Invoice management: What it is and how to optimize it in 2026

- What is invoice management?

- Why invoice management matters

- Challenges in invoice management

- What does the invoice management process involve?

- Benefits of automated invoice management

- How invoice management software can speed up your invoicing process

- What to look for in invoice management software

- Why Ramp Bill Pay is the best way to manage invoices

Invoice management is the process of receiving, verifying, approving, paying, and recording invoices from vendors or suppliers. It helps companies stay organized, pay bills on time, and build strong vendor relationships while maintaining steady cash flow.

When teams handle invoices manually, delays and errors quickly add up. Finance professionals spend hours chasing approvals, entering data, and tracking missing documents. Mistakes increase, payments get delayed, and email chains slow everything down. A strong invoice management system replaces that chaos with automation and accuracy.

Here, we explain what invoice management is and how the process works. We'll also cover its challenges and benefits.

What is invoice management?

Invoice management is the process of efficiently handling invoices from the moment they arrive until you pay them. This includes receiving, reviewing, validating, approving, and paying your supplier invoices on time.

In most businesses, invoice management falls to finance teams or accounts payable (AP) departments. For smaller companies, business owners or office managers often handle this process directly. The specific person or team responsible depends on your company's size and structure, but the goal remains the same: Managing invoices efficiently and accurately.

Invoice management vs. invoice processing vs. accounts payable

While companies often use the terms invoice management and invoice processing interchangeably, there's a subtle difference worth noting. Invoice processing typically refers to the technical steps of handling individual invoices: scanning, data entry, and moving them through approval workflows.

Invoice management takes a broader view, encompassing the entire system and strategy for how your business handles all invoices, including the policies, procedures, and controls that govern the process.

Similarly, accounts payable is the department or function responsible for paying what your company owes, while invoice management is the specific process of handling the invoices that create those payables. Invoice management is the operational heart of your AP function.

How to manage invoices: Key responsibilities

The invoice management process covers several tasks that work together to keep your business running smoothly. Here are the main responsibilities:

- Receiving: Collecting all incoming bills through various channels: email, physical mail, online portals, or direct delivery. This includes organizing them in a central location so you don’t lose or overlook anything.

- Validating: Checking that each invoice is legitimate, accurate, and matches your records. This means verifying vendor information, confirming you received or used the goods or services invoiced, and checking that prices match your agreements.

- Approving: Routing invoices to the appropriate stakeholders responsible for approving payment. This could include department managers, project leaders, or executives, depending on the amount and type of expense.

- Paying: Scheduling payments according to terms, processing payments through methods such as checks, ACH transfers, or credit cards, and maintaining cash flow while taking advantage of any early payment discounts

- Recording: Entering all relevant information into your accounting system, coding expenses to the correct accounts, and maintaining detailed records for invoice audit trails and financial reporting

- Tracking and optimizing: Monitoring invoice processing times, identifying bottlenecks in the approval process, and continuously improving workflows to reduce delays and costs while maintaining quality control

Accuracy and compliance are the foundation of invoice management. Accurate processing prevents duplicate payments and vendor relationship issues. Compliance with internal policies and external regulations protects your business from financial and legal risks while maintaining the integrity of your financial records.

Why invoice management matters

Invoices may seem like routine paperwork, but effective invoice management is important because it directly impacts cash flow and operational efficiency. Without a formal process, payments get delayed, errors occur, approvals take longer than necessary, and vendor relationships suffer.

That’s where a strong invoice management system makes a difference. By streamlining approvals and reducing errors, your business can stay on top of its payables while freeing up time for higher-value work. It also supports healthy cash flow, making for a stronger operation.

Challenges in invoice management

Many businesses struggle with outdated processes that create more headaches than solutions. The most common pain points include:

- Manual data entry: Hours spent typing invoice details into spreadsheets or accounting systems

- Lengthy approval chains: Invoices sitting in email inboxes waiting for multiple sign-offs

- Inconsistent vendor communication: Mixed messages about payment terms, delivery schedules, and billing requirements

- Lost or duplicate invoices: Documentation gets misplaced or accidentally processed twice

- Lack of visibility: No clear view of where invoices stand in the approval process

These challenges create a domino effect throughout your organization. Late payments can result in service disruptions or unfavorable contract terms. Vendors become frustrated when they can't get clear answers about payment status, leading to strained partnerships that might've taken years to build.

The compliance risks are equally concerning. Missing payment deadlines can trigger penalty fees, while duplicate payments drain cash flow unnecessarily. And poor record-keeping makes audits more complex and time-consuming, potentially exposing your business to regulatory issues or tax complications.

How long does an invoice take to process?

Most manual AP teams take 10–20 days to process invoices, especially when intake, coding, and approvals rely on email, PDFs, or paper. In organizations with complex approval hierarchies, processing can stretch to several weeks as invoices wait for review.

What does the invoice management process involve?

On its face, invoicing is pretty simple: A vendor sends a bill, and your company pays it. However, invoices don’t just land in accounts payable, get approved, and disappear. They move through multiple departments, often hitting roadblocks, especially with manual invoice processing.

Here’s a closer look at each stage of the invoice management process, and how to make it more efficient from start to finish:

Step 1: Receiving the invoice

In most businesses, invoices can arrive through various channels. Your company might receive them via physical mail, email attachments, vendor portals, or electronic data interchange (EDI) systems.

The key to success at this stage lies in promptly capturing every single invoice you receive. Missing an invoice can lead to late payment fees and potential disruptions to your supply chain.

Set up dedicated email addresses for invoice submissions and train your team to recognize and properly route any invoices that might arrive through unexpected channels.

Step 2: Validating the invoice

Start by checking that all basic information is correct: vendor name, address, invoice number, and date. Then, match the invoice details against your purchase order to confirm that quantities, prices, and product descriptions align.

Pay special attention to common errors that can slip through, such as:

- Duplicate invoices

- Incorrect pricing

- Incorrect tax calculations

- Mismatched shipping addresses

Some vendors accidentally send invoices for items that your company returned or never received. Taking a few minutes for invoice verification at this stage can save you from costly mistakes and lengthy disputes later in the payment cycle.

Step 3: Approving the invoice

Depending on the invoice amount and type of expense, this step typically involves department managers, budget holders, or finance team members. Smaller invoices might only need one signature, while larger purchases often require multiple approvals from different levels of management.

Delays happen at this stage when approvers are traveling, on vacation, or simply overwhelmed with other priorities. Invoices can sit in email inboxes for days or weeks, creating bottlenecks that frustrate vendors and potentially harm your payment terms.

Setting up clear escalation procedures and backup approvers helps keep the process moving even when key people are unavailable.

Step 4: Paying the invoice

Most companies use electronic methods such as ACH payments, wire transfers, or credit card payments for speed and convenience. Some vendors still prefer paper checks, though these are becoming less common due to processing delays and security concerns.

Timing is a significant factor at this stage. Each invoice has specific payment terms, whether that's net 30, net 60, or immediate payment upon receipt. Missing these deadlines can result in late fees and potential disruption to future orders.

Build in buffer time to account for weekends, holidays, and any technical issues that might arise with your banking systems. Timing payments right is critical: Paying too early can impact cash flow, while late payments can lead to penalties.

Step 5: Recording the payment

Once the payment goes out, your accounting team needs to document the transaction in your financial systems. This involves updating the vendor's account, marking the invoice as paid, and categorizing the expense in the appropriate general ledger accounts. Most accounting software automates much of this process, but someone still needs to verify that everything posts correctly.

Accurate recordkeeping becomes critical when auditors come calling or when you need to resolve disputes with vendors. Poor documentation can lead to compliance issues, tax problems, and lengthy investigations that eat up valuable time and resources.

Make sure you have complete documentation, including the original invoice, approval records, and payment confirmation, to create a clear audit trail that helps protect your company.

Step 6: Tracking and optimization

Invoice management doesn’t end once the payment process is complete. AP teams should track key performance indicators such as:

- Processing time: How long does it take to move from invoice receipt to payment?

- Error rates: How often do invoices need corrections?

- Payment timing: Are invoices paid early, late, or on time?

Gathering these insights can be difficult for businesses that manage invoices manually. But with AP automation, real-time dashboards provide visibility into trends, helping you improve efficiency and reduce errors. You can also perform regular audits and ask vendors for feedback to gather ideas for improvement.

Benefits of automated invoice management

Automation tackles invoice management challenges head-on by replacing traditionally manual processes with software that works around the clock. The key benefits include:

- Reduced manual errors: Automated data capture eliminates typos and miscalculations resulting from manual entry

- Faster approvals: Digital workflows route invoices to the right people instantly, cutting approval times from weeks to days

- Improved compliance: Built-in controls and audit trails help you meet regulatory requirements and catch issues before they become problems

- Better cash flow visibility: Real-time dashboards show exactly where your money is going and when payments are due

- Cost savings: Less time spent on administrative tasks means lower processing costs and fewer late payment penalties

How invoice management software can speed up your invoicing process

Invoice management wasn’t always this complex. Previously, businesses handled fewer invoices, and paper-based systems worked—until they didn’t. As companies grew, so did inefficiencies. Human error, lost invoices, and delayed approvals became common pain points.

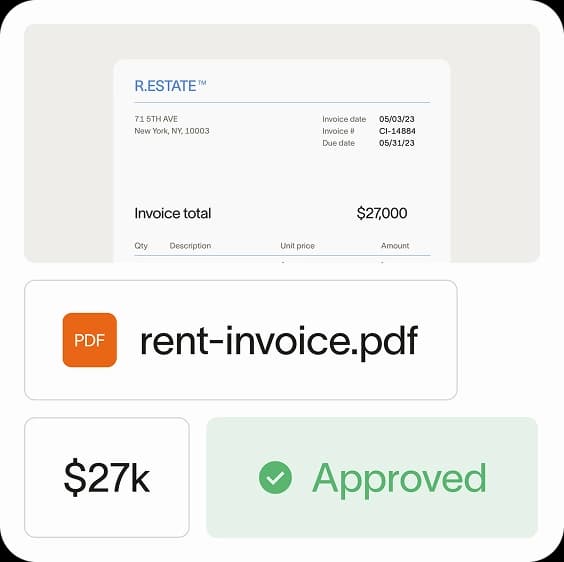

Early digital solutions helped, but they still relied on manual data entry and email-based invoice approvals. Now, AI-powered invoice automation can capture, code, approve, and even process payments with minimal human intervention.

Here’s how automated invoice management compares to manual processes:

Manual vs. automated invoice management

In a manual system, invoices arrive by email or mail and must go to the right person. Approvals happen through scattered emails or even printed documents that need a physical signature. Once approved, the invoice goes to an AP clerk who manually enters it into accounts payable software, initiates a payment, and records everything again in spreadsheets for tracking.

Here’s how automated invoice processing simplifies that:

- Automated data capture: No more tracking down missing invoices or manually entering data

- Approvals happen in one place: No forwarding emails or chasing signatures. Invoices route automatically based on rules you set.

- Payments process faster: No cutting checks or manually initiating transfers. The system schedules and processes payments on time.

- Data flows seamlessly: After approval and payment, the automated process records the invoice in your accounting system, eliminating double entry

A 2023 joint study by PYMNTS Intelligence and Corcentric found that 93% of CFOs surveyed said digital technologies or automation to support AP processes have reduced invoice tracking delays. Meanwhile, 80% of the firms that did not reduce payment delays cited a lack of automation as the main factor in their inability to reduce these delays.

What to look for in invoice management software

For businesses looking to improve efficiency, the question isn’t whether they should automate—it’s how to find the right system.

The best invoice management software should:

- Capture invoices automatically: Whether invoices arrive via email, PDF, or EDI, the system should pull them in without manual uploads

- Streamline approvals: Look for customizable workflows that route invoices to the right approvers based on amount, department, or vendor

- Integrate with accounting software: The system should sync seamlessly with ERPs and accounting software

- Automate payments: The best systems process payments, schedule them based on due dates, and reduce human intervention

- Provide real-time visibility: Dashboards should give clear insights into pending approvals, processing time, and cash flow impact

- Reduce errors and duplicates: AI-powered systems should flag inconsistencies, duplicate invoices, or potential fraud before payments go out

Why Ramp Bill Pay is the best way to manage invoices

Ramp Bill Pay is an autonomous AP platform powered by four AI agents that handle invoice coding, fraud detection, approval summaries, and card-based payments without manual intervention. With 99% accurate OCR and intelligent line-item capture, Ramp delivers touchless invoice processing that's 2.4x faster than legacy software1.

Whether you need a standalone invoice automation solution or a unified platform that connects bill pay with corporate cards, expenses, and procurement, Ramp Bill Pay adapts to how your business operates. Companies using Ramp report up to 95% improvement in financial visibility2.

Most accounts payable teams hit the same bottlenecks: approvals that stall invoice processing, purchase orders that don't match, and manual data entry into ERP systems that creates errors and delays.

Ramp resolves each with autonomous, touchless automation:

AI & Automation

- Four autonomous AI agents: Handle invoice coding, fraud detection, approval summaries, and card-based vendor payments automatically

- Intelligent invoice capture: Pulls data from every line item at 99% OCR accuracy, removing the need for manual data entry

- Automated PO matching: Checks invoices against purchase orders using 2-way and 3-way matching to flag overbilling before payment goes out

Workflows & Approvals

- Custom approval workflows: Create multi-level approval chains with role-based routing that fits your organization's structure

- Approval orchestration: Streamlines the review process with fewer clicks, better visibility, and faster turnaround

- Roles and permissions: Set granular user controls to enforce separation of duties across your team

- Real-time invoice tracking: Follow every invoice from the moment it's received through final payment

Payments

- Flexible payment methods: Pay vendors by ACH, corporate card, check, or wire transfer

- International payments: Send wire transfers to vendors in 185+ countries

- Batch payments: Process multiple invoices and vendor payments in a single batch

- Recurring bills: Set up automated payments for regular invoices using templates

Vendor Management

- Vendor onboarding: Collect W-9s, verify TINs, and track 1099 data without leaving the platform

- Vendor Portal: Give vendors a secure way to update payment details, check payment status, and communicate with your AP team

Accounting & ERP

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and other major ERPs for audit-ready records

- AI-assisted GL coding: Map transactions to the correct accounts using intelligent recommendations based on historical patterns

- Reconciliation: Match transactions automatically to close books faster

Why make the switch to Ramp?

Ramp sets a new standard for touchless, accurate, and fast invoice processing. Use it as a dedicated AP solution or connect it with Ramp's corporate cards, expense management, and procurement tools for complete financial visibility.

And don't just take our word for it—Ramp ranks as the easiest AP software to use on G2, backed by over 2,100 verified reviews and a 4.8 out of 5 star rating. Finance teams choose Ramp to eliminate manual work, catch errors before they become costly, and close books faster.

Getting started is easy: Ramp's free tier includes core AP automation, with advanced features available on Ramp Plus for $15 per user per month. Enterprise pricing is available upon request.

Invoice processing shouldn't require manual work. Ramp automates it. Learn more about Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°