8 best corporate credit card expense management software platforms in 2026

- What is corporate credit card expense management software?

- Best corporate credit card expense management software

- At a glance: Comparing the best corporate credit card expense management software

- Why use credit card expense management software?

- Essential features of corporate credit card expense management software

- How to choose the right solution for your business

- Why Ramp is the best credit card expense management software

- Simplify expense management for your team

Key takeaways

- Corporate credit card expense management software helps you track and manage company card spending by automating the process of recording, categorizing, and approving expenses.

- These platforms provide real-time visibility into spending, which helps you control budgets, reduce administrative tasks, and simplify reconciliation.

- When choosing a platform, look for essential features like mobile receipt capture, automated policy enforcement, and customizable spending controls to manage expenses effectively.

- To find the right solution for your business, you should evaluate factors like scalability, security, customer support, and how well it integrates with your existing accounting software or ERP.

- Ramp solves these challenges by combining corporate cards with built-in expense management software, giving you real-time spend controls and automated reporting to save time and money.

Managing corporate credit cards feels like a juggling act for any finance leader. You’re constantly chasing down receipts, trying to enforce spending policies, and reconciling statements—all while battling data entry errors.

These challenges waste your time and lead to overspending, compliance issues, and financial discrepancies that can be difficult to track and correct. But that’s where corporate credit card management software can help.

The best tools will automate expense tracking, enforce travel and expense (T&E) policies, and provide real-time insights into employee expenses. By adopting the right software, you can replace manual processes with efficient, accurate management, giving you greater control over your organization's finances.

What is corporate credit card expense management software?

Credit Card Expense Management Software

Credit card expense management software helps businesses track and manage spending on company credit cards. These tools streamline the process of recording, categorizing, and approving corporate credit card expenses.

Corporate credit card expense management software makes it easier for you to stay on top of your finances and ensure your employees are spending responsibly. By automating key pieces of the expense management process, including expense policy enforcement, expense reporting, and employee expense reimbursements, these tools help you take control of corporate credit card spending and reduce the hassle of managing expenses.

Best corporate credit card expense management software

Corporate credit card expense management software enables you to stay on top of your finances and ensure that your employees are spending responsibly. These tools enable you to take control of corporate credit card spending and streamline the management of expenses by automating key aspects of the expense management process, including:

- Expense policy enforcement

- Expense reporting

- Employee expense reimbursements

Here are our top choices for the nine best corporate credit card expense management software solutions available today. We selected based on key factors like features, integrations, ease of use, pricing, and more:

Ramp

Ramp is a corporate credit card expense management software designed to help businesses automate and control their financial operations. Ramp’s corporate credit card programs offer both physical and virtual cards with customizable spending limits, so you can set controls to keep expenses in check. Ramp also automates expense reporting by capturing and categorizing transactions in real time, eliminating manual data entry and minimizing errors.

Ramp provides real-time spend tracking and analytics, giving your finance teams instant visibility into spending. Ramp offers customizable workflows that automatically enforce policies. Ramp streamlines financial processes, enabling businesses to save time and money while maintaining control over their expenditures.

Key features:

- Spend controls customization

- Expense reporting automation

- Spend-tracking in realtime

Navan (formerly TripActions)

Navan (formerly TripActions) is an all-in-one travel and expense management platform designed to streamline corporate travel booking and expense tracking. Navan integrates travel arrangements, expense reporting, and payment processing into a single expense reimbursement software platform. It offers real-time expense tracking, automatically categorizing and reconciling expenses.

Navan's mobile app supports features like smart receipt capture, automated expense categorization, and real-time notifications, reducing administrative burdens. Additionally, Navan's platform integrates seamlessly with existing enterprise systems, including ERP and accounting software.

Key features:

- Integrated travel and expense management

- User friendly mobile app

- AI-powered travel booking

SAP Concur

SAP Concur is a travel and expense management solution that offers seamless integration with corporate credit cards with credit card reconciliation software. The platform's corporate expense tracking capabilities enable you to track, approve, manage, and report on spending while ensuring compliance with expense policies.

The SAP Concur mobile app allows employees to manage expenses, capture receipts, and book travel on the go. Its automated workflow approvals route expense reports and travel requests to the appropriate approvers, expediting the reimbursement process and improving operational efficiency.

Key features:

- Corporate card integration

- Workflow approvals automation

- Comprehensive expense management

Expensify

Expensify provides flexible approval workflows, ensuring that expenses are reviewed and approved by the appropriate people. With corporate card integration and corporate credit card receipt management, transactions are automatically reconciled with your budget.

One of Expensify’s standout features is its global currency support, which automatically converts currencies using daily exchange rates for more accurate international expense reporting. The easy-to-use mobile app enhances accessibility, allowing employees to submit and approve expense reports directly from their smartphones.

Key features:

- Global currency support

- Flexible approval workflows

- Expense reports automation

BILL Spend & Expense (formerly Divvy)

BILL Spend & Expense (formerly Divvy) is an all-in-one financial platform that integrates corporate credit card receipt management and corporate expense tracking. The platform also provides real-time visibility into company spending, enabling finance teams to monitor budgets and cash flow effectively.

BILL Spend & Expense provides flexible approval workflows that can be tailored to fit a company's specific needs. It also features a rewards system that allows businesses to earn points on their spending, which can be redeemed for cash back, travel, or gift cards.

Key features:

- Integrated corporate cards

- Approval workflow customization

- Rewards system

Emburse

Emburse offers a suite of expense management and corporate credit card solutions designed to help businesses automate spend and maintain tighter control over expenses. Its platform supports both physical and virtual cards, with customizable controls to enforce policies and prevent unauthorized spending.

Emburse’s software provides real-time expense tracking, receipt capture, and automated expense reporting, reducing manual work for finance teams. With integrations across popular ERP and accounting systems, it enables smooth reconciliation and accurate financial reporting.

Key features:

- Corporate cards with customizable spend controls

- Automated expense reporting and real-time spend visibility

- Integrations with major ERP and accounting systems

- Mobile app for on-the-go receipt capture and approvals

Zoho Expense

Zoho Expense is a comprehensive expense reimbursement software solution that streamlines the tracking, management, and reporting of business expenses. It offers seamless integration with corporate credit card programs, and the platform's SmartScan feature enables users to capture receipts on the go.

Zoho Expense also provides customizable approval workflows and a user-friendly mobile app, enabling employees to submit expenses, capture receipts, and manage approvals from anywhere.

Key features:

- Integrated expense management system

- SmartScan receipt capture

- Customizable approval workflows

Teampay

Teampay is a spend management platform that provides real-time tracking of employee purchases and expenses. With built-in policy controls, Teampay automatically enforces expense policies.

The platform also enables the issuance of unlimited virtual free corporate cards. Teampay's purchase order approval workflows guide users through the purchasing process, collecting necessary approvals and releasing secure payments efficiently. Additionally, Teampay integrates seamlessly with various finance and accounting platforms you’re already using, facilitating smooth data synchronization and enhancing overall operations.

Key features:

- Built-in policy controls

- Unlimited virtual cards

- Key integrations

At a glance: Comparing the best corporate credit card expense management software

Software comparison

- Customizable spend controls: Ramp’s corporate cards let you set specific spend limits and rules for each card. Meet your budgets without the hassle of micromanaging.

- Automated expense reporting: Say goodbye to manual data entry. Ramp captures and categorizes expenses automatically, saving time and reducing errors.

- Real-time spend tracking: Monitor company spending as it happens. Gain instant insights to make more informed financial decisions.

- Seamless integrations: Connect Ramp with the tools that are already in your tech stack, like QuickBooks, Slack, and Excel.

- Easy receipt capture: Snap a photo of your receipt, and Ramp’s OCR technology does the rest. No more missing paperwork or tedious expense matching.

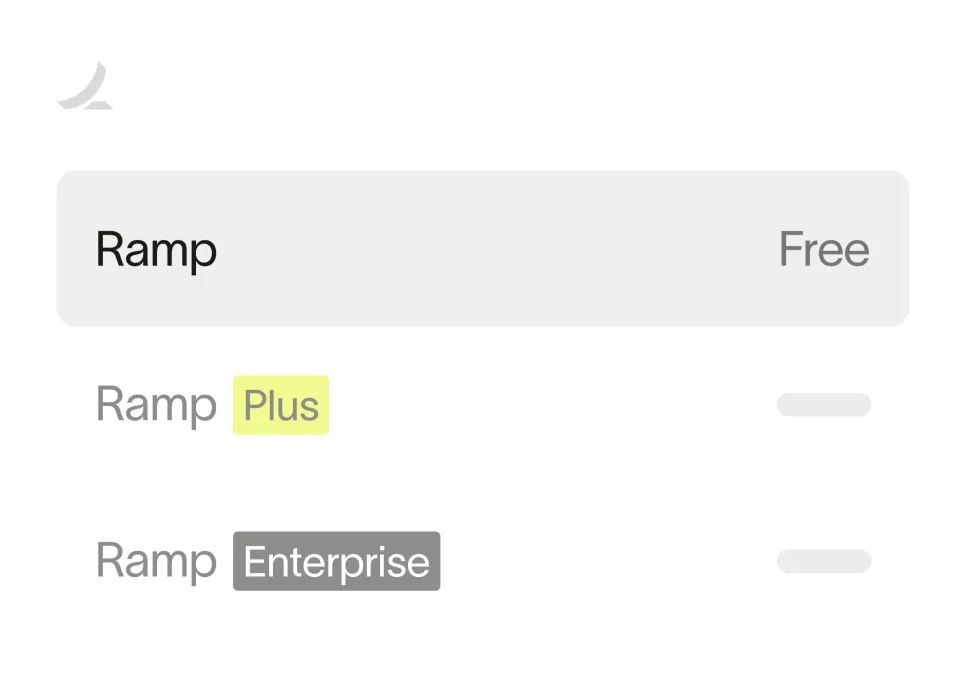

Starting at

$0/mo.

Additional pricing tiers

$15 per user/mo. for Ramp Plus. Enterprise pricing available.

Promotion

Unlimited free tier

Availability

Web, iOS, Android

Navan (formerly TripActions)

Navan (formerly TripActions)- Integrated travel and expense management: Navan combines travel booking and expense tracking in one platform.

- AI-powered booking: Get personalized travel recommendations with Navan's AI-driven search that finds the best options based on your preferences and company policies.

- Real-time expense tracking: Monitor spending as it happens with real-time updates to help you manage budgets and ensure compliance.

- Easy-to-use mobile app: Book flights, submit receipts, and approve expenses on the go.

Starting at

$0/mo.

Additional pricing tiers

$15 per user/mo. for more than 15 users

Promotion

Free tier with seat limits

Availability

Web, iOS, Android

SAP Concur

SAP Concur- Corporate card integration: Integrate corporate credit cards and automatically capture and reconcile transactions.

- Comprehensive expense management: Track, approve, manage, and report on all types of expenses.

- Mobile access: Manage expenses, capture receipts, and book travel on the go.

- Automated workflow approvals: SAP Concur routes expense reports and travel requests to the right approvers, speeding up reimbursement.

- Real-time spend visibility: Get instant insights into company spending with real-time transaction data and customizable dashboards.

Starting at

N/A

Additional pricing tiers

All pricing is quote-based

Promotion

15-day trial

Availability

Web, iOS, iPadOS, Android

Expensify

Expensify- Global currency support: Expensify supports multiple currencies and automatically converts transactions.

- Flexible approval workflows: Multi-level approvals ensure expenses are reviewed and approved by the right people.

- Mobile accessibility: Capture receipts, submit reports, and approve expenses from your smartphone.

- Automated expense reports: Create and submit expense reports with just a few clicks.

- Corporate card integration: Sync with your corporate credit cards or Expensify cards to automatically reconcile transactions with receipts.

Starting at

$0 for individuals

Additional pricing tiers

$5 per user/mo. for Collect, $9 per user/mo. for Control

Promotion

Free tier for individuals

Availability

Web, iOS, Android

BILL Spend & Expense (formerly Divvy)

BILL Spend & Expense (formerly Divvy)- Corporate card integration: Easily integrate business credit cards to automatically match transactions with relevant bills and receipts.

- Real-time expense tracking: Monitor expenses as they happen to maintain control over budgets and cash flow.

- Custom approval workflows: Whether it’s a single approval or a multi-level process, tailor approval workflows to fit your company’s needs.

- Rewards system: Earn rewards and redeem them for cashback, travel, or gift cards.

Starting at

$0/mo.

Additional pricing tiers

N/A

Promotion

Unlimited free tier

Availability

Web, iOS, Android

Emburse

Emburse- Flexible spend management: Choose from solutions tailored to different company sizes.

- Corporate cards with customizable controls: Set spend limits and enforce policies in real time.

- Automated expense reporting: Capture and categorize transactions instantly.

- Global support: Multi-currency and international compliance built in.

- ERP & accounting integrations: Works with NetSuite, Sage Intacct, QuickBooks, and more.

Starting at

N/A

Additional pricing tiers

All pricing is quote-based

Promotion

N/A

Availability

Web, iOS, Android

Zoho Expense

Zoho Expense- Integrated expense management system: Track, manage, and report business expenses in one place.

- Corporate card reconciliation: Integrates with Visa, Mastercard, and Amex corporate credit cards.

- SmartScan receipt capture: Capture receipts on the go while the app automatically extracts and categorizes the data.

- Customizable approval workflows: Set up multi-level approval workflows to review and approve expenses.

- Multi-currency support: Record expenses and manage reimbursements in various currencies with automatic conversions.

Starting at

$0 for up to 3 users and 20 scans/mo.

Additional pricing tiers

$5 per user/mo. for Standard, $9 per user/mo. for Premium

Promotion

Free tier with seat and usage limits

Availability

Web, iOS, iPadOS, Apple Watch, Android, Desktop

TeamPay

TeamPay- Spend management: Track employee purchases and expenses in real time.

- Built-in policy controls: Enforce your expense policies and manage your spending all in one platform.

- Virtual cards: An unlimited number of virtual cards can be issued to employees, even for one-time use.

- Purchase order approval workflows: The platform guides users through the process, collects approvals, and releases secure payments.

- Integrations: TeamPay integrates with your existing finance platforms, including Slack, Quickbooks Online, Microsoft 365, NetSuite, Xero, and Intacct.

Starting at

$20 per month

Additional pricing tiers

N/A

Promotion

N/A

Availability

Web, iOS, Android, Desktop

Why use credit card expense management software?

On top of streamlining expense claims, approvals, and receipt matching, here are five key reasons why credit card expense management software is important for businesses of all sizes:

Access real-time data

Most business credit card expense management solutions give you instant access to spending data as credit card transactions occur. Real-time visibility enables you to make informed decisions quickly, identify trends, and stay on top of budgets without waiting for monthly statements. In fact, a 2023 CPA.com survey found that 97% of SMBs using card-based spend management tools say it helps them stay within budget, compared with just 71% of those relying on traditional processes.1 This gap highlights how real-time controls directly translate into stronger financial discipline.

Reduce paperwork and admin tasks

With credit card expense management software, you can say goodbye to tedious manual data entry and filing paper receipts. Your software should offer automation features for repetitive tasks like tracking and reporting, freeing up your finance team to focus on more important work. Based on Ramp customer data, businesses save an average of 4 hours each month on accounting tasks thanks to automated transaction coding.2

Simplify reconciliation processes

Expense management software automatically matches transactions with receipts, making reconciliation faster and more accurate. It eliminates the hassle of manual matching and ensures your records are always up to date.

Improve budgeting and forecasting

With accurate, real-time data, credit card expense management software helps you track spending patterns and stay within budget. Clear visibility allows for better forecasting, ensuring your financial plans are aligned with actual expenses.

Ensure compliance with company policies

The best solutions automatically enforce your company's expense policy by flagging out-of-policy spending—or blocking it before it even happens. You can see that all expenses are compliant, reducing the risk of unauthorized charges and simplifying the approval process.

Eliminate the reimbursement process

If you’re using the right credit card reconciliation software, it will streamline your reimbursement processes. No longer will your team need to keep track of receipts and expense reports because everything happens automatically within the software. And when they are using your issued card, employees don’t need to be reimbursed for expenses.

Saves you time and money

Before corporate credit card management software, you had to track down expenses, reconcile receipts, and follow approval processes that could take up a lot of your time. And that time could better be spent working on your business. Integrations with your current accounting software, real-time expense tracking and reconciliation, and accurate and automated credit card translation matching all save you time—and, ultimately, money.

Essential features of corporate credit card expense management software

When evaluating credit card expense management software, make sure the feature set aligns with your business needs. You shouldn’t pay for more than you need, but at the same time, you want to ensure the tool can scale with your business as it grows and your needs change.

As you compare expense management platforms, these features should be non-negotiable:

- Mobile accessibility: Look for a tool that lets you manage expenses on the go with an easy-to-use mobile app that offers OCR-powered receipt capture

- Expense categorization and tagging: Choose a platform that automatically categorizes expenses and tags them for specific projects or departments

- Role-based access control: Look for admin tools that allow you to set different access levels based on user roles. This ensures that only the authorized team members can view, approve, or manage expenses.

- Policy compliance: Most software automatically enforces company expense policies. The platform you choose should be able to flag or outright block out-of-policy spending.

- Customizable spend controls: Your chosen tool should make it easy to set spending limits and rules tailored to your business needs. Control how much your employees can spend and where, keeping budgets in check.

- Automated receipt matching: The best platforms automatically match receipts to transactions, saving time and reducing errors

- Fraud detection and alerts: In addition to setting limits, you need instant alerts for suspicious transactions. Protect your business by identifying and addressing potential expense fraud early.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

How to choose the right solution for your business

Once you narrow your options, make sure to consider these key factors before making your final decision:

Scalability

Choose software that can grow with your business. As your company expands, your expense management needs will, too. Make sure the software can handle more users, cardholders, transactions, and features as you scale.

Customer support and training

Reliable customer support across multiple channels is crucial. Look for software that offers responsive support and training resources to help your team get up to speed quickly. Good support ensures that you can resolve issues quickly and keep things running smoothly.

Security and compliance

Your software should give you peace of mind that any sensitive financial data is safe. Look for a platform that offers robust security features and guarantees compliance with industry standards.

Integrations

Make sure your chosen software supports the necessary ERP and accounting integrations. Smooth integrations save time, reduce errors, and help maintain consistent expense data across systems.

Cost and budget

Ensure the software aligns with your budget while providing the necessary features and functionalities. Look for transparent pricing with no hidden fees so you know exactly what you’re paying for. Many expense management solutions charge a monthly fee per user, so always check and compare different platform billing options.

Customization options

Choose software that allows you to customize features to your business needs. This ensures the platform works the way you do, helping you create workflows, settings, reports, and dashboards that fit your unique processes.

Why Ramp is the best credit card expense management software

Managing corporate expenses can be a time-consuming and error-prone process, especially if you're using traditional methods like shared company cards and manual expense reports. Without the right tools, finance teams often struggle to maintain real-time visibility into spending, leading to surprises at month-end close. Fraudulent or out-of-policy charges may go undetected for weeks, and collecting receipts and chasing down expense details from spenders can feel like a never-ending battle.

Ramp solves these challenges by linking our physical and virtual corporate cards directly with a best-in-class expense management platform. When your employee makes a purchase on their Ramp card, the transaction instantly appears in your Ramp account. Ramp automatically captures rich details like merchant name, amount, date, and category, eliminating the need for manual data entry. Employees can simply snap a photo of their receipt using Ramp's mobile app, and the receipt image is linked to the corresponding transaction.

This card-linked approach enables powerful, real-time spend controls. You can set granular spending limits and restrict purchases to specific merchant categories. If an employee attempts a charge that exceeds their card's limit or falls outside the approved categories, Ramp will automatically decline the transaction at the point of sale. Ramp also uses machine learning to detect potential duplicates, fraud, or personal charges. By surfacing suspicious transactions immediately, Ramp helps catch unauthorized spending before it spirals out of control.

With all card spend flowing automatically into Ramp, you have an up-to-the-minute view of expenses across your company. Ramp's reporting dashboards allow you to slice and dice expense data by cardholder, department, category, vendor, and more. Need to see how much the sales team spent on travel last quarter? Just a few clicks in Ramp, rather than hours wrangling spreadsheets. This visibility allows you to make more informed, agile decisions to control costs and drive your business forward.

Simplify expense management for your team

Corporate card expense management software should do more than replace spreadsheets. You need a comprehensive solution that streamlines management processes for your finance team, enforces your expense policy, and eliminates manual data entry.

That’s why over 50,000 finance teams choose Ramp for their expense management needs:

- Unlimited physical and virtual corporate cards: Control spending at the vendor, category, team, or card level with Ramp’s corporate charge cards

- No fees or interest: Ramp corporate cards come with no annual fees, no interest rates, and no hidden charges, helping you manage expenses without extra costs

- Automated expense management: Ramp automatically tracks and categorizes transactions in real time, simplifying expense reporting and reducing manual work

- Enforce your T&E policy: Flights, accommodations, and rental cars are always within policy when you book through Ramp Travel

Sources

¹ CPA.com, The State of Spend Management for SMBs, 2023.

² Ramp internal customer usage data, 2024.

FAQs

Credit card expense management software helps businesses track and manage spending on company credit cards. These tools streamline the process of recording, categorizing, and approving corporate credit card expenses.

The biggest risk comes from not having the proper controls in place for spending, which can be solved with automation and credit card reconciliation software. Not having guardrails in place could lead to unauthorized transactions, accounting errors, delayed or late review processes, and misallocation of expenses in your budget.

Business credit cards work just like personal credit cards that you might already use, except that they are dedicated to your business expenses. These are generally easier for a small business or startup to obtain and often come with perks like points or cash back.

A corporate credit card, on the other hand, is often paired with expense management software. They are issued based on a company’s creditworthiness and help you more effectively track, manage, and automate expenses and reimbursement.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits