What is a cash budget? Definition, importance, and example

- What is a cash budget?

- Why is a cash budget important?

- Short-term vs. long-term cash budgets

- Key elements of a cash budget

- How to create a cash budget: A step-by-step guide

- Cash budget example

- Common cash budget challenges

- Tips for managing surpluses and shortfalls

- Is a cash budget worth the effort?

- Automate cash tracking and forecasting with Ramp's real-time visibility

Running out of cash at the wrong moment can stall growth, delay payroll, or force you to pass on new opportunities. A cash budget helps you forecast cash inflows and outflows so you can prevent shortfalls before they happen.

It’s not just about tracking revenue and expenses. A cash budget focuses on when cash actually moves in and out of your business, giving you clear visibility into your real liquidity.

What is a cash budget?

A cash budget is a financial document that projects your business’s cash inflows and outflows over a specific period to calculate your expected ending cash balance. It helps you anticipate shortfalls, plan for upcoming obligations, and identify periods when you can reinvest surplus cash.

Unlike traditional accrual-based budgets, which record revenue and expenses when they’re earned or incurred, a cash budget tracks only actual cash movements. It focuses on when customers pay you and when you pay suppliers, giving you a clear view of real-time liquidity.

Why is a cash budget important?

A cash budget gives you visibility into your future liquidity so you can make decisions before problems arise. Instead of reacting to cash shortages, you can plan for them.

Better forecasting

A cash budget projects your liquidity based on expected inflows and outflows. By forecasting your future cash position, you can prepare for large payments, payroll runs, or seasonal dips without scrambling for funds.

This forward-looking view helps you avoid emergency borrowing and manage working capital more deliberately.

Strategic use of surplus

Knowing when you’ll have excess cash allows you to put it to work. Instead of letting funds sit idle, you can invest in growth, reduce debt, or build reserves. A cash budget helps you time those decisions so you don’t overextend your business.

Managing cash flow gaps

Most businesses experience uneven cash cycles. A cash budget helps you prepare for slower months by setting aside funds during stronger ones. Planning for these fluctuations reduces the risk of missed payments and operational disruptions.

Stronger financial control

Unexpected costs are part of running a business. A cash budget helps you maintain a buffer for unforeseen expenses by showing how much cash is truly available at any given time. With clearer guardrails, you’re less likely to commit to spending you can’t support.

More confident decision-making

When you understand your projected cash position, you can evaluate investments, hiring plans, and expansion opportunities with real numbers. That clarity removes guesswork from financial planning. Instead of relying on revenue projections alone, you’re making decisions based on actual cash timing.

Short-term vs. long-term cash budgets

Short-term and long-term cash budgets serve different planning horizons but work together to protect your liquidity. Short-term budgets focus on daily operations, while long-term budgets support strategic decisions like capital investments and expansion.

| Factor | Short-term cash budget | Long-term cash budget |

|---|---|---|

| Time horizon | Days to a few months | Quarters to multiple years |

| Primary use case | Managing immediate liquidity and working capital | Strategic planning and capital allocation |

| Level of detail | High—tracks specific transactions and timing | Broader—focuses on trends and major cash events |

| Update frequency | Daily or weekly | Monthly or quarterly |

| Best for | Businesses with tight margins or seasonal swings | Businesses planning growth or major investments |

Short-term cash budget

A short-term cash budget typically covers several weeks or months. It ensures you have enough cash to cover day-to-day operational expenses (OpEx) and manage working capital closely.

For example, you might use it to plan payroll, vendor payments, and recurring bills. Close monitoring helps you catch potential shortages early and adjust collections or spending before issues escalate.

Short-term cash budget pros and cons

Short-term budgets give you real-time control. They’re especially useful if you have high transaction volumes or unpredictable cash cycles.

However, they require frequent updates and hands-on oversight. If you focus only on short-term needs, you may miss longer-term investment or financing opportunities.

Long-term cash budget

A long-term cash budget spans a quarter, a year, or more. It incorporates major capital expenditures (CapEx), debt repayments, and strategic investments.

This broader view helps you align your liquidity with long-term goals, such as expanding facilities, entering new markets, or funding large technology upgrades.

Long-term cash budget pros and cons

Long-term budgets support strategic planning and debt management. They help you evaluate whether major investments are financially sustainable.

The tradeoff is accuracy. Projections become less precise over time due to shifting market conditions, changing revenue patterns, or unexpected expenses.

Key elements of a cash budget

A cash budget is built from five core components that work together to show your projected liquidity over a set period.

Opening cash balance: The cash you start with

This is the amount of cash available at the beginning of the budget period, including balances in checking and savings accounts. It sets your liquidity baseline and determines how much flexibility you have before new cash comes in.

Projected cash inflows: The cash you expect to receive

Projected inflows include all anticipated cash receipts during the budget period, such as:

- Cash sales: Revenue collected immediately at the point of sale

- Accounts receivable: Payments from customers who previously purchased on credit

- Loan proceeds or other financing: Funds received from lenders or investors

Accurate inflow estimates help you plan spending without overestimating available liquidity.

Projected cash outflows: The cash you expect to pay

Outflows represent all expected payments during the period, including:

- Accounts payable: Payments to vendors and suppliers

- Payroll: Employee salaries, wages, and benefits

- Rent and utilities: Facility and operating costs

- Debt repayments: Scheduled principal and interest payments

Tracking these obligations ensures you can meet commitments without triggering liquidity risks.

Net cash flow: Inflows minus outflows

Net cash flow equals total projected inflows minus total projected outflows for the period. A positive figure indicates a surplus, while a negative figure signals a potential shortfall. This metric helps you determine whether you need to adjust spending, accelerate collections, or secure financing.

Closing cash balance: Your ending cash position

Your closing cash balance is calculated as:

Opening cash balance + Total inflows – Total outflows = Closing cash balance

This final figure shows how much cash you expect to have at the end of the period and becomes the opening balance for the next cycle.

Regular updates and realistic assumptions across all five elements keep your cash budget accurate and actionable.

How to create a cash budget: A step-by-step guide

Creating a cash budget is a straightforward process when you break it into clear steps. The goal is to estimate when cash will enter and leave your business so you can plan accordingly.

1. Determine the budget period

Choose a time frame that matches how closely you need to monitor liquidity. You might build a weekly budget if cash is tight or a monthly or quarterly budget if cash flows are more stable. The shorter the period, the more precise your cash control will be.

2. Estimate cash inflows

Project when you expect to collect cash from sales, accounts receivable, and other sources. Be realistic about timing, especially if you offer 30-day payment terms or longer. Include loan proceeds, tax refunds, or investment income if applicable. Timing matters more than total revenue in a cash budget.

3. Estimate cash outflows

List every expected payment during the budget period. This includes operating expenses, payroll, vendor payments, debt service, and capital purchases.

Don’t overlook periodic obligations like quarterly taxes or annual insurance premiums. Missing just one large payment can distort your projections.

4. Calculate net cash flow

Subtract total projected outflows from total projected inflows. The result shows whether you expect a surplus or a shortfall for the period. If the number is negative, you’ll need to reduce spending, accelerate collections, or secure financing.

5. Calculate the ending cash balance

Add your net cash flow to your opening cash balance to determine your projected closing balance:

Opening cash balance + Net cash flow = Closing cash balance

This final number shows whether you’ll maintain a healthy liquidity cushion.

6. Review and adjust regularly

Compare projections to actual results and update your assumptions as needed. If collections slow or expenses increase, revise your forecast immediately.

If you anticipate a deficit, consider short-term solutions such as a business line of credit. If you expect a surplus, decide whether to reinvest, pay down debt, or build reserves. Consistent review keeps your cash budget accurate and useful for decision-making.

Cash budget example

Below is a three-month cash budget example to show how projected inflows and outflows affect your ending cash balance over time.

| Item | January | February | March |

|---|---|---|---|

| Opening cash balance | $10,000 | $12,000 | $11,000 |

| Cash inflows | |||

| Sales revenue | $20,000 | $15,000 | $25,000 |

| Accounts receivable collections | $5,000 | $4,000 | $6,000 |

| Total inflows | $25,000 | $19,000 | $31,000 |

| Cash outflows | |||

| Payroll | $8,000 | $8,000 | $8,500 |

| Rent and utilities | $3,000 | $3,000 | $3,000 |

| Inventory purchases | $7,000 | $9,000 | $10,000 |

| Loan payments | $5,000 | $4,000 | $4,500 |

| Total outflows | $23,000 | $24,000 | $26,000 |

| Net cash flow | $2,000 | –$5,000 | $5,000 |

| Closing cash balance | $12,000 | $7,000 | $12,000 |

In January, the business generates a $2,000 surplus, increasing its cash position to $12,000. In February, higher inventory purchases create a $5,000 shortfall, reducing the balance to $7,000. March rebounds with stronger collections, restoring liquidity to $12,000.

A multi-period view like this makes seasonal swings and working capital pressure easier to identify before they create operational risk.

Common cash budget challenges

Even with a solid process in place, cash budgeting can break down if assumptions or systems fail. These are the most common obstacles finance teams run into:

- Inaccurate forecasting: Misjudging sales timing or customer payment behavior can quickly distort projections

- Unexpected expenses: Emergency repairs, legal costs, or unplanned purchases can disrupt even well-built budgets

- Seasonal fluctuations: Revenue swings during slow periods can create liquidity pressure when fixed expenses remain constant

- Data silos: Limited visibility across bank accounts, credit cards, and accounting systems makes it harder to maintain an accurate cash position

Anticipating these risks and building flexibility into your projections helps you respond faster when conditions change.

Tips for managing surpluses and shortfalls

Cash flow rarely stays perfectly balanced. You need clear strategies for both tight periods and surplus periods so you can stay stable and capitalize on opportunity.

Strategies for shortfalls:

- Speed up receivables: Shorten payment terms or offer early payment discounts to improve collection timing

- Negotiate vendor flexibility: Request extended payment terms during temporary cash constraints

- Use short-term financing: Consider a line of credit, invoice factoring, or other bridge financing to cover temporary gaps

Strategies for surpluses:

- Reinvest in growth: Allocate excess cash to marketing, hiring, inventory, or equipment that supports revenue expansion

- Pay down debt: Reduce outstanding balances to lower interest costs and improve financial flexibility

- Build a reserve: Set aside funds to strengthen your liquidity cushion for future slowdowns or unexpected expenses

Having predefined rules for both scenarios helps you avoid reactive decisions when cash positions change.

Is a cash budget worth the effort?

Yes. The time you spend building a cash budget is minimal compared to the cost of a preventable cash shortfall.

Your first version may take a few hours to set up, but ongoing maintenance often requires 30–60 minutes per week once you establish a rhythm. Templates and automation tools make the process even faster.

The real value comes from eliminating surprises. When you can see upcoming obligations and projected balances in advance, you can make informed decisions about hiring, expansion, or equipment purchases without guessing.

Start simple. Begin with core income and expense categories, then refine your model over time. Even a basic cash budget can significantly improve how you manage liquidity and risk.

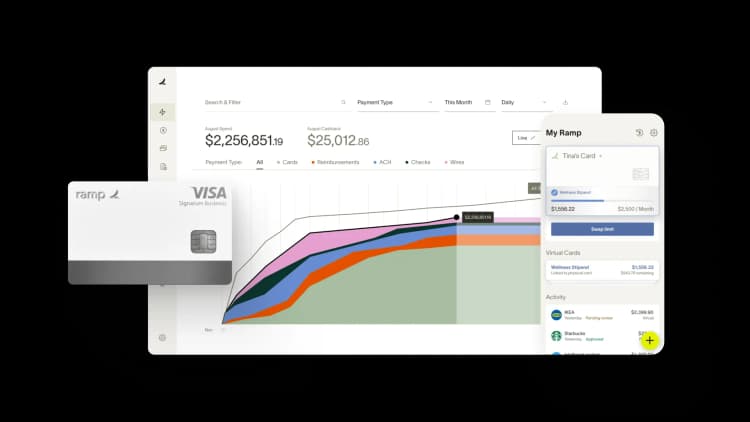

Automate cash tracking and forecasting with Ramp's real-time visibility

A cash budget is only as strong as the data behind it. Without real-time visibility into spending and commitments, projections quickly become outdated.

Ramp gives you a live view of your cash position, so you can forecast accurately and prevent shortfalls before they happen. Transactions, approvals, and bill payments sync into one dashboard that updates continuously, helping you build a cash budget based on current data—not stale reports.

Here’s how Ramp supports stronger cash forecasting:

- Track spend in real time: See card transactions, reimbursements, and bill payments as they happen

- Forecast using actual data: Analyze trends and spending patterns to project future cash needs more accurately

- Control budgets proactively: Set limits by team, department, or project to prevent overspending before it impacts liquidity

- Centralize vendor payments: Monitor recurring bills and upcoming obligations in one place

- Automate accounting workflows: Sync transactions automatically with your ERP using accounting automation software

When your systems update automatically, your cash budget reflects reality. That visibility makes it easier to manage risk, allocate capital, and move quickly when opportunities arise.

Try a demo to see how Ramp helps finance teams stay ahead of cash flow volatility.

FAQs

You calculate a cash budget by adding projected cash inflows to your opening cash balance, then subtracting projected cash outflows.

Closing cash balance = Opening cash balance + Total inflows – Total outflows

This calculation shows whether you expect a surplus or shortfall for the period.

A cash budget forecasts future cash inflows and outflows to help you plan ahead. A cash flow statement reports actual historical cash activity over a completed period.

In short, a cash budget is forward-looking, while a cash flow statement is backward-looking.

The four primary budget types are:

- Operating budget: Covers day-to-day revenue and expenses

- Capital budget: Plans for long-term investments and major purchases

- Cash budget: Projects cash inflows and outflows to manage liquidity

- Master budget: Consolidates all financial budgets into one comprehensive plan

Each serves a different purpose, but together they support complete financial planning and control.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°