- How do secured business credit cards work?

- Benefits of a secured business credit card

- Limitations of a secured business credit card

- Can you use a secured business credit card for personal use?

- How to get a secured business credit card

- Best secured business credit cards

- How to access business credit without freezing your capital

- How MakeStickers maximized working capital without tying up cash in deposits

- Building your business credit with the Ramp Business Credit Card

A secured card is a type of business credit card that requires a cash deposit as collateral, which serves as the card’s credit limit. This type of card is often used by businesses that are new, have limited credit history, or are working to improve their credit.

In this article, we'll cover how secured business credit cards work, their benefits, and how to get a secured card for your business.

How do secured business credit cards work?

Secured business credit cards function by requiring the cardholder to make an initial cash deposit, which directly determines the card's credit limit. For example, a $1,000 deposit would typically allow for a $1,000 line of credit. Unlike prepaid cards, secured credit cards provide actual credit, allowing businesses to make purchases up to the credit limit and pay the balance down monthly, similar to traditional credit cards.

When a business uses a secured credit card responsibly, by making timely payments and keeping balances low, it reflects positively on your business’s credit report. Over time, this responsible usage can help improve your business credit score, making it easier to qualify for larger, unsecured lines of credit.

Many credit card issuers also offer the opportunity to upgrade to an unsecured card after a period of demonstrated financial responsibility, which can further enhance the business’s credit options and financial flexibility.

Benefits of a secured business credit card

A secured business credit card has a number of benefits:

- Using a secured loan or credit card can rebuild your business credit score.

- Startups and small businesses may not have a sufficient credit history, so using secured credit cards can help establish a credit history.

- Employees may be added to the account to make purchases for the business.

- Similar to regular business credit cards, secured cards may have rewards.

Limitations of a secured business credit card

While secured business credit cards can help build credit, they also come with important limitations to consider:

- The upfront security deposit (typically $500-$5,000+) freezes your working capital when your business might need it for growth opportunities.

- Your credit limit is typically capped at your security deposit amount, limiting your purchasing power for larger business expenses.

- Despite requiring collateral, these cards often charge higher interest rates (frequently over 20% APR) and additional fees (annual, maintenance, employee card fees).

- Rewards programs, if available, offer minimal returns compared to unsecured cards, with few sign-up bonuses and limited business management tools.

Can you use a secured business credit card for personal use?

While it's not illegal to use a secured business credit card for personal expenses, it will likely violate the terms and conditions of your card agreement. This can come with some serious consequences, like penalties, the loss of certain benefits like reward points earned on business expenses, or cancellation of the card.

Moreover, in the case of an LLC or a corporation, using a business credit card for personal expenses can undermine the legal separation between the business and the individual. This separation is crucial for maintaining limited liability status, and breaching it could expose personal assets to business liabilities.

How to get a secured business credit card

Here are the typical steps to apply for a business credit card:

Research potential card issuers

Begin by identifying credit card issuers that offer secured business credit cards so that you can compare their terms. Look for cards with no annual fees or foreign transaction fees, good rewards programs, and relatively low APR or 0% introductory APR.

Check credit reporting practices

Confirm that the issuer reports to business credit bureaus such as Experian Business, Equifax Small Business, and Dun & Bradstreet. Regular reporting is crucial as it makes sure that your business’s credit activities are accurately reflected in its credit reports, helping you build a strong credit profile.

Gather required documentation

Prepare necessary documents that may include business financial statements, tax identification numbers, business licenses, and personal identification. Having these documents ready can streamline the application process.

Complete the application

Apply for the card either online or in person, depending on the issuer’s process. Provide accurate information about your business and personal finances as required. This step typically involves detailing your business's financial health and demonstrating the stability and legality of your operation.

Submit your security deposit

Once approved, you'll need to pay a security deposit. This deposit sets your credit limit and is held by the credit card issuer as collateral against your spending. Make sure the deposit amount is within your budget while still providing enough credit to be useful for business expenses.

Activate and manage your card

After your account is set up and your card is received, activate it following the issuer’s instructions. Start using your card for business-related expenses. It's crucial to manage the card responsibly by making on-time payments and keeping balances low relative to your credit limit. This will help you to improve your credit score and qualify for an unsecured credit card in the future.

Best secured business credit cards

When weighing secured business credit card choices, you should consider:

- Bank of America Business Advantage Unlimited Cash Rewards Mastercard Secured

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Truist Enjoy Cash Secured Credit Card

- Valley Visa Secured Business Credit Card

- First National Bank of Omaha Business Edition Secured Mastercard

All require a deposit to establish a credit line, but they differ in rewards programs (cashback percentages and categories), fees (annual fees and other charges), and specific features like introductory APRs or upgrade options.Here are some more details about each of the best secured business credit cards.

1. Bank of America Business Advantage Unlimited Cash Rewards Mastercard Secured

The Bank of America Business Advantage Unlimited Cash Rewards Mastercard Secured card offers a $1,000 minimum security deposit and unlimited 1.5% cashback on all purchases. Cardholders can qualify for an upgrade to an unsecured business credit card and enjoy no annual fees. The card also provides access to cash flow management tools, travel and emergency services, and Balance Connect for overdraft protection.

- Annual Fee: $0

- APR: 27.49% variable APR

- Minimum Deposit: $1,000

Key Benefits:

- Unlimited 1.5% cashback on all purchases

- No annual fee

- Possibility to upgrade to an unsecured card

Drawbacks:

- High minimum security deposit

- 4% balance transfer fee

- No introductory APR

Who is this card best suited for?

This card is best suited for business owners who want cashback rewards without annual fees and can afford the higher minimum deposit. It works well for businesses that prioritize straightforward rewards earning and are comfortable with the $1,000 security deposit requirement in exchange for unlimited 1.5% cashback on all purchases.

2. Capital One Quicksilver Secured Cash Rewards Credit Card

The Capital One Quicksilver Secured Cash Rewards Credit Card offers unlimited 1.5% cashback on all purchases with a minimum security deposit of $200. Potential cardholders can check for pre-approval without impacting their credit score. The card features automatic credit line reviews every six months, no hidden fees, and the ability to raise the credit limit with additional deposits. Cardholders can also upgrade to an unsecured Quicksilver card by building a positive payment history.

- Annual Fee: $0

- APR: 29.74% variable

- Minimum Deposit: $200

Key Benefits:

- Unlimited 1.5% cashback on all purchases

- Low minimum security deposit

- Automatic credit line reviews every six months

- No hidden fees

- Option to increase credit limit with additional deposits

Drawbacks:

- High variable APR

- No bonus categories for rewards

- Not specifically designed for business use

Who is this card best suited for?

This card is best suited for solo entrepreneurs with lower spending needs who want a low entry point and automatic credit line reviews. It's ideal for small business owners who prefer minimal barrier to entry with the $200 minimum deposit and value the convenience of automatic credit evaluations every six months.

3. Truist Enjoy Cash Secured Credit Card

The Truist Enjoy Cash Secured Credit Card offers a tiered cashback rewards system, earning 3% on gas and EV charging purchases, 2% on utilities and groceries, and 1% on all other purchases. The card carries a $19 annual fee and provides Zero Liability protection. Cardholders can also benefit from a Loyalty Cash Bonus. The variable APR for purchases and balance transfer fees is 24.49%.

- Annual Fee: $0

- APR: 24.49% variable

- Minimum Deposit: Varies

Key Benefits:

- High cashback for some categories: 3% on gas and EV charging, 2% on utilities and groceries

- Unlimited 1% cashback for everything else

- Loyalty Cash Bonus increases total rewards

Drawbacks:

- $19 annual fee

- Combined $1,000 monthly cap for 2% cashback categories

- 3% balance transfer fee

Who is this card best suited for?

This card is best suited for businesses with significant spending on gas, utilities, and groceries who can benefit from the tiered rewards structure. It's perfect for companies that regularly spend in these bonus categories and can maximize the 3% cashback on gas and EV charging and 2% on utilities and groceries.

4. First National Bank of Omaha Business Edition Secured Mastercard

The First National Bank of Omaha Business Edition Secured Mastercard allows cardholders to request their own credit limit with a security deposit between $2,000 and $10,000. The card has a $39 annual fee and a variable 25.99% APR on purchases and balance transfers. Benefits include auto rental insurance, cash flow management tools, and mobile receipt management.

- Annual Fee: $39

- APR: 25.99% (variable)

- Minimum Deposit: $2,000 (up to $10,000)

Key Benefits:

- High potential credit limit (up to $10,000)

- Interest accrues on your security deposit

- Auto rental insurance

Drawbacks:

- Requires a 110% security deposit of your requested credit limit

- $39 annual fee

- No introductory APR

Who is this card best suited for?

This card is best suited for established businesses seeking higher credit limits who don't mind paying an annual fee for business-specific features. It works well for companies that need substantial credit access up to $10,000 and value business-focused benefits like auto rental insurance and cash flow management tools.

5. Valley Visa Secured Business Credit Card

The Valley Visa Secured Business Credit Card offers a 0% introductory APR on purchases and balance transfers for the first six months, along with unlimited 1% cashback rewards. There is no annual fee, and the maximum security deposit is $25,000. A security deposit equal to 110% of the desired credit limit is required. The card also features a 2% foreign transaction fee and a $0.50 activity fee in any billing cycle with a cash advance or balance transfer.

- Annual Fee: $0

- APR: 0% Introductory APR for the first six months

- Minimum Deposit: 110% of desired credit limit (up to $25,000)

Key Benefits:

- 0% introductory APR on purchases and balance transfers for six months

- Unlimited 1% cashback rewards

- No annual fee

- High maximum security deposit/credit limit

Drawbacks:

- 4% balance transfer fee

- 2% foreign transaction fee

- $0.50 activity fee in billing cycles with cash advances or balance transfers

Who is this card best suited for?

This card is best suited for businesses planning large purchases who can benefit from the introductory 0% APR period. It's ideal for companies that need to finance significant expenses over six months without interest charges and can take advantage of the promotional period for major business investments.

6. Platinum Secured Mastercard

The Platinum Secured Mastercard offers flexible security deposit options of $49, $99, or $200 with no annual fee. Cardholders benefit from automatic credit line reviews, no hidden fees, and a refundable deposit with upgrade opportunities. The card also includes zero fraud liability and allows potential cardholders to check for pre-approval without impacting their credit score.

- Annual Fee: $0

- APR: 29.99% (variable)

- Minimum Deposit: Flexible options

Key Benefits:

- Low security deposit requirement

- Automatic credit line reviews

- Opportunity to upgrade to unsecured card

- No annual fees

Drawbacks:

- Maximum credit limit of only $1,000

- High variable APR

- 4% balance transfer fee

Who is this card best suited for?

This card is best suited for small businesses or sole proprietors who need a low entry point and are focused primarily on building credit. It's perfect for new business owners who want to establish credit history with minimal upfront investment and flexible deposit options, even with the lower credit limit.

How to access business credit without freezing your capital

While secured business credit cards can help establish credit, they present significant trade-offs that may not align with your growth goals. Each option requires locking up valuable capital as collateral, imposes high interest rates, and offers limited rewards, creating barriers rather than accelerating your business's potential.

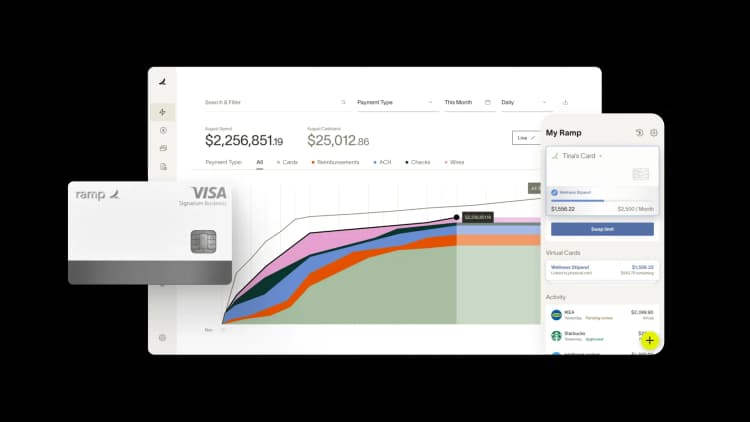

For businesses focused on smart financial management and growth, Ramp offers a compelling alternative that eliminates these compromises. Unlike secured cards that tie up your working capital, Ramp's business credit card qualifies you based on your company's financial health, not your personal credit score.

When comparing options for your business, you'll find Ramp provides distinct advantages:

- No security deposit required. Ramp evaluates your business based on factors like revenue and capital in the bank, keeping your cash accessible for critical investments.

- Higher credit limits. Access credit limits aligned with your business's true financial capacity, not arbitrary deposit-based restrictions.

- Cost-saving features. Businesses using Ramp save an average of 5% through built-in tools that identify redundant subscriptions and streamline spending.

- Integrated software platform. Ramp combines cards, expense management, bill payment, accounting, and reporting in a single system, eliminating manual reconciliation.

Ramp is particularly valuable for businesses looking to maximize cash flow, reduce administrative overhead, scale efficiently, or gain deeper insights into spending patterns. With Ramp, you gain immediate access to valuable credit while keeping your capital working where it matters most—growing your business.

How MakeStickers maximized working capital without tying up cash in deposits

Before switching to Ramp, MakeStickers faced the exact challenge that secured business credit cards create: tying up valuable working capital. The company had fragmented banking relationships with cash sitting in 0% interest accounts across multiple institutions, while managing credit cards at four different issuers. Accounting Manager Mike Rizzo explains that growing their cash reserves meant "it would be foolish to park large sums in a 0% interest account" while missing opportunities to earn returns and maintain liquidity.

Ramp enabled MakeStickers to access business credit without freezing capital in security deposits. Instead of locking up working capital as collateral, Ramp qualified them based on their business's financial health and allowed them to earn 2.5%¹ on their operating cash. This approach gave them both credit access and capital optimization, maximizing float by paying bills from the same account that earns returns.

Ramp's capital-preserving approach resulted in:

- No security deposits required while maintaining full access to business credit

- 2.5% earnings¹ on operating cash instead of 0% returns from traditional banks

- Free access to working capital by optimizing payment timing and float

- Consolidated systems that eliminated the need for multiple credit card issuers

- 8-10 hours per week saved from streamlined cash and credit management

For a growing e-commerce business, preserving working capital was essential for scaling operations. Rather than freezing cash in security deposits, MakeStickers could invest in growth while still accessing credit. As Mike puts it, "It's great to be able to maximize earnings on our operating cash, and also maximizing float by paying bills from that same account."

Building your business credit with the Ramp Business Credit Card

When evaluating your options for business credit, it's important to consider both immediate needs and long-term financial goals. Secured business credit cards serve a specific purpose in helping companies establish credit foundations, but they often come with limitations that can constrain growth.

Ramp offers a more efficient path forward by qualifying businesses based on their actual financial health rather than credit history alone. This approach allows companies of all sizes to access the credit they need without tying up valuable capital in security deposits.

With Ramp, your business can:

- Save an average of 5% through built-in cost-cutting features

- Get approval for higher credit limits based on your business's actual capacity

- Streamline operations with 5-in-1 software that integrates cards, expenses, bills, accounting, and reporting

- Start building credit and earning rewards in minutes, not months

Whether you're establishing credit for the first time or looking for a more efficient alternative to your current financial tools, Ramp provides the flexibility and functionality businesses need to succeed in today's competitive landscape.

1. Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC.

Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

FAQs

Most secured business credit card issuers don't typically offer limits as high as $10,000, as secured cards are aimed at businesses building or repairing credit and thus often have lower credit limits. However, some issuers may accommodate higher limits if you can provide a corresponding security deposit.

Yes, you can usually increase your credit limit by adding more money to your security deposit. Some issuers may also offer credit limit increases based on your payment history and account standing after several months of responsible use.

Yes, most secured business credit cards require a personal guarantee, which means the issuer will check your personal credit during the application process. This results in a hard inquiry that typically causes a small, temporary drop in your personal credit score. Additionally, your payment activity on the card may be reported to both business and personal credit bureaus, affecting both credit profiles.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits