7 benefits of business credit cards

- What is a business credit card?

- Why get a business credit card?

- Key benefits of business credit cards

- Business credit cards vs. personal credit cards

- How to choose the right business credit card

- Learn how the Ramp Business Credit Card can transform your business

There are several benefits to having a business credit card, including earning rewards, building business credit, separating personal and business finances, and accessing higher credit limits.

In this article, we break down the key advantages of business credit cards, which benefits can make the biggest impact on your company’s finances, and how to choose a card that best aligns with your business needs.

What is a business credit card?

A business credit card is a financial tool designed specifically for business expenses rather than personal spending. While it works much like a personal credit card, letting you make purchases and pay them off later, it’s tailored to the needs of businesses. The key difference is that it helps establish and build a business credit profile, which is separate from your personal credit history.

Business credit cards are available to a wide range of applicants, from freelancers and sole proprietors to LLC owners, startups, and established companies. You don’t need a large operation to qualify—many credit card issuers accept applications from individuals who are just starting out, as long as they have a business purpose for the card.

Why get a business credit card?

Getting a business credit card allows you to separate business expenses from personal spending, simplifying your accounting and reducing headaches at tax time. These cards also come with higher credit limits than most personal cards, giving your company greater purchasing power and flexibility to manage cash flow more effectively.

Another reason to consider a business credit card is the rewards. Many cards offer cashback, points, or miles on eligible purchases, so you earn value back on the money your business spends. Plus, responsible use builds your business credit profile, which can make it easier to qualify for loans, negotiate better terms with vendors, and secure favorable interest rates.

Beyond the basics, business cards often include features to support growth, such as expense management tools that simplify bookkeeping and provide greater visibility into spending.

Key benefits of business credit cards

Business credit cards come with a range of benefits that can help simplify your business finances and unlock valuable perks. Here’s a closer look at the main benefits of having a business credit card:

1. Separate business and personal expenses

Using a business credit card allows you to keep business and personal expenses separate. By dedicating a credit card solely to business purchases, you simplify your accounting and make tax preparation easier.

You distinctly categorize each transaction, reducing the chance of mistakenly mixing personal costs with business expenses. This clarity supports accurate bookkeeping and aids in creating a reliable financial record, which is valuable when applying for loans or managing budgets.

Separating business and personal spending also helps protect your personal credit. While business credit activity can impact your creditworthiness, maintaining a clear boundary between the two allows you to focus on building a strong business credit profile without exposing personal assets.

2. Build business credit history

A good business credit score helps set your company up for long-term success. It can improve your eligibility for business loans, secure more favorable interest rates, and even impact vendor relationships, making it easier to establish trade lines and negotiate payment terms. Opening a business card and paying on time is an effective way to build and maintain your business credit.

Additionally, most small business credit cards do not report to personal credit bureaus unless there is a delinquency. This separation helps protect your personal credit, even if balances are high during periods of significant spending.

3. Access higher spending limits and flexible terms

Business credit cards generally come with higher credit limits than personal cards, which gives your company greater purchasing power. This flexibility supports growth by making it easier to cover large expenses, smooth out cash flow gaps, and invest in essential tools or inventory without relying on short-term loans.

Some business credit cards also offer flexible repayment options, such as 0% introductory APR periods on purchases, balance transfers, or both, which can further ease cash flow management.

4. Earn business credit card rewards

One particularly valuable benefit of business credit cards is the ability to earn rewards on purchases, whether it’s cashback, points, or miles.

Cashback business credit cards are straightforward. A percentage of your spending goes back into your account, and you can typically cash it out or use it as a statement credit to offset future expenses.

Credit card points and miles may offer greater flexibility or value if you redeem for travel, as many issuers offer transfer partner programs that boost your rewards' value.

Many cards also include sign-up bonuses or ongoing promotional offers, giving you even more value. These perks can offset business expenses and turn purchases into long-term savings.

5. Access partner rewards and perks

Partner rewards are vendor discounts in the form of credits, percentages off, or exclusive access to services. They’re distinct from standard credit card rewards programs, as they are not accrued by card spend but are perks you receive when you open an account.

Partner rewards can save you thousands of dollars on everyday business-related expenses, such as software subscriptions, office supplies, or cleaning services. To get the most immediate bottom-line value, look for partner rewards that offer discounts on services you already use.

Say you’re already using Amazon Web Services (AWS). Look for cards that offer AWS credits and discounts or general business subscription credits to help you reduce AWS costs.

6. Issue employee cards and customize spend controls

Many business credit cards offer free employee cards with customizable spending limits. These controls let you decide who can spend, how much, and on what types of purchases, which helps you enforce expense policies and reduce misuse.

Some issuers even allow unlimited employee cards, including virtual cards for one-time purchases. This eliminates the need for sharing cards and improves your visibility into spending.

7. Streamline expense tracking and management

The best business credit cards offer built-in tools to help you track expenses by category, employee, or project. These are typically corporate card benefits and integrate directly with your accounting software, making bookkeeping faster and more accurate.

Some even include receipt capture features, so employees can upload photos of receipts that automatically sync with your records.

Business credit cards vs. personal credit cards

Business credit cards are designed for company expenses and often come with higher spending limits, expense-tracking tools, and rewards tailored to business spending categories such as office supplies, advertising, or business travel.

Personal or consumer credit cards, on the other hand, are structured for everyday individual spending and report directly to consumer credit bureaus. Business cards typically report to commercial or business credit bureaus instead, which helps you build a business credit profile separate from your personal score.

If you’re a freelancer, startup, or growing company with regular expenses, a business credit card can protect your personal credit and provide higher limits with business-focused perks. Personal cards may work for small side hustles, but once spending is consistent, the benefits of a business card usually outweigh those of a personal one.

Discover Ramp's corporate card for modern finance

How to choose the right business credit card

Choosing the right business credit card comes down to matching the card’s features with your company’s needs. Here are some key factors to weigh before applying:

- Rewards structure: Look for a card that offers rewards where your business spends the most. For example, if you travel frequently, a points- or miles-based card with lounge access or hotel perks may be best. If your expenses are broad, flat-rate cashback could deliver the most value.

- Fees and interest rates: Pay attention to annual fees, foreign transaction fees, and the card’s APR. Some cards come with a 0% introductory APR, which can be useful if you plan to finance large purchases in the short term.

- Credit requirements: Most business credit cards require good to excellent credit, and many ask for a personal guarantee. Startups and new LLCs may need to rely on the owner’s personal credit until they build a separate business credit profile.

- Business tools and benefits: Beyond spending power, consider features such as expense tracking, employee card controls, accounting software integrations, and partner discounts. These extras can help streamline your financial management.

Learn how the Ramp Business Credit Card can transform your business

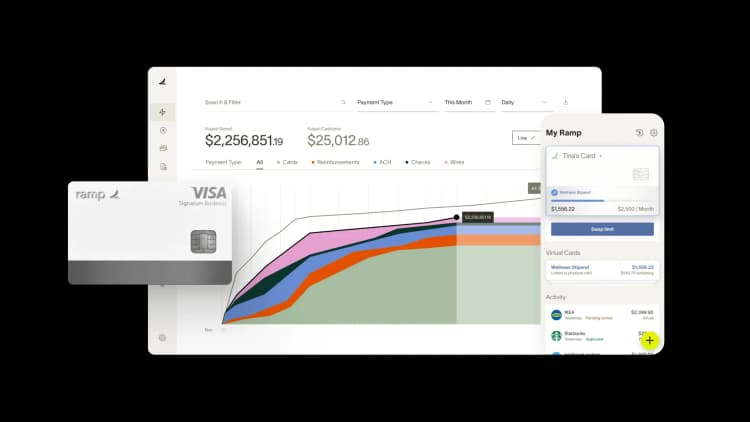

Whether you’re a small business owner, entrepreneur, or enterprise finance manager, the Ramp Business Credit Card offers valuable benefits like cashback rewards, custom spending controls, and seamless expense tracking, helping you save money and simplify financial management.

Our business credit card offers:

- Unlimited physical and virtual employee cards

- Built-in expense management software

- Customizable employee spending limits

- AI-powered insights to optimize your business cash flow

- Over $350,000 in exclusive partner rewards and offers

The Ramp Business Credit Card doesn't require a personal guarantee and has no interest, annual fees, or foreign transaction charges. Apply using just your EIN and get approved in under 48 hours.

Explore a demo to learn more about how Ramp can benefit your business.

FAQs

Many business credit cards require a personal guarantee, meaning you may be personally liable for the debt. Misuse or late payments can also hurt your business and personal credit.

It’s not recommended. Mixing personal and business expenses complicates bookkeeping, can cause tax issues, and may even violate the card’s terms of service. Keeping them separate protects both your records and your credit.

Business credit cards provide short-term financing by letting you spread out payments, often with higher credit limits than personal cards. Rewards, partner discounts, and 0% intro APR offers can also reduce costs and free up cash for other priorities.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°