How to set up direct deposit for employees: Step-by-step guide

- What is direct deposit?

- How does direct deposit work?

- What you need to set up direct deposit

- How to set up direct deposit for employees

- How long does direct deposit take?

- Does it cost money to set up direct deposit for employees?

- What are the benefits of using direct deposit for employees?

- Common errors with direct deposit and how to avoid them

- Can employers require direct deposit?

- Automate your business bill payments with Ramp

Setting up direct deposit for employees is the easiest way to pay your team accurately and on time. With direct deposit, employees get reliable access to their wages, and you gain more control and predictability over payroll. You can schedule payments in advance, reduce the costs and risks tied to paper checks, and build trust by ensuring your team is paid on time, every time.

What is direct deposit?

Direct deposit is the electronic transfer of wages to an employee’s bank account through the ACH network. Your bank or payroll provider submits payment instructions to ACH, which routes funds from your business account to each employee’s account on payday. It’s faster and more secure than paper checks, with fewer errors and lower mailing and materials costs.

How does direct deposit work?

Direct deposit moves money through the ACH network in the following steps:

- You approve payroll in your bank or payroll software

- Your provider or bank sends an ACH file to the ACH network

- The ACH network routes payments to employees’ banks

- Employees’ banks credit their accounts, while your account is debited

Funds usually settle in 1–2 business days, though timing depends on your provider, the banks involved, and holidays.

What is a Nacha file, and do you need one?

A Nacha file is the standardized format used to make ACH payments. Most payroll software creates and transmits this file for you. If you’re using a bank’s ACH portal, you may need to upload the file yourself. You’ll almost never build or code one manually.

What you need to set up direct deposit

Every employee must complete a direct deposit authorization form before you can pay them this way. The form should include:

- Employee name and contact information

- Bank name, routing number, and account number

- Account type (checking or savings)

- Allocation instructions if they want to split deposits (optional)

- Signature, date, and consent to deposit funds and correct errors

Some providers may also require a voided check, a bank letter, or additional details such as a Social Security number for verification.

How to collect this information

Use a standardized direct deposit form from your provider or create your own. If your payroll platform has an employee self-service portal, let employees enter details directly. When needed, verify bank details with a voided check or bank letter.

How to protect this information

Store forms securely with limited access and, if possible, encryption. Follow your company’s retention policy and any state requirements, and never share account details outside of payroll and HR.

State rules on requiring direct deposit

Some states let you require direct deposit, while others mandate an opt-out or an alternative such as a paper check or pay card. Always confirm your state’s rules before finalizing your payroll policy.

How to set up direct deposit for employees

Follow these seven steps to start paying employees by direct deposit.

1. Choose a provider (payroll software vs. bank)

Decide whether to process payroll through your bank or payroll management software. This entity will also be responsible for storing the sensitive financial information required to conduct these transactions.

Payroll management software often includes automation, employee self-service, integrations, and multi-state compliance support. Banks may offer same-day ACH, but they sometimes charge setup or transaction fees.

Compare how quickly each option processes payments, whether the platform is easy for both you and your employees to use, how well it integrates with your existing systems, and the level of customer support you can expect if issues come up.

Use payroll software to reduce errors and manual work

Banks may look cheaper per transaction, but they often require more manual work, stricter cutoff times, and extra compliance responsibility. Payroll software costs more in fees but usually offers automation, employee self-service, and fewer errors—making it a better fit for most growing businesses.

2. Complete employer setup and ACH enrollment

If you choose a bank, you can work with your representative to set up the process, or you may be able to do it yourself through your online banking portal. Your bank will ask you to sign off on the ACH network’s terms and conditions. It may also request recent financial statements to verify you have the funds needed to cover your deposits.

If you use payroll software, this process can be done easily within the platform. After creating your account, the platform will prompt you to verify your identity, often through a quick email confirmation or a test withdrawal (a small transaction used to confirm your bank account is connected properly).

3. Gather signed employee direct deposit authorizations

Collect a direct deposit authorization form from each employee. Make sure the information matches payroll records.

Forms should include:

- Name and contact information

- Bank name, routing number, and account number

- Account type (checking or savings)

- Split deposits if applicable

- Signature, date, and consent to deposit funds and correct errors

4. Add employees and set your pay schedule

If you collected employee information manually, now is the time to input employee data into your system and check for errors or missing information. Some providers allow you to upload this information to their platform using a NACHA file exported from your accounting software or through a simple spreadsheet.

If employees submitted their information through their portals, you can skip this step and move on to scheduling.

Once employees are added, set a consistent pay frequency (biweekly, semimonthly, or monthly), choose standard paydays, and configure rules for holidays and cutoff dates.

5. Verify bank accounts

Verification reduces errors and failed payments. Options include a prenote (a $0 test sent ~3 banking days before the first payroll), microdeposits (small deposits that clear in 1–3 business days and are confirmed by the employee), or instant verification (employees log in securely to confirm their account).

6. Run your first payroll and submit deposits

Preview gross-to-net totals, confirm deposit dates, and make sure you have enough funds in your business account.

If you’re using payroll software, you can usually run payroll and initiate deposits with a few clicks. If you’re using your bank, generate a NACHA file in your accounting system and upload it to your banking portal. Submit before your provider’s cutoff time so payments process on schedule. Funds typically become available to employees by midnight on payday.

7. Reconcile and confirm

After payroll is submitted, review your payroll reports and confirm that the total debits from your business account match the credits deposited into employee accounts. Check for any failed transactions, adjustments, or returned payments and resolve them quickly with your provider.

Keep copies of signed employee authorizations, payroll summaries, and bank confirmations in secure storage. These records not only support compliance with state and federal requirements but also provide an audit trail if questions arise later.

Discover Ramp's corporate card for modern finance

How long does direct deposit take?

Direct deposit timing depends on setup, account verification, and ACH processing.

Stage | Typical time | What you do |

|---|---|---|

Employer setup | 1–7 business days | Enroll with your provider and get ACH approval |

Account verification | Prenote ~3 banking days; microdeposits 1–3 days; instant verification | Verify each employee’s bank details |

Payroll processing | 1–3 business days | Submit payroll by your provider’s cutoff time |

Same-day ACH | Same business day (early cutoff; fees may apply; no weekends/holidays) | Use for urgent runs when supported |

Example: For a Friday payday, submit payroll by Tuesday at 3 PM ET (standard ACH) or by Thursday morning for same-day ACH, if your provider supports it.

Because ACH doesn’t process on weekends or federal holidays, plan ahead and adjust your payroll calendar so employees are always paid on time.

Does it cost money to set up direct deposit for employees?

The cost of direct deposit depends on whether you use payroll software or your bank. Many payroll platforms include direct deposit in their subscription pricing (often a monthly base rate plus a per-employee charge), while banks may assess per-batch or per-transaction fees and surcharges for same-day ACH. Some also charge one-time setup or underwriting fees.

Error-related fees, such as returns, reversals, or non-sufficient funds, can apply if a deposit bounces or payroll runs short on funds.

Even when direct deposit looks free, compare the total cost of ownership: subscription fees, ACH fees, error handling, and the time you save versus printing and mailing checks.

What are the benefits of using direct deposit for employees?

Direct deposit offers advantages for both employees and employers:

- Faster access to pay: Employees don’t have to wait to cash checks or risk delays

- Greater security: Reduces the risk of lost or stolen checks and protects sensitive information

- Lower costs: Cuts expenses tied to printing and mailing paper checks

- Less manual work: Simplifies payroll and record-keeping for HR and finance teams

- Eco-friendly choice: Reduces paper and postal waste, supporting sustainability goals

Common errors with direct deposit and how to avoid them

Setting up direct deposit is a relatively simple process, but nothing is perfect. Below are some common issues you may encounter and how to avoid them.

Returned or failed deposits

Returned deposits often happen when account or routing numbers are entered incorrectly, the account is closed, or names don’t match payroll records. If funds bounce back, you usually have a few banking days to correct the issue.

Update the employee’s information, stop or rescind the original transaction if possible, and reissue payment through a corrected direct deposit or paper check. Most ACH returns happen within a few banking days.

Wrong payment amount sent

Sending the wrong amount can result from data entry errors, incorrect withholdings, and duplicate runs. Review your payroll records to identify where the error occurred.

NACHA allows reversals for incorrect amounts, recipients, and duplicates within strict timeframes, so follow your provider’s reversal process quickly. You should also notify the affected employees and coordinate with your bank or payroll software to make the necessary corrections.

Incorrect or incomplete employee information

Incomplete authorization forms, missing account types, and typos in account numbers are common culprits. To prevent these issues, ask for as much information as possible upfront, including a signed form, account type, and a voided check or bank letter.

If errors slip through, recollect the authorization form and use microdeposits or instant bank verification to confirm accuracy before running payroll again.

Bank holidays and cutoff issues

Payments can be delayed if payroll is submitted after your provider’s cutoff time or is scheduled to land on a weekend or federal holiday. ACH doesn’t settle on these days, so build a payroll calendar that accounts for cutoffs, holidays, and lead times. Submit early and notify your employees in advance if a payday will be shifted to the prior business day.

Can employers require direct deposit?

Rules vary by state. Some states allow employers to require direct deposit, while others require you to offer an opt-out or provide an alternative, such as a paper check or pay card. As an employer, it’s your responsibility to stay current with the laws in every state where you have employees.

Have a written payroll policy, obtain employee consent, and provide a legally acceptable alternative where required. Your direct deposit provider can often point you in the right direction, but the most reliable source will be your state’s labor department or a current state-by-state compliance guide.

Automate your business bill payments with Ramp

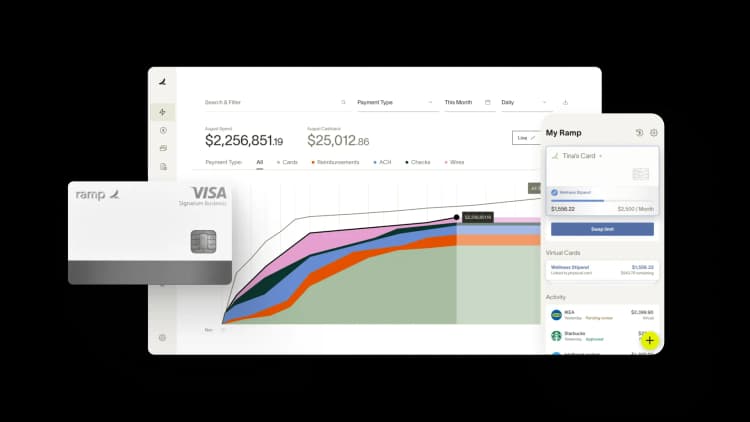

When paying employees, direct deposit is a great choice. But to pay everyone else, consider Ramp's automated accounts payable software.

We automate your entire AP workflow so every bill is recorded, approved, and paid without any manual work. You can use any payment method, including ACH, same-day ACH, card, check, or international wire.

With Ramp, you get complete visibility into the status of every bill and payment, so you can budget effectively and make sure bills are paid on time. Plus, pricing insights benchmark your vendor payments so you know whether you're getting a good deal.

Ready to get started? Explore a free interactive product tour.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°