What is billing management? Understanding how it works

- What is billing management?

- How does billing management work?

- Types of billing models and their applications

- Billing management software vs. invoice management software

- Benefits of both billing and invoice management software

- Process invoices faster with Ramp

Billing management keeps businesses running. It’s how companies send invoices, collect payments, and avoid the classic “Oops, we forgot to bill you” scenario. When done right, it keeps cash flow steady, customers happy, and accounting stress-free.

This guide breaks down how billing management works, the different billing models businesses use, and the tools that streamline the process. Plus, we clear up the difference between billing management software and invoice management software—they’re not the same thing.

What is billing management?

Billing management

Billing management is how businesses send invoices, collect payments, and keep their cash flow on track.

A strong system ensures customers are billed correctly, payments don’t fall through the cracks, and operations run smoothly.

For businesses with recurring revenue—like SaaS companies or subscription-based services—good billing management prevents revenue loss, improves customer retention, and makes day-to-day finances easier.

Even for businesses handling one-time payments, a structured billing process means fewer missed payments and no financial surprises. With the right tools, billing management speeds up payments, reduces human error, and strengthens financial control.

How does billing management work?

Effective billing management creates a smooth, predictable system that keeps cash moving and finances in check.

Here’s what that looks like:

- Plan and organize: Decide how to bill customers—monthly, quarterly, or another cadence. A structured billing system ensures consistency.

- Create and send invoices: Invoices should be clear, accurate, and include payment terms, due dates, and payment options. Automating this step saves time and prevents billing errors.

- Track payments: Keep an eye on incoming payments to ensure accounts stay current. Automating overdue invoice reminders helps avoid unnecessary back-and-forth.

- Handle late or missed payments: Set up structured follow-ups, late fees, or flexible payment options if needed. A clear process prevents future headaches.

- Keep records tidy: Log invoices, accounts receivable, and outstanding balances to simplify tax season and keep invoice records audit-ready.

Quick checklist for an efficient billing process

- Choose a billing management system that fits your business needs

- Automate invoices and notifications to stay on top of payments

- Set clear billing terms, payment policies, and late payment rules

- Track payments and follow up on overdue accounts receivable

- Review financial records regularly for better operational control

A well-managed billing system keeps your business financially stable and eliminates the hassle of chasing down payments.

Types of billing models and their applications

Billing affects how customers engage with your business, impacts customer satisfaction, and keeps revenue predictable. Whether your business runs on subscriptions, pay-as-you-go pricing, or one-time purchases, choosing the right billing model is essential.

Your billing model depends on:

- Industry

- Service structure

- Pricing strategy

Let’s walk through common billing models, their best applications, and how different industries approach billing to maintain smooth operations.

Overview of billing models

Every business has its own approach to billing. Some keep it simple, while others structure pricing around usage, tiers, or recurring plans.

Here are four common billing models:

- Subscription-based billing: Customers pay a recurring fee (monthly, quarterly, or annually) for ongoing access to a product or service. Common in SaaS, streaming, and membership businesses.

- Usage-based billing: Pricing depends on how much a customer uses a service. This model is common in telecom, cloud computing, utilities, and payment processing.

- Tiered billing: Customers choose a pricing tier based on features or usage levels. Often used in software pricing, internet plans, and businesses serving customers with varying needs.

- Flat-rate billing: A single price covers everything, keeping costs predictable. Common in consulting, fitness memberships, and digital subscriptions.

As businesses evolve, many are blending these models to create hybrid billing systems. Trends like dynamic pricing (adjusting rates based on demand) and value-based billing (pricing based on perceived customer value) are reshaping how companies structure revenue.

Industry-specific applications

Billing needs vary by industry—there’s no one-size-fits-all approach. Some businesses require flexible setups, while others prioritize simplicity and transparency.

Here’s how billing works across different industries:

- Telecom and utilities: These industries rely on usage-based billing and tiered pricing, where customers pay for what they use. Many also use convergent billing, bundling multiple services (internet, mobile, cable) into a single invoice for convenience.

- Managed service providers (MSPs): IT and cloud service providers often use a mix of subscription-based and hybrid billing. Many include convergent billing to bundle software, support, and infrastructure costs into one streamlined invoice.

- SaaS and digital services: Most SaaS companies favor subscription-based billing, but many are shifting toward usage-based and tiered pricing for more flexibility. Some are even testing AI-powered dynamic pricing to adjust rates based on demand.

- Healthcare and professional services: Many healthcare providers use third party billing services to handle insurance claims, patient invoicing, and payment collection. This allows medical practices to focus on patient care while specialized billing companies manage the complex reimbursement process across multiple payers.

No matter the industry, a well-structured billing system improves scalability, reduces churn, and enhances the customer payment experience.

Billing management software vs. invoice management software

Billing and invoices might seem interchangeable, but they serve different roles in financial management. Both help businesses streamline payments, but they operate on opposite sides of the equation.

Billing management software

Billing management software handles everything from setting up pricing models and automating recurring charges to managing customer accounts and tracking revenue. If your business runs on subscription-based or usage-based billing, this is the tool you need.

Invoice management software

Invoice management software helps businesses process and pay invoices from vendors and suppliers, track expenses, and manage cash flow—like Ramp Bill Pay.

Choosing the right tool

Knowing the difference is key. If you’re a SaaS company or operate on recurring revenue, billing management software keeps customer accounts and payments organized.

If your focus is on accounts payable—ensuring vendors get paid on time and expenses are tracked—invoice management software is the better fit.

Criteria | Billing management software | Invoice management software |

|---|---|---|

Purpose | Manages customer billing and revenue collection | Manages vendor invoices and payments |

Best for | SaaS, subscriptions, service providers | Businesses handling expenses and supplier payments |

Key functions | Automates pricing models, recurring charges, and billing workflows | Automates invoice capture, approvals, and payments |

Revenue vs. expenses | Tracks and collects customer revenue | Manages and processes business expenses |

Integration | Syncs with CRM, ERP, and API financial tools | Connects with ERP, accounting, and payment systems |

Automation | Handles billing notifications and customer payments | Automates invoice processing and payment scheduling |

Benefits of both billing and invoice management software

Both solutions keep finances organized, but they solve different challenges.

Benefits of billing management software

Billing management software makes sure you get paid on time and with minimal hassle. It automates customer billing, cuts down on billing errors, and keeps revenue tracking on point. Whether you're using subscription-based billing, usage-based billing, or tiered pricing, it helps businesses scale without losing track of who owes what.

Bonus: it also helps reduce churn by keeping renewals smooth and invoices accurate.

Benefits of invoice management software

Invoice management software improves vendor relationships and stabilizes cash flow. It automates invoice processing, reduces human error, and ensures payments go out on time—helping businesses avoid late fees and financial bottlenecks.

It also provides real-time visibility into spending, making financial management more predictable. Both tools simplify operations—whether you're collecting payments or making them.

What to look for in effective billing and invoice management solutions

Billing and invoice management can get complicated fast. Missed payments, billing errors, and unclear financial records can disrupt cash flow and create unnecessary stress.

Along with following billing and invoicing best practices, the right software should automate workflows, reduce human error, and provide real-time insights into your finances.

Some key features to look for are:

- Automation: Handles recurring billing, notifications, and accounts receivable tracking

- Integration: Syncs with ERP systems and API-enabled financial tools for seamless operations

- Customization: Supports different billing models and approval workflows tailored to business needs.

- Security and compliance: Protects financial data and ensures regulatory compliance.

A strong billing or invoice management solution keeps your financial operations efficient, reducing time spent on manual processes and minimizing errors.

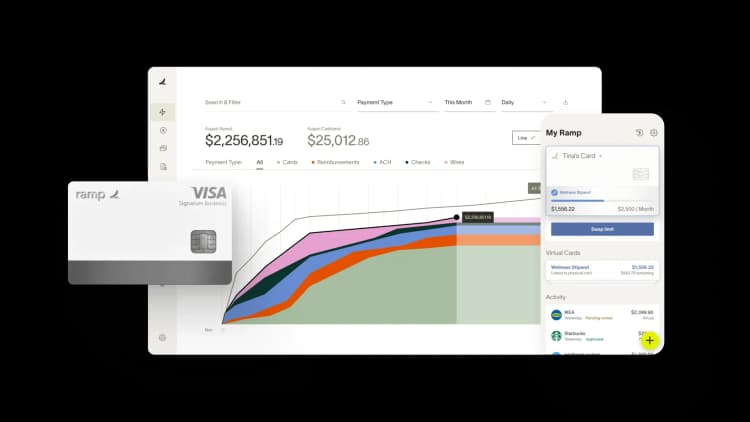

Process invoices faster with Ramp

Ramp Bill Pay is an autonomous AP platform powered by four AI agents that handle invoice coding, fraud detection, approval summaries, and card-based payments without manual intervention. With 99% accurate OCR and intelligent line-item capture, Ramp delivers touchless invoice processing that's 2.4x faster than legacy software1.

Whether you need a standalone invoice automation solution or a unified platform that connects bill pay with corporate cards, expenses, and procurement, Ramp Bill Pay adapts to how your business operates. Companies using Ramp report up to 95% improvement in financial visibility2.

Most accounts payable teams hit the same bottlenecks: approvals that stall invoice processing, purchase orders that don't match, and manual data entry into ERP systems that creates errors and delays.

Ramp resolves each with autonomous, touchless automation:

AI & Automation

- Four autonomous AI agents: Handle invoice coding, fraud detection, approval summaries, and card-based vendor payments automatically

- Intelligent invoice capture: Pulls data from every line item at 99% OCR accuracy, removing the need for manual data entry

- Automated PO matching: Checks invoices against purchase orders using 2-way and 3-way matching to flag overbilling before payment goes out

Workflows & Approvals

- Custom approval workflows: Create multi-level approval chains with role-based routing that fits your organization's structure

- Approval orchestration: Streamlines the review process with fewer clicks, better visibility, and faster turnaround

- Roles and permissions: Set granular user controls to enforce separation of duties across your team

- Real-time invoice tracking: Follow every invoice from the moment it's received through final payment

Payments

- Flexible payment methods: Pay vendors by ACH, corporate card, check, or wire transfer

- International payments: Send wire transfers to vendors in 185+ countries

- Batch payments: Process multiple invoices and vendor payments in a single batch

- Recurring bills: Set up automated payments for regular invoices using templates

Vendor Management

- Vendor onboarding: Collect W-9s, verify TINs, and track 1099 data without leaving the platform

- Vendor Portal: Give vendors a secure way to update payment details, check payment status, and communicate with your AP team

Accounting & ERP

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and other major ERPs for audit-ready records

- AI-assisted GL coding: Map transactions to the correct accounts using intelligent recommendations based on historical patterns

- Reconciliation: Match transactions automatically to close books faster

Why make the switch to Ramp?

Ramp sets a new standard for touchless, accurate, and fast invoice processing. Use it as a dedicated AP solution or connect it with Ramp's corporate cards, expense management, and procurement tools for complete financial visibility.

And don't just take our word for it—Ramp ranks as the easiest AP software to use on G2, backed by over 2,100 verified reviews and a 4.8 out of 5 star rating. Finance teams choose Ramp to eliminate manual work, catch errors before they become costly, and close books faster.

Getting started is easy: Ramp's free tier includes core AP automation, with advanced features available on Ramp Plus for $15 per user per month. Enterprise pricing is available upon request.

Invoice processing shouldn't require manual work. Ramp automates it. Learn more about Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits