Helping businesses manage money faster, smarter—and with more peace of mind in 2023

- 1. Eliminate expense reports while fully automating accounting processes

- 2. Give companies true visibility into best pricing

- 3. A platform that can grow with your needs, from SMBs to more complex enterprises

- How we’ll deliver more value to customers in 2023

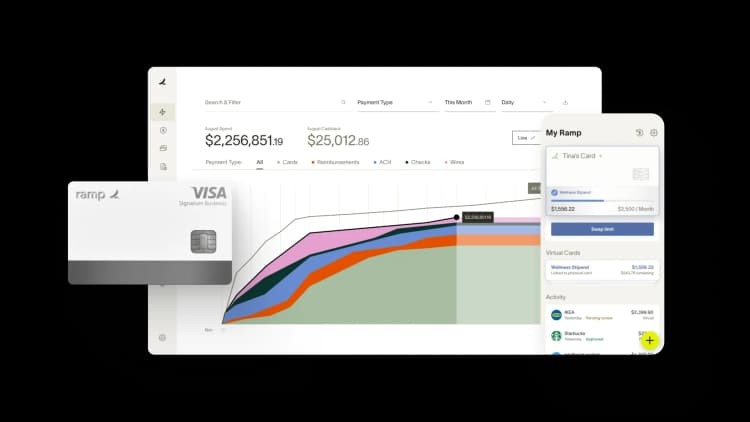

This year, with the macroeconomic environment still in flux, every finance leader is being asked to help their organizations save even more. The answer won’t come from obsolete credit card rewards that haven’t kept up with modern business needs or one-off point solutions. Rather, at Ramp, we believe that automation is the crucial key to help businesses cut even more burn. Just as Waze used real-time, crowd-sourced data to help revolutionize how people choose the best driving route, we think it’s time to harness the power of the crowd to spur a similar transformation in finance.

In 2023, that means empowering finance teams with a financial operations platform that learns from them and thousands of other companies to further automate their work, enabling companies to connect Ramp products with more external systems, and becoming a strong financial operations platform for companies at every stage.

We’ll do all of the above while continuing to abide by our north star of always doing what is right for our customers, with high integrity and diligence. Ramp’s journey is only just beginning—we’re excited to keep innovating new ways to maximize customer savings in 2023. Here’s what you can expect this year:

1. Eliminate expense reports while fully automating accounting processes

Ramp has been focused on creating tools that allow workers to spend their valuable time on strategic work instead of menial tasks, like filling out expense reports. These expense reports aren’t just a waste of time—19% of them are riddled with errors, and fixing each report costs teams $52 and takes 18 minutes.

In 2022, Ramp matched over 2.8 million receipts via users sending their receipt to Ramp and our finance AI successfully assigning it to the correct transaction. We also automatically detected and imported more than 500,000 receipts from the integrations we built for Gmail, Outlook, Lyft, and Amazon.

Our Chrome extension enables users to copy card numbers and capture receipts straight from their browser. And these aren’t just statistics: this is precious time saved grabbing coffee with a colleague or taking a client out for dinner.

Expense reports have no place in modern finance operations. Looking ahead, we plan to create a world where employees simply swipe their card and we take care of the rest. Using data across our platform, we’ll help you automatically classify transactions, as well as add more integrations with other frequently used vendors to auto-create receipts for employees

2. Give companies true visibility into best pricing

Ramp Bill Pay launched last year to make global bill payments effortless via the ability to automatically extract items like vendors and payment details with 99% accuracy. Since then, customers have uploaded thousands of contracts onto the platform and businesses use it to pay over 10,000 invoices every month. In 2023, we plan to leverage the power of the crowd to help customers improve their vendor pricing and reduce burn.

Access to best pricing shouldn’t be limited: all businesses deserve to understand how much vendor contracts cost. Companies that are looking to buy or renew products will know if they are overpaying and the right strategies to negotiate. Customers can know not just how much things cost, but the right solution to buy at their stage with discounted rates available through our vendor portal and Ramp negotiating the best rates for them. Finance heads will have total visibility into the vendors for their organization, who owns the relationships, and when contract renewals are coming up.

Ramp will become the source of truth for what to buy and how much to pay. Using Ramp, finance teams will get access to much more actionable insights to drive better decisions.

3. A platform that can grow with your needs, from SMBs to more complex enterprises

We are committed to iterating and improving our platform so that we can be the best partner to all of our customers and support them through every step of their lifecycle.

Last year, we launched functionality that helped businesses streamline their tech stacks and overcome tricky scaling pain points. This included:

- Expanding ERP access to Bill Pay to allow even more of our customers to eliminate data entry and automate approvals.

- Launching Ramp Flex to help customers effortlessly pay their bills on their own timelines.

- Helping businesses implement their travel policies and enforce them on Ramp.

- Making it possible for companies to now have the ability to onboard multiple entities on a single Ramp instance and manage payments from different bank accounts.

This year, we’ll help customers further customize complex workflows, such as onboarding employees in a given geography with specific budgets and coding more complex approvals based on the category or expense. Organizations will be able to use Ramp to oversee and manage all their spend without needing to log into their ERPs. Ramp will give rich context on every dollar to help finance leaders calculate ROI.

How we’ll deliver more value to customers in 2023

At Ramp, our guiding principle is saving customers their most valuable assets: time and money. We built powerful tools and services that save customers a significant amount of both—more than $300M dollars all time and more than 20,000 hours each month. We’ll continue to create and improve our offerings while building automation that harnesses data to deliver spend benchmarks and zero-touch expenses. Our work is only just beginning-we can’t wait to see what we can accomplish in 2023.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits