- How does AP automation work with NetSuite?

- Why automate accounts payable in NetSuite?

- What to consider when choosing AP automation tools to use with NetSuite

- The top 4 AP automation solutions for NetSuite

- How to integrate AP automation solutions with NetSuite

- Best practices for setting up AP automation software

- Take control of your AP process: Summary and next steps

- Integrate NetSuite with Ramp’s AP automation software

If your business runs on NetSuite ERP, you already have access to built-in accounts payable (AP) functionality—such as invoice entry, payment processing, and some workflow automation. This native functionality supports day-to-day AP tasks within a unified financial system.

For businesses looking to expand on those capabilities—whether to streamline approvals, improve payment flexibility, or reduce manual work—NetSuite also supports integrations with a range of AP automation tools. These solutions can enhance front-end workflows while keeping NetSuite as your single source of truth. Here’s our breakdown of the best solutions for a NetSuite-compatible AP automation integration.

How does AP automation work with NetSuite?

NetSuite provides foundational AP functionality as part of its ERP platform, including invoice management, vendor records, and payment execution. External AP automation solutions can expand NetSuite’s core modules with more advanced AI-powered invoice capture, smart approval routing, or seamless multi-entity support via native or custom integrations.

When integrated correctly, an AP automation solution works in tandem with NetSuite to streamline the full invoice-to-payment process. Here’s what that typically looks like:

- Invoice capture and data extraction: The AP solution automatically ingests invoices (via email, uploads, or portals), uses OCR and AI to extract relevant data, and syncs this information directly to NetSuite to reduce manual data entry

- Approval workflows: Instead of manually routing invoices for review, automation tools apply custom rules to route approvals based on vendor, amount, department, or other logic—while syncing status updates back to NetSuite

- Payment execution: Once invoices are approved, payments can be initiated directly from the AP platform using various methods (ACH, virtual cards, checks), while ensuring payment records and statuses flow back into NetSuite

- Reconciliation and audit trails: Robust AP platforms automatically match invoices with purchase orders or receipts, flag discrepancies, and provide detailed audit trails—all while updating NetSuite in real time

With the right AP automation solution integrated into NetSuite, teams can improve visibility, reduce human error, and cut AP processing costs significantly—sometimes by as much as 80%. But to realize these benefits, the integration must be seamless. Poorly integrated tools can introduce silos or require duplicative work. In contrast, a strong NetSuite integration ensures all AP activity remains connected to your ERP, so NetSuite continues to serve as your core financial system.

Why automate accounts payable in NetSuite?

Using NetSuite’s core AP features in tandem with third-party AP automation integrations allows for deeper efficiency, accuracy, and control. By streamlining invoice intake, approvals, and payments, automation reduces manual work, cuts costs, and minimizes errors that can disrupt reporting or vendor relationships.

For finance leaders, it also brings real-time visibility into cash outflows and commitments—making forecasting more accurate and freeing up cash that would otherwise sit in reserve. Meanwhile, AP teams benefit from faster cycle times and fewer headaches at month-end close or during audits. Ultimately, layering automation into your NetSuite environment helps shift your team focus less on data entry and more on managing spend, strengthening supplier partnerships, and driving business value.

What to consider when choosing AP automation tools to use with NetSuite

When choosing an AP automation solution to use with NetSuite, it’s important to consider how seamless the integration is, scalability, compliance, and of course, vendor support and ROI.

Integration methods

AP automation solutions connect to NetSuite ERP using several methods, and each has different implications for your business:

- Native integration: This type of solution works directly within NetSuite as a SuiteApp. While it provides a seamless user experience without sync concerns, it may offer less functionality than a standalone solution

- API integration: This method connects external AP platforms to NetSuite, like Ramp Bill Pay, through its programming interfaces. It provides great flexibility and robust features with real-time data exchange, but it requires careful API management as NetSuite issues updates

- Connector-based integration: This approach uses pre-built middleware to facilitate communication between systems. It simplifies implementation but may limit customization compared to a direct API integration

Make sure to choose an integration method that’ll enable a seamless syncing process.

Scalability and global support

The AP automation solution you choose to integrate with NetSuite should be able to grow with your business and function wherever you operate. When evaluating options, you should consider several key questions:

- Can the solution handle a significant increase in invoice volume without slowing down?

- If you're a multi-subsidiary organization, does it support multiple NetSuite instances and allow for cross-subsidiary reporting?

- Does it properly support your international currencies, payment methods, and local tax regulations?

- Can it process invoices in multiple languages and comply with country-specific e-invoicing requirements?

- Does it allow for different approval workflows by region while still maintaining centralized visibility?

Security and Compliance

Payment security and regulatory compliance are paramount. You should look for NetSuite AP integrations that provide strong fraud prevention features, including segregation of duties, approval thresholds, and anomaly detection. SOC 1 and SOC 2 compliance is also important to ensure the security of financial reporting and data protection. Complete audit trails and easily accessible compliance documentation is also a must.

Vendor support and ROI

You should also assess the vendor's implementation support, training resources, and ongoing customer service. It's a good idea to ask for references from NetSuite customers of a similar size to understand their real-world experiences.

To project your return on investment, calculate your expected ROI by comparing current processing costs with the costs of automation. Be sure to include both hard savings (like labor, paper, and postage) and soft benefits (like capturing early payment discounts and reducing fraud).

The top 4 AP automation solutions for NetSuite

NetSuite includes AP capabilities out of the box, and with integrations purpose-built with AP automation tools to simplify workflows, businesses can easily improve data accuracy and reduce manual overhead even further. Here’s a breakdown of four leading AP automation platforms to use with NetSuite.

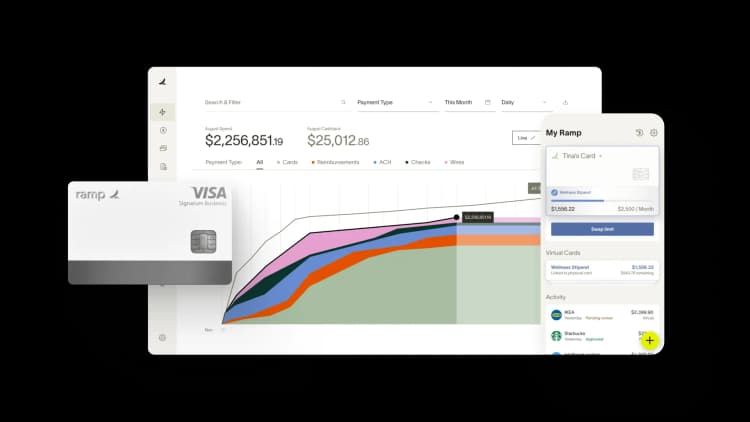

1. Ramp

Ramp is a modern finance automation platform that offers a direct API integration as a vetted Built for NetSuite partner, enabling seamless, two-way synchronization of AP data, accounting fields, and more. Ramp Bill Pay—Ramp’s embedded AP software—is purpose-built to streamline invoice intake, approvals, and payments within a NetSuite environment. With features like AI-powered invoice capture, smart approval workflows, and support for ACH, check, and virtual card payments, Ramp helps AP teams reduce manual work while keeping NetSuite as their source of financial truth.

In more detail, Ramp’s NetSuite ERP integration:

- Consolidates procurement, accounts payable, expense management, travel booking, and treasury

- Manages all global NetSuite entities in one Ramp multi-entity environment

- Syncs accounting fields, transactions, reimbursements, payments, cashback, purchase orders, vendor bills, vendor bill payments and credits in real time via Ramp’s API

- Processes vendor bills from start to finish: initiate your process in either NetSuite or Ramp, and complete it with Ramp payments

- Eliminates manual verification with Ramp’s 3-way matching of purchase orders, receipts, and invoices

- Provides seamless integration with NetSuite as a vetted Built for NetSuite partner, ensuring the solution meets the same level of standards for security, data privacy and overall quality as those offered by NetSuite

Integration method: Ramp connects to NetSuite via an API integration. It uses a dedicated connector to sync vendors, accounting fields, transactions, and other master data. This integration is bi-directional, which keeps NetSuite data current without requiring manual work.

Pricing model: NetSuite integration is a part of Ramp’s Plus pricing, starting at $15 per user per month, with platform fees based on team size.

Business size guidance: Small businesses benefit from the platform's easy entry point and minimal implementation complexity. Mid-market companies and enterprise customers can also scale effectively with Ramp when dealing with moderate invoice volumes.

We’ve also put together a list of Ramp and NetSuite common questions to help you get started.

2. DocuPeak

DocuPeak offers native NetSuite AP automation as a certified SuiteApp, which provides deep integration with NetSuite's own workflows and user interfaces. Its key features include document management, customizable approval matrices, and comprehensive audit trails.

Integration method: As a native SuiteApp, DocuPeak operates directly within the NetSuite environment. This approach reduces synchronization issues and provides real-time access to NetSuite data.

Pricing model: DocuPeak does not require extra NetSuite licenses to view documents.

Business size guidance: Mid-sized companies and enterprise customers can benefit from DocuPeak's balance of functionality and usability. Small businesses, however, may find it more complex than necessary, though simplified packages are available.

3. Quadient AP Automation by Beanworks

Quadient AP Automation by Beanworks (Quadient acquired Beanworks in 2021) is an AP automation platform that offers procure-to-pay and invoice-to-cash for NetSuite users. Its key features include customizable route approvals and flexible payment options.

Integration method: Quadient seems to use an API connector for its NetSuite integration, which syncs master data and transactions bidirectionally.

Pricing model: It’s unclear if integrating NetSuite with Quadient charges additional fees. It’s best to check in with either provider.

Business size guidance: This integration provides AR support and may be of use for small and mid-sized businesses. Enterprise customers may need extra customization for complex approval hierarchies.

4. Stampli

Stampli provides a communication-centric approach to AP automation for NetSuite. Its key features are AI-powered coding, centralized collaboration tools, and flexible approval workflows. Stampli may be beneficial for organizations that want to streamline communication between AP teams.

Integration method: Stampli offers an API integration that includes SuiteApp components, providing bidirectional synchronization with NetSuite. This hybrid approach combines the flexibility of an external platform with the convenience of native NetSuite elements.

Pricing model: The pricing is transaction-based and includes a minimum monthly fee, with volume discounts available for high invoice volumes. Implementation services are priced separately.

Business size guidance: Mid-sized organizations and enterprise customers can benefit from Stampli's balance of functionality and ease of use. However, small businesses with lower transaction volumes may find other solutions to be more cost-effective.

How to integrate AP automation solutions with NetSuite

Integrating an AP automation solution with NetSuite successfully typically involves these key steps, though they may vary by provider:

- Pre-implementation assessment: Before beginning any technical work, you should document your current AP workflows, identify all integration requirements, and set clear success metrics

- NetSuite configuration: Next, prepare your NetSuite environment by creating any necessary custom fields, setting up vendor records, and configuring GL accounts for automation

- Connection setup: Establish the technical connection between NetSuite and your AP solution using your chosen integration method (API, SuiteApp, or connector)

- Data mapping: Clearly define how information will flow between the two systems. This includes vendor details, GL codes, departments, subsidiaries, and any custom fields

- Workflow configuration: Set up approval rules, matching requirements, and payment workflows within the AP automation solution to mirror your business processes

- Testing: Thoroughly validate the integration with test transactions that cover different scenarios, including standard invoices, exceptions, and other edge cases

- User training: Prepare your team for the new system with comprehensive training before the full deployment

- Go-live and monitoring: Finally, launch the integration and closely monitor data synchronization and transaction processing to ensure everything runs smoothly

The integration may require specific roles and permissions to be configured within NetSuite. These may include but are not limited to:

- Administrator: This role needs full system configuration access for the initial setup and any ongoing maintenance

- Integration user: This should be a dedicated API user with permissions limited only to the data access required for the integration to function

- AP manager: This role requires access to approve vendor bills and payment transactions generated by the system

- Web services: This permission allows external systems to communicate with NetSuite via its API

Most implementations will require a mix of standard and custom roles to properly balance security with functionality. It's a best practice to always create dedicated integration users instead of using personal accounts for system-to-system connections.

Best practices for setting up AP automation software

Phased rollout approach

The first step in setting up AP software is using a phased approach. It's a great way to minimize disruption and help your team adapt gradually. You can start with a limited scope, such as processing invoices from a single department or vendor category, before expanding to your entire AP operation. This approach allows you to identify and fix issues early on, when the impact is smaller.

It's also wise to begin with basic features like invoice capture and approval workflows. Once those are running smoothly, you can add more advanced features like three-way matching or payment automation. Each phase builds on the success of the last, which creates momentum and builds user confidence. This step-by-step approach helps your team develop expertise without feeling overwhelmed by too many changes at once.

Documenting workflows and changes

Good documentation is critical during an implementation project. You should start by documenting your current workflows to establish a baseline for measuring improvement. From there, create detailed process maps that show how information will flow through the new system, making sure to include procedures for exception handling and approval hierarchies.

You should also record all configuration decisions and the rationale behind them for the benefit of future administrators. Maintain a change log that tracks all modifications to settings, workflows, and integrations throughout the project. This documentation is invaluable during system updates, staff transitions, and audits, as it preserves institutional knowledge and ensures consistency.

Testing and performance monitoring

Thorough testing ensures your AP automation solution works as expected before you commit to a full deployment. You should develop test scripts for both standard processes and edge cases, such as foreign currency invoices or multi-subsidiary transactions. It's also important to conduct user acceptance testing with your actual AP staff to verify the system's usability and identify potential workflow improvements.

After implementation, you'll need to monitor AP key performance indicators (KPIs) to measure success and spot opportunities for optimization:

- Processing time from invoice receipt to payment

- Exception rates and the time it takes to resolve them

- First-time match rates for automated coding

- User adoption metrics and qualitative feedback

- The average cost per invoice processed

Regularly reviewing these performance metrics will help you identify bottlenecks and inform ongoing improvements to your AP automation setup.

Implementation Roadmap

Successfully implementing an AP automation solution with NetSuite typically involves several phases, each with its own timeline and goals. Below is a step-by-step breakdown of what to expect.

Planning (2–4 weeks): Teams define AP requirements, select a vendor, and align on project goals. This phase includes stakeholder interviews and success metric definition.

Configuration (3–6 weeks): The system is set up, and the NetSuite integration is configured. Teams map data, establish workflows, and create approval rules.

Testing (2–4 weeks): Test scenarios are executed to validate performance and data syncing. User feedback is collected, and any issues are resolved before go-live.

Pilot (2–4 weeks): A small group of users begins processing live transactions in a controlled setting. This phase helps refine workflows and collect initial performance data.

Full deployment (2–4 weeks): The system is rolled out company-wide, and all users are trained. Monitoring begins, and the project transitions to long-term support.

Optimization (ongoing): Teams regularly review performance and gather user feedback. Improvements are made through configuration tweaks and feature enhancements.

Take control of your AP process: Summary and next steps

Key decision factors for AP automation selection

Integration approach: Choose the right connection method (native SuiteApp, API, or connector) based on your available technical resources and customization needs

Workflow flexibility: Make sure the solution can support your specific approval hierarchies, coding requirements, and exception handling processes

Global capabilities: If you're a multi-entity business, verify that the solution supports your operating currencies, countries, and compliance requirements

Scalability: Select a solution that can grow with your business volume without causing performance issues or significant cost increases

Security and compliance: Confirm that the provider has the appropriate certifications (like SOC 1/2 and GDPR) and security controls to protect your financial data

Vendor stability: Evaluate the provider's financial health, customer retention rates, and product roadmap to ensure its long-term viability

Total cost of ownership: Consider all costs, including implementation fees, subscription costs, transaction charges, and the internal resources required

Next steps

To start finding the best AP integration for NetSuite, you can start by reviewing vendor websites and requesting demos of your shortlisted solutions. This will help you see how each one handles your specific invoice scenarios and approval workflows. It's also helpful to download a comprehensive implementation checklist to guide your project planning and execution, which ensures all critical steps are addressed.

Then, schedule discovery calls with vendors to discuss your requirements in detail and get tailored recommendations. You can prepare for these conversations by documenting your current process pain points and key volume metrics. Begin building internal consensus by sharing this guide with key stakeholders in your finance, IT, and operations departments. Involving them early in the process improves requirements definition and ultimately increases adoption of the solution you choose.

Integrate NetSuite with Ramp’s AP automation software

NetSuite’s AP functionality simplifies processes by streamlining key tasks, improving accuracy, and providing real-time financial visibility within its ERP system. Pairing NetSuite with Ramp takes these benefits further, offering complementary tools that reduce AP complexity and deliver meaningful time savings.

Don’t just take it from us. The Second City, a renowned entertainment company, had outdated AP processes that were holding them back. But when they adopted Ramp Bill Pay, its OCR seamlessly recognized vendor data, helping them process invoices 2x faster.

“When we moved to (Ramp) Bill Pay, I was hesitant because we were promised the same type of functionality as our previous technology, which didn’t work. But Ramp’s OCR works seamlessly—it not only recognizes the vendor but reads each individual line item and uses accounting rules to code them correctly. That made adopting Ramp Bill Pay a no-brainer.” —Frank Byers, Controller at The Second City

Read The Second City’s full customer story here.

Want to experience the same? Integrate NetSuite with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits