Can you use a business credit card for personal expenses?

- Can you use a business credit card for personal use?

- Is it illegal to use a business credit card for personal expenses?

- What happens if you put personal expenses on a business credit card?

- Are there benefits to using a business credit card for personal expenses?

- Why you might want a business credit card

- Keep your business spending separate with Ramp’s Business Credit Card

Although it’s not against the law, using a business credit card for personal expenses may violate the terms and conditions you agreed to when signing up for the card. This can lead to much bigger financial headaches down the road, and more broadly, it makes tracking business expenses much more difficult.

In this article, we clarify the consequences of charging personal expenses on a business credit card, explain issuer policies, discuss legality, and offer tips for better managing your spending. Of course, sometimes you accidentally pull out the wrong card, so we'll also review how to correct that as simply as possible.

Can you use a business credit card for personal use?

Yes, you can use your business card for personal expenses. But it’s not recommended, and it often goes against the card issuer’s terms.

"Can” and “should” are two different things. While you can technically pay for personal charges with a business credit card, you shouldn’t make a habit of it due to the risks.

This is a common question for small business owners, freelancers, and self-employed individuals, as well as those who accidentally use the wrong credit card for a personal transaction.

Is it illegal to use a business credit card for personal expenses?

It isn’t illegal to use a business credit card for personal expenses, but it may violate your card’s terms and conditions. While it's certainly not likely that you’ll be arrested, violating credit card policies can lead to penalties or account closure.

The only time it could become a legal issue is when the credit card use is tied to fraud or tax evasion. So it’s best to keep things as separate as possible.

If you’re unsure whether you can use your business credit card for personal use, check your card issuer’s website and find the card agreement associated with your credit card.

You can learn more about some of the top credit card issuers' terms of service by the links below:

Discover Ramp's corporate card for modern finance

What happens if you put personal expenses on a business credit card?

If you accidentally use your business card for a personal expense here and there, it’s unlikely that anything will happen. However, if you do it regularly, then your credit card issuer may start to notice that a large amount of your transactions are not business-related. If that happens, you may lose the rewards you've earned or even have your account closed.

Here are a few of the known consequences:

- Tax filing issues: When you mix personal and business expenses, sorting out deductible business expenses can become difficult during tax season. If you're audited, having personal charges on a business card complicates the process. It may prompt closer IRS scrutiny, so maintaining clean, separate records is the best way to avoid these complications during tax time.

- Loss of liability protections: If you operate as an LLC or corporation, your personal assets are usually protected from business liabilities. But using a business credit card for personal purchases blurs the line, potentially putting those protections at risk, making you personally liable for business debts if creditors argue you've commingled your funds.

- Loss of consumer protections: Business credit cards don’t offer the same consumer protections as personal credit cards. This means if you face issues such as billing disputes, higher interest rates, or unexpected fees, your business card issuer is not obligated to follow the same consumer-friendly regulations.

- Account closure: Many business credit card issuers explicitly state that they are for business purposes only. Using the card for personal expenses is a violation of these terms, which may result in penalties, including account suspension or cancellation.

- Credit score impact: Personal expenses on a business credit card can harm not only your business credit score but also your personal credit score. High credit utilization from personal spending can make it appear as though your business is overextended, potentially leading to a decline in your business credit score and making it more challenging to secure favorable financing terms for your business. Misuse increases the risk of penalties.

What if you accidentally use a business card for personal expenses?

Mistakes happen. Let’s say you’re at the store, and you accidentally use your business credit card instead of your personal debit card to pay for your groceries. You just need to act quickly to remedy the situation.

Make sure to reimburse the business and settle the charge with your personal funds, and document the transaction for transparency. Don’t try to hide the charge. Coming clean right away and maintaining clean records makes things a lot easier if you're questioned by the credit card company or audited by the IRS.

Occasional accidental misuse isn't as serious as consistent and deliberate misuse of your card, but that doesn’t mean you should ignore the situation.

Violating issuer terms and conditions

When you place personal expenses on business credit cards, you're likely in violation of the card issuer's terms and conditions. Once the issuer becomes aware, you can expect these potential actions:

- Warnings

- Account suspension

- Account closure

Furthermore, violations could also impact your eligibility for future business credit.

Are there benefits to using a business credit card for personal expenses?

There’s a common perception that combining business and personal expenses onto one credit card can actually help you in the long run. It simplifies spending, potentially gives you access to a higher credit limit, and you can maximize card perks or rewards.

But the risks certainly outweigh any potential benefits. Most issuers and experts strongly discourage these practices.

You could be putting your company’s finances in jeopardy if your account is suspended or closed and you’re unable to obtain business credit in the future. Especially as your business grows, you will find it increasingly difficult to untangle the combined finances. The short-term perks are not worth the long-term consequences.

Why you might want a business credit card

As a small business owner or sole proprietor, there are many reasons to use a business credit card. In addition to stronger legal protections and a clearer separation of your business and personal finances, there are many advantages to using a business credit card:

- Separating business and personal finances: Keeping your business finances separate from your personal expenses allows for better bookkeeping, tracking, and ultimately better decision-making for your company

- Building business credit: One of the best ways to build your business credit score, especially as a new business, is by using a dedicated business credit card. Building business credit over time allows your business to access better interest rates and terms on any loans you may need.

- Access to higher credit limits: Running a business can be expensive, so having a line of credit to help cover costs is essential. The best business credit cards are specifically designed for the demands of running a business, offering higher credit limits than personal credit cards.

- Access to business-specific rewards and perks: Business credit cards often optimize their rewards programs for common business expenses, such as fuel, office supplies, and travel costs. That means you’ll stand to get more points, miles, or cashback on eligible purchases than you would with a personal credit card.

- Streamlined expense tracking and tax preparation: Business credit cards come with powerful expense management features that help you track expenses in real time, categorize transactions, and set spending limits for employees

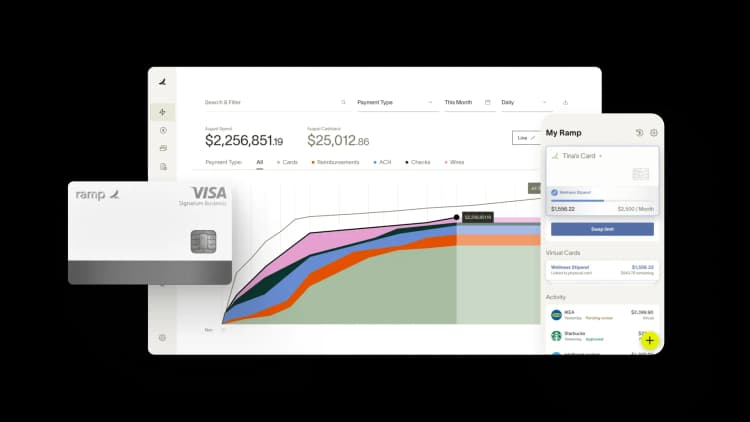

Keep your business spending separate with Ramp’s Business Credit Card

We’ve established that it’s not a good idea to charge personal expenses to your business credit card, and that it’s best to keep these two accounts separate. So if you’re in the market for a business credit card, Ramp may be exactly what you’re looking for.

The Ramp Business Credit Card comes with a comprehensive set of expense management features to track finances and provides budgeting and reporting tools. With no credit check or personal guarantee, you can qualify with a registered business and $25,000 in a U.S. business bank account.

Watch our demo video to learn how our modern finance platform helps customers save an average of 5% a year across all spending.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°