What is financial reporting? Definition and importance

- What is financial reporting?

- Why is financial reporting important?

- Types of financial reports

- What is included in financial reports?

- Who uses financial reports?

- Financial reporting requirements: GAAP, SEC, and IFRS rules

- Financial reporting examples

- Best practices for financial reporting

- How Ramp simplifies financial reporting

Financial reporting is the process of preparing financial statements that show your company’s financial performance and position over a specific period. It gives you and your stakeholders a clear view of revenue, expenses, cash flow, and overall financial health.

Strong financial reporting helps you make better decisions, maintain compliance, and build trust with investors, lenders, and regulators. When your numbers are accurate and timely, you can plan confidently and respond quickly to change.

What is financial reporting?

Financial reporting is the structured process of recording, analyzing, and disclosing your company’s financial data to stakeholders. It involves preparing standardized statements that summarize income, expenses, assets, liabilities, and cash flow over a defined period, typically monthly, quarterly, or annually.

These reports follow established accounting standards such as GAAP or IFRS to ensure consistency, comparability, and credibility. When your reporting is accurate and timely, stakeholders can evaluate performance and make informed decisions.

At a high level, financial reporting covers four core areas:

- Income and revenue: What you earned during the reporting period

- Expenses: What you spent to operate the business

- Assets and liabilities: What you own versus what you owe

- Cash flow: How money moves in and out of the business

Reliable reporting supports transparency across your financial operations and creates a clear record of how your business is performing.

Why is financial reporting important?

Financial reporting gives you the information you need to run your business responsibly and plan for growth. It supports daily decisions, long-term strategy, compliance, and stakeholder trust.

Supports strategic decision-making

Accurate reports show you where your business stands and where it’s headed. Revenue trends, margin shifts, and cash flow patterns help you decide where to invest, hire, or cut costs.

For example, if quarterly reports reveal rising input costs in one division, you can renegotiate contracts or adjust pricing before margins erode. Regular reporting helps you catch issues early and act with confidence.

Tracks income and expenses

Consistent reporting keeps you close to your numbers. When you know what’s coming in and going out, you can manage working capital, monitor burn rate, and avoid unexpected cash shortages.

This is financial reporting at its core: giving you a current, reliable view of performance so small issues don’t turn into larger financial problems.

Ensures regulatory compliance

If you’re a public company, you must follow generally accepted accounting principles (GAAP) and meet SEC filing requirements. These standards create consistency across companies and protect investors.

Even private companies benefit from structured reporting. Strong documentation reduces legal risk, supports lender requirements, and positions you for future fundraising or acquisition.

Communicates financial health to stakeholders

Clear reporting builds trust with investors, lenders, and partners. When stakeholders can easily understand your financial position, they’re more confident in your leadership and long-term stability.

Reliable reporting also strengthens relationships with employees and vendors who want assurance that your business is financially sound.

Prepares your business for audits

Disciplined reporting creates a clean audit trail. When auditors or banks request documentation, you’ll have organized records ready instead of reconstructing transactions under pressure.

Strong reporting processes also help you identify discrepancies early, reducing the risk of audit findings or compliance issues.

Types of financial reports

Four core financial statements form the foundation of financial reporting. Each one shows a different aspect of your company’s financial position and performance.

Balance sheet

The balance sheet shows what you own and owe at a specific point in time. It includes three main sections:

- Assets: Cash, inventory, equipment, investments, and accounts receivable, grouped as current or long-term

- Liabilities: Debts such as loans, accounts payable, wages owed, and taxes due, also divided into current and long-term

- Shareholders’ equity: The owners’ residual interest after liabilities are subtracted from assets

The balance sheet follows this formula:

Assets = Liabilities + Shareholders’ equity

You can use it to assess liquidity, leverage, and overall financial stability.

Income statement

Also called the profit and loss (P&L) statement, the income statement shows performance over a defined period, such as a month, quarter, or year.

It follows a straightforward formula:

Net income = Revenues – Expenses

The income statement starts with revenue and subtracts the cost of goods sold (COGS) and operating expenses such as payroll, rent, and marketing. After accounting for taxes and interest, the result is net income.

A multi-step format is most common because it separates operating and non-operating items, giving stakeholders a clearer view of profitability.

Cash flow statement

The cash flow statement shows how cash moves in and out of your business. Profit does not always equal cash, especially under accrual accounting, which makes this report essential.

It breaks activity into three categories:

- Operating activities: Cash generated from core business operations

- Investing activities: Cash used to buy or sell long-term assets

- Financing activities: Cash raised from or returned to investors and lenders

Together, these sections explain changes in your cash balance during the reporting period.

Statement of shareholders' equity

The statement of shareholders’ equity tracks changes in ownership value over time. It starts with beginning equity, adds net income or capital contributions, and subtracts losses or dividends to calculate ending equity.

This statement connects the income statement and balance sheet and helps investors understand how retained earnings and ownership interests change.

Comparing the 4 types of financial reports

| Report | What it shows | Time frame |

|---|---|---|

| Balance sheet | Assets, liabilities, and equity | Point in time |

| Income statement | Revenue, expenses, and net income | Period (month, quarter, year) |

| Cash flow statement | Cash inflows and outflows | Period |

| Statement of shareholders’ equity | Changes in ownership value | Period |

Other common financial reports

In addition to the four primary statements, you may rely on operational reports to manage day-to-day performance:

- Accounts receivable aging: Tracks overdue invoices and collection timelines

- Budget vs. actual reports: Compare actual results against forecasts

- Inventory reports: Monitor stock levels, valuation, and turnover

- Payroll expense reports: Break down payroll expenses by department or employee

- Sales reports: Analyze revenue by product, region, or customer

These reports support internal decision-making and complement formal financial statements.

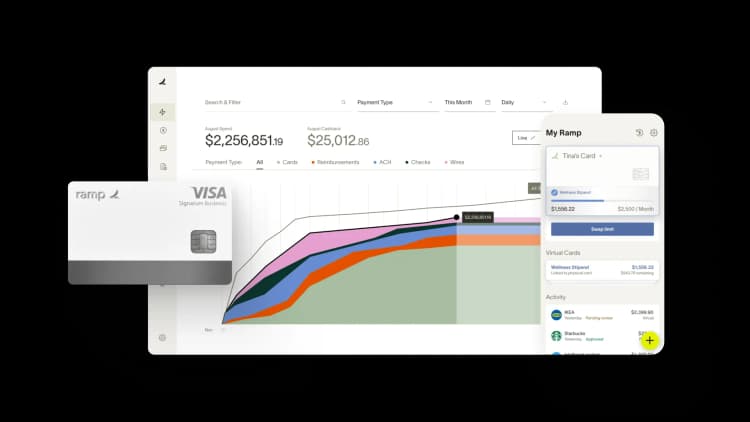

Discover Ramp's corporate card for modern finance

What is included in financial reports?

Financial reports typically include core financial statements plus supporting disclosures and context. The exact contents depend on whether the report is for internal management or external stakeholders.

Most financial reports include:

- Financial data: Revenue, expenses, assets, liabilities, and equity figures that form the foundation of the report

- Notes and disclosures: Explanations of accounting policies, significant transactions, assumptions, and risks that affect the numbers

- Comparative figures: Prior-period results shown alongside current data so you can track trends and measure performance

- Management discussion and analysis (MD&A): Leadership’s explanation of results, risks, and forward-looking considerations, typically included in external filings

Internal reports are often more detailed and operational, such as departmental P&Ls or weekly cash flow summaries. External reports follow standardized formats and disclosure rules so investors, lenders, and regulators can evaluate performance consistently.

Regardless of the audience, the goal is the same: provide accurate, relevant information that supports sound decision-making.

Who uses financial reports?

Financial reports are used by both internal leaders and external stakeholders to evaluate performance, risk, and financial stability. Each group relies on the same core data but for different purposes.

Internal users

Management, finance teams, and department leaders use financial reports to guide budgeting, forecasting, and operational decisions. A CFO might review cash flow before approving new hires, while a sales leader analyzes revenue reports to adjust quarterly targets.

Internal reports are typically more detailed and produced more frequently than external filings. They’re designed to answer specific operational questions and support real-time decision-making.

External users

Investors, lenders, regulators, tax authorities, and auditors use financial reports to assess performance and compliance. An investor reviews your income statement to evaluate profitability. A lender analyzes your balance sheet before extending credit.

External reports must follow standardized formats so stakeholders can compare your results to industry benchmarks and peer companies.

Financial reporting requirements: GAAP, SEC, and IFRS rules

Financial reporting requirements depend on whether your company is public or private and where you operate. The more external stakeholders you have, the stricter your reporting obligations become.

Public companies must file quarterly reports (Form 10-Q) and annual reports (Form 10-K) with the SEC. These filings must follow GAAP and include all four core financial statements plus detailed footnotes and disclosures.

Outside the US, most companies follow International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

- Public companies: Must file quarterly (10-Q) and annual (10-K) reports with the SEC in accordance with GAAP

- Private companies: Must meet tax filing requirements and comply with lender or investor agreements

- All companies: Benefit from following GAAP or IFRS to maintain consistency, credibility, and comparability

Certain industries, including government contractors and financial services firms, must also comply with additional regulations such as the Sarbanes-Oxley (SOX) Act and Dodd-Frank requirements.

The value of consistency and transparency

Accounting standards exist to build trust. When you apply consistent accounting policies year after year, stakeholders can compare results, identify trends, and evaluate performance more confidently.

Transparency also means clearly disclosing assumptions, risks, and accounting methods. Clear disclosures make your financial results easier to interpret and reduce the risk of misunderstandings.

Risks of non-compliance

Failing to meet reporting requirements can result in fines, enforcement actions, and reputational damage. Loss of investor confidence can affect valuation and make it harder to raise capital.

A 2024 KPMG study found that 8% of non-IPO companies disclosed material weaknesses in their SEC filings. Weak internal controls remain a common reporting risk, even for growing companies.

Financial reporting examples

Financial reporting appears in different formats depending on the audience and purpose. Public filings, internal dashboards, and board materials all rely on the same underlying financial data but present it differently.

Common examples include:

- 10-K annual report: A comprehensive yearly SEC filing that includes audited financial statements, management discussion and analysis (MD&A), and detailed disclosures about operations, risks, and accounting policies

- 10-Q quarterly report: A quarterly SEC filing that updates investors on financial performance and material changes since the last annual report

- Internal management reports: Budget-versus-actual comparisons, departmental P&Ls, cash flow forecasts, and KPI dashboards used to guide operational decisions

- Board presentations: Condensed financial summaries prepared for governance and strategic planning discussions

For example, a growing SaaS company might prepare a detailed monthly internal report comparing actual revenue to forecast and tracking burn rate. That same data may be summarized for a board deck or formatted into a 10-Q if the company is publicly traded.

The format changes, but the goal stays the same: provide clear, reliable financial information tailored to the audience reviewing it.

Best practices for financial reporting

Strong financial reporting depends on consistent processes, reliable data, and the right systems. Most reporting issues—errors, delays, compliance gaps—stem from manual workflows and unclear ownership.

Automate data collection and reconciliation

Manual data entry increases the risk of errors and slows your close process. Pulling transactions directly from banks, expense platforms, and payment systems improves accuracy and reduces reconciliation time.

Automation allows your team to focus less on correcting mistakes and more on analyzing performance and identifying opportunities.

Establish consistent reporting processes

Create a reporting calendar with clear deadlines for data collection, review, and distribution. Assign ownership for each step and build in time for review before finalizing reports.

Standardized close checklists help prevent oversights. When your process is consistent every cycle, reporting becomes faster and more predictable.

Use financial reporting software

Dedicated reporting tools reduce spreadsheet sprawl and eliminate version control issues. Cloud-based platforms provide real-time visibility, automate calculations, and centralize documentation.

Make sure your team understands applicable standards such as GAAP or IFRS so the data they produce remains accurate and compliant.

Integrate your accounting and expense systems

Connecting expense management, bill pay, and accounting systems reduces duplicate entry and keeps data aligned. When transactions sync automatically, you minimize mismatches and accelerate closing the books. Fewer manual handoffs mean cleaner data and more reliable financial statements.

How Ramp simplifies financial reporting

Expense data plays a critical role in financial reporting, but collecting and categorizing it manually slows your team down. Ramp automates expense tracking, reconciliation, and reporting so your financial statements reflect accurate, real-time data.

Ramp combines a corporate card with an integrated expense management platform. Transactions sync automatically, receipts are captured and matched using AI, and expenses are categorized according to your GL structure and policies.

Instead of chasing down receipts or correcting miscoded entries, you can review clean, structured data that’s ready for reporting. Built-in controls flag duplicate subscriptions, unusual charges, and out-of-policy spend before they create reporting issues.

You can analyze spend by category, department, or vendor and export custom reports in seconds. By consolidating non-payroll expenses into one system, Ramp reduces manual work, shortens your close cycle, and improves the reliability of your financial reporting.

If you want stronger reporting without adding headcount, Ramp gives your finance team the automation and visibility needed to close faster and plan with confidence.

FAQs

The four primary financial reports are the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity. Together, they show your company’s financial position, profitability, cash movement, and changes in ownership value.

Financial statements are the individual documents, such as the balance sheet or income statement. Financial reporting is the broader process of preparing, analyzing, and sharing those statements with stakeholders.

Most companies prepare financial reports monthly for internal management and quarterly or annually for external stakeholders. Public companies must file quarterly (10-Q) and annual (10-K) reports with the SEC.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°