- What is an expense management workflow?

- Benefits of implementing an expense management workflow

- How to design an effective expense management workflow

- Expense management workflow examples

- Best practices for expense management workflows

- Tools and technology for expense management workflows

- Measuring and optimizing your expense management workflow

- How Ramp eliminates manual expense workflows through intelligent automation

An expense management workflow is the step-by-step process companies use to handle employee spending, from purchase to reimbursement. Without a clear workflow, finance teams lose visibility into expenses, approvals slow down, and policy violations are easier to miss. A well-designed process helps you control spending, close the books faster, and reimburse employees without unnecessary back-and-forth.

What is an expense management workflow?

An expense management workflow is your company’s defined process for handling employee spending from start to finish. It lays out how expenses are submitted, who reviews and approves them, when reimbursements are issued, and how each transaction is recorded in your accounting system.

The difference between ad-hoc expense handling and a workflow comes down to consistency. Without a workflow, employees submit expenses in different ways—emails, paper forms, spreadsheets—each following a different path and timeline. This leads to confusion, delays, and more manual work for finance teams.

A standardized workflow ensures every expense follows the same steps and meets the same requirements. When an employee makes a purchase, they submit it through a single system, approvals route automatically based on amount and category, and accounting processes the reimbursement and records it properly.

Key components of an expense management workflow

Every expense management workflow relies on four core components working together to move spending from submission to payment:

- Submission: Employees enter expense details and attach receipts through your expense management system, creating a clear record of what was purchased, when, and for how much

- Approval: Managers and finance teams review expenses against company policy to confirm business purpose, documentation, and spending limits before authorizing payment

- Reimbursement: Once approved, accounting issues payment to the employee according to your reimbursement schedule, such as weekly, biweekly, or monthly

- Reporting: All expense data is tracked for financial reporting, budget monitoring, and audit purposes, giving you visibility into spending patterns

Each stakeholder plays a defined role in keeping the workflow running smoothly:

- Employees: Submit accurate expense reports with required documentation and follow expense policy guidelines and deadlines

- Managers: Review expenses for business relevance and policy compliance, acting as the first layer of approval

- Finance teams: Process reimbursements, reconcile accounts, handle exceptions, and maintain records for compliance and reporting

- Executives: Set expense policies, review aggregated spend data, and use insights to guide budgeting and planning decisions

Traditional vs. digital expense management approaches

The way companies manage expenses has evolved significantly as manual processes have been replaced by automated systems:

| Aspect | Paper-based systems | Digital solutions |

|---|---|---|

| Submission | Physical forms and receipt envelopes | Mobile apps with receipt scanning |

| Approval | Manual routing between managers | Automated approval workflows |

| Processing time | Days or weeks | Hours or days |

| Data entry | Manual input into accounting software | Automatic extraction and integration |

| Receipt storage | Filing cabinets | Cloud-based digital archives |

| Policy enforcement | Manual review of each expense | Automated rule checks |

| Reporting | Spreadsheet-based summaries | Real-time dashboards and analytics |

| Audit trail | Paper documentation | Complete digital history |

Early digital tools focused on replacing paper forms with online submissions. Modern platforms now incorporate receipt scanning, real-time policy enforcement, and integrations with corporate cards and accounting systems. More advanced solutions use automation and machine learning to categorize expenses, flag potential issues, and surface spending insights, making expense management faster and more accurate for both employees and finance teams.

Key steps in an expense management workflow

This high-level workflow outlines how expenses move from purchase to reimbursement, with each stage playing a distinct role in maintaining accuracy, control, and compliance:

1. Gather the relevant records

In order to submit an expense report, an employee must provide proof of the business transaction. This proof of purchase typically comes in the form of an expense receipt, though other documentation—such as a canceled check, credit card statement, invoice, or bill—is sometimes acceptable.

With this in mind, the first step in the expense management workflow is typically to gather the relevant receipts, records, and other documentation that must be submitted alongside the expense report.

2. Generate an expense report

Once the employee has the required documentation, they generate an expense report that lists each purchase, the business purpose, and any required details such as category, date, and payment method.

3. Submit the expense report

After reviewing the report for accuracy, the employee submits it for approval with the documentation required by the company’s expense policy.

4. Review and approve the report

Approvers review the submission for completeness, business relevance, and policy compliance. If anything is missing or out of policy, the report is returned for corrections or additional documentation.

5. Process the expense

Once approved, finance or accounts payable validates the report, ensures expenses are coded correctly, and records the transactions in the accounting system.

6. Reimburse the employee or reconcile the corporate card transaction

If the employee paid out of pocket, reimbursement is issued according to the company’s schedule. If the purchase was made on a corporate card, the expense is reconciled and posted to the general ledger.

Benefits of implementing an expense management workflow

A well-defined expense management workflow strengthens financial controls and reduces the risk of fraud. Clear submission requirements and approval chains make it harder for inappropriate or inaccurate expenses to slip through. Automated policy checks catch violations before payments go out, while complete audit trails deter dishonest behavior and simplify reviews.

Common expense issues a structured workflow helps prevent include:

- Missing or inadequate receipts: Expenses submitted without itemized receipts or with documentation that doesn’t clearly show what was purchased. Requiring receipt uploads at submission time and setting automatic reminders for missing documentation helps prevent this.

- Late expense submissions: Expenses submitted weeks or months after purchase create reconciliation challenges and can cause tax issues when reimbursements cross reporting periods. Clear deadlines and automated warnings reduce delays.

- Personal expenses on corporate cards: Employees accidentally or intentionally charging personal purchases to company cards. Real-time transaction monitoring and required business justifications help flag these issues early.

- Exceeding spending limits: Meals, travel, or other expenses that go over approved limits without preapproval. Built-in controls alert employees before submission and route exceptions for review.

- Duplicate submissions: The same expense submitted more than once, either accidentally or through multiple systems. Duplicate detection compares amounts, dates, and merchants to catch errors.

Beyond compliance, better visibility into spending patterns helps you manage budgets more effectively. Real-time data shows where money is going, making it easier to spot overspending, adjust policies, and identify opportunities to negotiate better rates with vendors.

For employees

Employees benefit from faster reimbursements and a simpler submission process that reduces administrative work. According to the Global Business Travel Association, it takes about 20 minutes to manually create and submit one expense report, while expense management software can reduce that time by up to 90%.

Key benefits for employees include:

- Faster reimbursements: Automated workflows move expenses through approvals quickly, reducing wait times and follow-ups

- Simplified submissions: Guided forms and built-in policy rules reduce rejected reports and back-and-forth with finance

- Mobile accessibility: Employees can capture receipts and submit expenses from their phones, reducing lost documentation and end-of-month scrambles

These improvements save time and reduce frustration for employees who regularly incur business expenses.

For finance teams

Finance teams see significant efficiency gains when expense workflows automate repetitive tasks and centralize data. The GBTA reports that 19% of expense reports contain errors, and correcting each one costs time and money. Automation helps reduce these errors while improving accuracy.

Benefits for finance teams include:

- Reduced manual data entry: Integrated systems automatically pull transaction details from corporate cards and accounting software

- Stronger audit trails: Digital workflows record every step of the expense lifecycle, making audits faster and easier to manage

- Real-time spending insights: Live dashboards show current spend against budgets, helping teams address issues before month-end

With fewer manual tasks, finance teams can focus on analysis, forecasting, and strategic planning.

For management

Management gains better control and visibility into company spending without needing to micromanage individual purchases.

- Strategic spending decisions: Aggregated expense data highlights trends that inform budgeting, vendor negotiations, and policy updates

- Consistent policy enforcement: Automated rules apply the same standards across teams, reducing subjective decision-making

- Improved budget control: Real-time visibility allows leaders to course-correct during the quarter instead of reacting after overspending occurs

These benefits help leadership maintain financial discipline while supporting teams’ day-to-day needs.

How to design an effective expense management workflow

Designing an effective expense management workflow starts with understanding how expenses move through your organization today and where problems tend to arise. The goal is to create a process that balances control with ease of use, so employees follow it consistently and finance teams get accurate, timely data.

Step 1: Assess current process

Begin by documenting how expenses are currently submitted, reviewed, approved, and reimbursed. Talk to employees about submission challenges, ask managers what slows down approvals, and have finance teams identify their biggest bottlenecks. Common issues include lost receipts, delayed reimbursements, unclear policies, and duplicate work.

Once you understand the current state, define what success looks like. Set specific goals such as reducing reimbursement time, lowering processing costs, or improving policy compliance, and choose metrics you can track over time to measure progress.

Step 2: Establish clear expense policies

Your expense policy should clearly define what employees can and cannot spend company money on. This includes spending limits by category, receipt and documentation requirements, approval thresholds, and rules for travel, meals, and entertainment.

Write the policy in plain language and make it easy to find. Publish it in your employee handbook, on your internal knowledge base, and within your expense management system so employees can reference it while submitting expenses. When policies change, communicate updates clearly and explain why adjustments were made.

Common guidelines include daily meal limits that vary by location, requirements for manager preapproval on larger purchases, restrictions on premium travel options, and rules around alcohol or gift spending. Many companies also prohibit personal expenses on corporate cards and require detailed business justification for client entertainment.

Step 3: Map out the approval process

Clear expense approval chains eliminate confusion about who needs to review different types of expenses. Define approval thresholds based on amount, category, or department, and create escalation paths for higher-value purchases:

- Under $50: Automatic approval or single manager review

- $50–500: Direct manager approval

- $501–5,000: Manager plus department head approval

- Over $5,000: Executive-level approval

Document how exceptions are handled, such as emergency purchases, executive expenses, or costs that span multiple categories. Clear guidance helps reviewers act consistently and reduces delays when edge cases arise.

Step 4: Define submission requirements

Employees should know exactly what information to include with every expense report. Require original, itemized receipts above a defined threshold, since credit card statements alone rarely provide sufficient detail.

Set clear deadlines for submission, such as within 30 days of purchase, to simplify reconciliation and avoid accounting or tax complications. Specify approved expense categories and any required coding, such as department, project, or client identifiers, so expenses post correctly in your accounting system.

Step 5: Set up reimbursement procedures

Choose reimbursement methods that work for both your business and employees. Direct deposit is typically the fastest option, while checks add processing time and risk of delay. Decide whether reimbursements are issued weekly, biweekly, or monthly, and communicate timelines clearly.

Integrate your expense management system with payroll and accounting software to avoid duplicate data entry. If your company operates internationally, document how exchange rates are handled and whether employees are reimbursed in local or home currency.

Expense management workflow examples

The following examples show how expense management workflows can look in practice for companies of different sizes, depending on expense volume, approval needs, and internal controls.

Small business example

A 25-person marketing agency uses a simple two-tier approval process. When an account manager submits a $180 client dinner expense, the workflow typically looks like this:

- The employee submits the expense through the company’s expense app with a photo of the itemized receipt and notes which client attended

- The direct manager reviews and approves the expense within 24 hours, confirming it falls within the $200 per-person limit for client meals

- Finance processes the reimbursement in the next weekly payment run

- The expense posts to the client’s project code for billing and reporting purposes

Total time from submission to reimbursement is usually 5–7 days.

This structure works well because the agency has clear policies, low expense volume, and managers who are familiar with their teams’ spending patterns. Expenses over $1,000 require an additional sign-off from the CEO, but those cases are infrequent.

Enterprise example

A 5,000-person manufacturing company uses a multi-layered approval process with automated controls. When a regional sales director submits a $3,200 expense report for a week-long conference, the workflow follows these steps:

- The employee submits expenses through the corporate system, which automatically categorizes transactions from the integrated corporate card

- The system flags two items for review: a $400 dinner that exceeds standard limits and a $150 airport lounge membership

- The direct manager receives a notification, reviews the business justification, and approves the dinner as an exception for entertaining a major client

- An escalation alert routes the lounge membership to the department VP because it is a recurring expense that requires executive approval

- The VP approves the expense based on the employee’s frequent travel schedule

- Finance receives the fully approved report and processes reimbursement in the next biweekly cycle

- Expenses automatically post to the general ledger with proper department, region, and account coding

Total time from submission to reimbursement is typically 10–14 days.

The additional approval layers reflect the company’s higher expense volume, multiple budget owners, and more complex accounting requirements. Automation allows routine expenses to move quickly while escalating exceptions to the right reviewers.

Best practices for expense management workflows

The most effective expense management workflows are simple enough that employees actually use them. When processes are overly complex or difficult to follow, employees find workarounds that undermine controls and create more work for finance teams. Prioritizing clarity and ease of use helps ensure consistent adoption without sacrificing oversight.

Automation plays a key role in reducing errors and enforcing policies consistently. Manual processes rely on employees and reviewers to catch mistakes, which leads to inconsistent outcomes. Automated systems apply the same rules every time, improving data quality and reducing rework.

Automation opportunities

Modern expense management tools can automate repetitive tasks and speed up processing while improving accuracy:

- Receipt scanning and OCR technology: Optical character recognition extracts merchant names, dates, amounts, and payment methods from receipt photos, reducing manual data entry and errors

- Automatic policy violation detection: Built-in rules flag expenses that exceed limits, lack documentation, or fall outside approved categories before they move forward

- Integration with corporate cards: Direct card feeds import transaction data automatically, match charges to expense reports, and help identify missing submissions

These capabilities shorten processing times and free finance teams to focus on higher-value work.

Common pitfalls to avoid

Workflows most often fail when they introduce unnecessary friction or ambiguity:

- Overcomplicated approval chains: Requiring too many approvals for routine expenses slows reimbursements and frustrates employees. Use amount thresholds to escalate only higher-risk purchases.

- Unclear policy documentation: Vague rules leave too much room for interpretation and lead to inconsistent enforcement. Clear dollar limits and examples reduce confusion.

- Lack of mobile accessibility: If employees cannot submit expenses from their phones, receipts pile up and reports are delayed. Mobile-friendly tools make timely submission easier.

Addressing these issues early helps maintain adoption and keeps workflows running smoothly.

Ensuring compliance and audit readiness

Strong documentation practices protect your company during audits and reviews. Maintain complete records for each expense, including receipts, approvals, and business purpose. Digital storage makes historical data easier to search and retrieve.

Review expense policies regularly to keep them aligned with business needs, inflation, and regulatory changes. Training employees during onboarding and providing refreshers when policies change helps reinforce expectations and reduce repeat violations. Assigning a clear point of contact for expense questions also prevents guesswork and inconsistent decisions.

Tools and technology for expense management workflows

Expense management software ranges from simple tools focused on reimbursements to broader platforms that integrate expenses with accounting, corporate cards, and bill payments. The right solution depends on your company’s size, spending complexity, and reporting needs.

Essential features

Any expense management solution should include core capabilities that make expense reporting faster and more accurate:

- Mobile apps and receipt capture: Employees can photograph receipts and submit expenses from anywhere, reducing lost documentation and delayed submissions

- Real-time reporting dashboards: Live visibility into spending shows totals against budgets without waiting for month-end reports

- Integration capabilities: Connections to accounting software, corporate cards, and payroll systems reduce duplicate data entry and improve accuracy

These features handle the day-to-day mechanics of expense management and support consistent adoption.

Advanced capabilities

More advanced platforms offer features that extend beyond basic processing and provide deeper insights:

- AI-powered expense categorization: Machine learning models analyze transaction data and automatically assign expenses to the correct categories, improving accuracy over time

- Predictive analytics: Forecasting tools identify future spending trends based on historical data and planned activity, helping teams address budget risks earlier

- Automated expense reporting: Systems generate scheduled reports on spending patterns, compliance rates, and cost-saving opportunities without manual analysis

These capabilities are especially valuable for organizations with higher expense volumes or more complex reporting requirements.

Measuring and optimizing your expense management workflow

Optimizing an expense management workflow is an ongoing process that depends on feedback and data. Regular input from employees, managers, and finance teams helps identify friction points and uncover opportunities to improve efficiency. Short surveys, focus groups with frequent submitters, and support ticket trends can all reveal where the process breaks down.

Continuous improvement works best when changes are incremental. Review performance data regularly, test small adjustments with pilot groups, and document what improves speed, accuracy, or adoption before rolling updates out more broadly.

Important metrics to monitor

Tracking the right metrics helps you spot bottlenecks and measure whether workflow changes are delivering real improvements:

- Processing time per expense report: Measures the average time from submission to reimbursement and highlights delays in approvals or reviews

- Policy violation rates: Shows how often submitted expenses fall outside policy, which can indicate unclear rules or training gaps

- User satisfaction scores: Captures employee and manager feedback on ease of use, clarity, and reimbursement speed

- Cost per expense report processed: Compares total expense management costs to the number of reports handled, helping quantify efficiency gains from automation

These metrics provide a clear picture of how well your expense management workflow is performing and where further refinements can deliver value.

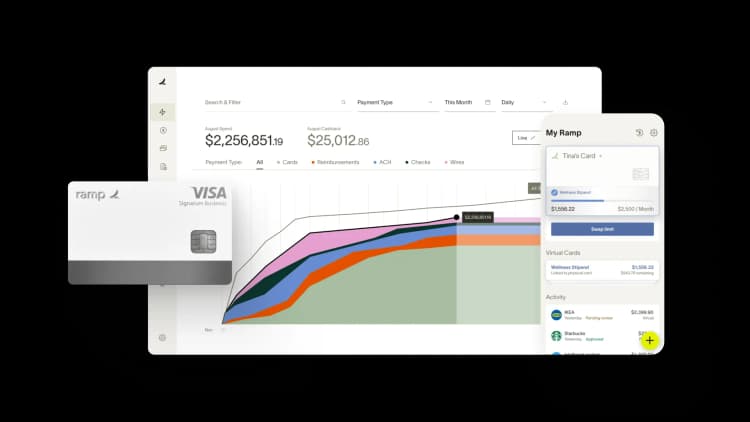

How Ramp eliminates manual expense workflows through intelligent automation

Manual expense management workflows drain your team's productivity. You're stuck chasing receipts, manually entering data, waiting for approvals, and reconciling expenses across spreadsheets—all while trying to maintain visibility into company spending and ensure policy compliance.

Ramp's expense management software transforms this time-consuming process through end-to-end automation. The platform automatically captures and categorizes expenses in real time, eliminating the need for manual data entry. When employees make purchases with Ramp cards, transactions automatically sync with our built-in expense management platform with merchant details, amounts, and suggested categories already populated. You can customize these categories to match your chart of accounts, ensuring seamless synchronization with your accounting software.

Our mobile app streamlines receipt collection through intelligent OCR technology. Employees simply snap a photo of their receipt, and Ramp automatically extracts vendor information, dates, amounts, and line items. The system matches receipts to transactions instantly, maintaining complete documentation for audit trails. If receipts are missing, automated reminders prompt employees to upload them, preventing last-minute scrambles during month-end close.

Ramp's customizable approval workflows route expenses to the right approvers based on amount thresholds, expense types, or departmental hierarchies you define. Instead of emails and spreadsheets, approvers review expenses directly in the platform with full transaction context and receipt documentation. Multi-level approval chains process automatically, moving expenses through your workflow without manual intervention.

Real-time reporting dashboards give you immediate visibility into spending patterns, budget utilization, and policy violations. You can track expenses by category, department, project, or custom fields, identifying trends before they become problems. This combination of automated capture, intelligent processing, and real-time visibility transforms expense management from a manual burden into a streamlined process that saves hours while improving accuracy and control.

Use Ramp to modernize your expense management

Beyond automating workflows, Ramp's all-in-one platform integrates expense management with corporate cards, bill payments, and accounting software to create a unified finance stack. This means every transaction, whether it's a card purchase, reimbursement, or vendor payment, flows through the same system with consistent controls and reporting.

Ready to see how much time and money you could save? Try an interactive demo and discover how Ramp customers save an average of 5% a year across all spending.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits