- At a glance: Zoho Expense alternatives compared

- Best overall Zoho Expense alternative: Ramp

- Navan (formerly TripActions)

- Expensify

- BILL Spend & Expense (formerly Divvy)

- Paylocity

- It pays to pick the best Zoho Expense alternative

Zoho Expense is a travel and expense management platform that offers corporate card reconciliation, cash advances, multilevel approval workflows, and multicurrency support. It’s especially popular among small businesses, with a score of 4.5 out of 5 stars on the software review website G2.

If you already use the other products within the Zoho ecosystem, Zoho Expense could be a good choice that meets your business needs. However, many companies will likely outgrow its feature set. Customization can be complex, and some users report issues syncing data between Zoho Expense and their accounting software.

On top of that, its mobile apps receive poor marks for usability, and even its most basic features require a paid plan. In contrast, many Zoho Expense alternatives can match or even exceed its feature set for free.

In this article, we compare Zoho Expense with its other highly rated competitors, including:

- Ramp

- Navan (formerly TripActions)

- Expensify

- BILL Spend & Expense (formerly Divvy)

- Paylocity (formerly Fyle)

At a glance: Zoho Expense alternatives compared

| Platform | G2 rating | Market segment | Key features | Minimum cost |

|---|---|---|---|---|

| Ramp | 4.8 | Startups, small businesses, mid-market | Expense management, corporate cards, travel booking | $0; unlimited free tier |

| Navan | 4.7 | Mid-market | Travel booking, expense management | $0; free tier with seat and usage limits |

| Fyle | 4.6 | Mid-market | Expense management | $11.99 per user per month, billed annually |

| Paylocity | 4.5 | Mid-market | Procurement, expense management | N/A; all pricing is quote based |

| Emburse Professional | 4.5 | Mid-market, enterprise | Expense management | $3,000 per year |

| Coupa | 4.2 | Mid-market, enterprise | Procurement, expense management, invoice automation, payments | N/A; all pricing is quote based |

| Zoho Expense | 4.2 | Small businesses, mid-market | Expense management, travel booking | $3 per active user per month; free plan available |

Best overall Zoho Expense alternative: Ramp

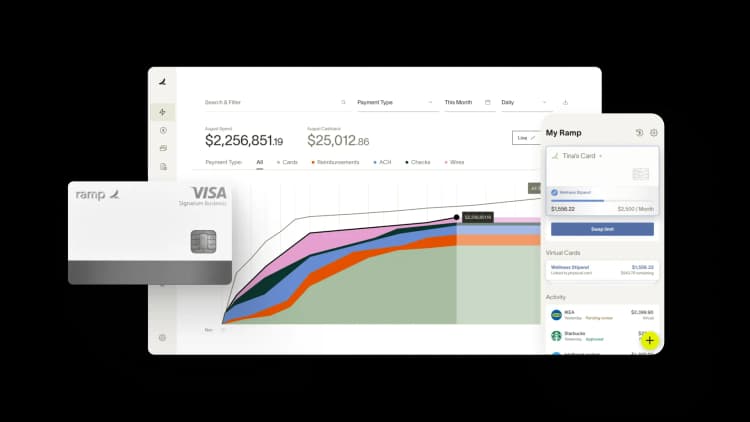

Ramp is an all-in-one finance platform that helps businesses streamline travel and expense management. More than 25,000 businesses have saved over $1 billion with Ramp’s savings insights, automation software, and AI-generated pricing intelligence. And unlike Zoho Expense, Ramp offers industry-leading corporate charge cards with built-in spend controls.

While we might seem biased, we have the numbers to back it up—over 2,000 verified reviewers on G2 have earned Ramp a rating of 4.8 out of 5 stars as a top expense management solution.

Key features

- Unified expense management: Get full visibility into all your spending on one intuitive platform, from paying invoices to managing expense reimbursements. And say goodbye to expense reports with automated receipt collection and mobile receipt capture.

- Integrated corporate charge cards: Ramp’s unlimited physical and virtual corporate cards are designed to help you save time and money with built-in controls to set spending limits

- Accounts payable automation: Automate invoice intake and approval with Ramp Bill Pay. Schedule payments via corporate card, check, ACH, or international wire.

- Built-in travel booking: Ramp Travel automatically enforces your T&E policy, pulling together a wide inventory of flights and accommodations for employees to review and book—including exclusive deals through our partnership with Priceline

- Industry-leading finance AI: Identify areas to reduce costs with AI-generated recommendations based on millions of financial transactions

- Seamless accounting integrations: Ramp offers direct integrations with the most popular accounting software, including QuickBooks, NetSuite, Xero, and Sage Intacct

Why customers choose Ramp vs. Zoho Expense

- Better controls: Customers who chose Ramp did so because their corporate card and spend management needs outgrew Zoho Expense

- Cleaner books and accounts: Ramp’s accounting integrations helped customers record and match transactions with speed and accuracy

- Ongoing savings: Ramp will keep finding savings with its always-on AI, notifying you of suspicious transactions, duplicate invoices, lower prices, and out-of-policy spending

Pricing

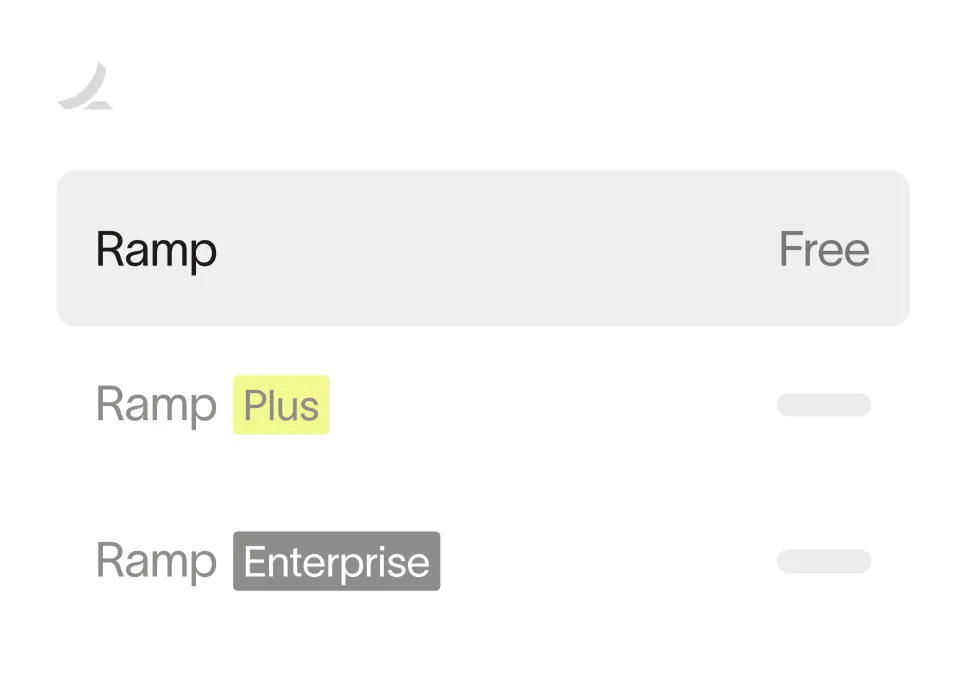

Ramp helps you control spend, automate payments, book corporate travel, and rapidly close your books for free. If you need even more control and customization, you can upgrade to Ramp Plus for $15 per user per month. Ramp also offers enterprise pricing—just reach out for a quote.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Navan (formerly TripActions)

Navan, formerly known as TripActions, is a travel booking and expense management platform that’s popular among mid-market companies. It boasts a 4.7 rating on G2 and beats Zoho Expense straight-up in all but one of G2’s ratings criteria:

Key features

- Customizable spend controls that block out-of-policy spending

- Ability to link any business credit card to Navan’s automated expense management system

- Navan Rewards program encourages employees to book more economical travel itineraries

- Automated expense reconciliation at the point of sale

Navan vs. Zoho Expense

G2 reviewers reported that Navan is easier to use, set up, and administer. They also prefer doing business with Navan overall, especially citing the quality of its customer support.

Pricing

Navan has a free plan for up to 5 monthly users. Once you hit that cap, the subscription cost is $15 per user per month. Navan also offers enterprise pricing on request.

Expensify

Expensify is an expense management platform that offers corporate cards, expense tracking, invoicing, bill pay, and travel booking. Expensify has the same overall G2 score as Zoho Expense with 4.5 out of 5, but it beats or ties Zoho Expense in four of G2’s criteria:

Key features

- SmartScan receipt scanning technology makes for effortless expense submission

- Intuitive and user-friendly mobile app for on-the-go expense reporting

- Automatically assigns categories/accounts based on past entries and credit card statements

- Ability to reimburse employees by directly sending ACH payments or integrating with your payroll system

Expensify vs. Zoho Expense

A reviewer on G2 reported that Expensify’s SmartScan feature is easier and more efficient than similar tech offered by Zoho Expense. Expensify also has better ongoing product support.

Pricing

Expensify’s pricing structure can be a bit confusing. Your subscription cost will vary based on the plan you choose, your number of monthly users, whether you use Expensify’s corporate card, and how much you spend each month on your Expensify card. It’s best to check out their billing support page for the full details.

BILL Spend & Expense (formerly Divvy)

BILL Spend & Expense, formerly Divvy, combines free expense management software with corporate cards to provide real-time spend visibility and control. Though it matches Zoho Expense’s overall score of 4.5 out of 5 on G2, it’s the clear winner in a head-to-head matchup:

Key benefits

- Receipt generation and matching for card transactions

- Real-time expense tracking features

- Integations with top accounting software

- Automatic expense categorization with rules at the card, merchant, budget, and user levels

Why customers choose BILL vs. Zoho Expense

G2 reviewers found BILL Spend & Expense easier to learn and use than Zoho Expense. Reviewers also preferred BILL in part because of its accounts payable product, which makes it easy to process payments, track invoices, and manage approvals—more on that below.

Pricing

BILL Spend & Expense is free, provided you qualify for their corporate card. However, accounts payable features aren’t included. BILL offers AP/AR as a separate product, which costs $49 to $89 per user per month depending on the plan you choose.

Paylocity

Paylocity’s spend and expense management platform (which now includes the former Airbase capabilities) offers procurement, accounts payable automation, and real-time spend visibility all within its larger HR & finance ecosystem. Paylocity maintains an average rating of 4.5 out of 5 based on more than 5,000 reviews. In comparative views, Paylocity typically outperforms Zoho Expense in areas like ease of use, integrations, and support:

Key features

- Guided procurement workflows and vendor onboarding

- Invoice capture, processing, and payments

- Real-time expense tracking, automated coding, reconciliation support

- Receipt upload with OCR and expense reconciliation tools

Why customers choose Paylocity over Zoho Expense

Reviewers often call out Paylocity’s stronger automation, better spend controls, and unified procure-to-pay experience. Many note that it reduces the need for stitching together multiple tools the way Zoho users sometimes must.

Pricing

Paylocity does not publish public pricing for its spend and expense module. Organizations interested in pricing should contact the Paylocity sales team for a tailored quote.

It pays to pick the best Zoho Expense alternative

Most of today’s Zoho Expense competitors offer the same functionality for free. With Ramp, you get all the same features as Zoho Expense and then some.

Ramp’s modern finance platform has it all: expense management, travel booking, integrated corporate cards, AP automation, procurement, and more. That’s what makes Ramp the clear leader in the field, and it’s why we believe it’s the top Zoho Expense alternative.

Try an interactive demo to learn more about how Ramp customers save an average of 5% a year.

FAQs

Zoho Expense is used for tracking and managing business expenses, including employee reimbursements, travel spending, and corporate card transactions. It automates expense reporting, streamlines approvals, and integrates with accounting systems for easier financial oversight.

Zoho Books is a full-featured accounting software designed to manage invoices, payments, and financial reporting, while Zoho Expense focuses specifically on tracking and managing business expenses and reimbursements. They serve complementary but distinct functions within the Zoho ecosystem.

To choose the best Zoho Expense alternative, consider your organization's size, budget, and need for integrated features like travel booking, corporate cards, or accounts payable automation. Look for platforms that offer real-time visibility, strong accounting integrations, and intuitive controls to streamline workflows. Ramp stands out as a top choice with its free all-in-one finance platform, robust automation, and AI-driven savings insights.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits