How to structure your accounts payable department: Roles, responsibilities, and best practices

- What is an accounts payable department?

- Importance of the accounts payable department

- 8 key accounts payable functions

- AP challenges, best practices, and tips

- AP automation software and ROI

- Why Ramp Bill Pay is the best way to simplify AP processes

- Why Ramp Bill Pay delivers results

An efficient accounts payable (AP) department does more than process invoices; it keeps business operations running smoothly. From managing outgoing payments to maintaining supplier relationships, AP plays a direct role in cash flow stability and financial health.

But without proper structuring and processes, inefficiencies can lead to delayed payments, strained vendor relationships, and unnecessary costs. Let’s take a deeper look at an AP department's key functions, best practices for optimizing workflows, and how automation improves AP processes.

What is an accounts payable department?

The accounts payable department is responsible for managing a company’s outgoing payments to suppliers, vendors, and service providers. It plays a crucial role in managing a company's cash flow, vendor relationships, and overall financial health.

AP makes sure invoices process accurately and payments go through on time, keeping financial records accurate and up to date. A well-run AP team prevents late fees, secures favorable payment terms, and helps maintain financial stability.

Delayed payments could lead to stock shortages, fulfillment delays, lost sales, and damaged supplier partnerships, proving that AP isn’t just a back-office function, but a critical part of business continuity.

Accounts payable vs. other finance functions

Accounts payable manages the money your company owes to others, while other finance functions handle different aspects of cash flow and financial operations:

- Accounts payable: Processes and pays bills from suppliers, vendors, and service providers. This includes invoice processing, payment scheduling, and managing outstanding debts.

- Accounts receivable (AR): Tracks money owed to your company by customers and clients—in other words, the opposite of AP. AR handles invoicing customers, collecting payments, and managing overdue accounts.

- Payroll: Manages employee compensation, taxes, and benefits

- Treasury: Handles cash management, investments, and banking relationships

- Financial planning and analysis (FP&A): Creates budgets, forecasts, and financial reports

- Tax: Manages tax compliance and planning

The main distinction is that AP focuses specifically on outgoing payments to external parties, while other functions handle incoming money (AR), internal payments (payroll), or strategic financial management (FP&A, treasury).

Key roles in the accounts payable department

While AP structures vary by company size and industry, most teams include the following roles:

- AP clerk: Handles invoice entry, payment processing, and vendor communication

- AP specialist: Manages reconciliations, monitors outstanding payables, and maintains compliance with company policies

- AP manager: Oversees workflows, implements process improvements, and makes timely payments while managing vendor relationships

- Finance controller: Reviews operations for accuracy, AP fraud prevention, and compliance with financial reporting standards

The AP team works together to process payments accurately, build strong vendor relationships, and implement proper financial controls that support the company's cash flow and operational objectives.

Importance of the accounts payable department

The accounts payable department is much more than just a cost center. It's an essential part of your business for several strategic and operational reasons:

- Cash flow management: AP directly impacts when and how much cash leaves your business. Poor AP management can create cash flow crunches or missed early payment discounts, while strategic payment timing can optimize working capital.

- Vendor relationships: AP processes affect supplier relationships. Late payments can damage partnerships, limit credit terms, or result in supply disruptions.

- Financial controls and fraud prevention: AP is a high-risk area for fraud, duplicate payments, and unauthorized expenses. Understanding AP controls helps prevent financial losses and ensures proper authorization of expenditures.

- Compliance and audit: Transactions must comply with tax regulations, contract terms, and internal accounts payable policies. Proper AP understanding makes for accurate recordkeeping and smooth audits.

- Cost management: AP data reveals spending patterns, vendor performance, and opportunities for cost savings through early payment discounts, vendor consolidation, or contract renegotiation

- Working capital optimization: AP, along with inventory and AR, is one-third of the working capital equation. Strategically managing payment timing can free up cash for operations or investments.

- Business intelligence: AP data provides insights into operational efficiency, budget variance, and supplier dependency that inform strategic decisions

8 key accounts payable functions

Accounts payable teams don’t just cut checks—they serve as the financial gatekeepers who maintain vendor relationships, protect against fraud, and keep accurate records that support company-wide decision-making.

The core functions that make AP departments indispensable to your business operations include:

1. Invoice receipt and validation

The AP process begins when invoices arrive through email, mail, or electronic data interchange (EDI). The AP team verifies that each invoice contains complete information: vendor details, invoice number, date, amount, and proper authorization. This validation step catches errors before they enter your financial system.

Common errors to watch for include:

- Duplicate invoice numbers

- Missing purchase order (PO) references

- Incorrect pricing, quantities, or tax calculations

- Invoices from unregistered vendors or lacking proper approval signatures

Proper invoice validation prevents payment delays and maintains clean financial records that will make any potential audits go much more smoothly.

2. Purchase order matching (3-way matching)

Three-way matching compares three documents to verify payment accuracy: the purchase order (what was ordered), the goods received note (what was delivered), and the vendor invoice (what's being billed). This process helps catch discrepancies before payment occurs, saving you money.

The matching process follows these basic steps:

- Compare invoice line items against the original PO

- Verify quantities and pricing match the goods received note

- Flag any variances for investigation and resolution

This control prevents fraudulent invoices and overpayments and builds confidence in your payment accuracy. By using 3-way matching, you can see significant reductions in payment errors and unauthorized purchases.

3. Payment scheduling and approval

Payment scheduling balances cash flow management with maintaining vendor relationships. AP teams create payment runs based on due dates, early payment discounts, and available cash. Approval workflows vary by company size but typically require multiple sign-offs for larger amounts.

Timely payments strengthen vendor partnerships and often unlock better pricing terms. Late payments damage your relationships and can result in supply chain disruptions or loss of preferred customer status, costing you more money in the long run.

4. Vendor management

Your AP team should create and maintain a vendor master file, which includes contact information, payment terms, tax identification numbers, and banking details. They'll also handle vendor onboarding by collecting required documentation and setting up payment preferences.

Daily communication involves addressing payment inquiries, updating vendor information, and resolving disputes. Strong vendor management creates partnerships that benefit both you and your suppliers through improved service levels and favorable terms, helping you save money.

5. Expense coding and general ledger posting

The AP team makes sure each expense gets coded to the correct general ledger (GL) account so financial statements accurately reflect the company's spending. They assign costs to the right departments, projects, or cost categories based on your company's chart of accounts and approval documentation.

Getting the coding right directly impacts the quality of your financial reporting. When you misclassify expenses, it can throw off budget analysis, skew departmental performance metrics, and create problems with tax reporting. Your accounts payable department should conduct regular coding accuracy reviews to maintain data integrity across all your financial reports.

6. Compliance and internal controls

AP departments implement controls that both prevent fraud and meet regulatory requirements. These controls protect your company's assets while creating audit trails that external auditors need.

Common internal controls include:

- Segregation of duties between invoice approval and payment processing

- Vendor master file access restrictions and regular reviews

- Mandatory supporting documentation for all payments above set thresholds

Well-designed controls balance fraud prevention with operational efficiency, creating processes that protect your interests without slowing your business operations.

7. Reconciliation and reporting

Each month, the AP department reconciles accounts payable subsidiary ledgers with GL balances and compares them against outstanding vendor statements. This process helps the team stay on top of financial commitments and makes sure everything lines up properly.

Regular reporting from the accounts payable department gives management the insights they need, including aging analyses to see how long invoices have been outstanding, cash flow projections to plan ahead, and vendor payment summaries to track spending patterns. These practices keep the AP department audit-ready and give leadership clear visibility into cash commitments.

8. Responding to inquiries and issue resolution

The AP team regularly handles questions from vendors asking about payment status and internal staff seeking clarification on expenses. When issues come up, they investigate payment discrepancies, track down missing invoices, and work with purchasing teams to resolve any delivery problems.

Quick resolution of these inquiries helps the AP department maintain positive vendor relationships and prevents small issues from snowballing into major headaches. When the team keeps good records, documentation is easily discoverable, making resolution much more efficient.

AP challenges, best practices, and tips

Managing accounts payable effectively can make or break your financial operations. While every organization faces unique obstacles, the good news is that most AP challenges have proven solutions that deliver real results.

Common pitfalls

Even well-intentioned finance teams can fall into traps that slow down operations and create unnecessary stress for everyone involved.

- Manual data entry errors: Typos in vendor information, invoice amounts, or payment details that lead to costly mistakes and damaged relationships

- Late payments: Missing payment deadlines due to poor tracking systems, resulting in penalties, strained vendor relationships, and damaged credit ratings

- Lack of visibility: Limited insight into payment status, cash flow projections, and outstanding obligations, which hampers decision-making

- Compliance lapses: Failing to meet regulatory requirements or internal policies, creating audit risks and potential legal exposure

- Fraud risks: Inadequate verification processes that leave organizations vulnerable to duplicate payments, fake vendors, and unauthorized transactions

These pitfalls often compound each other, creating a culture of poor management that gets harder to fix over time.

Best practices

The path forward involves building solid foundations while embracing tools and techniques that reduce manual work and human error:

- Standardize processes: Create consistent procedures for invoice approval, vendor onboarding, and payment authorization across all departments

- Implement approval workflows: Establish clear chains of command with defined spending limits and required sign-offs for different transaction types

- Perform regular audits: Schedule periodic reviews of vendor files, payment processes, and financial records to catch issues before they escalate

- Train staff: Invest in ongoing education about AP best practices, new technologies, and regulatory changes affecting your industry

- Implement automation: Deploy software solutions for invoice processing, payment scheduling, and reporting to reduce manual tasks and improve accuracy

Strong accounts payable management combines standardized processes, proper controls, and strategic automation to create a scalable financial operation that supports growth.

Tips for immediate improvement

Small changes can make a big difference in your AP operations. These steps can help you build better processes without overwhelming your team or budget:

- Set up vendor payment terms in your system to automatically flag approaching due dates

- Create standardized vendor onboarding checklists to prevent incomplete or inaccurate information

- Implement 3-way matching for all transactions above a set threshold

- Use electronic payments whenever possible to improve tracking and reduce processing time

- Establish monthly reconciliation processes to catch discrepancies early

Start with one or two improvements that address your biggest pain points. Building momentum with quick wins makes it easier to tackle larger process enhancements later.

Tips to strengthen controls

Strong accounts payable internal controls protect your organization from fraud and errors while maintaining vendor relationships. These foundational practices create accountability and reduce financial risk across your payment processes:

- Require dual approval for payments above a certain amount

- Segregate duties such that the same person can't create vendors and process payments for them

- Implement regular vendor file cleanups to remove inactive or duplicate entries

- Create exception reports for unusual payment patterns or amounts

- Maintain detailed audit trails for all transactions and accounts payable approvals

Building better AP practices takes time, but the payoff in reduced stress and improved vendor relationships makes the effort worthwhile.

AP automation software and ROI

The best AP automation software changes how finance teams handle vendor payments by handling the repetitive, time-consuming tasks that once ate up entire workdays. This shift frees up your team to focus on analysis, vendor relationship management, and other high-value activities that move the business forward.

Unlike team members manually keying in invoice details, scanning documents, and routing approvals through email chains, automation software captures invoice data instantly, matches it against purchase orders, and moves everything through the approval process without human intervention.

The technology also brings a level of accuracy that's hard to achieve by hand. When people process hundreds of invoices, mistakes happen. They can enter wrong amounts, lose invoices, or issue the same payments twice. Automated systems catch these errors before they become expensive problems, flagging duplicates and inconsistencies that might otherwise slip through.

The return on investment from AP automation becomes clear pretty quickly when you look at the time savings alone. For example, according to a 2024 study performed by Ardent Partners, organizations that employ automation increase invoice processing time by 81%, which also results in roughly 80% lower processing costs.

Choosing and implementing AP automation

Evaluating AP automation tools starts with mapping your current process to identify the biggest pain points. Some companies struggle most with invoice capture and data entry, while others need better approval workflows or integration with their existing enterprise resource planning (ERP) system.

Look for solutions that integrate cleanly with your accounting software and offer flexible approval routing, strong security features, and reporting capabilities that give you visibility into your AP metrics. Implementation works best when you start small. Pick a subset of vendors or invoice types to automate first, then expand the scope once your team is comfortable with the new process.

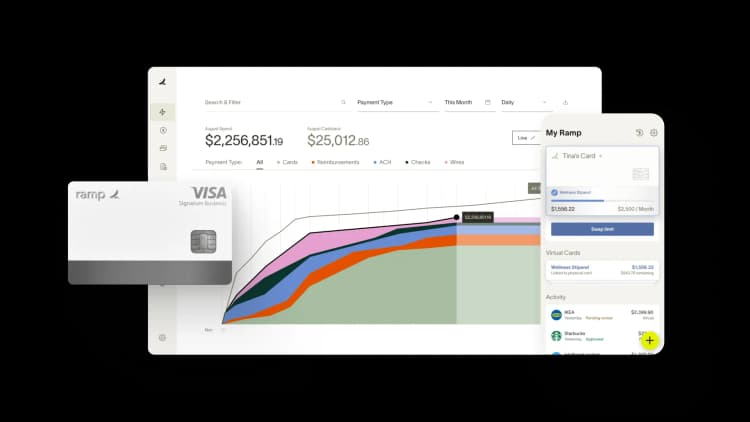

Why Ramp Bill Pay is the best way to simplify AP processes

Ramp Bill Pay enables finance teams to streamline AP operations through intelligent automation. This autonomous AP platform deploys AI agents that categorize invoices using historical data, flag suspicious activity pre-approval, generate comprehensive approval records, and execute vendor payments via cards—removing manual friction from your AP workflow.

OCR technology extracts invoice details at up to 99% accuracy while moving invoices through 2.4x faster than traditional platforms1—accelerating AP cycles while reducing processing errors. Up to 95% of businesses also report gaining stronger oversight of their operations when using Ramp2.

Core Ramp Bill Pay features

- Four AI agents: Code transactions automatically by learning from invoice patterns, identify fraudulent submissions and anomalies, build approval documentation with vendor history and contract analysis, and process card-eligible payments through vendor portals

- Automated PO matching: Performs 2-way and 3-way verification between invoices and purchase orders to catch discrepancies and overbilling

- Intelligent invoice capture: Pulls data from every line item with 99% OCR accuracy for complete invoice processing

- Real-time invoice tracking: Monitors each invoice from receipt through final payment for complete workflow visibility

- Custom approval workflows: Builds multi-tier approval routing based on your organizational structure and business rules

- Approval orchestration: Accelerates reviewer processes while maintaining control and visibility across approval chains

- Payment methods: Executes vendor payments through ACH, corporate card, check, or wire based on your payment strategy

- Vendor Portal: Provides vendors secure access to check payment status and update account details

- Real-time ERP sync: Connects bidirectionally with ERPs like NetSuite, QuickBooks, Xero, Sage Intacct, and others for synchronized financial data

- GL coding: Assigns transactions to appropriate accounts using AI-powered recommendations

- Vendor onboarding: Collects W-9s, verifies TINs, and manages 1099 information for compliance

- Recurring bills: Handles regular payment schedules through automated templates

- Batch payments: Combines multiple vendor payments into single processing runs for operational efficiency

- Reconciliation: Automatically matches transactions during month-end close to accelerate book closing

Why Ramp Bill Pay delivers results

Ramp Bill Pay represents modern AP software—precision in data handling, autonomous operations that eliminate busywork, touchless processing that accelerates workflows, and transparency that improves financial control.

Your AP priorities might include faster processing cycles, lower operating costs, higher data accuracy, or better spend visibility—Ramp delivers the automation tools and insights to achieve these outcomes. Finance professionals on G2 consistently rate it as one of the most intuitive AP platforms available.

Run Ramp Bill Pay as your dedicated AP system, or connect it with Ramp's corporate card infrastructure, expense management capabilities, and procurement tools for end-to-end spend governance. Begin with the no-cost tier handling essential AP functions, or upgrade to Ramp Plus at $15 per user monthly for expanded features.

AP management doesn't have to drain resources. Ramp Bill Pay handles it efficiently.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits