How can small businesses become more agile in their accounting?

- 4 challenges in agile accounting practice for small businesses

- The importance of agility for small businesses

- How small businesses become more agile in their accounting

- Build a smarter, more resilient business with agile accounting

- Automate routine accounting work so your team can focus on what matters

This post is from Ramp's contributor network—a group of professionals with deep experience in accounting, finance, strategy, startups, and more.

Interested in joining? Sign up here.

Agile accounting means having the flexibility to respond to changes, making shifts as necessary, adjusting decisions on the fly, and anticipating the environmental challenges and threats that may occur.

For small businesses, agility is one of the most important areas to focus on, especially during volatile economic conditions. Further, becoming more agile helps a business respond to financial opportunities right on time.

4 challenges in agile accounting practice for small businesses

Agile accounting offers speed, flexibility, and sharper decision-making. But, small businesses often struggle to implement it effectively. Unlike larger companies, they operate with leaner teams, tighter budgets, and limited access to specialized tools.

Resource constraints are the biggest challenge

Often, small businesses lack the resources required to invest in expensive accounting software, onboard a dedicated accounting staff, or outsource bookkeeping services.

More importantly, owners and employees often wear several hats, not giving enough time to the nitty-gritty, such as record-keeping and financial analysis.

Absence of the proper knowledge and expertise

The lack of an in-house accounting specialist can indeed complicate things. Small businesses often don’t have the right accounting knowledge or necessary training to have a solid grasp of their finances. According to Intuit, 60% of small business owners feel they aren’t knowledgeable about accounting and finance, which creates a major roadblock to agility. Not to mention, the back-breaking nature of tax laws and frequently changing accounting standards make it even more challenging for small businesses to be agile in their accounting.

Manual processes and disconnected systems

Undoubtedly, manual processes and repetitive tasks, such as expense reconciliation and data entry, can consume a lot of time and be error-prone. Moreover, data silos that exist between bank accounts, accounting software, and other financial tools can limit visibility and add to the workload.

Limited access to real-time data and reporting

Manual processes and outdated systems often slow down access to critical financial insights, making them a major concern for small businesses. On top of that, inaccurate or incomplete data can result in misleading financial reports, making decision-making a lot more complicated than it already is.

This brings us to the next question: why is it important for small businesses to be agile in their accounting practices?

The importance of agility for small businesses

There's always an added edge for businesses that are agile in their accounting. Here’s why small businesses need to be more adaptable:

- Faster decision-making. Small businesses often need to make decisions on the spot to take advantage of the new opportunities available to them. This is one of the benefits of agile accounting practices. In simple words, accounting practices offer accurate and updated financial information that helps to make wise decisions in no time.

- Greater adaptability to change. The business landscape is changing with new regulations, market changes, and economic shifts emerging rapidly over time. Agility is one of the many ways that allow small businesses to adjust their strategies and operate smoothly as a response to these changes. How does it help? Well, it helps to minimize disruptions and bolster compliance.

- Gives a competitive edge. Small businesses have a higher chance of gaining a competitive edge by adapting faster. With leaner systems it takes less time to adopt agile accounting practices.

- Greater cost efficiency. When small businesses start to adopt cloud-based software and automation, they can use these technology advancements to mitigate manual errors and significantly reduce operational costs. The business can then use these savings to fund expansion-oriented departments.

How small businesses become more agile in their accounting

Agile methodologies help businesses boost flexibility, strengthen collaboration, and respond swiftly to financial challenges. Here are several ways small businesses can implement agility in their accounting:

1. Embrace cloud-based accounting solutions

Using cloud-based accounting solutions offers a number of advantages over traditional software. In fact, it represents a radical change in the way small businesses handle their finances.

- Accessibility and real-time updates: Cloud-based accounting software can offer you unmatched access to financial information anywhere and anytime. This means you can stay updated with the financial well-being of your business, regardless of whether you are working from home or on the go. Tools like Quickbooks Online, Xero, and FreshBooks, among many more, can always give you real-time updates to help you stay ahead of the curve, enabling easy and prompt decision-making as well as financial management.

- Cost efficiency and scalability: Tools like Wave and Zoho usually offer more features than most people need and all the necessary adjustments just included in their free plans. In software like this, there's no upfront investment, which makes it even more appealing. Rather, these services generally use a subscription model, which covers regular updates and support at no extra cost. Moreover, cloud-based accounting software can readily expand to accommodate extra users, clients, or transactions as your business grows, negating the need for costly system overhauls or upgrades.

Cloud-based accounting solutions enable real-time updates and automation, supporting an iterative approach to financial management. They allow businesses to refine processes continuously, correct discrepancies quickly, and make smarter decisions with current data.

These systems improve efficiency and accuracy through features like automated bank feeds, error-free invoice generation, and streamlined expense tracking. They also enhance team coordination by giving multiple users access to the same up-to-date financial information. On top of that, cloud platforms offer stronger security than traditional systems, protecting sensitive data while supporting a more agile way of working.

2. Streamline processes and workflows

In non-agile organizations, time is often lost to inconsistent processes, repetitive manual tasks, and poor communication. Streamlining workflows is key to building an agile accounting practice—and that starts with three focus areas: identifying bottlenecks, automating repetitive tasks, and simplifying approval chains.

Identify and eliminate bottlenecks

Start by conducting a workflow audit. Map out each step in your current processes—from sales and invoicing to sourcing and delivery. This helps you pinpoint where time is being wasted or where errors tend to occur.

Once you’ve identified pain points, prioritize them based on their impact—whether it’s delays, cost overruns, or customer dissatisfaction. From there, implement targeted solutions. That could mean redefining roles, reallocating resources, or adopting tools that reduce friction. For example, if month-end close is consistently delayed, using cloud-based automation software like Ramp can drastically reduce manual work in expense management and reconciliation.

Automate repetitive tasks

Repetitive tasks like data entry, invoice creation, and customer follow-ups can drain time without adding much value. These are ideal candidates for automation.

Look for tools and management systems that fit your workflows and budget. Platforms like Zapier can sync emails with your calendar, automate reminders, and integrate apps to cut down on manual steps. The goal is to reduce low-value work so your team can focus on strategic financial tasks.

Simplify approval processes

Slow approval chains are another common bottleneck. Use project management principles to define clear workflows, assign responsibilities, and reduce unnecessary steps. Delegation can also help speed things up without sacrificing control.

Digital tools, like e-signatures and cloud-based document sharing, can make approvals faster and more reliable. In agile accounting, quick and informed sign-offs are essential to keeping things moving and reducing turnaround times.

3. Establish collaboration between departments

Agile accounting requires active collaboration across departments. When sales, operations, and finance work in silos, key data gets delayed or lost, leading to poor financial decisions. In small businesses, leadership, often founders or managers, must drive this collaboration.

- Breaking down silos between accounting and other departments: In order to encourage teamwork, it's best to bring people from accounting and other departments together for certain agile projects. This can help set common goals and uncover challenges teams may be experiencing. What’s more? This is one of the most important ways to make sure everyone is on the same page.

- Encouraging cross-functional communication: Tools can make it easier to share and talk deeply about ideas, no matter the department. This largely includes using digital spaces to make working together more practical. This is one of the ways to build a supportive and understanding culture in workplaces.

- Collaborative budgeting and forecasting: Budgeting and forecasting discussions require input from more than just a couple of individuals. It's important to include different team members. This helps make financial plans more realistic and support the aspirations every department has.

4. Prioritize data security and compliance

Undeniably, securing your sensitive information has become more important than it ever was. A study by IBM disclosed its annual Cost of Data Breach Report. Surprisingly, the worldwide average cost of a data breach rose to $4.45 million in 2023.

Businesses that are operating internationally most definitely have to comply with regulations like the General Data Protection Regulation (GDPR) in the EU, and the Health Insurance Profitability and Accountability Act (HIPAA), alongside any other local data protection laws.

Quite frankly, any form of non-compliance can attract huge fines and major legal repercussions. Now, when I say “compliant”, I mean you should adhere to some important areas like regular training, policy updates, and ensuring all data practices meet the mandated standards.

Last but not least, with cyberattacks becoming more and more frequent, we must be a lot more mindful and implement robust cybersecurity measures. This covers safe, encrypted connections, firewalls, and antivirus programs.

5. Invest in employee training and development

For small businesses wanting to boost their accounting agility, they need to invest in employee training and development. There should be no compromise in this area. According to a LinkedIn Learning study, 94% of workers would stay with a company longer if it made investments in their professional growth.

With accounting technologies evolving constantly, ongoing training is the only way to not lose out anymore. There's no doubt that this not only boosts efficiency but also helps empower members of a team to contribute to the business’s agility in the long term. Not to mention, when you cultivate a culture where learning is indispensable, you can gradually adapt to changes.

6. Regularly review and fine-tune strategies

A key aspect of agile accounting is fostering a culture of continuous improvement by regularly assessing and refining financial strategies. This ensures that businesses remain adaptable and optimize their accounting processes over time. In simple words, this means looking at whether you have met the set objectives or not, at the end of the day. Moreover, it's also critical to get input from staff members and any other relevant parties, such as partners, affiliates, or clients.

In many cases, they can help you identify and offer invaluable insights into what’s actually working and what isn’t. This is the time you need to be the most prepared about. Simply put, be prepared to adjust your strategies in light of market developments and any new demands your company may encounter. With this adaptability in place, you can make sure that your accounting practices keep up with the expansion and change happening in your business.

Build a smarter, more resilient business with agile accounting

Agile accounting is the future, as it incorporates core agile principles into financial management, enabling small businesses to adapt quickly, optimize processes, and make data-driven decisions with greater ease and efficiency. There are a lot of advantages to agile accounting—from enhanced decision-making to a stronger ability to adapt as markets shift.

With agile accounting, your business not only keeps its books in order but also gets the chance to propel it forward. In other words, for small businesses that are poised for growth and transformation, agile accounting can be your ticket to a future where having powerful financial management is essential to your success rather than just an advantage.

Truth be told, “agile” is simply a method that takes everyone in participation, including both users and customers of your business. The motive behind it? To communicate. If you really want to succeed with Agile, you must be communicative with your staff and customers from both a management and customer service perspective.

In agile accounting, the goal is quite simple: Agile prioritizes who will best execute the delicate details of the operation, not what will change. So, keep in mind that agile accounting for small businesses is all about staying ahead of the curve and understanding the what-ifs in detail.

Automate routine accounting work so your team can focus on what matters

Small-business accounting teams often struggle with limited resources and manual processes that slow down decision-making. You're stuck coding transactions by hand, chasing receipts, and reconciling accounts when you could be analyzing trends and planning for growth.

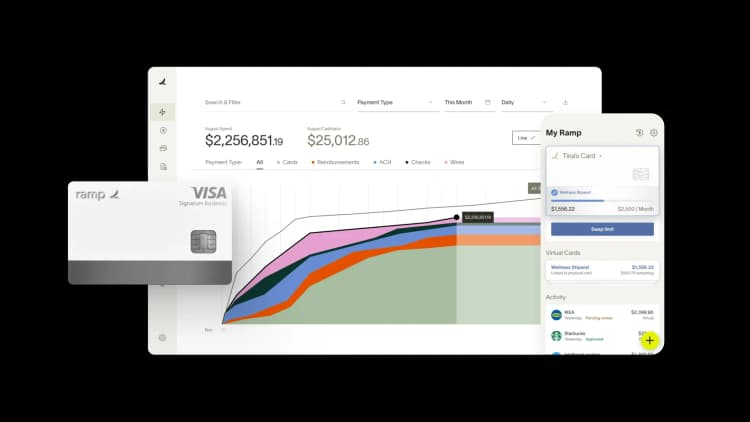

Ramp's accounting automation software eliminates the busywork so you can operate with the speed and flexibility your business needs. Here's how Ramp makes small-business accounting more agile:

- AI codes transactions automatically: Ramp learns your accounting patterns and codes every transaction across all required fields as it posts, achieving 90%+ accuracy and delivering 3.5x more automation than rules-only systems

- Auto-collect receipts and documentation: Ramp texts employees for missing receipts and matches them to transactions automatically, so you're not hunting down documentation or following up manually

- Sync routine spend to your ERP: Ramp identifies in-policy transactions and syncs them to your accounting system without human review, so your books stay current and your team focuses on exceptions

- Review with AI-powered context: Ramp analyzes every transaction in the background and suggests an action, flagging what needs attention and clearing what's ready to sync

- Reconcile faster: Use Ramp's reconciliation workspace to spot variances and surface missing entries so you tie out with confidence every time

Teams using Ramp save 40+ hours every month by eliminating manual receipt collection, expense approvals, and coding. Clear your accounting queue 3x faster and get more time back to support strategic projects and respond to changing business needs.

Try an interactive demo to see how Ramp transforms small-business accounting.

FAQs

Agile accounting emphasizes adaptability, real-time data, and continuous process improvement, while traditional accounting typically follows a fixed, periodic schedule with less flexibility. Agile focuses on speed and responsiveness, which is especially valuable for small businesses in fast-changing markets.

While cloud-based accounting software helps, agile accounting is more about mindset and workflows, such as faster reporting cycles, collaboration, and using automation to reduce repetitive tasks. Tools help, but processes and culture are just as critical.

Agile accounting offers quicker visibility into incoming and outgoing cash. With real-time insights, businesses can spot issues early, like late customer payments or overspending, and adjust proactively rather than reactively.

Accounts payable outsourcing is worth considering for businesses facing staffing constraints or high manual costs. Adopting AP software is also another option as it can streamline workflows just as effectively while keeping operations internal.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°