- What is 4-way matching?

- How the 4-way matching process works

- Example of 4-way matching

- 2-way vs. 3-way vs. 4-way matching

- Benefits and drawbacks of 4-way matching

- How automation simplifies 4-way matching

- Why Ramp Bill Pay is the best AP software for your team

- Choose Ramp Bill Pay to save your team time and money

When you're managing accounts payable, 4-way matching adds an extra layer of verification to help you prevent overpayments, catch invoice discrepancies, and ensure you actually received and approved what you're paying for. You might not need this level of control for every purchase, but it's essential when you're dealing with high-value, high-risk procurement.

What is 4-way matching?

4-way matching helps you verify four key documents in accounts payable before approving a payment. These documents include:

- The purchase order

- The goods received note (GRN)

- The inspection report

- The supplier invoice

Each document serves as a checkpoint to confirm you're paying for goods you actually ordered, received, and inspected. When you compare these four documents, you catch payment errors, prevent fraud, and maintain control over spending.

It also helps you build stronger supplier relationships by ensuring you pay the right amount on time.

How the 4-way matching process works

In 4-way matching, you'll use each document to validate a specific part of the transaction. They ensure the invoice reflects not just what was ordered and delivered—but also what passed inspection.

1. Purchase order (PO)

Your purchase order starts the transaction. It specifies what you agreed to purchase, including product details, quantity, unit cost, and delivery terms. This becomes the baseline you'll check the rest of the documents against.

2. Invoice

The vendor's invoice requests payment for the items or services provided. It should mirror the PO in quantity and pricing. If there's a mismatch—like billing for more units or a different price—you'll flag it for review.

3. Receiving report

When the shipment arrives, your receiving team logs what was actually delivered. The goods received note helps you verify that the correct items and quantities arrived as expected. Any discrepancies here may indicate a short shipment or delivery issue.

4. Inspection report

In the final step, you'll verify whether the delivered items meet quality or compliance standards. The inspection report—typically prepared by your quality control team—confirms that what you received is in acceptable condition and meets the specifications outlined in the PO or contract.

You'll only clear the invoice for approval and payment when all four documents align.

Who performs each step?

To make 4-way matching work, you need clear ownership of each verification step. Different departments play crucial roles in this process, ensuring proper segregation of duties and maintaining financial controls throughout the procurement cycle.

Document | Owner |

|---|---|

Purchase order | Procurement/purchasing department |

Invoice | |

Receiving report | Warehouse/receiving department |

Inspection report | Quality control/quality assurance team |

When you assign clear ownership to each document, you create accountability and ensure thorough verification at every stage. This approach strengthens your internal controls and speeds up the payment approval process.

Example of 4-way matching

Say your construction company places an order for 200 steel beams at $300 each, totaling $60,000. Here's how you'd apply 4-way matching before approving the invoice:

- Your procurement team issues a purchase order with the agreed quantity, price, and delivery terms

- When the beams arrive on-site, your receiving team confirms that all 200 were delivered as expected and logs a receiving report

- Your quality team conducts an inspection to verify that the beams meet size, grade, and structural specifications and documents the results in an inspection report

- The supplier sends an invoice for $60,000, which matches the PO, the delivery record, and the inspection results

Since all four documents align, you can approve the invoice and process payment.

2-way vs. 3-way vs. 4-way matching

You'll need to choose the right matching method based on your business needs, transaction size, and risk level. Here's how 2-way, 3-way, and 4-way matching compare:

Matching type | What it compares | Use case |

|---|---|---|

Invoice vs. Purchase Order | Suitable for routine, low-risk purchases where goods don’t need confirmation of receipt | |

Invoice vs. Purchase Order vs. Receiving Report | Ideal for most goods-based purchases where verifying delivery is important | |

4-way match | Invoice vs. Purchase Order vs. Receiving Report vs. Inspection Report | Used in high-value or regulated environments where quality inspection is required |

If you use 2-way or 3-way matching for basic purchases, 4-way matching adds a quality safeguard. It's the most robust option but requires more resources, so you'll want to reserve it for purchases that justify the extra scrutiny.

When to use 4-way matching

You'll find 4-way matching most useful when you need to verify both delivery and quality before payment. This typically applies to manufacturing, construction, healthcare, and aerospace companies.

Manufacturing

Manufacturing environments often involve complex assembly processes. Component quality directly impacts final product performance. Raw materials or precision parts must pass technical inspection before you use them in production, as a single flawed component could compromise product integrity.

Implementing 4-way matching helps you maintain strict quality control throughout your supply chain, reducing costly production delays and potential warranty claims.

Construction

Your construction projects typically involve significant capital investment and safety considerations that demand thorough verification. Machinery, structural materials, or prefabricated parts must meet specific tolerances or contractual specs before you accept them.

By incorporating inspection reports into your payment process, you can document compliance with building codes and project specifications while protecting yourself from liability associated with substandard materials. You can also manage this easily with an integrated construction business credit card.

Healthcare and pharmaceuticals

Patient safety depends on the integrity of medical products, making thorough inspection absolutely essential. Regulatory compliance and safety standards require that medical devices, drugs, or clinical supplies meet strict quality criteria.

You can use 4-way matching to create audit trails that demonstrate regulatory compliance while ensuring that all products entering your facilities meet the exacting standards required for patient care.

Aerospace and defense

In highly regulated supply chains, performance and traceability standards are non-negotiable. These industries operate with zero tolerance for component failure, as lives often depend on product reliability.

The 4-way matching process helps you document comprehensive testing and verification procedures, satisfying both government oversight requirements and internal quality management systems.

Benefits and drawbacks of 4-way matching

4-way matching offers stronger payment controls but requires more time and resources than simpler matching methods. You'll need to weigh these tradeoffs when deciding whether it's right for your AP process.

Benefits of 4-way matching

- Improves payment accuracy: Ensures you only pay vendors when goods meet agreed-upon standards

- Reduces fraud and error: Adds an additional layer of review to catch invoice discrepancies, delivery mismatches, or unauthorized changes

- Supports compliance: Helps you meet industry or internal requirements for quality, safety, or financial control

- Strengthens vendor accountability: Holds vendors accountable—they're less likely to submit incomplete or inaccurate deliveries when they know you'll inspect everything

Drawbacks of 4-way matching

- More time-consuming: Reviewing four documents instead of two or three adds extra steps to your AP process, especially if you're doing it manually

- Resource-intensive: Requires coordination between your purchasing, receiving, quality control, and AP teams—each needs to complete their part before payment can proceed

- Not necessary for all purchases: Adds unnecessary overhead for routine, low-risk transactions like office supplies or recurring services where 2-way or 3-way matching works fine

Reserve 4-way matching for high-value or critical purchases where quality verification justifies the extra time and resources in your approval workflow.

How automation simplifies 4-way matching

Manual 4-way matching creates bottlenecks when you need to cross-check data across different systems or chase down missing documentation from other departments. The process is slow, error-prone, and easy to bypass without proper controls.

AP automation platforms transform 4-way matching into a practical, scalable process:

- Extract and standardize data automatically: OCR and AI-powered data capture pull key fields from your invoices, POs, delivery receipts, and inspection reports, eliminating manual data entry

- Match documents instantly: The system compares quantities, pricing, and quality fields across all four documents and flags any mismatches in real time

- Automate exception routing: The platform sends flagged invoices to the appropriate reviewers based on rules you define, so you don't have to chase approvals manually

- Track status from intake to resolution: Every step is logged and visible, making audits easier and helping you close the books faster

- Reduce human error and oversight gaps: Automation enforces your matching policy consistently, ensuring no steps are skipped—even when volumes increase

With the right technology, you can implement 4-way matching without slowing down your AP process. You'll catch discrepancies before payment while keeping invoices moving through approval.

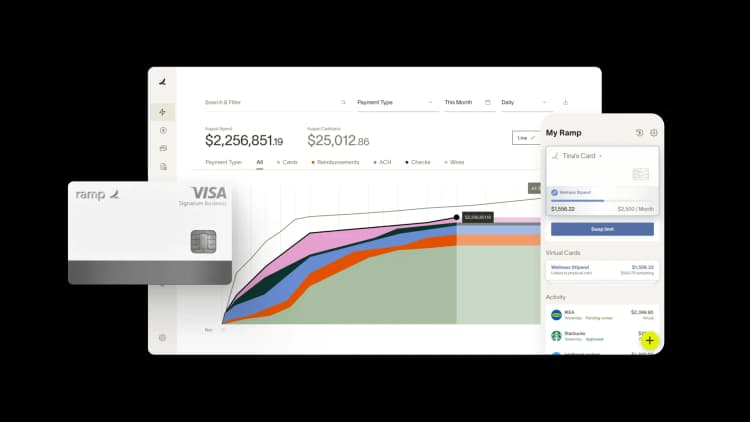

Why Ramp Bill Pay is the best AP software for your team

Ramp Bill Pay is an autonomous accounts payable platform where four AI agents make your AP process touchless. They manage invoice coding, spot payment fraud, build approval summaries, and process vendor payments through cards—no manual work needed. OCR achieves 99% accuracy on line-item data, while invoice processing runs 2.4x faster than older AP systems1.

Use Ramp Bill Pay as your standalone AP system, or connect it with Ramp’s corporate cards, expense reimbursements, and procurement workflows for unified financial oversight. Even up to 95% of companies report stronger payables visibility after moving to Ramp2.

Top Ramp Bill Pay features

- Intelligent invoice capture: Optical character recognition technology reads and digitizes invoice content with 99% accuracy

- Automated PO matching: The system reconciles invoices with purchase orders using two-way and three-way matching to identify discrepancies before funds are released

- Four AI agents: Reviews transaction history to code invoices, scans invoices for anomalies before authorization, compiles approval documentation with historical vendor data, and initiates card payments for you

- Custom approval workflows: Configure authorization chains that route invoices according to department hierarchy, spending thresholds, and vendor relationships

- Approval orchestration: Streamlines review processes by removing redundant steps and providing contextual information to decision-makers

- Real-time invoice tracking: View the current status of every invoice from initial receipt to final disbursement

- Roles and permissions: Establish access controls that maintain proper segregation of financial responsibilities across your organization

- Recurring bills: Schedule automatic payment execution for subscription services and regular vendor invoices

- Batch payments: Execute multiple vendor disbursements simultaneously rather than processing them individually

- Real-time ERP sync: Maintain bidirectional synchronization of vendor information with leading accounting platforms including NetSuite, QuickBooks, Xero, Sage Intacct, and others—ensuring your books stay audit-ready

- Vendor onboarding: Request and store tax documentation, validate taxpayer identification numbers, and organize 1099 information within the system

- Bulk W-9 collection: Request all W-9s and e-consent at once instead of chasing vendors with one-off emails

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- One-click IRS filing: File directly with the IRS and eligible states in minutes—no extra portals or logins

Choose Ramp Bill Pay to save your team time and money

Ramp Bill Pay redefines what modern AP should look like: accurate, autonomous, touchless, and fast. Over 2,100 verified G2 reviews give Ramp a 4.8-star rating, and users consistently rank it as one of the easiest AP platforms to use. Finance leaders turn to Ramp to cut out busywork, prevent costly mistakes, and finish month-end close faster.

You don't have to use Ramp's other products to get value from Bill Pay—it's a complete AP solution on its own. But if you're looking to manage bill payments, card spending, employee expenses, and procurement all in one system, Ramp also makes that possible.

Get Ramp's free plan for essential AP automation, and Ramp Plus for advanced capabilities at $15 per user per month.

AP should be simple. With Ramp Bill Pay, it is. Try Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits