- What is an eCheck?

- What is the ACH network?

- eChecks vs. ACH payments

- Which method is right for your business?

- Setting up eCheck or ACH payments: Step by step

- Automate your payments with ACH and Ramp

Your business likely processes multiple vendor invoices each month, so it's important to understand your electronic payment options and how they fit into your workflow. Many businesses wonder about the difference between eChecks and ACH payments—and the answer might surprise you.

eChecks and ACH payments are closely related, but they're not interchangeable. Understanding how they work together can help your accounts payable (AP) team choose the most efficient payment method for each transaction.

In this article, we'll explain what eChecks and ACH payments are, how they relate to each other, and help you decide which approach works best for your business.

What is an eCheck?

An eCheck (electronic check) is a specific type of ACH debit payment that electronically debits a checking account, mimicking how paper checks work digitally.

Key characteristics of eChecks:

- Processed through the ACH network

- Designed to replace paper checks

- Typically used for one-time or occasional payments

- Requires account and routing number (like a paper check)

- Often initiated through payment processors or online checkout systems

All eChecks are ACH payments, but not all ACH payments are eChecks. eChecks are simply one way to use the ACH network—specifically for check-like transactions.

How do eCheck payments work?

eCheck payments follow the standard ACH processing workflow with some additional verification steps:

- Authorization: You provide your bank account number and routing number through a secure payment portal. The vendor must obtain explicit consent before processing the transaction, usually via a digital authorization form.

- Verification: The payment processor verifies the payment information, confirming sufficient funds and scanning for fraud. Some systems perform micro-deposits to confirm account validity.

- Transmission: The payment details are transmitted through the ACH network for processing. ACH transactions process in batches, keeping costs low.

- Processing: Your bank withdraws the payment amount and transfers it to the vendor's account through the ACH network. Both banks finalize the transaction and update account balances.

- Settlement: Funds typically settle within 1–3 business days (standard ACH timing).

- Notification: Both parties receive confirmation once the payment clears.

eCheck payment example

Say you're a small business hiring a web developer to build your e-commerce site. Once the developer completes the work, they send you an invoice along with their bank account and routing numbers and a digital authorization form.

You approve the invoice and use your payment platform to process an eCheck payment. The transaction goes through the ACH network, withdrawing funds from your account and depositing them into the developer's account within 1-3 business days. Both parties receive email confirmation with transaction details.

Pros and cons of eChecks

Advantages:

- Familiar check-like process for those transitioning from paper

- Lower cost than credit card processing

- Secure electronic processing through ACH network

- No need for physical check stock, printing, or postage

- Good for one-time or occasional payments

Disadvantages:

- Potential for returned payments due to insufficient funds

- Requires customer's bank account information

- 1–3 day clearance window (standard ACH timing)

- May require setup with a payment processor

What is the ACH network?

The Automated Clearing House (ACH) is the electronic network used to process payments between U.S. bank accounts. Governed by Nacha, the ACH network processes billions of transactions annually, including:

- Direct deposits (payroll)

- Recurring bill payments

- Business-to-business payments

- Vendor payments

- Tax payments

- eChecks

ACH payments fall into two main categories:

- ACH credits: You push funds to another account (like payroll direct deposits or vendor payments)

- ACH debits: A vendor pulls funds from your account after obtaining authorization (like recurring bill payments or subscription charges)

How do ACH payments work?

When businesses refer to "ACH payments" (as distinct from eChecks), they typically mean setting up automated recurring payments or initiating business payments through their accounting or AP software.

The process follows standard ACH workflows:

- Initiation: You provide the recipient’s bank account information, ACH routing number, and the payment amount. Then, you specify the transaction type: credit or debit.

- Request hits Originating Depository Financial Institution (ODFI): The request goes to the ODFI, the sender’s bank, which compiles the payment data into a standardized file and verifies the details before submitting it to the ACH network

- Batch processing: Instead of processing payments one at a time, the ODFI groups multiple transactions into batches and submits them at scheduled intervals. This is more efficient and cost-effective.

- ACH operator: The ACH operator, either the Federal Reserve or Electronic Payments Network, acts as an intermediary, sorting and routing transactions to the correct recipient banks for processing

- Receiving Depository Financial Institution (RDFI) processing: The RDFI, the recipient’s bank, processes the transaction by debiting your account for the ACH debit

- Settlement: With the transactions verified, banks reconcile balances through a central clearinghouse. After settlement, the banks update both account balances, and both parties receive payment confirmation.

ACH payment example

Let’s say an advertising agency hires a design contractor on a monthly retainer. The agency would like to set up ACH recurring payments, so the contractor provides their bank information and written authorization.

Then the ACH system authorizes their agreed-upon payments, scheduled for the same day each month. Once that’s complete, both receive notifications via email about the payment.

Pros and cons of ACH

Advantages:

- Lower likelihood of ACH scams due to secure Nacha regulations

- Low ACH processing fees ($0.20–$1.50 per transaction typically)

- Wide acceptance across businesses

- Easy to automate recurring payments

- Integrates with accounting and AP software

- Environmentally friendly (paperless)

Disadvantages:

- Standard 1–3 day processing (same-day available for extra fee)

- Domestic U.S. payments only (standard ACH)

- May have daily or monthly transaction limits

- Payments can be delayed if submitted after bank cutoff times

eChecks vs. ACH payments

Key differences

The real distinction isn't "eCheck vs. ACH"—it's how you use the ACH network. Here's what actually differs:

| Criteria | eChecks | General ACH Payments |

|---|---|---|

| What it is | Specific type of ACH debit mimicking paper checks | Broad term for electronic payments via ACH network |

| Processing network | ACH network | ACH network |

| Processing time | 1–3 business days (standard ACH) | 1–3 business days (standard ACH) |

| Typical fees | $0.10–$1.50 per transaction | $0.20–$1.50 per transaction |

| Best for | One-time or occasional payments, replacing paper checks | Recurring payments, payroll, automated billing |

| Setup | Minimal (often through payment processor) | May require integration with accounting/AP software |

| Common use | Customer makes one-time payment to vendor | Business automates recurring vendor or employee payments |

Key similarities

Despite different use cases, eChecks and general ACH payments share fundamental characteristics:

- Same network: Both use the ACH network for processing

- Same timeline: Both typically settle in 1-3 business days

- Cost-effective: Both are cheaper than credit card processing

- Security: Both follow Nacha security standards and regulations

- Electronic: Both eliminate paper checks and manual processing

- Widely accepted: Both work across U.S. financial institutions

Which method is right for your business?

The choice between eChecks and setting up standard ACH payments depends on your payment patterns and operational needs:

When to choose eChecks

- You need a simple way to accept one-time payments

- You're replacing paper checks without changing your workflow significantly

- You process occasional large payments (like contractor invoices)

- You want minimal setup through a payment processor

- Your customers prefer a check-like payment experience

When to choose standard ACH:

- You process high volumes of recurring payments

- You want to automate payroll or vendor payments

- You need integration with accounting or AP software

- You want to streamline your entire AP workflow

- Speed and automation are priorities

Other factors to consider

- Payment frequency High-volume recurring transactions (subscriptions, payroll, monthly bills) benefit from automated ACH setup through your AP software. Occasional large payments work well with eChecks.

- Processing speed Both use the ACH network with 1-3 day standard processing. Same-day or instant ACH is available with either method for an additional fee if speed is critical.

- Cost efficiency Both methods cost significantly less than credit cards. Fees are similar ($0.10–$1.50 per transaction), with exact costs depending on your processor or bank.

- Workflow compatibility Standard ACH payments integrate with accounting platforms for automated reconciliation. eChecks work through payment processors with simpler setup requirements.

- Vendor and customer expectations Some prefer eChecks for their familiarity with check-based systems. Others favor automated ACH for recurring transactions. Consider your vendors' preferences and payment patterns.

Setting up eCheck or ACH payments: Step by step

Whether you choose eChecks or standard ACH integration, setup follows similar steps:

- Choose a processor or banking partner: For eChecks, select a payment processor that offers eCheck services. For ACH, work with your bank or choose AP automation software with ACH capabilities.

- Set up and verify your business bank account: Most processors require a business bank account for verification. You’ll need account and routing numbers and, potentially, a bank that supports ACH payments. Be sure to verify early in the process to avoid delays, either with a micro-deposit verification or secure login through the bank.

- Ensure compliance: To initiate payments, your business must first get an ACH authorization form from your customers or vendors, keep a record of the confirmation for a minimum of 2 years, and provide a method to dispute charges. Failure to file a written authorization can lead to legal issues.

- Integrate with existing systems: Once you pick a method, make sure it integrates with your accounting or expense management tools to automate reconciliation, track your payments, and verify timing. Providers with open APIs often integrate more smoothly.

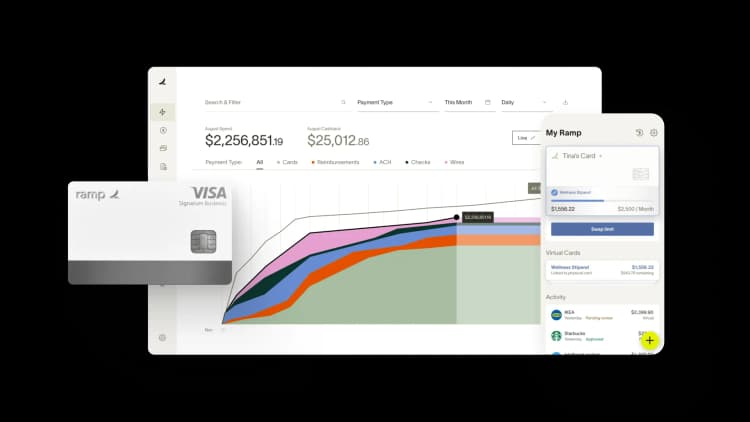

Automate your payments with ACH and Ramp

Ramp Bill Pay is an accounts payable automation platform that streamlines business payments by integrating them into your AP workflows. Ramp Bill Pay provides:

- Automated ACH payments: Schedule recurring vendor payments or process one-time ACH transfers with a few clicks

- Customizable approval workflows: Keep invoices moving quickly with automated routing based on amount, vendor, or department

- Seamless ERP integration: One-click syncing with QuickBooks, NetSuite, Xero, and other accounting platforms

- Intelligent matching: Automated 2-way and 3-way matching catches errors before payment

- Complete visibility: Track every payment from invoice receipt through settlement

Try Ramp Bill Pay and see how much time and money your AP team can save with automated ACH payments.

Get started with Ramp Bill Pay.

This post includes general information about ACH payments. For help with ACH functionality specific to Ramp, visit Ramp Support for more details.

FAQs

An eCheck (electronic check) is a specific type of ACH check payment that electronically debits a checking account, mimicking how paper checks work digitally.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits