Does requesting a credit increase hurt your credit score?

- What happens when you request a credit limit increase?

- How credit limit increases affect your credit score

- Which credit card companies do hard vs. soft pulls?

- When should I request a credit limit increase?

- Signs you’re ready for a credit limit increase

- When you should wait to request a credit limit increase

- How to request a credit limit increase

- Access higher credit limits with a Ramp Business Credit Card

You might hesitate to request a credit limit increase, worried it could hurt your credit score. This concern is completely valid. After all, your credit score affects everything from loan approvals to interest rates. The good news is that requesting a higher limit doesn't always affect your score negatively.

The confusion comes from how issuers check your creditworthiness. Some perform hard inquiries that can lower your score, while others use soft inquiries that leave no mark. Knowing which type of credit check your issuer uses makes all the difference.

What happens when you request a credit limit increase?

When you ask your credit card issuer for a higher limit, they review your account activity and financial profile to decide if you qualify. You can usually request an increase online, in the mobile app, or by calling customer service, and the process only takes a few minutes.

Issuers also grant automatic increases without you asking. These happen when you’ve shown responsible use over time—paying on time, keeping balances low, and reporting improved income. Automatic increases don’t require a hard inquiry, so they won’t affect your credit score.

Lenders consider several factors when you request more credit, including your:

- Payment history

- Current income

- Employment status

- Existing debt levels

- Overall credit profile

Your chances improve if you’ve been a customer in good standing for at least six months.

Is it bad to request a credit limit increase?

Requesting a credit limit increase is generally not bad and can even help your credit score by lowering your credit utilization ratio. Plus, if your issuer performs a soft inquiry, it won’t affect your credit score.

Hard inquiries vs. soft inquiries

A hard inquiry, also called a hard pull, happens when a lender checks your full credit report to make a lending decision. Hard inquiries may lower your score by about 5 to 10 points. They can remain visible on your credit report for up to 2 years, although the score impact typically fades within 3 to 6 months.

Soft inquiries occur when you check your own credit or when companies run background checks for pre-approval offers. Soft inquiries do not affect your credit score, and only you can see them on your credit report. When your card issuer uses a soft inquiry for a credit limit increase, your score is not affected.

How credit limit increases affect your credit score

If your issuer performs a hard inquiry, you may see a small, temporary dip in your credit score, usually between 5 and 10 points. This impact typically fades within 3 to 6 months. The good news is that many major credit card companies now use soft inquiries for existing customers, meaning your score often stays unaffected.

The long-term benefits of a higher credit limit usually outweigh any short-term dip. A larger credit line improves your credit utilization ratio, one of the most significant factors in your credit score. Over time, this can boost your score by 20 points or more if you maintain low balances relative to your total available credit.

Effect on credit utilization ratio

Your credit utilization ratio is the percentage of available credit you’re using. It accounts for 30% of your FICO score. Lenders view a lower utilization rate as a sign of responsible credit management. Keeping this ratio low shows that you’re living within your means rather than maxing out your cards.

The formula is:

Credit utilization ratio = (Total credit card balances / Total credit limits) * 100

If you have a $5,000 limit and carry a $2,000 balance, your utilization is 40%. After an increase to $10,000 with the same balance, your utilization drops to 20%. That’s a meaningful improvement in the eyes of credit scoring models.

Credit experts recommend keeping your utilization below 30% of your total credit limit across all cards. For the best possible credit scores, aim to stay below 10%. Even if you pay off your balance in full each month, the balance reported to credit bureaus matters, so timing your credit limit increase strategically can provide immediate benefits.

Other credit score factors to consider

While credit utilization is important, your overall credit health depends on several other factors working together. Here’s how FICO weights each one:

| Factor | Weight in FICO Score |

|---|---|

| Payment history | 35% |

| Credit utilization | 30% |

| Length of credit history | 15% |

| New credit inquiries | 10% |

| Credit mix | 10% |

Source: FICO

Here’s how these factors interact with your credit utilization:

- Payment history: Your record of on-time payments makes up 35% of your FICO score and carries the most weight of any single factor

- Length of credit history: Older accounts generally help your score more than newer ones, which is why keeping your oldest credit cards open matters

- Credit mix: Having different types of credit, such as credit cards, auto loans, and mortgages, shows lenders you can manage various obligations responsibly

These elements combine with your utilization rate to shape your complete credit profile and overall score.

Can I ask for a credit limit increase every month?

You can ask for a credit limit increase every month, but it's not recommended. Frequent requests may raise red flags for lenders, making you seem financially unstable or overly reliant on credit.

Which credit card companies do hard vs. soft pulls?

Here are some of the major credit card issuers and their policies on credit limit increases:

| Card issuer | Automatic increase | Requested increase | Additional notes |

|---|---|---|---|

| American Express | Soft pull | Soft pull | If you decline a credit limit increase offer and request a higher limit, it’s a hard pull. |

| Bank of America | Soft pull | Soft pull | — |

| Capital One | Soft pull | Soft pull | — |

| Chase | Soft pull | Hard pull | — |

| Citi | Soft pull | Hard pull | Usually requires excellent credit for approval. |

| Discover | N/A | Soft pull | Doesn’t normally increase credit limits automatically. |

| U.S. Bank | Soft pull | Hard pull | — |

| Wells Fargo | Soft pull | Soft pull | If you decline a credit limit increase offer and request a higher limit, it’s a hard pull. |

Credit card issuers can change their policies at any time. Check your issuer’s website for the most current details or contact customer service directly to confirm whether a hard or soft inquiry applies.

When should I request a credit limit increase?

Requesting a credit limit increase can be a smart move, but timing it right can make a big difference in your approval odds and credit score. Here are some of the best times to ask.

After a significant revenue increase

If your business has recently experienced a substantial rise in annual revenue, it’s a good time to request a credit limit increase. Lenders are more likely to approve your request if they see that your business is generating higher income, since it shows a greater ability to repay borrowed amounts. An increase in revenue also signals that your business can manage a higher credit limit responsibly.

When your credit score has improved

An improved credit score signals to lenders that you’re a responsible borrower. If you’ve been working on improving your credit score by paying bills on time, reducing debt, and correcting any errors on your credit report, you’re in a strong position to request a credit limit increase. A higher credit score increases your chances of approval and can result in a more substantial increase.

Before making a large purchase

If you anticipate a significant expense, such as an office relocation or an equipment purchase, requesting a credit limit increase beforehand can be beneficial. This can help you manage the expense without maxing out your current credit limits, which can negatively affect your credit utilization ratio and, consequently, your credit score.

After demonstrating responsible credit use

Lenders look favorably on borrowers who demonstrate responsible credit behavior. If you’ve consistently paid your bills on time, kept your balances low, and avoided late payments, you’re showing that you can handle credit responsibly. This track record makes it a good time to request a credit limit increase, as lenders will see you as a lower risk.

When you haven't applied for new credit recently

If it’s been a while since you last applied for credit, you’re less likely to appear overextended. Requesting an increase at this time shows lenders you’re managing existing credit well without relying on frequent new accounts. Timing your request strategically can improve your approval odds and minimize potential dips in your credit score.

How can I raise my credit score 100 points in 30 days?

If your score is already high, a 100-point increase in 30 days is unlikely, but if you have high utilization or errors, it could be possible. To improve your odds, dispute errors on your report with the credit bureaus (Experian, TransUnion, Equifax) and request an increase to your line of credit. Then, pay down your credit card balances to lower your credit utilization to below 10%.

Signs you’re ready for a credit limit increase

Requesting a credit limit increase at the right time improves your chances of approval and helps you maximize the benefits. You’re likely ready to ask if you meet these conditions:

- Consistent on-time payments for 6+ months: Lenders want to see a solid history of timely payments before extending more credit

- Improved credit score since account opening: A higher score shows stronger credit management and makes you a lower-risk borrower

- Increased income or reduced debt: Positive changes in your finances signal that you can handle a higher limit responsibly

- Current utilization above 30%: If you regularly use more than 30% of your available credit, a higher limit can quickly improve your utilization ratio

These signs show lenders that you’ve built a strong financial profile and can manage additional credit responsibly.

When you should wait to request a credit limit increase

Timing matters when requesting more credit. In some situations, it’s better to hold off until your financial profile strengthens.

- Recent late or missed payments: Wait until you’ve built at least 6 months of perfect payment history before asking for an increase

- New account holder: Most issuers want to see 6 months of account history before considering a higher limit

- Recent credit limit increase: Requesting too soon can raise red flags and may result in a hard inquiry with little benefit

- Multiple recent hard inquiries: Several inquiries within a short period can signal financial stress to lenders and hurt your approval odds

- Upcoming major loan application: If you’re planning to apply for a mortgage or auto loan soon, avoid additional inquiries that could temporarily lower your score

- Decreasing income or rising debt: Wait until your financial situation improves before seeking more credit

Waiting for the right moment increases your approval chances and protects your credit score from unnecessary inquiries.

How to request a credit limit increase

Requesting a credit limit increase is simple once you’ve gathered what you need. Here’s the information most issuers will ask for:

- Current annual income

- Monthly housing payment (rent or mortgage)

- Employment status and employer name

- Desired credit limit amount

- Reason for requesting the increase

Follow these steps to submit your request online:

- Log in to your credit card account on the issuer’s website or mobile app

- Go to the account services or credit limit increase section

- Enter your current income and housing payment details

- Specify the credit limit amount you’re requesting

- Review the terms to see whether a hard or soft inquiry applies

- Submit your request and wait for an immediate decision or follow-up notification

You can also call customer service directly. The number is usually on the back of your card.

How can I get a credit limit of $20,000?

To get a $20,000 credit limit, maintain a good to excellent credit score (700+), low credit utilization, and strong payment and credit histories. Having a high income and low debt-to-income ratio also improves your chances.

Tips for increasing approval odds

There’s no guarantee your request will be approved, but these strategies can help improve your chances:

- Be realistic with your request: Asking for a modest increase—about 10% to 25% of your current limit—is more likely to be approved

- Update your income: If your income has increased since opening the account, make sure your issuer has your current information

- Pay down your balance first: Lowering your balance before requesting an increase shows financial discipline

- Show a consistent record: Aim for at least 6 months of on-time payments before applying

- Consider calling instead of applying online: A representative can sometimes offer soft inquiry options or guidance on timing

What to do if your request is denied

A denial doesn’t close the door to higher limits in the future. Here are the most common reasons for denial and how to recover:

- Insufficient income: Your income may be too low compared with your debt obligations

- Short account history: Issuers often prefer a longer track record before extending more credit

- High credit utilization: High balances across accounts can make you appear overextended

- Recent late payments: Late or missed payments raise risk concerns for lenders

- Too many recent inquiries: Multiple hard inquiries suggest you’re seeking too much credit at once

Most issuers recommend waiting at least 6 months before reapplying. Use that time to improve payment history, pay down balances, and reduce overall utilization. You can also contact your issuer to ask why your request was denied, so you know what to fix before trying again.

Does getting denied for credit affect your credit score?

Getting denied for credit doesn't directly affect your credit score. However, a hard inquiry made by the lender when you applied can lower your score slightly. The effect of this hard inquiry is usually minimal and short-term.

Alternative strategies for managing credit utilization

If you want to lower your credit utilization quickly, try making multiple payments throughout the month instead of waiting for your statement date. This helps keep your reported balances lower and can improve your score before the next billing cycle closes.

You can also request a credit limit increase on a different card if that issuer has more flexible criteria. This adds to your total available credit, reducing your overall utilization.

Opening a new credit card can also raise your total limit, though it comes with a hard inquiry and may slightly reduce your average account age. Consider this option only if you can manage another account responsibly.

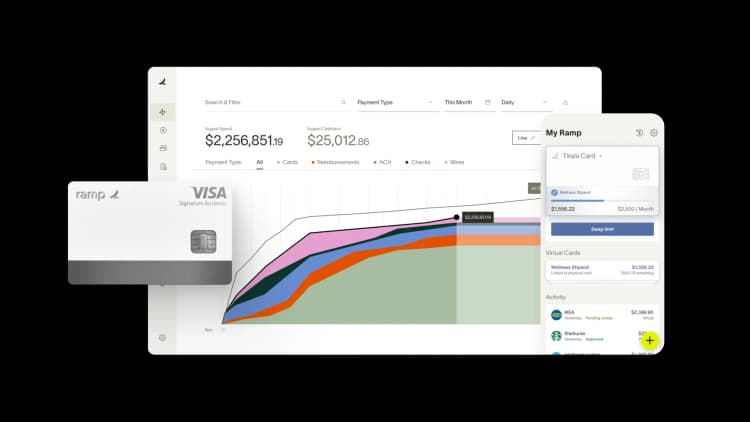

Access higher credit limits with a Ramp Business Credit Card

At Ramp, we can offer credit limits up to 30 times higher than traditional credit cards. That’s because we use factors such as sales data and cash in the bank to determine spending limits instead of running a credit check. To qualify, all you need is one year of sales data.

Our card comes with built-in spend management tools that help you optimize spending, allowing you to grow your business. You can give your employees spending power with custom rules and limits, alleviating the need for costly employee reimbursement programs.

Track every expense you have in real time. You can even analyze spending by department, vendor, location, and more. And through our automatic categorization and integration with accounting platforms such as QuickBooks and NetSuite, you can close your books 8 days faster on average.

Apply for a Ramp corporate card and start taking advantage of the benefits.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°