Charge card vs. credit card: Key differences and how to choose

- What is a charge card?

- How does a charge card work?

- Benefits of charge cards

- Key differences between charge cards and credit cards

- Repayment options and limits for charge cards vs. credit cards

- Who should use a charge card?

- How to choose the right card for your business

- Simplify spending with the Ramp Business Credit Card

Looking for a smarter way to manage business expenses? A credit card lets you carry a balance from month to month with interest, while a charge card requires you to pay your full balance each month.

Charge cards require discipline, but they ensure you don't burn cash on interest charges and other fees. On the other hand, a credit card gives more flexibility, with room to pace your payments—but at a cost.

What is a charge card?

A charge card is a type of payment card that requires you to pay your balance in full at the end of each billing cycle. Since there's no option to carry a balance, charge cards don’t charge interest. Additionally, charge cards don’t usually have a preset spending limit, although the issuer may still restrict spending based on your creditworthiness and spending history.

Businesses commonly use charge cards to improve expense management since they combine flexible spending power with clear repayment discipline.

How does a charge card work?

A charge card is similar to a traditional credit card, except you must pay off your balance in full every month. There’s no option to make a minimum payment and carry your balance to the next month with interest, which some might consider a disadvantage.

Charge cards have no preset spending limit; they’re usually based on your payment history, business financials, and overall account activity. And since you pay your balance in full, your charge card doesn’t accrue interest. But missing a payment can result in late fees or even a temporary freeze on your account.

Corporate charge cards often include expense management software and custom controls to help you manage employee spending. You can add rules such as merchant restrictions or preset spending limits to enforce your expense policy.

Application process

Applying for a charge card is similar to applying for a business credit card, but issuers often look more closely at your company’s financials than your personal credit score. You’ll typically need business documentation such as proof of registration, banking information, and revenue details. Some issuers also require a minimum cash balance in your business account to qualify.

Repayment timeline

When you use a charge card for purchases, you’ll receive a monthly statement summarizing your charges. The entire balance is due by the payment due date each cycle. Since you can’t carry a balance, timely repayment is critical to avoid late fees or account restrictions.

Interest and fees

Charge cards don’t charge interest, but they may come with annual fees, especially those that offer rewards or premium perks. Depending on the card, missing a payment can also trigger late fees or penalties.

Benefits of charge cards

When you choose a charge card for your business, you’ll enjoy a few unique advantages compared to traditional credit cards:

- No preset spending limit: Unlike credit cards, charge cards adjust your spending power based on factors such as payment history, cash flow, and account activity. You can make large purchases without worrying about maxing out a credit line.

- Helps build business credit: Charge cards report your payment activity to business credit bureaus. Being forced to pay your balance in full and on time each month will strengthen your company’s credit profile. This can make it easier to secure financing, negotiate with vendors, or qualify for better terms down the road.

- Simplifies expense tracking and management: Many charge cards have built-in expense management tools. You can set custom rules, track employee purchases in real time, and generate reports that make bookkeeping and reconciliation faster.

- Business-focused rewards and perks: Charge cards often offer rewards tailored to business needs, including cashback, points, or miles, as well as vendor discounts and travel perks. Some cards also offer detailed reporting, integrations with accounting software, or partner benefits that extend beyond what standard credit cards provide.

Key differences between charge cards and credit cards

The primary difference between a charge card and a traditional credit card is how you're allowed to pay off your balance. A charge card requires you to pay your balance in full at the end of every billing cycle, while a credit card allows you to carry a balance month over month with interest.

With that said, there are a few other key differences to highlight:

Feature | Credit card | Charge card |

|---|---|---|

Spending limit | Has a preset credit limit | No preset spending limit |

Carrying a balance | Allows users to carry a balance from month to month | Requires full balance payments each month |

Interest rates | Typically charges interest on balances carried month-to-month | No interest rates since you must pay the balance in full |

Fees | May have annual fees, interest fees, and late fees | Often has no annual fee or other fees |

Rewards and benefits | Cashback, points, or miles, with perks such as travel credits and insurance | Cashback or points, as well as vendor discounts |

Building credit | Activity is reported to credit bureaus | Payment information is reported to credit bureaus |

Flexibility in payments | Allows minimum payments | You must pay the full balance monthly |

Suitability | Good for businesses looking to earn rewards and pay off balances over time | Ideal for companies that value high-end rewards and benefits and can afford to pay off their full balance each month |

Approval criteria | Typically requires good credit and a personal guarantee | Usually has no credit check but requires a certain minimum balance in a business bank account |

Your company might choose a charge card to avoid interest, control spending patterns, and streamline expense management. On the other hand, a credit card offers the flexibility to carry a balance, which can help with short-term cash flow but adds borrowing risk. That difference affects how you manage working capital, monitor employee spending, and close your books.

Payment terms

Charge cards offer flexible spending limits, but credit cards provide more flexible payment terms. With a credit card, you only need to make the minimum monthly payment by the due date, even if it’s just a small portion of your total balance. However, the issuer carries over any unpaid balance to the next month.

This flexibility can make it easy to accumulate debt over time, potentially leading to high interest costs and negatively impacting your business credit score. In contrast, charge cards require you to pay the full balance each month, avoiding interest and late fees. If your business has a stable cash flow, it can effectively manage expenses and avoid debt.

Spending limits

Credit cards cap the amount of credit available to cardholders each month. When you reach your credit limit, the issuer blocks new purchases on the account. Your available credit increases again after you pay down some of the balance.

When the issuer approves you for a card, it determines your credit limit based on your credit score and payment history. You must demonstrate a history of responsible and frequent card use to increase your limit.

Charge cards, on the other hand, don't have preset card limits. Their spending limit fluctuates based on factors such as monthly spending, liquid assets, historical sales, or repayment and spending habits.

These flexible limits make charge cards useful for large purchases or multiple purchases in a short timeframe. If your business frequently makes high-value purchases, a charge card may provide more flexibility than a traditional credit card with a fixed credit limit.

Eligibility requirements

Credit card issuers determine your eligibility based on your credit history. If you have a bad credit score, you'll still qualify for some cards, but they usually come with higher interest rates. A good to excellent credit score allows you to access the best business credit cards.

Charge cards, on the other hand, evaluate your application based on your company's financial situation. Most providers consider your annual revenue and the amount of capital in the bank. So, if you don't have an established business credit history, you can still qualify as long as your business is bringing in enough profit.

Impact on credit score

Credit utilization refers to the percentage of your available credit that you’re using at any given time. Since credit cards come with a preset limit, how much of that credit you use compared to your total available credit will impact your profile.

Keeping your credit utilization low can help improve your credit score. It signals to creditors and credit bureaus that you can use your business credit card and pay it off responsibly. Conversely, a higher credit utilization ratio will negatively impact your credit report.

Charge cards generally don’t have preset limits, so credit agencies don’t factor credit utilization rates into their scoring models. Because of this, making larger purchases with a charge card instead of a credit card can help improve your credit score, rather than harming it.

Repayment options and limits for charge cards vs. credit cards

With a charge card, there’s no option to carry a partial balance forward or make only a minimum payment. This structure encourages disciplined spending and ensures you never accumulate interest charges.

If you can’t pay your charge card in full, issuers may apply late fees or penalties, restrict your spending power, or even suspend or close your account until you make repayment. These consequences can disrupt your operations and hurt your company’s credit profile, so it’s important to plan ahead for on-time payments.

Spending limits also work differently with charge cards. A credit card gives you a preset limit that doesn’t change unless you request an increase. A charge card, on the other hand, usually has no fixed spending limit. Instead, issuers determine your purchasing power based on your payment history, cash flow, account balances, and overall business financials.

Who should use a charge card?

A charge card isn’t the right fit for every business, but it can be a powerful tool if it matches your financial model and goals. You’ll benefit most from a charge card if:

- Your cash flow is predictable. If your business has steady monthly revenue, it’s well-positioned to pay off balances in full and avoid late fees

- You want to avoid interest charges: Since charge cards don’t allow revolving balances, you’ll never get stuck with accumulating interest, helping you keep your books clean and debt-free

- You’re focused on building business credit: Full, on-time payments are reported to business credit bureaus, which can strengthen your credit profile and improve financing options over time

- You value expense controls and reporting: Many charge cards include spend tracking, merchant restrictions, and integrations that simplify expense reconciliation and give you more visibility into employee expenses

Charge cards are also an attractive option if your business makes large or frequent purchases since spending limits adjust dynamically based on payment history, cash reserves, and overall business finances.

Discover Ramp's corporate card for modern finance

Can you switch from a charge card to a credit card?

You can switch from a charge card to a credit card. However, you'll need to apply for a new credit card rather than convert your existing charge card. Most issuers don't allow direct transfers between the two since charge cards and credit cards are structured differently.

Still, that doesn’t make your charge card any less useful. In fact, keeping it open can build your business credit score over time. Length of credit history makes up about 15% of your score. Using a charge card consistently and responsibly can reinforce strong financial habits and lender confidence.

How to choose the right card for your business

The best credit card for your company depends on how you manage cash flow and what features matter most. Keep these factors in mind as you narrow down your options:

- Payment flexibility: If you want the option to carry a balance during slower months, a credit card gives you more breathing room. If you’d rather stay disciplined and avoid interest, a charge card that requires full payment each month may be the smarter choice.

- Rewards and perks: Look at where your business spends the most. If your company does a lot of business travel, a credit card that earns travel points or miles, alongside perks such as lounge access and complimentary hotel elite status, may deliver more value. If you want consistent cashback or vendor discounts, a charge card may be a better fit for your expenses.

- Fees and costs: Compare annual fees, annual percentage rates (APRs), and late payment fees. Some premium cards offset higher annual fees with stronger benefits, while others offer rewards and business-centric tools for no annual fee.

- Reporting tools and expense management: Consider how each card supports your bookkeeping. Many charge cards come with built-in reporting, controls, and integrations that streamline reconciliation. Credit cards typically offer simpler tracking and fewer automation features.

- Eligibility and approval process: Credit cards often require a personal credit check and personal guarantee, while charge cards may evaluate your company’s revenue and account balances instead. Think about whether you want to tie the card to your personal credit history.

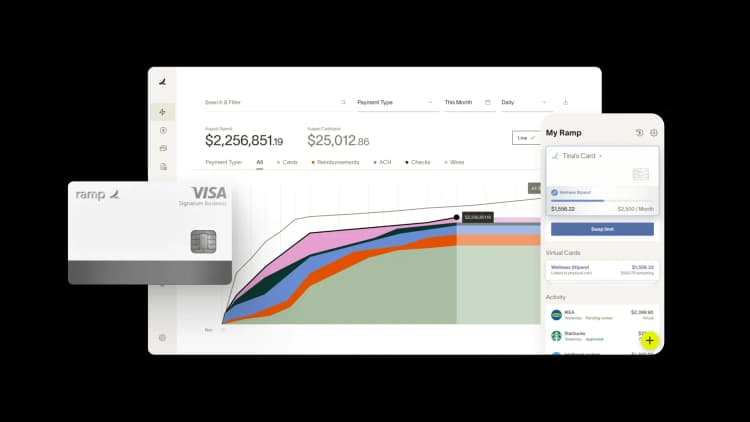

Simplify spending with the Ramp Business Credit Card

If you’ve decided a charge card is a better fit for your business, Ramp makes the choice even easier. The Ramp Business Credit Card combines the traditional benefits of a charge card with modern tools designed to simplify how you manage company spend.

There’s no annual fee, no interest, and no personal credit check or guarantee. You qualify based on business revenue, not your credit score. If you have at least $25,000 in a U.S. business bank account, you can get approved in 48 hours or less.

Set custom spending controls on employee credit cards, create unlimited virtual cards for specific teams or vendors, and automate expense reporting with smart integrations that capture receipts automatically. You’ll also get over $350,000 in partner rewards and perks.

Ready to get started? Try an interactive demo and see why Ramp cardholders save an average of 5% a year across all spending.

FAQs

No, a debit card pulls money directly from your bank account at the time of purchase, while a charge card lets you buy on credit but requires full repayment at the end of each billing cycle.

Charge cards report your payment activity to business credit bureaus, so paying balances in full and on time each month can strengthen your credit profile. Since they don’t use preset limits, they also avoid raising your credit utilization ratio, which can help your score.

Charge cards often have stricter eligibility requirements than credit cards. Instead of focusing on your personal credit score, issuers usually look at your business’s revenue, cash reserves, and financial history to determine approval. This can make them harder to get for newer or smaller businesses.

Charge cards require full payment each month. If you miss a payment, you may face late fees, penalties, or a temporary spending freeze. Some issuers may reduce your available limit or close the account.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits