Spending made smarter

Easy-to-use cards, spend limits, approval flows, vendor payments, and more — plus an average savings of 5%1

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Trusted by innovators and industry leaders

.svg)

The card is just the start

Everything you need to control spend and optimize finance operations, all on a single platform.

Save an average of 5%1 with Ramp

Designed to help you spend less time and money across your entire business.

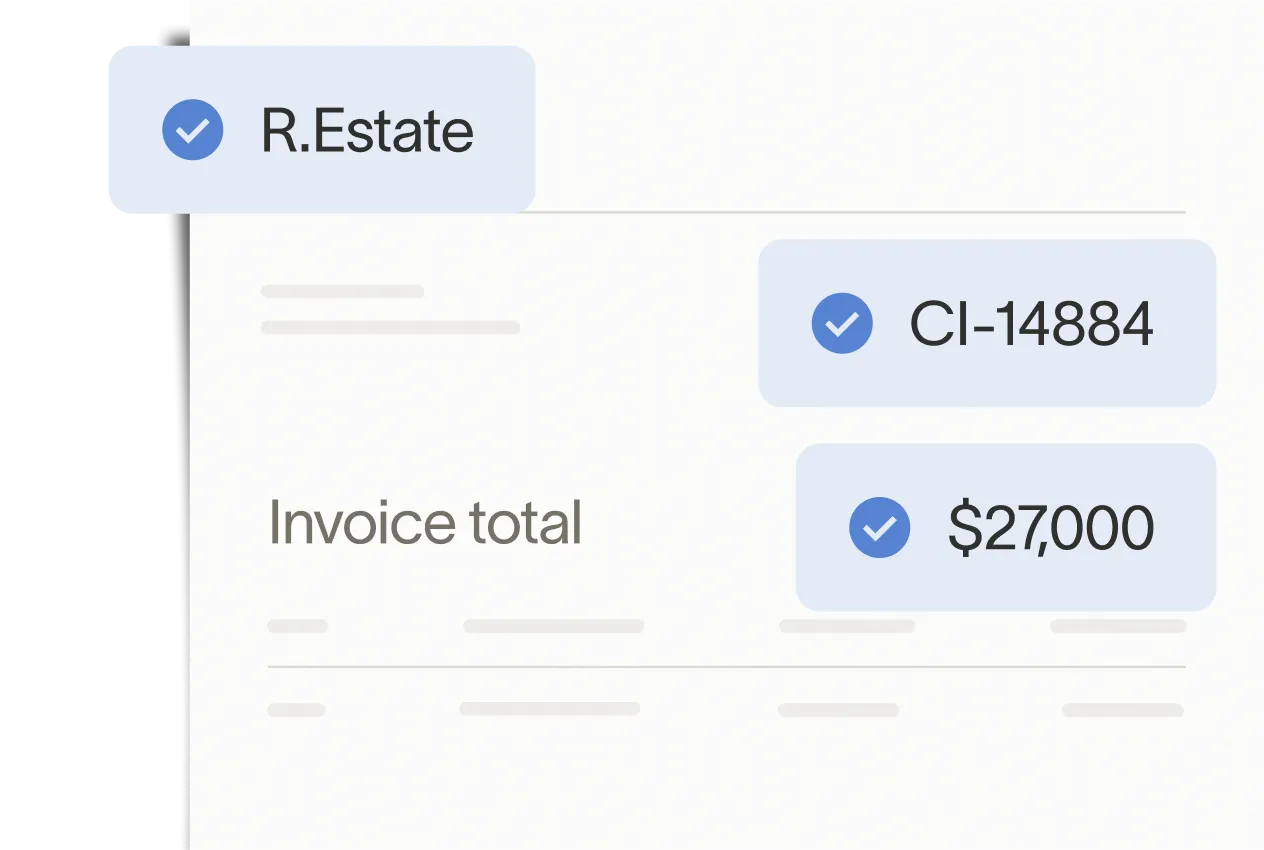

Set guardrails to prevent overspending

Stay in policy and on budget with proactive policy controls, configurable approvals, and AI-powered reconciliation.

Spend smarter, save every time

Use instant insights to get the best price on software, stop redundant spend before it happens, and make every dollar go further.

Set your team free

Keep everyone focused on the big picture, and let Ramp automate the rest: expenses, accounting, compliance, and more.

Built to scale with you

Whether you’re building your business, expanding internationally, or cutting costs—Ramp works for you.

Integrate and stay synced

Seamlessly integrate Ramp with your accounting systems and consolidate your finance stack.

.png)

Operate globally

Send payments to 195 countries in over 40 currencies and reimburse employees in their local currencies within 2 days.

Completely flexible

Customize Ramp to fit your business and give you the controls you need with policies, roles, and approval workflows.

.png)

An extension of your team

Get dedicated support anytime, anywhere. We’re always ready to help.

Modern finance teams run on Ramp

Visionary startups and industry leaders use Ramp to build healthier businesses.

In the news

Time is money. Save both.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)