How to choose a cashback business credit card (2026 Guide)

- Understanding the impact of cashback on your business

- What to consider when choosing a cashback business card

- Best business credit cards with cashback at a glance

- 5 best business credit cards with cashback

- How to maximize your business cashback rewards

- Redeeming cashback rewards

- Turn everyday spending into savings with the right cashback card

Cashback business credit cards help companies earn money back on everyday spending, from software and advertising to travel and office expenses. The right card can turn routine costs into predictable savings without changing how your business operates.

But not all cashback cards work the same way—and the best one for your business depends on how you spend, how much control you need, and whether simplicity or maximum returns matter more. This guide covers how cashback actually affects your bottom line, what to prioritize when comparing business credit cards, and which options stand out for different types of businesses.

Note: The cashback percentages, limits, fees, and other figures mentioned in this article are for illustrative purposes only. They do not represent guaranteed or expected rates. Actual terms, credit limits, rewards, and approval criteria vary by card issuer and may change at any time. Readers should verify current details directly with each issuer before applying.

Understanding the impact of cashback on your business

Cashback rewards act like an automatic discount on your operating expenses. Every eligible purchase earns money back, which directly improves your bottom line without requiring changes to how your business spends.

This adds up quickly at scale. Businesses and individuals in the U.S. make over 58.5 billion credit card payments annually, totaling more than $5.83 trillion in spend. Capturing even a small percentage of that activity as cashback can meaningfully offset routine costs.

For businesses with regular monthly expenses, a cashback credit card ensures you earn returns on spending you already incur. Those rewards can help offset operating costs, reinvest in growth, improve cash flow flexibility, or build a buffer for unexpected expenses.

As an example, a business spending $20,000 per month could earn more than $1,000 annually with a modest flat-rate cashback card. Over time, those savings become a predictable and low-effort contribution to your bottom line.

What to consider when choosing a cashback business card

The cashback percentage matters, but it’s only one part of the decision. To choose a card that actually delivers value, you’ll also want to evaluate how rewards are earned, redeemed, and supported by the card’s broader features.

Cashback structure

Business cashback cards typically use one of three reward structures:

- Flat-rate cashback: Earns the same percentage on every purchase, regardless of category. This works well for businesses with diverse spending patterns that don’t want to track bonus categories.

- Category-based cashback: Offers higher rewards in specific categories such as travel, advertising, or software. These cards can be lucrative if your spending aligns with the bonus categories.

- Rotating categories: Provides elevated cashback in categories that change periodically. While potentially rewarding, these cards require more active management and planning.

To figure out which structure fits, review your expenses over the last three to six months. Most businesses concentrate spending in a few core areas — office supplies, telecommunications, and travel and dining. If more than half of your spend falls into one or two categories that a card rewards at an elevated rate, a category card will likely deliver more value. If it's spread across many types of purchases, a flat-rate card offers simplicity and consistent returns.

Annual fees vs. rewards potential

Cards with annual fees often offer higher cashback rates or additional benefits. To decide whether a fee is worth it, calculate your break-even point:

Spending required to break even = Annual fee / Cashback percentage

For example, a $95 annual fee paired with a 0.5% flat-rate cashback card would require about $19,000 in annual spending to break even. Spending beyond that threshold generates net returns.

Welcome bonuses and introductory offers

Many cashback business cards offer welcome bonuses after meeting a minimum spend requirement. These can provide immediate value if the spending threshold aligns with your normal expenses.

Look for offers with:

- Realistic spending requirements

- Introductory 0% APR periods for planned purchases

- First-year fee waivers that improve early value

Redemption options and flexibility

Redemption rules affect how easily you can access rewards. Common options include statement credits, direct deposits, or transfers through issuer portals.

Cards with automatic redemption and no minimum thresholds simplify accounting and reduce the risk of unused rewards. Ramp’s cashback, for example, is applied automatically as a statement credit with no manual redemption required.

Additional benefits beyond cashback

Beyond rewards, card features can significantly impact overall value:

- Expense tracking and reporting tools

- Employee card controls

- Purchase protection and extended warranties

- No foreign transaction fees

For many businesses, these operational benefits can save more time and money than cashback alone.

Credit requirements

Traditional cashback business cards often require good to excellent personal credit. Newer businesses or owners with limited credit history may need to consider secured cards or options that evaluate business performance instead of personal credit scores.

Some modern business cards approve companies based on factors like cash flow and bank balances rather than founder credit history. This approach can make higher credit limits accessible without a personal guarantee.

How do I know whether to choose a category bonus card or a flat-rate cashback card?

Compare how much you spend in a card’s bonus categories against what you’d earn with a flat-rate card. If most of your spending falls into one or two bonus categories, a category card can deliver higher returns. If your spending is spread across many categories, a flat-rate cashback card is usually the simpler and more reliable choice.

Best business credit cards with cashback at a glance

The best cashback business credit card depends on how you spend, how much control you need, and whether simplicity or maximum returns matter more. The cards below cover a range of use cases, from flat-rate cashback to category bonuses and built-in expense controls.

| Card | Best for | Cashback structure | Annual fee |

|---|---|---|---|

| Ramp Business Credit Card | Automated cashback and spend control | Flat-rate cashback on all purchases | $0 |

| Capital One Spark Cash Plus | High-volume spend | Unlimited flat-rate cashback | $150 (waived with spend) |

| American Express Blue Business Cash | Smaller businesses | Tiered cashback with annual cap | $0 |

| Bank of America Business Advantage Unlimited Cash Rewards | Simple, unlimited cashback | Flat-rate cashback | $0 |

| Chase Ink Business Unlimited | Large welcome bonus | Flat-rate cashback | $0 |

Cashback rates, fees, and terms vary by issuer and may change. Verify details with the card issuer before applying.

How we evaluated the best cashback business credit cards

To identify the best business credit cards with cashback, we evaluated each card based on rewards structure, fees, redemption flexibility, and how well it supports real-world business spending. Cards were selected to represent a range of use cases, from simple flat-rate rewards to higher-spend businesses that benefit from bonus structures or added controls.

5 best business credit cards with cashback

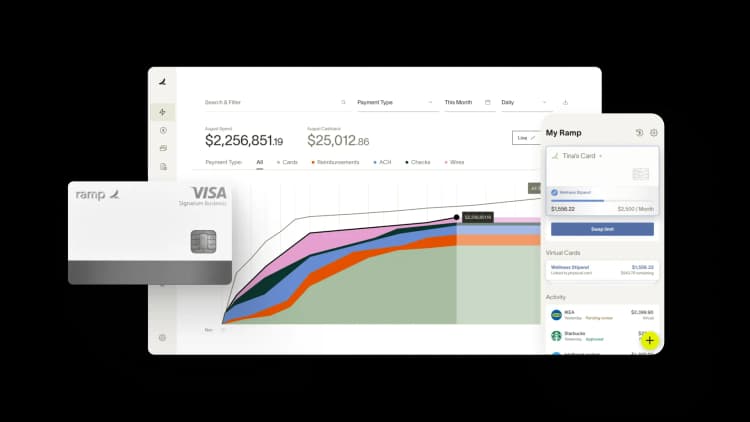

Ramp Business Credit Card

- Cashback rewards on purchases

- Built-in expense management software

- No personal guarantee or credit check required

- Must be a registered business to qualify

- Must have most of your business spend in the U.S.

The Ramp Corporate Card is a strong option for teams that value simplicity and operational control alongside cashback.

Ramp’s differentiator is control. Finance teams can set spending limits, issue unlimited employee cards, and monitor transactions in real time, which helps reduce waste and keep expenses aligned with policy. Those controls matter as teams grow and spending becomes harder to manage.

Why it wins for automation and oversight: Cashback is applied automatically with no redemption steps, and spending data flows directly into accounting tools. That combination reduces admin work and ensures rewards aren’t left unused.

Ideal for: Growing businesses that want straightforward cashback, strong expense controls, and clean accounting without managing categories or points.

Capital One Spark 2% Cash Plus

- Unlimited cashback rewards

- Offers $150 statement credit to cover annual fee

- 0% interest when used as intended

- $1,200 early spending bonus

- 2.99% monthly fee to carry a balance

- Must spend $30,000 in your first 3 months to access $1,200 bonus cash

- Must spend $150,000 per year to access the $150 annual cash bonus

- Limited spend management features

The Capital One Spark Cash Plus card is designed for companies that spend heavily and can pay their balance in full each month.

This card stands out for scale. There’s no preset spending limit, so purchasing power adjusts based on your business’s spending patterns and payment history. That flexibility can be valuable for companies with large or fluctuating monthly expenses.

Why it wins for high-volume cashback: Unlimited flat-rate cashback means rewards continue to accumulate without caps, and the ability to offset the annual fee through high spend makes it appealing for larger businesses.

The tradeoff is commitment. Because it’s a charge card, balances must be paid in full each month, and the annual fee only makes sense if your spending volume is high enough to justify it.

Ideal for: Established businesses with significant monthly expenses that want unlimited cashback and can reliably pay balances in full.

American Express Blue Business Cash Card

- Earns cash back on every purchase without category restrictions

- Includes valuable purchase protection and extended warranty benefits

- Allows for easy management of employee spending

- High APR after the introductory period

- Cashback rate may not compete with specialized category cards for specific expenses

- Lacks travel perks like airport lounge access or free checked bags which are common in other business cards

The American Express Blue Business Cash Card is a solid option for companies that want predictable rewards without paying an annual fee or managing complex categories. For businesses with moderate annual spend, this simplicity often outweighs more aggressive rewards programs with caps or fees.

Why it wins for simplicity: Cashback is applied automatically as a statement credit, and there’s no annual fee to offset. That makes it easy to capture value without added friction.

The main limitation is the rewards cap. Once spending exceeds the annual threshold for higher cashback, rewards drop to a lower rate, which can limit upside for faster-growing businesses.

Ideal for: Small businesses with moderate spending that want easy, automatic cashback and no annual fee.

Bank of America Business Advantage Unlimited Cash Rewards Mastercard

- The card offers a straightforward, unlimited 1.5% cash back on all purchases

- No annual fee

- If you have a business checking account with Bank of America, you can qualify for boosted cashback earnings

- The base reward rate of 1.5% is relatively low

- No introductory bonus

- Few frills or extra perks

The Bank of America Business Advantage Unlimited Cash Rewards card is built for simplicity. This card is especially appealing for businesses that want steady rewards and short-term financing flexibility. The introductory 0% APR period can help smooth cash flow for planned purchases, while the lack of an annual fee keeps ongoing costs low.

Why it wins for straightforward value: Unlimited cashback and no annual fee make this card easy to justify, particularly for businesses that want reliable rewards without complexity.

The main tradeoff is upside. While simple, the cashback rate is lower than some premium cards, and advanced expense controls or automation features are limited compared to newer fintech options.

Ideal for: Businesses that want predictable, unlimited cashback, no annual fee, and minimal management overhead.

Chase Ink Business Unlimited Credit Card

- Unlimited 1.5% cashback on all business purchases

- Rewards never expire

- Welcome bonus if you spend enough in the first 3 months of account opening

- No bonus reward categories

- Not the best card for balance transfers

The Chase Ink Business Unlimited Credit Card is a strong choice for business owners who want straightforward rewards paired with a generous introductory offer. In addition to ongoing cashback, the welcome bonus can deliver significant short-term value if your business can meet the initial spending requirement using normal operating expenses.

Why it wins for upfront value: The combination of unlimited cashback and a sizable welcome bonus makes this card especially attractive in the first year, when many businesses are looking to offset startup or expansion costs.

The tradeoffs are long-term differentiation and controls. After the welcome bonus, rewards are similar to other flat-rate cards, and the card doesn’t offer the same level of expense management or automation found in newer business card platforms.

Ideal for: Businesses that can meet the welcome bonus spending requirement and want simple, unlimited cashback without paying an annual fee.

How to maximize your business cashback rewards

To maximize cashback, start by reviewing your expense reports from the past six to twelve months. Understanding where your business spends the most helps you choose cards that consistently reward those purchases.

If spending is concentrated in a few categories, a category-based cashback card may deliver higher returns. If expenses are spread across many vendors or categories, a flat-rate card often provides more reliable value with less effort.

Some businesses increase rewards by timing large purchases around welcome bonus requirements or introductory offers. Others use multiple cards to earn higher cashback on specific categories. While these approaches can boost returns, they also add complexity and administrative overhead.

As businesses grow, simplicity often matters more than optimization. Straightforward cashback structures with automatic redemption are easier to manage and less likely to leave rewards unused.

Where businesses earn the most cashback

Understanding where businesses tend to earn the most cashback can help set realistic expectations when choosing a card. Some categories generate higher returns not because they dominate spending, but because reward structures align well with how those purchases are classified.

Based on Ramp customer data from June 20251, the following categories generated the highest average annualized cashback per business:

- Advertising: $5,217

- General merchandise: $2,440

- SaaS and software: $1,642

- Cloud computing: $1,503

- Lodging: $1,428

While these categories may not represent your largest expense lines, they often deliver outsized cashback returns. Reviewing your own spending mix can help determine whether a flat-rate or category-based cashback card is likely to perform better for your business.

Discover Ramp's corporate card for modern finance

Redeeming cashback rewards

How you redeem cashback depends on the card issuer’s rewards program. The most common option is applying rewards as a statement credit, which directly reduces your balance. Some issuers also allow direct deposits into a business checking account, giving you more flexibility in how funds are used.

Other cards offer redemption through issuer portals for travel, gift cards, or merchandise. While these options add choice, they often provide less value than straightforward cash redemption and can require additional steps.

Around 72% of cardholders actively try to earn rewards, underscoring how important cashback has become in managing business finances. That makes redemption friction a meaningful consideration when choosing a card.

Ramp takes a simpler approach: cashback is applied automatically as a statement credit, with no minimum thresholds or manual redemption required. That reduces administrative work and ensures rewards aren’t forgotten or left unused.

Before choosing a card, review redemption rules carefully. Some issuers require minimum balances to redeem cashback or impose expiration policies tied to account activity or product changes.

What other types of business card rewards are available besides cashback?

Besides cashback, some business credit cards earn points or miles that can be redeemed for travel, merchandise, or statement credits through issuer portals. Others offer cash equivalents that must be redeemed in specific ways, such as travel bookings, or provide partner discounts on services like shipping, software, or advertising.

Cashback remains the simplest option because it delivers predictable value without redemption friction, which is why many businesses prefer it over points-based programs.

Turn everyday spending into savings with the right cashback card

The best cashback business credit cards help you earn while you spend. Whether you’re covering software subscriptions, travel, or everyday operations, the right card can return a portion of that spend to your bottom line.

Ramp’s corporate card stands out for businesses that value automation, speed, and control. It offers cashback on purchases, without any limits, interest, or foreign transaction fees. You don’t need to manage points or activate categories. Cashback is applied automatically, with no redemption steps. Ramp also requires no personal guarantee and integrates directly with accounting tools, helping you streamline spend and compliance in one place.

At Ramp, transparency and integrity are core values guiding our content. We believe in the exceptional value of our products, which may shape our perspective. Our methodical approach involves competitor analysis, comparison of credit cards, and frequent reviews to maintain reliability. Review our full methodology for choosing the best business credit cards.

1These figures represent historical averages across Ramp customers and are not indicative of individual results or future performance.

FAQs

Yes, but approval depends on your business’s financial profile. Some cards may require established revenue or time in business. If you're just starting out, consider cards that evaluate cash flow over credit history, like Ramp.

Many business cards report only to business credit bureaus, but some also report to personal credit bureaus if you miss payments or carry a balance. Ramp does not report to personal credit bureaus at all.

Mixing personal and business expenses can create accounting and tax issues. Most issuers also prohibit it in their terms. Keeping spending separate protects your business and simplifies bookkeeping.

Most business credit cards, including those from Chase, Capital One, and Ramp allow you to issue employee cards at no additional cost. All purchases made on those cards typically earn cashback for the primary account.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits