- What is an open invoice?

- Why do open invoices matter?

- From an open to closed invoice: Its progress through the AR process

- Closing invoices efficiently

- How to manage and reduce open invoices

- How Ramp Bill Pay processes invoices faster than legacy AP software

- Why finance teams choose Ramp to manage invoices

Most invoices start as open invoices. Whether it’s a routine transaction or a major contract, it remains open until the payment is received. But when too many invoices stay open for too long, businesses face cash flow gaps, delayed revenue, and administrative slow down.

Managing open invoices effectively isn’t just about tracking what’s owed—it’s about keeping payments predictable, reducing follow-ups, and maintaining financial stability.

Let’s walk through what open invoices are, how they impact your business, and the best ways to manage them.

What is an open invoice?

Open Invoice

An open invoice is an unpaid invoice that remains in accounts receivable until the customer settles it. If the invoice surpasses its due date, it becomes both open and past due.

These invoices sit in your accounts receivable, representing revenue that has yet to be collected.

In B2B transactions, open invoices are standard since businesses often operate on payment terms rather than requiring upfront payments. Terms typically range from Net 30 to Net 60 or longer, depending on the agreement. If the invoice isn’t paid by the due date, it becomes both overdue and remains open, requiring follow-ups or collections to secure payment.

Here are the main characteristics associated with open invoices:

- Issued but unpaid: The invoice has been sent to a customer, but payment has not yet been received.

- Has a due date: Open invoices are typically associated with payment terms (e.g., Net 30, Net 60), meaning payment is expected within a set timeframe.

- Can be partially paid: A payment might have been made, but if the full amount isn’t settled, the invoice remains open.

- May be past due: An invoice that exceeds its due date without full payment is still considered open but is also classified as past due.

- Recorded in accounts receivable: Open invoices appear as outstanding balances on a company’s balance sheet under AR until payment is received.

Why do open invoices matter?

Unmanaged open invoices slow down payments, but they can also create ripple effects that hurt cash flow, financial stability, and operations. If you don’t manage invoices properly, they can lead to:

- Cash flow disruptions: Unpaid invoices tie up revenue, making it harder to cover payroll, inventory, and other expenses.

- Financial planning challenges: Inconsistent payments make budgeting unpredictable and can limit your ability to invest in growth.

- Risk of bad debt: The longer an invoice remains unpaid, the lower the chance of collection. Some customers may delay indefinitely or default altogether.

- Increased administrative burden: Chasing late payments and managing collections takes time, pulling resources away from strategic work.

- Credit and funding concerns: Lenders and investors assess your ability to collect payments. A high number of overdue invoices can make your business seem risky, potentially affecting loan approvals and interest rates.

From an open to closed invoice: Its progress through the AR process

Open invoices move through a structured accounts receivable cycle, from the moment they’re issued to final payment (or escalation if unpaid). The invoice transitions from open to closed once the full payment has been received and recorded.

Here’s how the process works:

1. Invoice issuance

The process begins when a business issues an invoice for goods or services provided. At this stage, the invoice is documented in accounts receivable, marking it as an open balance. A well-structured invoice should clearly outline:

- Invoice number and issue date for tracking

- Due date and payment terms (e.g., Net 30, Net 60)

- Itemized breakdown of charges to prevent disputes

- Accepted payment methods to streamline transactions

Sending invoices promptly and accurately sets the foundation for a smooth payment process.

2. Pending payment (Within payment terms)

Once the invoice is issued, it remains open while the customer is within the agreed payment window. Most businesses operate on terms like Net 30 or Net 60, meaning the invoice isn’t overdue yet.

During this period, businesses should proactively monitor payment statuses. Sending a friendly reminder a few days before the due date can encourage prompt payment, especially for clients who process invoices in batches.

3. Overdue invoice (Past due status)

If the due date passes without payment, the invoice remains open but is now classified as past due, requiring follow-ups or escalation. This is when businesses need to act quickly to prevent prolonged delays.

- First, send a polite yet firm payment reminder via email.

- If there’s no response, follow up with a phone call to confirm the issue isn’t a simple oversight.

- If payment delays persist, businesses may start applying late fees or penalties (if outlined in the original terms).

At this stage, maintaining professional but persistent communication is key to resolving the outstanding balance without damaging client relationships.

4. Escalation and collections

If an invoice remains unpaid despite follow-ups, businesses must consider stronger measures. Some common escalation steps include:

- Internal review: Involve the finance team or account manager to assess the situation.

- Formal demand notices: Send a written demand for payment outlining consequences for non-payment.

- Third-party collection agencies: If the amount is significant, some businesses choose to work with collections agencies to recover funds.

- Legal action: As a last resort, businesses may pursue legal action or write off the invoice as bad debt.

The goal is to minimize how often invoices reach this stage by having structured AR processes in place and proactively managing payments.

Closing invoices efficiently

Closing invoices efficiently improves cash flow, but businesses should balance speed with maintaining strong client relationships. A structured follow-up process helps ensure timely payments without damaging customer trust.

If delays occur, having a structured approach—whether through gentle follow-ups, credit adjustments, or final settlement terms—ensures invoices don’t stay open longer than necessary. By staying proactive and making payments easy, businesses can close invoices faster and keep accounts receivable running smoothly.

How to manage and reduce open invoices

The best way to prevent uncertainties with open invoices is to implement proactive invoice management strategies that reduce the number of open invoices and encourage on-time payments.

- Send clear, professional invoices: A well-structured invoice reduces confusion and increases the likelihood of prompt payment.

- Automate invoice tracking and reminders: Relying on manual tracking can lead to overlooked invoices and payment delays. Businesses that implement invoice automation can gain real-time visibility into their open invoices.

- Offer multiple payment options: Making payments easy increases the chances of faster invoice settlements. For recurring clients, offering automatic payments can prevent open invoices from accumulating.

- Consider invoice discounting for cash flow gaps: If open invoices are creating cash flow challenges, invoice discounting allows you to borrow against unpaid invoices confidentially while retaining control of customer relationships and collections.

- Set credit terms strategically: Businesses should define clear payment terms upfront, requiring partial payments for large invoices or specifying late fees where legally enforceable.

- Have a system for handling late payments: Include soft reminders, escalation, and clearly defined late fees on invoices where applicable. If payment delays persist, try implementing payment plans, account holds, or formal demand notices before considering legal action.

By addressing overdue invoices methodically, businesses can recover more payments while preserving customer relationships.

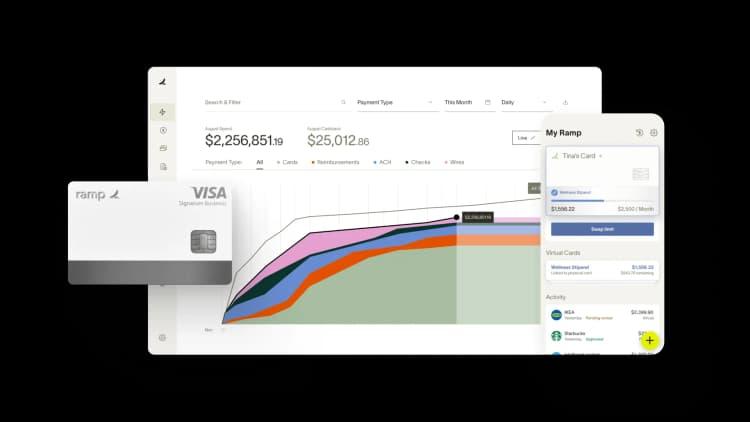

How Ramp Bill Pay processes invoices faster than legacy AP software

Ramp Bill Pay is an autonomous AP platform that prevents invoices from piling up. Four AI agents manage transaction coding, fraud detection, approval summaries, and card-based payments—moving invoices from open to paid without manual bottlenecks. With up to 99% accurate OCR capturing every line item instantly, Ramp processes invoices 2.4x faster than legacy AP software1.

Deploy Ramp as a standalone AP solution or connect it with corporate cards, expenses, and procurement for unified visibility into every open invoice. Teams using Ramp also report up to 95% improvement in financial visibility2.

Open invoices stack up when approvals stall, coding takes too long, or payments get delayed. Ramp's touchless, autonomous automation clears the backlog:

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons—then recommends approval or rejection

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Batch payments: Process multiple vendor payments in a single batch

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Recurring bills: Automate regular payments with recurring bill templates

- International payments: Send wires to 185+ countries with global spend management support

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

Why finance teams choose Ramp to manage invoices

Ramp sets the standard for touchless AP—accurate capture, fast approvals, and on-time payments that keep outstanding invoices to a minimum. Use it as a dedicated invoice management tool or integrate it across your spend stack for complete oversight.

Over 2,100 finance professionals on G2 rate Ramp 4.8 out of 5 stars, ranking it the easiest AP software to use. Ramp's free tier includes core AP automation. Ramp Plus unlocks advanced tracking and payment features at $15 per user per month, with enterprise pricing available on request.

Outstanding invoices slow your business down. Ramp keeps them moving. Learn more about Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits