- What is an ACH hold?

- How does an ACH hold work?

- Why do banks use ACH holds?

- How long does an ACH hold last?

- How ACH holds affect your business

- Unauthorized ACH holds and how to resolve them

- ACH vs. wire: Which is faster?

- See real-time status for all your ACH payments with Ramp

You're checking your business bank account on a busy Monday morning when you spot something unexpected: "ACH hold" next to a recent deposit. Will this delay payroll, vendor payments, or other critical operations that keep your business running smoothly?

An ACH hold is a temporary restriction your bank places on funds from an electronic transfer, preventing you from accessing the money until the transaction fully clears. Banks implement these holds as a protective measure to verify that incoming ACH transfers are legitimate and that sufficient funds exist in the sender's account.

In this guide, we’ll break down how ACH holds work, the key reasons they occur, how long they typically last, and what steps you can take to minimize their effect on your business.

What is an ACH hold?

An ACH hold temporarily pauses access to funds during a transaction, allowing banks to verify details and ensure secure processing. You’ll often see an ACH hold listed in your bank account for pending payments (ACH debit) or direct deposits (ACH credit) that are still in process but likely to execute soon.

ACH holds are a routine occurrence for any transaction that takes place over the ACH network, governed by the regulatory body Nacha. But for businesses, these holds can create ripple effects, from delayed payments to cash flow disruptions. They may even impact vendor relationships or payroll schedules if you don’t manage them effectively.

ACH hold meaning and key terms

ACH stands for Automated Clearing House, a system that facilitates electronic funds transfers between financial institutions. A "hold" in banking refers to a temporary restriction placed on funds in your account, making them unavailable for withdrawal or use even though they may appear in your account balance.

A few other key terms to know are:

- ACH deposit: An electronic transfer of funds between banks using the ACH network, commonly used for direct deposits, bill payments, and other routine transactions

- ACH transfer: An electronic money movement between bank accounts through the ACH network, which can be either a deposit (credit) or withdrawal (debit)

- ACH reversal: The cancellation or return of an electronic transfer, either initiated by the sender to correct an error or automatically processed by the bank due to insufficient funds or other issues

ACH hold vs. wire transfer or check hold

ACH holds typically last 1–3 business days, while check holds can extend 5–7 days, depending on the amount and your banking relationship. Wire transfers generally clear the fastest, often within the same day, because they move through different networks with stricter verification up front.

The speed difference comes down to processing methods. Wire transfers use real-time settlement systems, ACH transfers batch-process overnight, and checks require physical verification steps.

While each payment method has its place, ACH transfers offer the best balance of speed, security, and affordability for most business transactions. That's clearly reflected in its popularity: According to Nacha, the ACH network processed more than 33.5 billion payments totaling more than $86 trillion in 2024.

How does an ACH hold work?

ACH holds follow a predictable process designed to protect both banks and account holders from fraud and insufficient funds.

Your bank or payment processor initiates an ACH hold when they receive an electronic transfer that requires additional verification time. This happens automatically based on factors such as transaction size, your account history, and the sender's banking institution. The hold ensures the sending bank has adequate funds before your bank releases the money to your account.

Knowing how ACH holds work empowers you to plan better and reduces the stress of waiting for important payments to clear.

Typical timeline of an ACH hold

The ACH hold process unfolds in four main stages:

- The sender initiates the transfer through their bank

- The ACH network processes the transaction overnight in batches

- The recipient's bank places a hold on the incoming funds while verifying the transfer details

- The bank releases the funds once verification completes

Standard ACH transfers take 1–3 business days to process. Same-day ACH transfers, which usually carry a higher fee, can clear within hours. Larger transfers or those from new accounts may require additional verification time, potentially extending the hold period to 5–7 business days.

How to track an ACH hold

Your online banking platform provides the most convenient way to monitor ACH hold status. Log in to your account and check the transaction history or pending deposits section. Most banks display hold information alongside the transaction details, including expected release dates.

If online banking doesn't show sufficient detail, contact your bank's customer service directly. Have your account number and transaction reference ready. Bank representatives can provide specific timelines and explain any delays affecting your particular transfer.

Staying proactive about tracking holds helps you plan cash flow and communicate accurate timelines to clients or vendors who depend on those funds.

Do banks charge ACH hold fees?

Banks do not typically charge separate fees for placing holds on ACH transactions. ACH holds are a standard risk management practice that financial institutions use to verify funds and prevent fraudulent activity. The hold itself is a temporary delay in fund availability rather than a billable service.

However, if an ACH transaction is returned due to insufficient funds or other issues during the hold period, your bank may charge a returned item fee or a non-sufficient funds (NSF) fee. These charges are separate from any ACH holds and relate to the failed transaction rather than the hold process.

Why do banks use ACH holds?

ACH holds are part of the ACH network’s operating rules to prevent errors, fraud, and compliance issues. Here are the most common triggers:

- Verification checks: The bank ensures account and ACH routing details are accurate

- Fraud prevention: The bank monitors for unusual payment patterns or large transactions

- Insufficient funds: The sender's account doesn't have enough money to cover the transfer

- New account: The sender's account requires additional verification until it's better established

Business accounts face additional scrutiny due to higher transaction volumes and amounts. Payroll deposits from new clients often trigger holds until your bank establishes a payment pattern with that employer. Vendor payments may experience holds when they exceed your typical deposit amounts or come from suppliers you haven't worked with before.

Seasonal businesses encounter holds more frequently during peak periods when deposit patterns change dramatically. For example, a landscaping company receiving large payments in spring after a quiet winter might see holds on early-season deposits. Similarly, retail businesses may experience holds on holiday season payments that dwarf their usual transaction sizes.

The banking relationship you maintain plays a significant role in hold frequency. Established business accounts with consistent deposit patterns and strong balances typically face fewer holds than newer accounts or those with irregular activity.

How long does an ACH hold last?

ACH holds typically last 1–3 business days. While they sometimes settle on the next business day, it ultimately depends on a few factors:

- Timing of initiation: Transactions initiated before the bank’s cutoff time process more quickly

- Bank schedules: Some financial institutions and payment processors batch-process payments multiple times a day, while others only do so once daily

- Transaction type: Same-day ACH payments may come with additional fees at shortened payment processing times

Timing matters. Double-checking payment details and scheduling transfers during optimal windows can reduce delays and keep operations running smoothly.

How ACH holds affect your business

ACH holds are more than just a minor delay. They can directly affect your business’s cash flow, payment schedules, and operations. The impact isn’t all bad, though—they also help mitigate risk. Here’s how they might affect your day-to-day AP processes:

- Delayed access to funds: Holds can extend typical processing times, temporarily pausing access to transferred amounts

- Cash flow disruptions: Holds can affect vendor payments, payroll, or other operational expenses

- Enhanced security: Holds help reduce risks of insufficient funds, fraud, or unauthorized transactions

That’s why many finance teams rely on industry-recommended AP automation systems to track payment statuses in real time, minimize disruptions from ACH holds, and ensure vendor payments stay on schedule.

What to do if you encounter an ACH hold

Encountering an ACH hold can be frustrating, but since it’s a normal part of the ACH processing workflow, resolving it is often straightforward. Here’s what your business can do to address delays and get payments back on track:

- Track the transaction: Use your bank’s online tools to monitor the status and expected settlement date

- Verify payment details: Double-check routing and account information for accuracy

- Contact your bank: If the hold persists or seems unwarranted, speak with your bank to clarify the reason and resolve the issue

Clear communication and accurate payment details are your best tools for minimizing disruptions.

All payments in one place? Check.

Handle all domestic and global vendor payments on a single platform—by check, card, ACH, or international wire. Our standard tier is free.

Unauthorized ACH holds and how to resolve them

An unauthorized ACH hold occurs when a payment is disputed or incorrectly flagged. These can impact cash flow management and require direct resolution. Common causes include:

- Incorrect transaction details: Mistakes in routing or account numbers trigger holds

- Disputed payments: Customer disputes lead to temporary holds while claims are investigated

- Suspicious activity: Unusual payment patterns prompt additional ACH verification

Banks may also place an ACH hold if they detect suspicious ACH return code patterns from your account—such as multiple R01 (insufficient funds) or R02 (account closed) returns. Frequent return codes can trigger additional scrutiny on future transactions, as they may indicate account instability or potential fraud risk.

How to resolve or cancel an unauthorized ACH hold

If you encounter an unauthorized ACH hold, here’s how to address it:

- Contact your bank: Customer service can explain the reason for the hold and outline the steps to resolve it

- Request a cancellation: If the electronic funds transfer (EFT) hasn’t yet been processed, you may be able to cancel the ACH payment

- Initiate a reversal: If the transaction is completed and an error is discovered, work with your financial institution to initiate a reversal (if possible)

The amount of time it takes to resolve an unauthorized ACH hold will depend on the reason it occurred and the financial institution. Your bank should be able to tell you how long it will take to cancel or reverse the transaction.

ACH vs. wire: Which is faster?

Speed is the most obvious difference between ACH and wire transfers. Wire transfers are processed in real time and typically complete within hours, while ACH transfers take 1–3 business days to process through the ACH network.

Here's how the two payment options differ:

- Speed: Wire transfers offer immediate processing, making them ideal for time-sensitive transactions. ACH transfers work in batches and require patience, though same-day and instant ACH options are increasingly available for urgent needs.

- Cost: ACH transfers are significantly more affordable, often costing under $1 or at no charge. Wire transfers carry higher fees, typically ranging from $15–$50 for domestic transfers and even more for international transactions.

- Typical use cases: ACH transfers work well for routine payments such as payroll, vendor payments, and recurring bills where timing flexibility exists. Wire transfers suit urgent situations such as real estate closings, large purchases, or emergency fund transfers where immediate availability matters most.

- Business decision factors: Companies often choose ACH for regular operational expenses due to lower costs and batch processing efficiency. Wire transfers become the preferred option when deals require immediate settlement or when working with international partners who need guaranteed same-day funds.

The volume of transactions also influences the choice. High-frequency, lower-value payments favor ACH, while occasional, high-value transfers may justify wire transfer costs. Overall, ACH wins on cost and convenience for routine transactions, while wire transfers excel when immediate fund availability outweighs the higher expense.

Some businesses also use credit cards for certain payments to take advantage of cash back, float time, or reward programs. However, vendors don’t always accept credit card payments, and they typically carry higher processing fees.

Same-day ACH is sometimes offered depending on your bank or ACH bill processor. Though, the cost may be similar to wire transfer costs.

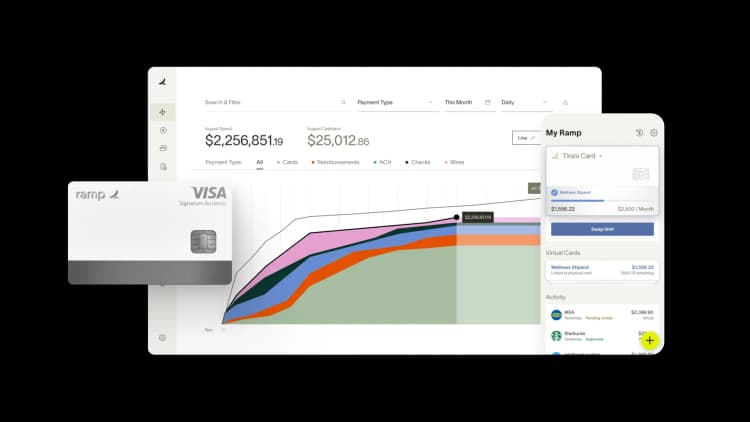

See real-time status for all your ACH payments with Ramp

Effectively managing payments is the foundation of any successful AP process. Whether you’re making vendor payments via ACH, writing out paper checks, or using any other payment method, knowing the status of all your outgoing payments is crucial.

Ramp’ Bill Pay is AP automation software that gives you real-time visibility into all your outstanding invoices and where they are in the payment cycle, helping you manage cash flow strategically. Make payments via ACH, check, credit card, or wire transfer while enjoying zero processing fees on domestic bill payments.

Learn more about how Ramp Bill Pay helps you handle a month’s worth of payments in minutes.

This post includes general information about ACH payments. For help with ACH functionality specific to Ramp, visit Ramp Support for more details.

FAQs

You can learn more about Ramp Bill Pay and how it helps automate accounts payable at our official page: https://ramp.com/accounts-payable

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits