Business credit cards vs. debit cards: Which is better for your business?

- Business credit cards vs. debit cards at a glance

- What is a business credit card?

- What is a business debit card?

- Key differences between business credit and debit cards

- Which is better for managing business expenses: A business credit card or a debit card?

- Unlock savings and control with the Ramp Business Credit Card

A business credit card offers a line of credit to make purchases, which can accrue interest if you don’t pay off the balance. A business debit card draws funds directly from your company's bank account with no credit involved.

Below, we'll outline the similarities and differences between business credit cards vs. debit cards so you know what to expect with each of these payment methods.

Business credit cards vs. debit cards at a glance

Business credit cards provide access to a revolving line of credit you can use for purchases and repay later, often with the opportunity to earn rewards and build credit. Business debit cards, on the other hand, tie directly to your business checking account and allow spending only from your available funds.

Feature | Business credit card | Business debit card |

|---|---|---|

Primary function | Short-term financing and cash flow management | Direct spending and budget control |

Funds source | Line of credit (borrowed funds) | Business checking account (own funds) |

Credit building | Helps establish and improve business credit | Does not affect business credit |

Expense management | Allows setting limits on employee cards and tracking expenses | Directly deducts from account, simplifying budgeting |

Cash flow flexibility | Can use for large purchases and paid off later | Limited to available account balance |

Rewards & benefits | Offers cash back, travel rewards, and purchase protections | Typically, no rewards or limited perks |

Risk of debt | Can accumulate interest if you don’t pay in full | No risk of debt or interest charges |

Fraud protection | Strong fraud protection with zero-liability policies | Some protection, but direct account access poses risk |

Best for | Businesses looking for financial flexibility, rewards, and credit building | Businesses that prefer direct, controlled spending without borrowing |

While both facilitate business transactions, their functions and best-use scenarios differ significantly.

What is a business credit card?

A business credit card functions as a short-term financing tool, allowing you to make purchases without immediately drawing from your bank account. It extends a line of credit, providing financial flexibility to cover cash flow gaps, unexpected expenses, or large purchases.

Like personal credit cards, business credit cards operate on a monthly billing cycle. You can pay the balance in full to avoid interest or make minimum payments and carry a balance, though interest will accrue. Unlike personal cards, they often come with higher credit limits, tailored rewards, and the ability to build a separate business credit history.

Pros of business credit cards

- Credit building: Helps your business establish and improve its credit history, which is essential for securing loans and favorable financing terms

- Working capital management: You can make necessary purchases even when cash is temporarily tight, then pay off the balance later

- Expense optimization: Many credit cards offer rewards programs, cardholder sign-up bonuses, and business-related perks that can reduce overall costs

- Employee spending control: You can issue employee credit cards with set spending limits, making it easier to manage team expenses

- Fraud protection and insurance: Business credit cards generally include strong protections against unauthorized charges, as well as benefits such as extended warranty coverage, purchase protection, and travel insurance

Cons of business credit cards

- Interest charges: If you don’t pay your balance in full, it will accrue interest, adding to your business costs

- Fees: Many business cards carry annual fees, late payment fees, or foreign transaction fees

- Credit risk: Mismanaging your business credit card or overspending can negatively affect your business credit and, in some cases, your personal credit as well

What is a business debit card?

A business debit card is a direct spending tool tied to your business checking account. It ensures all transactions are backed by available funds, making it a good option if your business focuses on simple budgeting and spending discipline. Unlike a credit card, it doesn't involve borrowing; funds immediately move from your account.

Pros of business debit cards

- Immediate fund access: Transactions move directly from your business account, ensuring real-time spending control

- Simplified expense management: Since the card limits purchases to your available balance, your business can avoid debt and interest charges

- Operational efficiency: Debit cards are useful for everyday business purchases such as office supplies, software subscriptions, and day-to-day incidental expenses

- Cash access: You can use debit cards for ATM withdrawals, providing quick access to your business’s funds when needed

Cons of business debit cards

- No credit-building: Debit card usage does not help establish or build business credit

- Fewer rewards and perks: Business debit cards usually lack the rewards programs and benefits that credit cards provide

- Overdraft risk: If your spending exceeds the available account balance, overdraft fees may apply

Discover Ramp's corporate card for modern finance

Key differences between business credit and debit cards

Business credit cards and debit cards have some key differences that can affect your business's financial strategy. These differences range from transaction handling to fees, rewards, and credit-building potential.

Borrowing vs. immediate payment

Business credit cards allow you to make purchases on credit, offering a grace period before the repayment due date. Each purchase draws from your available credit limit, which is usually set up front when you're approved for the card. If you pay your balance in full by the due date, you won’t be charged any interest.

In comparison, debit cards directly fund payments from your business checking account. This immediate deduction means there's no borrowing or interest rates to worry about, but it also means you need sufficient funds available in your account to avoid overdraft fees.

Different fee structures

Business credit cards often come with a range of fees, including annual fees, late payment fees, and fees on foreign transactions. Some cards also charge fees for balance transfers and cash advances, all of which can add up.

Business debit cards typically have fewer fees. Common fees may include monthly maintenance fees, ATM withdrawal fees, and, in some cases, transaction fees if you exceed the maximum number allowed per month. These fees tend to be lower and less complex than those of credit cards.

Building business credit

Business credit cards offer an opportunity to build and improve your business credit score. As long as you use your business credit card responsibly by making timely payments, you’ll improve your business’s creditworthiness over time.

A good business credit score is crucial for accessing business loans and other forms of credit. In contrast, business debit cards don’t contribute to building credit since they don’t involve borrowing or credit reporting, limiting their impact on your business's credit profile.

Does a business card in your name affect your credit?

A business credit card in your name can affect your personal credit if the card issuer reports your account activity to the consumer credit bureaus. Some issuers only report negative information, such as missed payments, while others report all activity, impacting your credit score accordingly.

Rewards and perks

There are many types of rewards cards, all with different programs and earning structures. Some offer credit card points or cashback on business purchases, while others earn miles on travel-related purchases. These rewards can help lower costs, provide perks you can reinvest into operations, or even fund future business travel and employee incentives.

Business debit cards usually lack rewards programs. While they offer simple and direct spending, you miss out on the additional perks that come with credit card rewards, which can be a strategic asset for maximizing your spending efficiency.

Security and fraud protection

Business credit cards generally offer stronger fraud protection, including zero-liability policies and fraud alerts. Debit cards also provide fraud protection, but since they link directly to your business checking account, unauthorized charges can more immediately impact your funds.

Which is better for managing business expenses: A business credit card or a debit card?

The best choice between a business credit card and a business debit card depends on your company’s financial needs and spending habits.

In reality, using both can be the smartest approach. A credit card can help with larger purchases, building business credit, earning rewards, and managing cash flow when revenue is unpredictable. For example, if you’re looking to expand or rely on seasonal income, a credit card can help smooth out cash flow while you also benefit from earning rewards.

A debit card keeps operational spending straightforward and controlled. It’s a strong fit if you have steady cash reserves, want to avoid debt and interest, and primarily need to cover day-to-day expenses such as office supplies or subscriptions.

Unlock savings and control with the Ramp Business Credit Card

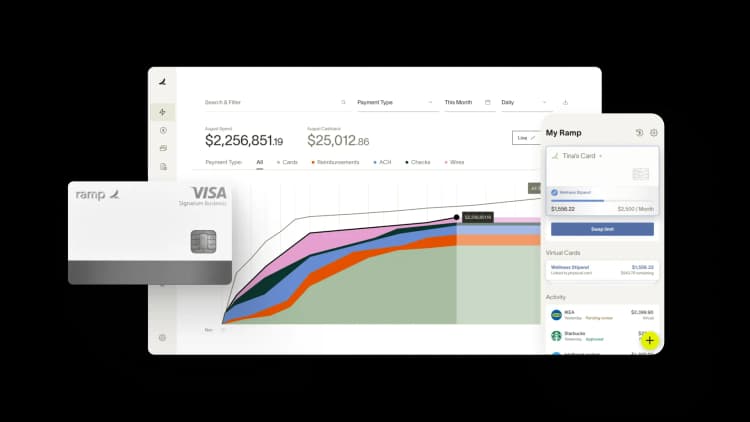

The Ramp Business Credit Card is a fee-free alternative to traditional business credit cards. Like most credit cards, you can use Ramp at any retailer while building your business credit score. But unlike traditional cards, there’s no credit check and no annual fees—all you need to qualify is a registered business and $25,000 in any U.S. business banking account.

Ramp's cards come with built-in expense management software to help you track and control spending. Ramp also simplifies the process of setting up an employee card program with unlimited free physical and virtual cards.

Try an interactive demo to learn more about how Ramp can streamline your business finances and help you save 5% a year across all spending.

FAQs

You generally need to own or operate a business, startup, side hustle, or freelance activity to qualify. Lenders may also check your personal credit and business finances before approval.

A business credit card can be a smart move for an LLC. It helps separate business and personal finances, builds business credit, and may provide rewards and expense management tools.

Using a personal credit card for business expenses isn’t a good idea. Mixing personal and business expenses can complicate taxes and hurt bookkeeping accuracy. It also won’t help you build business credit. A dedicated business card is the better option.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits