- What accounting software actually does

- Common types of accounting software

- Essential features to look for

- How accounting software supports compliance and security

- Eliminate manual bookkeeping with AI-powered accounting automation

Accounting software is a digital tool for recording, managing, and reporting your business’s financial activity. It replaces manual spreadsheets with a system that tracks income, expenses, invoices, and payments in one place. Instead of juggling spreadsheets and paper receipts, you get real-time visibility into your company's financial health from a single platform.

Today's accounting software offers more than basic bookkeeping. It can integrate with your bank accounts, credit cards, and other financial tools to automatically categorize transactions, reconcile accounts, and flag potential issues before they become problems.

Whether you're a startup founder managing finances solo or a controller overseeing a finance team, the right accounting software can transform how you handle everything from accounts payable (AP) to tax prep. The key is understanding what features matter most for your business and how different solutions stack up against each other.

What accounting software actually does

At its core, accounting software records, organizes, and stores every financial transaction. Each transaction gets logged in your general ledger (GL), which forms the foundation of your financial reporting.

You can manage your AP by tracking what you owe to vendors, setting due dates, and scheduling payments. At the same time, accounts receivable helps you stay on top of customer invoices, monitor overdue balances, and follow up on payments.

The software connects directly to your bank, syncing transactions automatically. Instead of manually entering every expense or deposit, you can reconcile your accounts in a few clicks. This helps you spot discrepancies early and keep your cash flow accurate. It also generates key financial reports like your income, balance, and cash flow statements.

If your small business works across currencies or legal entities, many tools let you consolidate data and standardize reports without extra effort. You'll be able to understand your performance at a global level without juggling multiple systems.

Common types of accounting software

The needs of a solo freelancer look nothing like those of a growing retail brand or a multinational company. That’s why different types of accounting software exist. Each one is designed to solve specific challenges based on your size, industry, and complexity.

Basic tools for freelancers and sole proprietors

If you manage your business alone, basic accounting software gives you just what you need to stay organized. You can create invoices, track income and expenses, categorize transactions, and prepare for tax returns, all without hiring an accountant.

These tools connect to your bank, sync transactions, and give you simple reports so you always know how much you're making and spending. You won’t get advanced features, but you won’t need them either. This type of software works best when your business operations are straightforward, and your focus is on keeping the books clean without extra effort.

SMB-focused accounting platforms

Once your business grows, so does the complexity of your finances. You will have vendors to pay, customers to invoice, and budgets to manage. SMB-focused platforms are designed for this stage. They support double-entry bookkeeping, bank reconciliations, payroll, inventory management, and recurring billing.

You can generate standard reports, close the books each month, and stay on top of taxes. These tools give you more control without the overhead of enterprise systems. If you are managing a small team or planning to scale, this type of software helps you run day-to-day operations while building financial discipline.

ERP systems with built-in accounting

You need a system that brings everything together if your business spans multiple departments, locations, or entities. ERP software does that. It includes accounting features like general ledger, payables, receivables, and reporting. But it also adds modules for inventory, procurement, and HR.

These systems handle high volumes of transactions, support multi-currency operations, and meet strict compliance standards. You can track performance across teams in real-time and maintain one central source of financial truth. If you are running a fast-scaling company or managing complex operations, an ERP system helps you stay in control without juggling separate tools.

Industry-specific accounting solutions

Not every business fits a general mold. Industry-specific software is built for you if your work involves unique reporting requirements or compliance rules. These tools address the gaps that traditional platforms miss.

For example, nonprofits can track restricted funds and donor contributions, construction companies can manage job costs and contracts, and e-commerce brands can handle multichannel inventory and sales tax. Instead of customizing a generic system, you get features tailored to how your industry operates. If your business needs specialized workflows to stay compliant and efficient, this type of software can save time and reduce errors.

Essential features to look for

When we say “essential features,” we are talking about core functions every system should include, regardless of your business size or industry. Without them, you will do extra work, risk errors, or lose visibility into your finances.

Not all accounting software solution is built the same, but some features aren’t optional. These are the tools that keep your books accurate, your records clean, and your accounting processes efficient.

General ledger management

The GL is the backbone of your accounting system. It stores every financial transaction your business records, including revenue, expenses, assets, liabilities, and equity.

Without strong GL management, your reports won't be accurate, and your books won't close on time. That’s why your software needs to make it easy to post, track, and organize every entry across all accounts.

Look for tools that support double-entry accounting, allow for custom charts of accounts, and keep audit trails for every change. You should be able to drill into transactions, review supporting documents, and trace errors back to the source without digging through files.

Some platforms let you tag transactions by department, project, or location. This gives you better visibility into how money moves across your business.

Accounts payable and receivable

To stay in control of cash flow, you need a system that tracks what you owe and what others owe you. That’s where accounts payable and accounts receivable come in.

With strong AP tools, you can manage vendor bills, set due dates, and schedule payments without missing deadlines. You will avoid late fees, strengthen supplier relationships, and keep spending visible.

AR features help you create and send invoices, track unpaid balances, and follow up on overdue accounts. Some systems even send automated reminders to reduce delays and improve collection rates.

When AP and AR live inside your accounting software, you see both sides of the cash flow equation in one place. You can forecast payments and receipts, manage credit terms, and spot issues before they impact your balance.

Over 57% of CFOs said AI has improved AP efficiency by reducing payment delays. If your software doesn’t support automation, you are missing out on faster payments and better control.

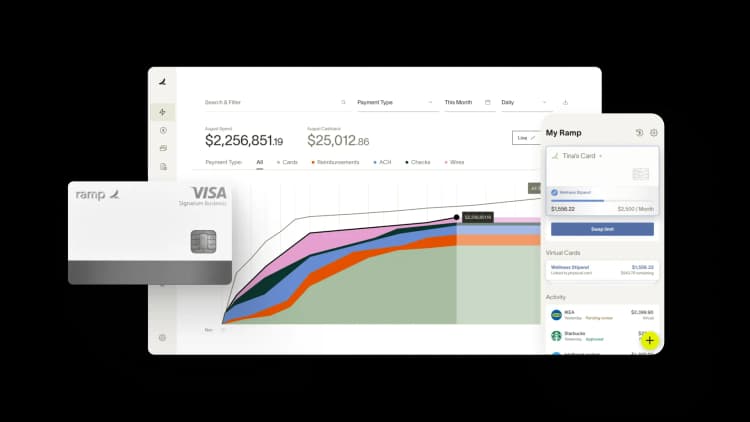

Ramp’s reliable AP automation system allows you to manage bills, route approvals, and schedule payments all in one place. It auto-matches recurring invoices with transactions, flags duplicates, and enforces custom approval policies. This helps finance teams close faster and with fewer errors while maintaining full control over outgoing payments.

Bank feeds and reconciliation

Bank feeds connect your accounting software directly to your bank accounts. Every transaction syncs automatically whenever money moves, whether it’s a deposit, withdrawal, or transfer.

You no longer need to upload bank statements or enter line items by hand. The system pulls in real-time data, so your books stay current and your cash position is always clear.

Reconciliation matches these bank transactions to those in your general ledger. If something does not line up, you can flag and fix the issue quickly. This process keeps your records accurate and helps you catch errors, duplicates, or missing entries before they become bigger problems.

Some tools use machine learning to suggest matches, speeding up reconciliation even more. This matters when you are closing the books or preparing for audits.

Financial statements and compliance-ready reports

Your financial statements tell the story of your business. Without them, you can’t track performance, secure funding, or meet regulatory requirements.

Your accounting software should automatically generate core financial reports, including income statements, balance sheets, and cash flow statements. These reports need to follow accounting standards and reflect real-time data entry, not outdated numbers from manual entry.

You should also be able to customize reports by department, location, or project. That flexibility helps you monitor team performance and spot trends before they impact your bottom line.

Compliance-ready reports go a step further. They include audit trails, approval logs, and detailed breakdowns of transactions. This helps you stay aligned with tax regulations, investor expectations, and accounting standards like GAAP or IFRS.

Integration with payroll, CRM, and banking platforms

Your accounting software shouldn't work in isolation. It needs to connect with the other tools you use to run your business, starting with payroll, CRM, and banking platforms.

When payroll is integrated, you avoid double entry and reduce errors. Wages, taxes, and benefits sync directly to your general ledger, keeping your books clean and your team paid on time.

CRM integration brings customer billing and revenue data into your accounting system. You can link sales activity to financial results and automate invoicing based on closed deals. That connection helps you shorten billing cycles and improve collections.

Bank integration enables real-time transaction syncing. You can track deposits, match payments, and reconcile accounts without uploading files or chasing bank statements.

Over 98% of finance leaders say integrated systems improve their decision-making and reduce manual work. When you sync your tools, you speed up processes and gain clearer visibility.

User permissions and approval workflows

Managing who can access your financial data becomes critical as your team grows. User permissions and approval workflows let you control how your team handles accounting tasks.

User permissions allow you to assign roles and restrict access based on each team member's needs. For example, you can let operations teams submit expenses without giving them access to bank details or payroll. This keeps sensitive financial information protected while allowing your team to do their jobs.

Approval workflows help you control spending and maintain oversight. Before a bill is paid or a journal entry is posted, it can move through a predefined review process. This ensures that no transaction goes unreviewed and nothing gets approved without visibility.

When these workflows are built into your business accounting software, you don’t need to manually manage approvals over email or track edits. Each step is logged automatically, which creates a reliable audit trail and reduces the chance of errors or missed approvals.

How accounting software supports compliance and security

Accounting software enforces compliance and security by building rules and safeguards directly into your daily workflows. It controls how that data moves through your system.

When you enter a transaction, the software checks for required fields, tax codes, and account classifications before it posts. If something’s missing or doesn’t match your accounting policies, it flags the issue or blocks the entry entirely. This helps you catch mistakes before they reach your financial statements.

Approval workflows add another layer. Bills, journal entries, and expenses move through a set review process. Each approval is timestamped and linked to a specific user. That creates a clear audit trail, so if questions come up later, you can trace who approved what and why.

The system also helps you stay aligned with reporting standards like GAAP or IFRS. For example, it can enforce accrual-based recognition or generate reports that meet disclosure requirements. Instead of relying on manual adjustments, you apply rules once and use them consistently across the business.

On the security side, access controls prevent the wrong people from seeing or editing financial data. You can assign roles by function, so a team member who submits expenses can’t edit payroll or approve payments. Every login, edit, and approval is logged, giving you a complete record of system activity.

Encryption keeps your data protected, both in transit and at rest. Built-in authentication features, like two-factor authentication, reduce the risk of unauthorized access.

These safeguards are about protecting your business from real risk. IBM reports that the average cost of a data breach in the US hit $4.4 million in 2025. Strong financial controls and secure systems help you stay protected and audit-ready at all times.

Eliminate manual bookkeeping with AI-powered accounting automation

Manual bookkeeping drains time from strategic work and introduces errors that ripple through your financial records. Ramp's accounting automation software removes the repetitive tasks that slow teams down, so you can focus on analysis instead of data entry while maintaining tighter controls across your spend.

Ramp automates the entire accounting workflow from transaction to close. Every purchase is coded automatically using AI that learns your chart of accounts and applies your feedback across future transactions. Receipts are collected and matched without chasing employees, and transactions sync to your ERP only after they've been reviewed and approved. You maintain full control while eliminating hours of manual work every month.

Here's how Ramp transforms your accounting process:

- AI codes with 90%+ accuracy: Ramp's AI learns your coding patterns and applies them across all required fields, including class, location, and department, so transactions are categorized correctly from the start

- Auto-collect receipts: Ramp texts employees for missing receipts and matches them to transactions automatically, so you never chase documentation again

- Review with full context: Every transaction includes the receipt, approval chain, and merchant details in one view, so you can verify accuracy and catch policy violations before sync

- Auto-sync only approved spend: Ramp holds transactions until they're reviewed and approved, so only clean, policy-compliant expenses hit your books

Try a demo to see how teams save 40+ hours every month by automating receipt collection, approvals, and coding.

FAQs

Many platforms offer multi-entity support, allowing you to manage several subsidiaries, business units, or legal entities from a single dashboard. You can consolidate reports, manage intercompany transactions, and apply different currencies or tax rules where needed.

The software gives your accountant direct access to real-time data, reducing the need for back-and-forth emails or document transfers. You can grant restricted access, share reports, and streamline collaboration during tax season or audits.

Many systems support multi-currency accounting, international tax rules, and localization for different regulatory requirements. This is especially useful for companies that operate globally or deal with international vendors and clients.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits