Pending transaction: What it means and how it works

- What is a pending transaction?

- How long do pending transactions take to clear?

- Common types of pending transactions

- How pending transactions affect your available balance

- Why pending transactions appear and disappear

- Can you cancel a pending transaction?

- What to do about problematic pending transactions

- How pending transactions impact business operations

- Get complete transaction visibility with Ramp

You swipe your card, see the charge show up as “pending,” and wonder whether the money is actually gone.

A pending transaction is an authorized payment that hasn’t fully processed yet, which means it can affect your available balance even though it hasn’t posted to your account. While most pending transactions clear within a few business days, understanding how they work matters even more when you’re tracking expenses, managing budgets, or reconciling accounts across a team.

What is a pending transaction?

A pending transaction is a card payment that’s been authorized by your bank but hasn’t fully processed yet. When you make a purchase, the merchant requests approval for the amount, and your card issuer temporarily sets those funds aside.

That temporary hold reduces your available balance right away, even though the charge hasn’t officially posted. Until the transaction settles, the amount can still change or disappear if the merchant cancels or adjusts it.

How pending transactions work

Pending transactions follow a two-step process that happens behind the scenes every time you use your card.

First, the merchant requests authorization for the purchase amount. Your card issuer checks that your account can cover the charge and, if approved, places a temporary hold on those funds. This step usually happens instantly.

Next comes settlement. The merchant submits completed transactions, often in daily batches, for final processing. Once your bank processes that request, the transaction posts to your account and the funds officially move to the merchant.

Pending vs. posted transactions

Pending and posted transactions serve different purposes in your account, and understanding the difference helps explain why balances don’t always line up:

| Aspect | Pending transactions | Posted transactions |

|---|---|---|

| Status | Temporary authorization hold | Finalized transaction |

| Impact on available balance | Reduces it immediately | Already reflected |

| Appearance in account activity | Marked as pending or provisional | Listed as completed |

| Ability to change or cancel | Possible before settlement | Requires a refund or dispute |

| Typical timeline | Usually 1–5 business days | Complete |

| Amount changes | Can change before posting | Final and fixed |

How long do pending transactions take to clear?

Most pending transactions clear within 1–5 business days. In many cases, they post sooner, but the exact timing depends on the type of transaction, the merchant’s processing schedule, and whether you used a debit or credit card.

Credit card transactions typically settle faster because they don’t require immediate fund verification. Debit card transactions can stay pending longer since the money is tied directly to your bank balance, which makes banks more cautious about releasing holds.

Transactions made late in the week can also take longer to post. If you make a purchase on Friday evening, it may not clear until the following Tuesday or Wednesday because banks don’t process settlements on weekends or holidays.

Standard processing times by transaction type

While most card purchases follow similar timelines, some payment types have different processing rules that affect how long they stay pending.

| Transaction type | Typical timeline | What affects timing |

|---|---|---|

| Debit or credit card purchases | 1–3 business days | Merchant batch processing |

| ACH payments | 1–3 business days | Bank processing windows |

| Online purchases | 1–3 business days | Shipment confirmation |

| Domestic wire transfers | Same day | Bank cutoff times |

| Check deposits | 1–2 business days | Verification requirements |

| International wire transfers | Several days to 2 weeks | Compliance and currency conversion |

Why some pending transactions take longer

Some transactions stay pending longer than usual because the merchant needs flexibility to adjust the final amount or because additional checks are required.

- Merchant batching schedules vary, and some businesses only submit transactions for settlement once or twice a week

- Pre-authorization holds from hotels, gas stations, and car rental companies can remain pending for days or even weeks

- Weekend and holiday delays add time when banks aren’t processing settlements

- International transactions take longer due to currency conversion and fraud checks

- Unusual spending patterns may trigger manual reviews before settlement

Ready to take control of your finances?

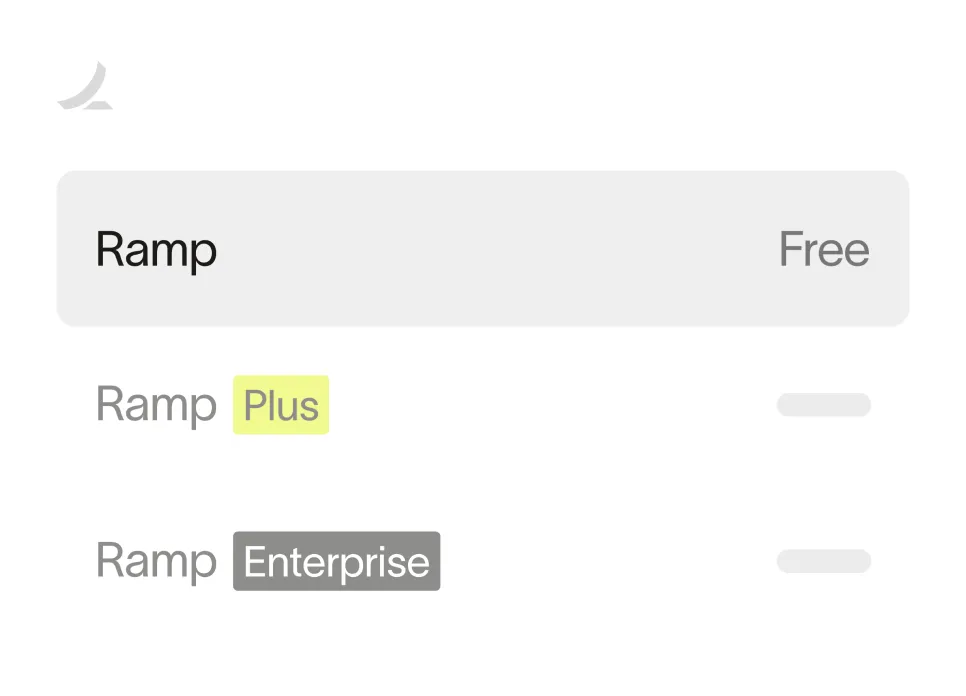

Learn about Ramp’s pricing plans and start saving today.

Common types of pending transactions

Different types of purchases stay pending for different reasons. In most cases, the delay comes down to whether the merchant needs time to finalize the amount or confirm that the transaction is complete.

Knowing which transactions tend to stay pending longer can help you anticipate temporary holds on your available balance and avoid confusion when charges don’t post right away.

| Transaction type | Typical duration | Why it stays pending | How it affects you |

|---|---|---|---|

| Restaurant purchases | 1–2 days | Tip is added after the initial authorization | Final amount may be higher than the pending charge |

| Hotel bookings | Up to 30 days | Incidental hold for potential charges | Ties up more available credit than expected |

| Gas station purchases | Up to 3 days | Pre-authorization for a full tank | Pending amount often exceeds the final charge |

| SaaS subscriptions | 1–2 days | Payment verification | Can delay expense categorization |

| Online orders | 1–3 days | Order or shipment confirmation | Charge may not post until the item ships |

| Airline tickets | 1–2 days | Fare and seat confirmation | Affects travel budget availability |

How pending transactions affect your available balance

Pending transactions create a gap between what your account shows and what you can actually spend. Your current balance reflects posted transactions, while your available balance subtracts pending charges to show how much spending power you have right now.

For example, if your account shows a $50,000 current balance but $10,000 in pending transactions, your available balance is $40,000. That difference matters when multiple people are using shared cards or when spending happens close to budget limits.

Impact on cash flow and spending power

Pending transactions reduce your available funds immediately, even though the money hasn’t officially left your account. That timing mismatch can cause cards to decline or make it harder to plan near-term spending.

For example, one team might book travel early in the week, tying up credit with pending charges, while another team tries to make purchases before those charges post. Without visibility into pending activity, the available balance can drop faster than expected.

Managing pending transactions for business accounts

Staying ahead of pending transactions requires consistent visibility and a few practical guardrails:

- Monitor pending transactions regularly to spot unusual amounts or merchants early

- Plan for large pre-authorization holds when booking hotels, rentals, or travel

- Set alerts when pending charges exceed thresholds or available balance drops too low

- Help employees understand how pending charges affect shared card limits

- Use tools that show pending and posted transactions together to reduce guesswork

Why pending transactions appear and disappear

Pending transactions aren’t final charges, so they don’t always move straight from pending to posted. In some cases, they change amounts, disappear temporarily, or never post at all. These shifts usually reflect how merchants handle authorizations, not an error with your account.

When pending charges fall off without posting

A pending transaction can drop off your account without ever posting, which restores your available balance. This most often happens when the authorization expires or the merchant doesn’t complete the charge.

If a merchant doesn’t submit the transaction within the authorization window, typically within several days, the hold expires automatically. You might also see a pending charge disappear if you cancel an order before it ships or if the merchant voids the authorization.

Duplicate pending charges can also occur due to processing errors. In most cases, only one charge posts, and the duplicate falls off on its own.

Why pending amounts change

The amount of a pending transaction can change before it posts because the initial authorization is often an estimate.

Restaurant charges commonly change when a tip is added after the card is run. Hotel charges often start higher to cover potential incidentals, then post at a lower amount after checkout. Gas stations may place a larger hold to ensure sufficient funds, then update the charge to the actual purchase amount.

International transactions can also shift slightly due to currency conversion between authorization and settlement.

Can you cancel a pending transaction?

You can sometimes cancel a pending transaction, but it depends on how quickly you act and whether the merchant has already submitted the charge for settlement. Once the merchant batches the transaction, usually at the end of the day, it’s no longer possible to stop it from posting.

Steps to cancel a pending transaction

If you want to try to cancel a pending charge, timing matters.

- Contact the merchant as soon as possible with your transaction details

- Ask the merchant to void the authorization rather than issue a refund, since a void prevents the charge from posting

- If the merchant can’t help, contact your card issuer so they’re aware of the issue

- Report suspected fraud immediately so the card can be blocked before the charge posts

- Keep a record of emails or calls in case the transaction still posts and needs to be disputed later

What to do about problematic pending transactions

Problematic pending transactions can be frustrating because you usually can’t dispute them until they post. In most cases, the best approach is to monitor the charge closely and act only if it doesn’t resolve on its own.

Stuck or duplicate charges

If a transaction stays pending longer than expected or appears more than once, it can tie up your available balance and create confusion:

- Wait several business days, since many authorization holds expire automatically

- Contact the merchant to confirm whether the charge was submitted for settlement

- Save screenshots or notes in case the transaction eventually posts incorrectly and needs to be disputed

Incorrect or unrecognized charges

If the pending amount looks wrong or you don’t recognize the merchant, act carefully before assuming it’s fraud:

- Contact the merchant first to ask whether the charge can be corrected or voided

- Give unfamiliar merchant names a day or two to resolve, since pending descriptors often differ from the final posted name

- Report the charge to your card issuer right away if you suspect fraud so the card can be secured

How pending transactions impact business operations

Pending transactions can complicate business finances because spending happens before it’s fully recorded. That gap makes it harder to understand what’s been committed, what’s still available, and when costs should be reflected in reports.

When teams rely on shared cards or operate close to budget limits, even short delays between authorization and settlement can create operational friction.

Challenges for finance teams

Pending transactions introduce several issues that slow down day-to-day finance work.

Delayed month-end close is a common problem. Large purchases made late in the month may still be pending when it’s time to finalize reports, forcing teams to wait or make adjustments later.

Budget tracking can also become less reliable. Departments may appear under budget based on posted expenses, even though pending charges have already reduced available funds.

Manual reconciliation adds another layer of work. Finance teams often have to match pending charges to receipts or invoices, then review them again once the transactions post.

Best practices for managing pending transactions in business

Clear processes and better visibility can reduce the disruption caused by pending charges.

- Use tools that show pending and posted transactions together in real time

- Set policies for reporting large or unusual pending charges

- Train employees on how pending transactions affect shared limits and budgets

- Assign virtual cards with defined limits for specific vendors or projects

- Capture receipts early so documentation is ready when transactions post

Get complete transaction visibility with Ramp

Staying on top of pending, posted, and flagged charges is key to managing your business finances effectively.

The Ramp Business Credit Card gives you complete visibility into pending and posted transactions in one centralized platform, with automated expense reporting and categorization tools to help you track and understand every charge in real time. With Ramp, you can:

- Identify and flag fraudulent, suspicious, and unauthorized charges in real time, even while they’re still pending

- Set custom controls on corporate cards for specific vendors and categories to prevent out-of-policy spend

- Create unlimited free virtual cards with custom permissions

- Give employees the ability to submit receipts and memos instantly via SMS, web, mobile app, or direct integrations with services like Gmail

- Personalize approval workflows to keep the right people informed, with automated reminders

See how Ramp helps your business stay on top of every transaction with an interactive demo.

FAQs

Most clear in 1–5 business days, but some holds (like for hotels or car rentals) can remain pending for up to 30 days.

No. Pending transactions reduce your available balance but are not deducted from your current balance until they post. The money has not officially left your account yet.

It means the transaction was authorized and is processing, but it is not final. The amount could still change, or the merchant could cancel it before it posts.

Yes. A transaction can be declined during settlement if there are insufficient funds, it's flagged for fraud, or the authorization expires before the merchant settles it.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°