for visibility.” — Chris Lowdermilk, Senior Controller at Viking Well Service

Start automating AP with Ramp Bill Pay

Ramp Bill Pay helps construction companies bring together invoice capture, approvals, payments, and compliance tracking in one system to support the pace and complexity of construction work.

Want to see how it fits into your workflows? Get started with Ramp Bill Pay.

*Same-day ACH payments and International payments may incur a fee unless you are using a Ramp Business Account. Ramp Bill Pay is available on our free plan with no software or transaction fees. Note that certain ERP integrations require a Ramp Plus account, which includes a monthly fee.

FAQs

Ramp Bill Pay is Ramp’s name for its accounts payable software—a modern AP automation system that helps finance teams manage invoices, streamline approvals, and make vendor payments all in one place. It automates manual AP tasks, syncs directly with accounting systems like NetSuite, QuickBooks, and Sage Intacct, and gives businesses real-time visibility and control over spend.

Learn how your team can simplify and automate AP on our official Ramp Bill Pay page.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group